GST with Adv. Bimal Jain & A2Z Taxcorp LLP

11.3K subscribers

Similar Channels

Swipe to see more

Posts

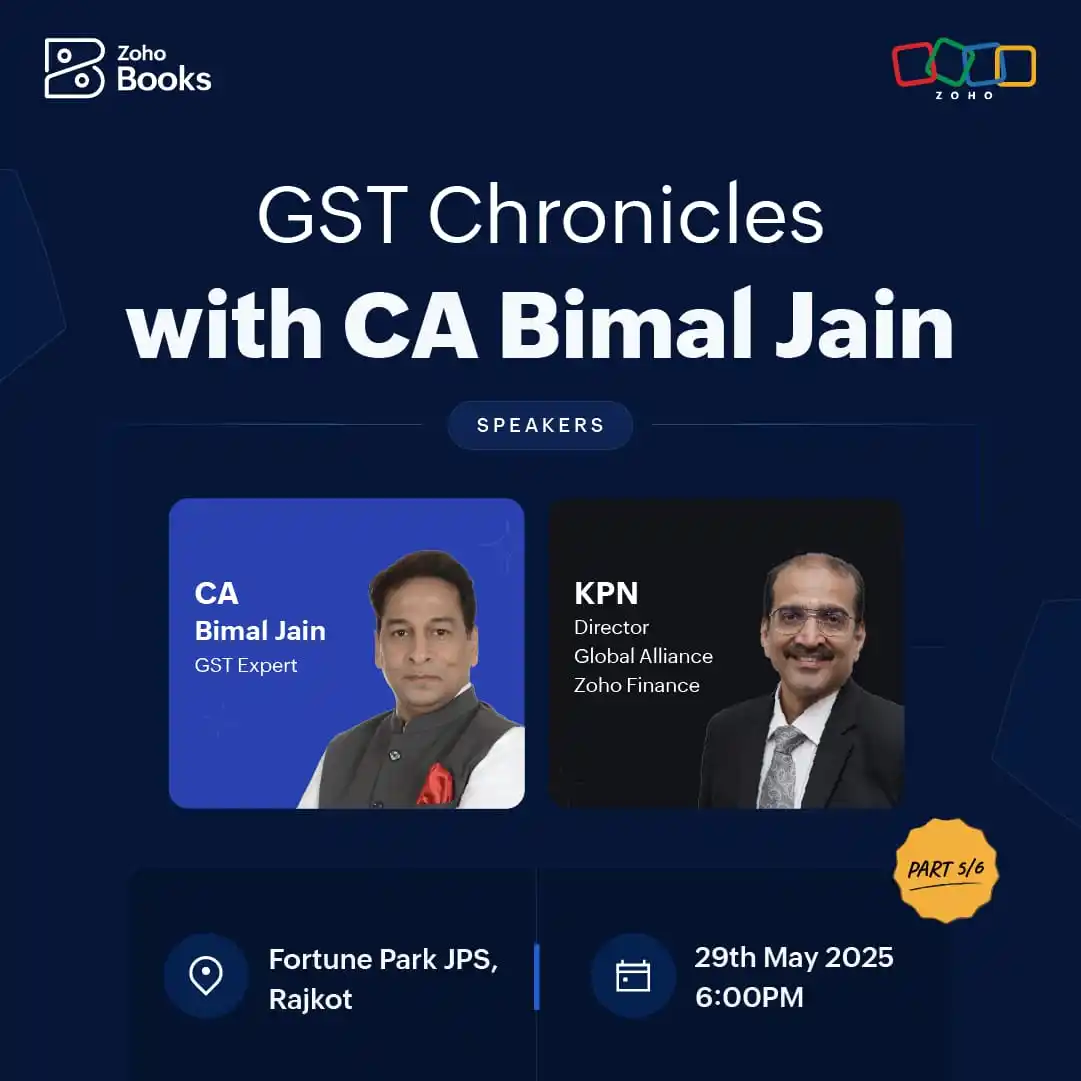

𝗜𝗻 𝗥𝗮𝗷𝗸𝗼𝘁 𝗚𝘂𝗷𝗮𝗿𝗮𝘁 𝗙𝗥𝗘𝗘 𝗠𝗲𝗲𝘁-𝘂𝗽 𝗼𝗻 𝗚𝗦𝗧! 💼🚀 🌟 Join us for an exclusive evening of insights, networking, and opportunities at "𝗚𝗦𝗧 𝗖𝗵𝗿𝗼𝗻𝗶𝗰𝗹𝗲𝘀" E-5 organised by Zoho Books, featuring renowned GST expert 𝗖𝗔 𝗕𝗶𝗺𝗮𝗹 𝗝𝗮𝗶𝗻! 🎉 📅 Date: 𝗠𝗮𝘆 𝟮𝟵, 𝟮𝟬𝟮𝟱 (𝗧𝗵𝘂𝗿𝘀𝗱𝗮𝘆) 🕕 Time: 𝟔:𝟎𝟎 𝐏𝐌 𝐨𝐧𝐰𝐚𝐫𝐝𝐬 🏢 Venue: 𝐅𝐨𝐫𝐭𝐮𝐧𝐞 𝐏𝐚𝐫𝐤 𝐉𝐏𝐒 𝐆𝐫𝐚𝐧𝐝, 𝐑𝐚𝐣𝐤𝐨𝐭 - 𝐌𝐞𝐦𝐛𝐞𝐫 𝐈𝐓𝐂 𝐡𝐨𝐭𝐞𝐥𝐬' 𝐠𝐫𝐨𝐮𝐩 𝐧𝐞𝐚𝐫 𝐌𝐚𝐯𝐝𝐢, 𝟏𝟓𝟎 𝐅𝐞𝐞𝐭 𝐑𝐢𝐧𝐠 𝐑𝐨𝐚𝐝, 𝐧𝐞𝐚𝐫 𝐌𝐚𝐯𝐝𝐢, 𝐂𝐢𝐫𝐜𝐥𝐞, 𝐑𝐚𝐣𝐤𝐨𝐭, 𝐑𝐚𝐣𝐤𝐨𝐭, 𝐆𝐮𝐣𝐚𝐫𝐚𝐭 - 𝟑𝟔𝟎𝟎𝟎𝟒 (𝐈𝐧𝐝𝐢𝐚) 📌 𝗥𝗲𝗴𝗶𝘀𝘁𝗲𝗿 𝗡𝗼𝘄: https://zohoevents.zohobackstage.com/GSTChronicleswithCABimalJain-Rajkot#/?affl=A2Z

💥⚠️ ⏳ 𝙃𝙪𝙧𝙧𝙮! 𝙏𝙝𝙚 𝙧𝙚𝙜𝙞𝙨𝙩𝙧𝙖𝙩𝙞𝙤𝙣 𝙬𝙞𝙣𝙙𝙤𝙬 𝙞𝙨 𝙘𝙡𝙤𝙨𝙞𝙣𝙜 𝙞𝙣 𝙟𝙪𝙨𝙩 𝙖 𝙛𝙚𝙬 𝙝𝙤𝙪𝙧𝙨. 𝙍𝙚𝙜𝙞𝙨𝙩𝙚𝙧 𝙣𝙤𝙬! 👨🏻💻 *🚨 [VERY IMPORTANT] (FREE) Webinar On:* *📢 "Digests of Latest Judgment in GST"* *🔖 Registration Link:* https://meeting.zoho.com/meeting/register?sessionId=1054440876 *🗓 Date : May 23, 2025, Friday* *⏰ Time : 4: 30 PM to 6: 00 PM (IST)* *🎤 Speaker : CA. Bimal Jain* Gain expert insights on: - Whether GST returns can be revised beyond the statutory time limit - Taxability of services supplied by clubs or associations to their members in light of recent judicial rulings - The importance of physical receipt of goods or services in availing Input Tax Credit (ITC) - The impact on ITC eligibility when a supplier’s registration is cancelled with retrospective effect - Whether the existence of an alternate legal remedy bars intervention in cases of natural justice violations - The legality of fixing a date of hearing that precedes the deadline for replying to a Show Cause Notice (SCN) - Whether GST officers are legally empowered to seize valuable assets, currency, or bullion during a search operation *_Limited seats available_*

