CNBC International

64.1K subscribers

Verified ChannelAbout CNBC International

An international perspective from the world leader in business and finance news. Get the latest updates at cnbc.com

Similar Channels

Swipe to see more

Posts

*Japan’s inflation heats up* Japan’s Nikkei 225 added 0.6% as at 2 p.m. Singapore time amid news that the country’s core inflation heated up to 3.5% in April, the highest level since January 2023. ➡️ https://cnb.cx/4jkk4sy *Fed members might be protected* The U.S. Supreme Court on Thursday strongly suggested that Federal Reserve board members would have special protection against being fired by a president. ➡️ https://cnb.cx/3H3AckZ *China and U.S. hold first call since Geneva* U.S. and China have agreed to maintain communication following a call between Chinese Vice Foreign Minister Ma Zhaoxu and U.S. Deputy Secretary of State Christopher Landau. ➡️ https://cnb.cx/43rQWcR *A warning sign from the equity market* Markets stabilized Thursday after the dual sell-off in stocks and bonds, but a key corner of the equity market is blinking a caution light on the economy, wrote CNBC PRO’s Jesse Pound. ➡️ https://cnb.cx/4jkk7oe _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Is the UK out of the woods?* It’s been rare for a string of positive economic news to emerge out of the U.K. in 2025, but this week in particular has given Britain three reasons to be optimistic. ➡️ https://cnb.cx/43RvQoP *Dubai’s crypto party* A May crypto boat party was part of a long string of high-profile UAE-based industry events, demonstrating the ever-growing exuberance around cryptocurrencies in the Middle East, and globally, right now. ➡️ https://cnb.cx/4jeftYL *Investors call Trump's bluff* European stocks appear to have mostly shrugged off U.S. President Donald Trump's abrupt threat to impose a 50% tariff on European Union goods, regarding it as a high-stakes negotiating tactic rather than a policy set in stone. ➡️ https://cnb.cx/3Fp5EJI *Europe market moves* European stock markets appear to have shrugged off President Donald Trump's tariff threat. ➡️ https://cnb.cx/3ZxfMXA _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

