Abhishek Raja Tax Wisdom by ARR (FREE)

7.4K subscribers

Similar Channels

Swipe to see more

Posts

*Good Evening Friends,* Shared a carousel on Top-10 GST ITC Cases where the allegations are that the Supplier has not made the payment or their registration has been cancelled retrospectively. These landmark cases are from IDT and GST Era. Also, at end shared the arguments and grounds that could be taken in reply and/or Appeals. *link to the post* : https://x.com/abhishekrajaram/status/1933512874607194150 I hope you will find this usedfull

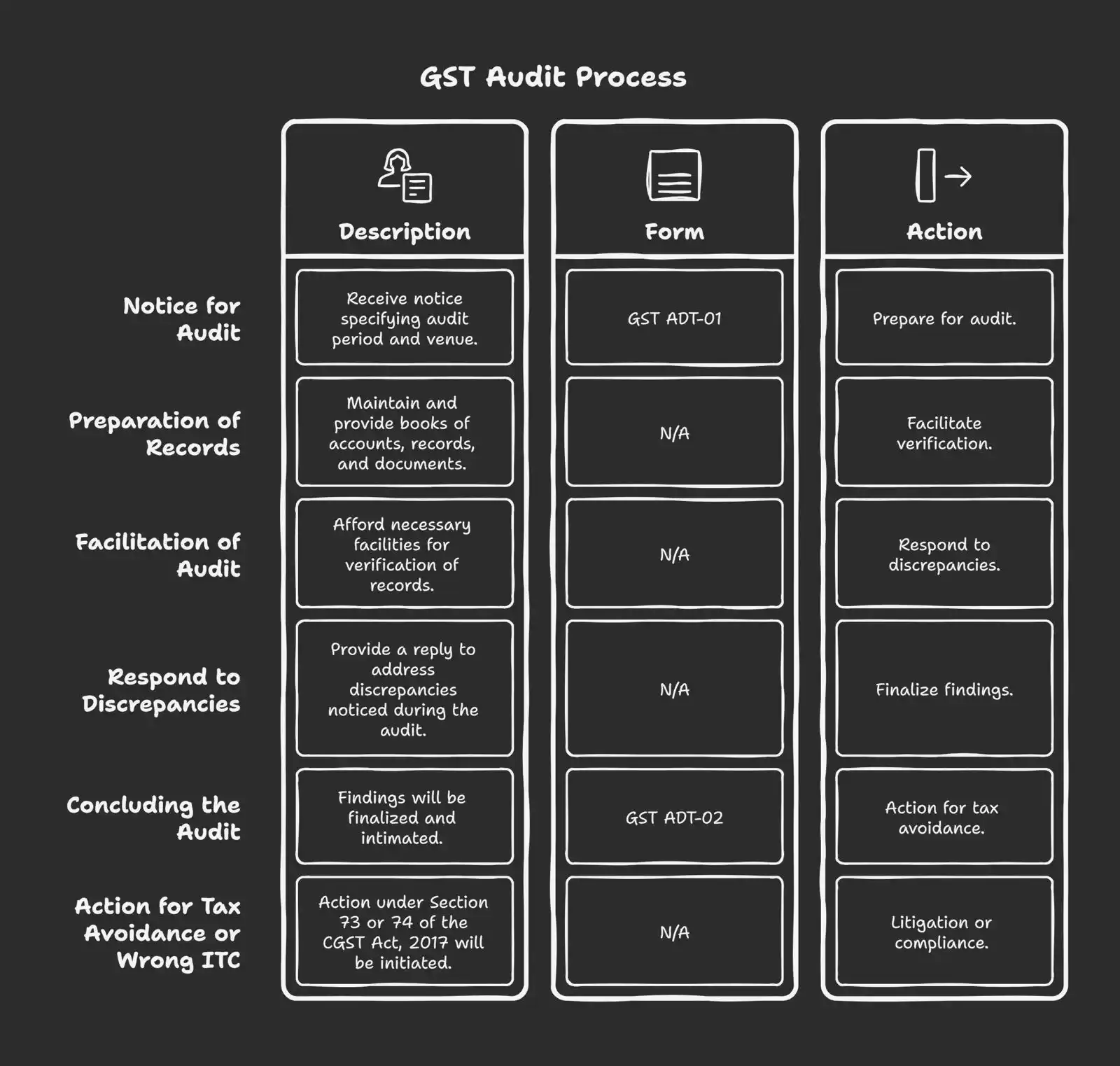

Steps to Handle the GST Audit: 1. Notice for Audit: You will receive the notice for audit in Form GST ADT-01 as per Rule 101(2) of the CGST Rules, 2017. This notice specifies the period of audit and the venue (your premises or the tax officer's office). 2. Preparation of Records: Ensure that all your books of accounts, records, and other documents (e.g., inward supply details, bank statements, invoices, etc.) are properly maintained and readily available for verification. You are required to provide these as requested by the authorized officer. 3. Facilitation of Audit: As per the notice, you must afford the necessary facilities to the audit team for verification of the records, turnover declared, taxes paid, refunds claimed, and input tax credit availed. 4. Respond to Discrepancies: If discrepancies are noticed during the audit, the proper officer will inform you as per Sub-Rule (4) of Rule 101. You must provide a reply to address the discrepancies. 5. Concluding the Audit: After considering your response, the findings will be finalized. The proper officer will intimate the findings in Form GST ADT-02 within 30 days of concluding the audit. 6. Action for Tax Avoidance or Wrong ITC: If tax liability or wrong ITC is detected during the audit, action under Section 73 or Section 74 of the CGST Act, 2017 will be initiated for determination and recovery of the tax. 7. Litigation or Compliance: If you disagree with the audit findings, you can choose to litigate or comply with the demands raised based on the audit observations. Ensure all communications are handled timely and accurately to avoid penalties or further scrutiny.

Gauhati High Court allows restoration of GST Registration if the Assessee fulfils the requirements of Rule 22(4), i.e. furnishing pending returns and full payments, as the cancellation of GST registration has serious civil consequences. Debaish Boruah vs Union of India Gauhati High Court WP(C) No. 3149/2025 06-Jun-2025