It is with great honour and deep respect that *we presented to Shri Shashank Priya, Special Secretary and Member - GST, CBIC*, a copy of *our latest publication of "GST Law and Commentary - 10th Edition".* Your distinguished service in the Indian Revenue Service and your exemplary leadership in shaping the GST framework have been a guiding force for professionals, administrators, and policymakers alike. This book is a humble effort to contribute to the ever-evolving discourse on GST, and we sincerely hope it finds merit in your esteemed hands. Your invaluable contributions to India’s tax administration continue to inspire all stakeholders in the domain. *_Regards. CA (Adv) Bimal Jain_*

*Walkthrough* of *10th Edition (2025)* of our book on Goods and Services Tax, titled, *"GST LAW AND COMMENTARY – WITH ANALYSIS AND PROCEDURES", by Bimal Jain & A2Z Taxcorp LLP, updated with the Finance Act, 2025.* *📚 Order your Copy at:* https://a2ztaxcorp.in/gst-law-and-commentary/ *💥 Complete Walk-through of the Book:* https://a2ztaxcorp.net/wp-content/uploads/2025/05/Final-_-Walk-through-of-GST-Law-and-Commentary_10th-LC-by-BJ_A2Z.pdf 🎥 *Watch at:* https://youtu.be/Ob6QgIbUz6k?si=1OWNKaG78viG-Uky 👨🏻💻 For more details: 📧: [email protected] - 📞: +91 9899632870

*🟥 [IMPORTANT VIDEO] "SC: Dismisses Revenue's appeal involving Proper Officer's power to seize valuable assets, currency" || CA (Adv) Bimal Jain* *🎥 Watch Complete Video:* https://youtube.com/shorts/hUfLmTgfEbY?feature=share 📢 Do *like, share and subscribe to our YouTube Channel* for regular updates in GST *[100K Subscriber's Target 🎯]*

𝗜𝗻 𝗥𝗮𝗷𝗸𝗼𝘁 𝗚𝘂𝗷𝗮𝗿𝗮𝘁 𝗙𝗥𝗘𝗘 𝗠𝗲𝗲𝘁-𝘂𝗽 𝗼𝗻 𝗚𝗦𝗧! 💼🚀 🌟 Join us for an exclusive evening of insights, networking, and opportunities at "𝗚𝗦𝗧 𝗖𝗵𝗿𝗼𝗻𝗶𝗰𝗹𝗲𝘀" E-5 organised by Zoho Books, featuring renowned GST expert 𝗖𝗔 𝗕𝗶𝗺𝗮𝗹 𝗝𝗮𝗶𝗻! 🎉 📅 Date: 𝗠𝗮𝘆 𝟮𝟵, 𝟮𝟬𝟮𝟱 (𝗧𝗵𝘂𝗿𝘀𝗱𝗮𝘆) 🕕 Time: 𝟔:𝟎𝟎 𝐏𝐌 𝐨𝐧𝐰𝐚𝐫𝐝𝐬 🏢 Venue: 𝐅𝐨𝐫𝐭𝐮𝐧𝐞 𝐏𝐚𝐫𝐤 𝐉𝐏𝐒 𝐆𝐫𝐚𝐧𝐝, 𝐑𝐚𝐣𝐤𝐨𝐭 - 𝐌𝐞𝐦𝐛𝐞𝐫 𝐈𝐓𝐂 𝐡𝐨𝐭𝐞𝐥𝐬' 𝐠𝐫𝐨𝐮𝐩 𝐧𝐞𝐚𝐫 𝐌𝐚𝐯𝐝𝐢, 𝟏𝟓𝟎 𝐅𝐞𝐞𝐭 𝐑𝐢𝐧𝐠 𝐑𝐨𝐚𝐝, 𝐧𝐞𝐚𝐫 𝐌𝐚𝐯𝐝𝐢, 𝐂𝐢𝐫𝐜𝐥𝐞, 𝐑𝐚𝐣𝐤𝐨𝐭, 𝐑𝐚𝐣𝐤𝐨𝐭, 𝐆𝐮𝐣𝐚𝐫𝐚𝐭 - 𝟑𝟔𝟎𝟎𝟎𝟒 (𝐈𝐧𝐝𝐢𝐚) 📌 𝗥𝗲𝗴𝗶𝘀𝘁𝗲𝗿 𝗡𝗼𝘄: https://zohoevents.zohobackstage.com/GSTChronicleswithCABimalJain-Rajkot#/?affl=A2Z