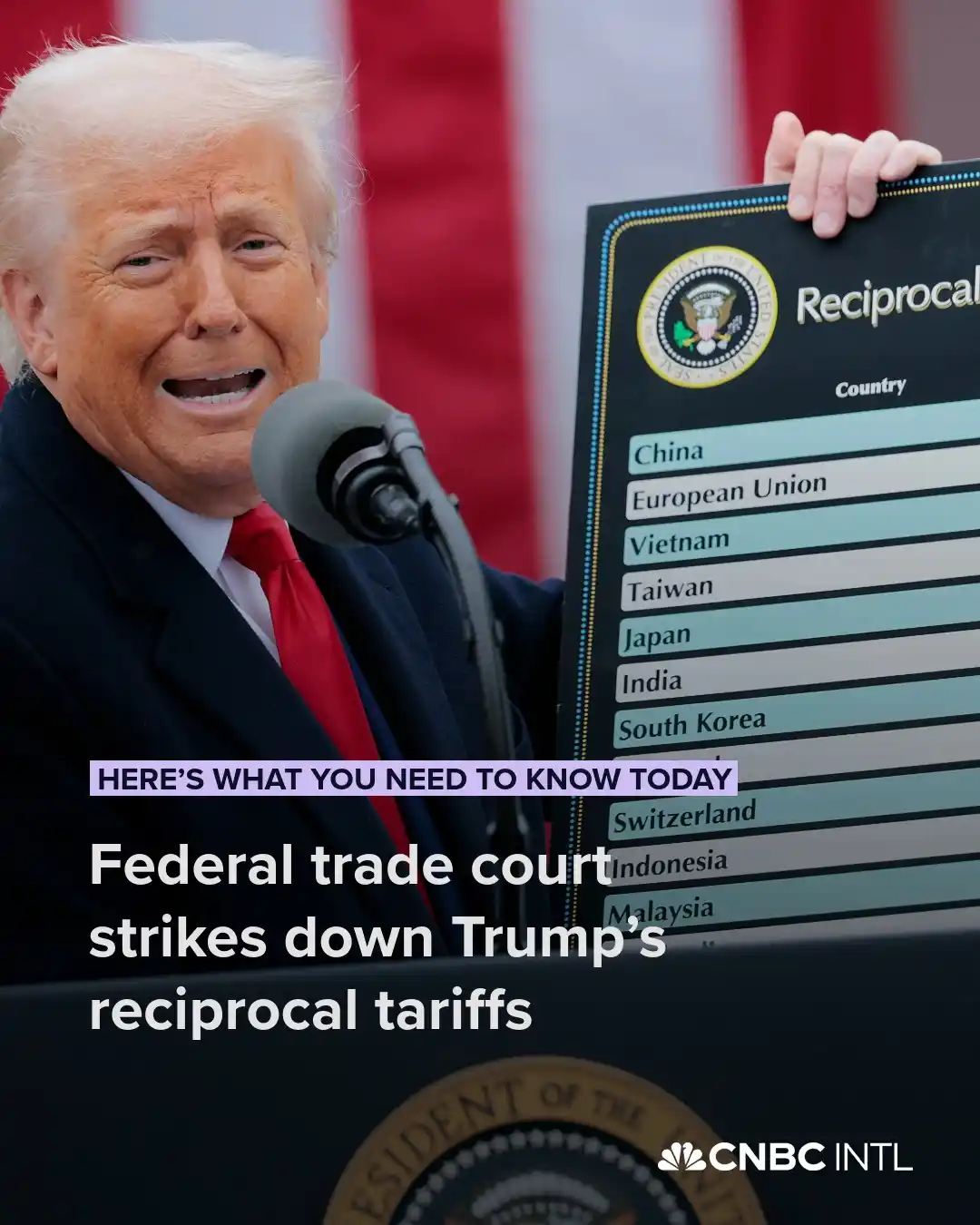

*Trump ‘reciprocal’ tariffs stuck down* The U.S. Court of International Trade on Wednesday blocked Trump’s “reciprocal” tariffs on countries worldwide, which he enacted in April. The court ordered a permanent halt to the tariffs at issue in the case. ➡️ https://cnb.cx/4dFJ0JN *Nvidia posts revenue jump despite China curbs* Nvidia first-quarter earnings beat LSEG estimates. Export restrictions to China, however, are weighing on Nvidia. ➡️ https://cnb.cx/4krJwgY *Bank of Korea cuts rates* South Korea’s Kospi index was up 1.8% as the country’s central bank cut its interest rate to 2.5% from 2.75%, its lowest level since August 2022. ➡️ https://cnb.cx/4kLwOtz *Bond yields might still pressure stocks* The 30-year Treasury yield pushed back toward the 5% level as the S&P 500 stalled. Analysts are warning the bond market could experience more ruction, which would put a lid on any stock rally. ➡️ https://cnb.cx/3Z8gPgJ _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Australia’s higher-than-expected inflation* Australia’s S&P/ASX 200 slipped 0.15% at 1:30 p.m. Singapore time, as the country’s consumer inflation rose a higher-than-expected 2.4% in April. ➡️ https://cnb.cx/4kdaatU *Rising Japanese bond yields pose dangers* Japan’s long-dated government bond yields have been moving higher. That could spark a wave in which Japan’s investors suddenly move their capital from the U.S. back home. ➡️ https://cnb.cx/43XmhVp *All eyes on Nvidia’s first-quarter earnings* With the Trump administration’s new restrictions on Nvidia’s exports to China, the mood heading into the chipmaker’s earnings report, out Wednesday, is different from that in recent quarters. ➡️ https://cnb.cx/3SVr18B *Stocks to be ‘rangebound’: JPMorgan* Despite the surge in U.S. stocks Tuesday, JPMorgan thinks the S&P 500 could “remain rangebound,” with those gains being short-lived because of two reasons. ➡️ https://cnb.cx/4kfP52j _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Hong-Kong listed bubble tea shares pop* Hong Kong-listed shares of Chinese bubble tea companies popped, Mixue jumped 8%, Guming rose 6.3% and Nayuki climbed 5.5%. ➡️ https://cnb.cx/4dzuAe4 *Consecutive growth for China’s industrial profits* China’s industrial profits rose 3% in April, accelerating from 2.6% growth in March. That marks the second straight month that profits at major industrial firms have increased. ➡️ https://cnb.cx/3FvKXMc *Vietnam agrees to buy 20 Airbus jets* During French President Macron’s state visit to Vietnam, the two countries signed an agreement to buy 20 Airbus A330neo planes, vaccines from Sanofi and cooperate on nuclear energy. ➡️ https://cnb.cx/3Z3qq8r *Buffett wisdom from shareholder meeting* Warren Buffett stepping down from his role as CEO was the biggest news from the firm’s annual meeting. CNBC PRO’s Yun Li points out other nuggets of wisdom investors might have missed. ➡️ https://cnb.cx/4mtkUpD _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Europe market moves* ➡️ https://www.cnbc.com/2025/05/28/europe-stock-markets-live-share-prices-economic-data-ftse-100-dax-cac-40-stoxx-600.html *AI love affair* Deep in the oil-rich deserts of the Middle East, the United Arab Emirates is on a mission to establish supremacy in the field of artificial intelligence. ➡️ https://www.cnbc.com/2025/05/28/the-us-ai-love-affair-with-the-uae-boils-down-to-dominance.html *Oil prices pick up* OPEC+ countries on Wednesday agreed to leave their formal output quotas unchanged. ➡️ https://www.cnbc.com/2025/05/28/opec-holds-oil-quotas-ahead-of-july-production-review.html *Stellantis' new CEO* Auto giant Stellantis on Wednesday appointed North American chief operating officer Antonio Filosa as its new chief executive, ending a months-long campaign to fill the firm’s leadership void. ➡️ https://www.cnbc.com/2025/05/28/auto-stellantis-appoints-north-america-boss-antonio-filosa-as-new-ceo.html _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Trump ‘reciprocal’ tariffs reinstated for now* A U.S. federal appeals court on Thursday granted the Trump administration’s request to temporarily pause a lower-court ruling that struck down most of Trump’s tariffs. ➡️ https://cnb.cx/3HvAAsm *Rocky U.S.