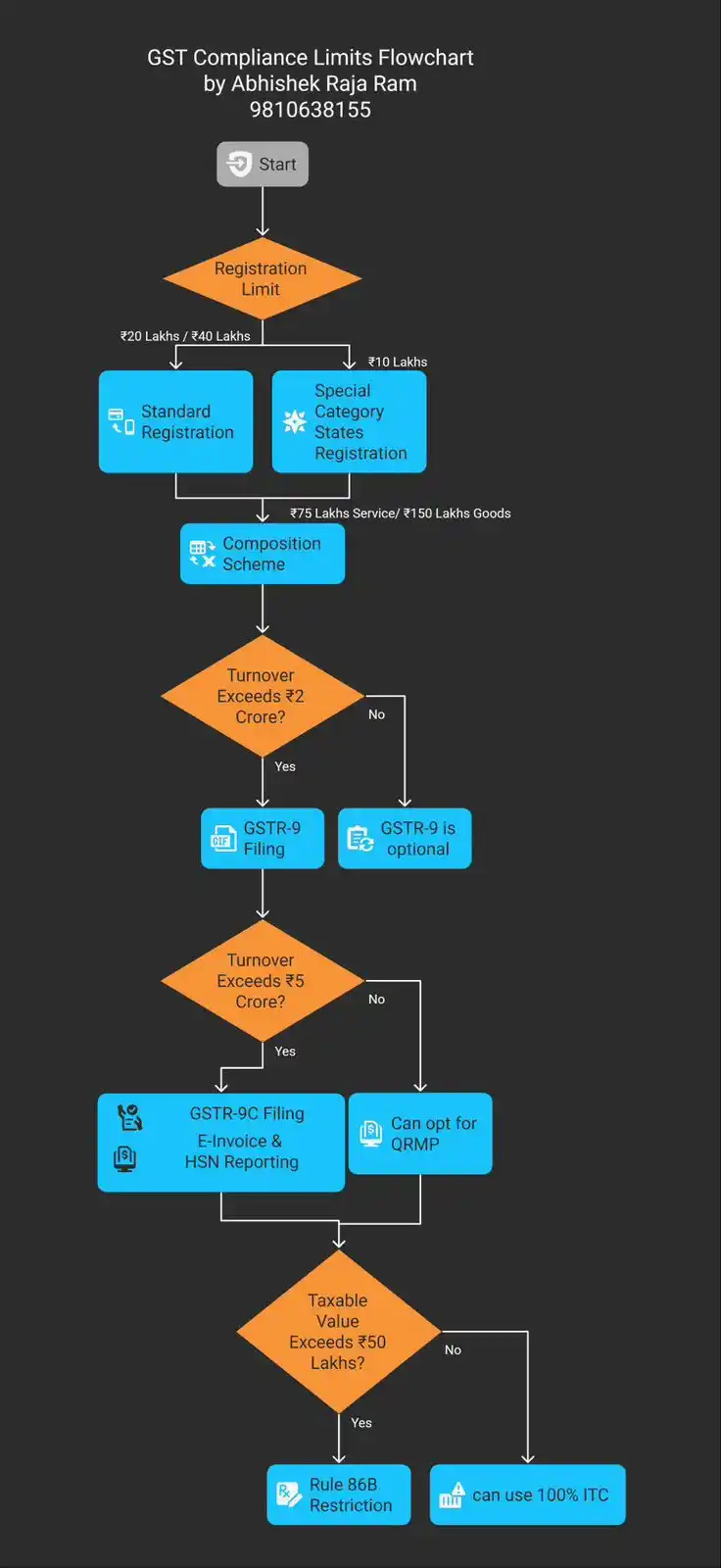

GST Compliance Limits - A Quick Reference by Abhishek Raja Ram; 9810638155 This document provides a concise overview of key Goods and Services Tax (GST) compliance limits that businesses should be aware of before filing their returns. It covers thresholds for registration, composition scheme, annual returns, quarterly filing, e-invoicing, and restrictions on input tax credit utilisation. Here's a quick reference guide to the GST limits you need to know: ✳️Registration Limit: 🔺₹20 Lakhs / ₹40 Lakhs (depending on the type of supply and state regulations) 🔺Special Category States Registration Limit: ₹10 Lakhs ✳️Composition Scheme: 🔺₹75 Lakhs (for Service Providers and Mixed Suppliers) 🔺₹1.5 Crore (for Goods Suppliers) ✳️Annual Return & Reconsiliation Satement: 🔺GSTR-9 (Annual Return): Applicable for taxpayers with aggregate turnover exceeding ₹2 Crore 🔺GSTR-9C (Reconciliation Statement): Applicable for taxpayers with aggregate turnover exceeding ₹5 Crore ✳️QRMP (Quarterly Return Filing with Monthly Payment) Scheme: 🔺Eligible for taxpayers with aggregate turnover up to ₹5 Crore ✳️E-Invoice & HSN Reporting: 🔺Applicable for taxpayers with aggregate turnover exceeding ₹5 Crore ✳️Rule 86B (Restriction on Input Tax Credit Utilisation): 🔺Applicable if the taxable value of supply exceeds ₹50 Lakhs per month. I hope this chart and writeup will be handy and can be shared with the clients too. Thanks & Regards Abhishek Raja Ram 9810638155

The supplier collected GST but skipped filing GSTR-1. Jharkhand HC orders the Department to invoke Section 76 and slaps a ₹1 lakh cost. Assessee hired commercial vehicles from Supplier during Oct'20-Mar'21 and paid ₹73.34 lakh, incl. ₹11.18 lakh GST. Supplier didn't filed GSTR-1. Issue ❓ Whether the Department must invoke §76 JGST Act against Supplier who collected GST but never remitted it, blocking Assessee’s hashtag#InputTaxCredit. Assessee’s grounds 📝 Paid GST in full; credit missing in GSTR-2A Supplier’s failure to file GSTR-1 violated statutory duty Department’s inaction contravenes Section 76(2) Judgment 🏛️ Reason: Sec. 76 uses the expression “every person”; jurisdictional excuse untenable. Conclusion: Writ allowed. 