*🔰 Weekly GST Communique dated May 26, 2025* _✅ Highlights of recent updates and important judgments of last week in the field of indirect taxation and direct taxation._ *🔖 For Complete Newsletter:* https://a2ztaxcorp.net/wp-content/uploads/2025/05/Weekly_GST_Communique_A2Z_Taxcorp_LLP_26_05_2025.pdf

🟥 [IMPORTANT VIDEO] *"Section 74 Notice/ Orders Without Fraud = Eligible for Amnesty Scheme under Section 128A!*" || CA (Adv) Bimal Jain *🎥 Watch Complete Video:* https://youtube.com/shorts/xl505IvVO8I?feature=share 📢 Do *like, share and subscribe to our YouTube Channel* for regular updates in GST *[100K Subscriber's Target 🎯]*

Recently, attended and felicitated Mr. Chirag Paswan, Union Minister of Food Processing Industries' at Conclave - Le Meridian Hotel, New Delhi.. The Indian food processing industry has experienced significant growth and transformation in recent years, bolstered by strategic government initiatives and the leadership of Union Minister Chirag Paswan. ________________________________________ 🇮🇳 Key Achievements of the Indian Food Processing Industry 1. Expansion of Processed Food Exports: The share of processed food in agri-food exports increased from 13.7% in 2014–15 to 23.4% in 2023–24, amounting to USD 10.88 billion. 2. Employment Generation: The sector has become a major employment provider, accounting for 12.41% of total employment in the organized manufacturing sector as per the Annual Survey of Industries 2022–23. 3. Pradhan Mantri Kisan Sampada Yojana (PMKSY): In 2024, 143 new projects were approved, creating processing capacities of 14.41 lakh metric tons, benefiting approximately 3.53 lakh farmers and

💥 *Hurry up! TOMORROW IS LAST DAY:* *🚨 [VERY IMPORTANT] (FREE) Webinar On:* *📢 "Digests of Latest Judgment in GST"* *🔖 Registration Link:* https://meeting.zoho.com/meeting/register?sessionId=1054440876 *🗓 Date : May 23, 2025, Friday* *⏰ Time : 4: 30 PM to 6: 00 PM (IST)* *🎤 Speaker : CA. Bimal Jain* Gain expert insights on: - Whether GST returns can be revised beyond the statutory time limit - Taxability of services supplied by clubs or associations to their members in light of recent judicial rulings - The importance of physical receipt of goods or services in availing Input Tax Credit (ITC) - The impact on ITC eligibility when a supplier’s registration is cancelled with retrospective effect - Whether the existence of an alternate legal remedy bars intervention in cases of natural justice violations - The legality of fixing a date of hearing that precedes the deadline for replying to a Show Cause Notice (SCN) - Whether GST officers are legally empowered to seize valuable assets, currency, or bullion during a search operation *_Limited seats available_*