-China negotiations* U.S.-China trade talks “are a bit stalled,” Treasury Secretary Scott Bessent told Fox News in an interview Thursday local time. ➡️ https://cnb.cx/3Fx0g7w *Tokyo inflation hits two-year high* Japan’s Nikkei 225 retreated 1.15% at 1:30 p.m. Singapore time as data showed annual core inflation in Tokyo hitting 3.6% in May, the highest since January 2023. ➡️ https://cnb.cx/4mDUxxf *European sectors to play: JPMorgan* JPMorgan analysts non-U.S. markets could trade “increasingly more favorably” against their American counterparts for the next 12 to 18 months. Here are the bank’s preferred sectors for this period. ➡️ https://cnb.cx/4jkZyIh _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Renk's auto strategy* Tank parts maker Renk is eyeing up talent from the auto sector as it races to scale up and fuel growth in the wake of rising geopolitical tensions and soaring military spending. ➡️ https://cnb.cx/4kssDmk *Courts block tariffs* U.S. President Donald Trump could still find a work-around after suffering a major blow to a core part of his economic agenda. ➡️ https://cnb.cx/4kESXcP *European opportunities* The first five months of 2025 have thrown some curveballs into European markets with the European Union now seeking to stave off a threatened 50% base rate. ➡️ https://cnb.cx/4jkZyIh *Europe market moves* European stock markets closed lower on Thursday, as investors rode the latest turn in the Trump tariff rollercoaster. ➡️ https://cnb.cx/3Z8q3JQ _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*U.S.-EU trade talks* U.S. President Donald Trump said Tuesday he welcomed talks with the European Union, after he agreed to delay a 50% tariff on goods from the bloc until July 9. ➡️ https://cnb.cx/3FjWuyh *Europe's nuclear pivot* A European-wide shift to nuclear power appears to be gathering momentum as countries hedge their bets in pursuit of more energy independence. ➡️ https://cnb.cx/3FjWuyh *A tariff workaround?* Businesses are finding a workaround to minimize the most significant hit from tariffs, using a decades-old piece of legislation known as the “first sale rule.” ➡️ https://cnb.cx/4kDaBOb *AI stock picks* Spending on artificial intelligence helped give some Chinese tech companies a boost in the first quarter, despite economic headwinds. ➡️ https://cnb.cx/43exxxm _Get the latest updates: https://bit.ly/CNBCiWhatsApp_

*Trump recommends 50% tariffs on EU* U.S. President Donald Trump said Sunday he will delay 50% tariffs on the European Union until July 9, days after “recommending” them to kick in from June 1. ➡️ https://cnb.cx/4dDdNXM *Staying ahead despite export curbs* Stockpiling chips, making AI models more efficient and using homegrown semiconductors — those are some strategies Chinese tech companies are using to keep up in the global AI race. ➡️ https://cnb.cx/4dC5Z8E *Nippon Steel shares rise* Today, Japan’s Nikkei 225 was up nearly 1% as shares of Nippon Steel added 2.2% following news that Trump had approved a merger between the company and U.S. Steel. ➡️ https://cnb.cx/43x2tYq *Nvidia earnings to determine markets* Nvidia announces first-quarter earnings this week. The event, and the U.S. personal consumption expenditures index for April, out Friday, will determine investor sentiment of markets for the week. ➡️ https://cnb.cx/4dBuvH9 _Get the latest updates: https://bit.ly/CNBCiWhatsApp_