🔎 Dept. to initiate Sec. 76 proceedings vs. Supplier within 8 weeks 💼 Supplier to pay ₹1 lakh costs to Assessee 💸 🚛RK Transport & Constructions Ltd. (Assessee) v. State of Jharkhand (Department) — Jharkhand High Court [W. P. (T) No. 1624 of 2024; dated 13-Jun-2025]

Mistakenly claiming eligible IGST credit under CGST and SGST categories is a technical error, not a wrongful availment of Input Tax Credit (ITC), provided no revenue loss occurred. Kerala High Court view the electronic credit ledger as a unified fund, allowing for such rectification without penalties. M/s Grand Hyundai vs State Tax Officer, Kerala [Writ Petition (C) No. 499/2025; 08-Jan-2025] Earlier judgment Rejimon Padickapparambil Alex vs Union of India upheld. (2025) 93 GSTL 23 (Kerala) An assessee had an assessment order imposing liability under Section 73 for allegedly utilising excess Input Tax Credit (ITC) because they availed IGST credit under the CGST and SGST heads. The assessee challenged this order. During the appeal, the Kerala High Court's ruling in Rejimon Padickapparambil Alex v. Union of India [2024] 169 taxmann. com 152 (Kerala)/[2025] 107 GST 483 (Kerala)/[2025] 93 GSTL 23 (Kerala) was brought up. This ruling stated that the electronic credit ledger is like a wallet with different compartments for IGST, CGST, and SGST, and merely availing IGST credit under CGST and SGST heads does not constitute "wrong availment" of ITC if the assessee was genuinely eligible for the credit and no revenue loss occurred. The assessee argued that this principle directly applied to their case. However, the court stated that since the appeal against the assessment order was still pending, they could not directly interfere with the impugned assessment order at that stage.