Parimal Ade

3.5K subscribers

About Parimal Ade

Investing, Personal Finance….

Similar Channels

Swipe to see more

Posts

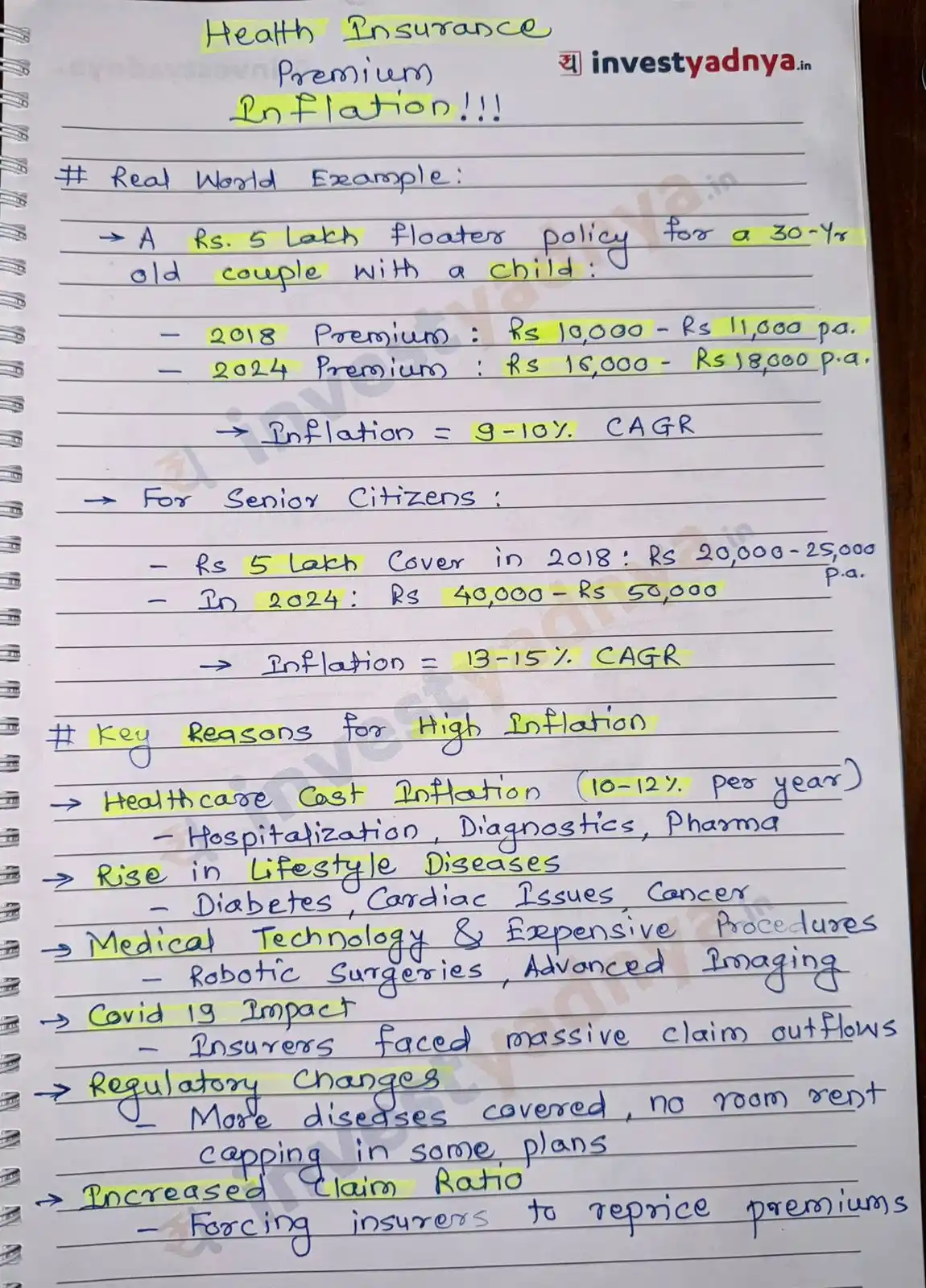

Health Insurance Premium Inflation! Try to develop a separate Medical Fund to take care of this inflation monster🙏🏻

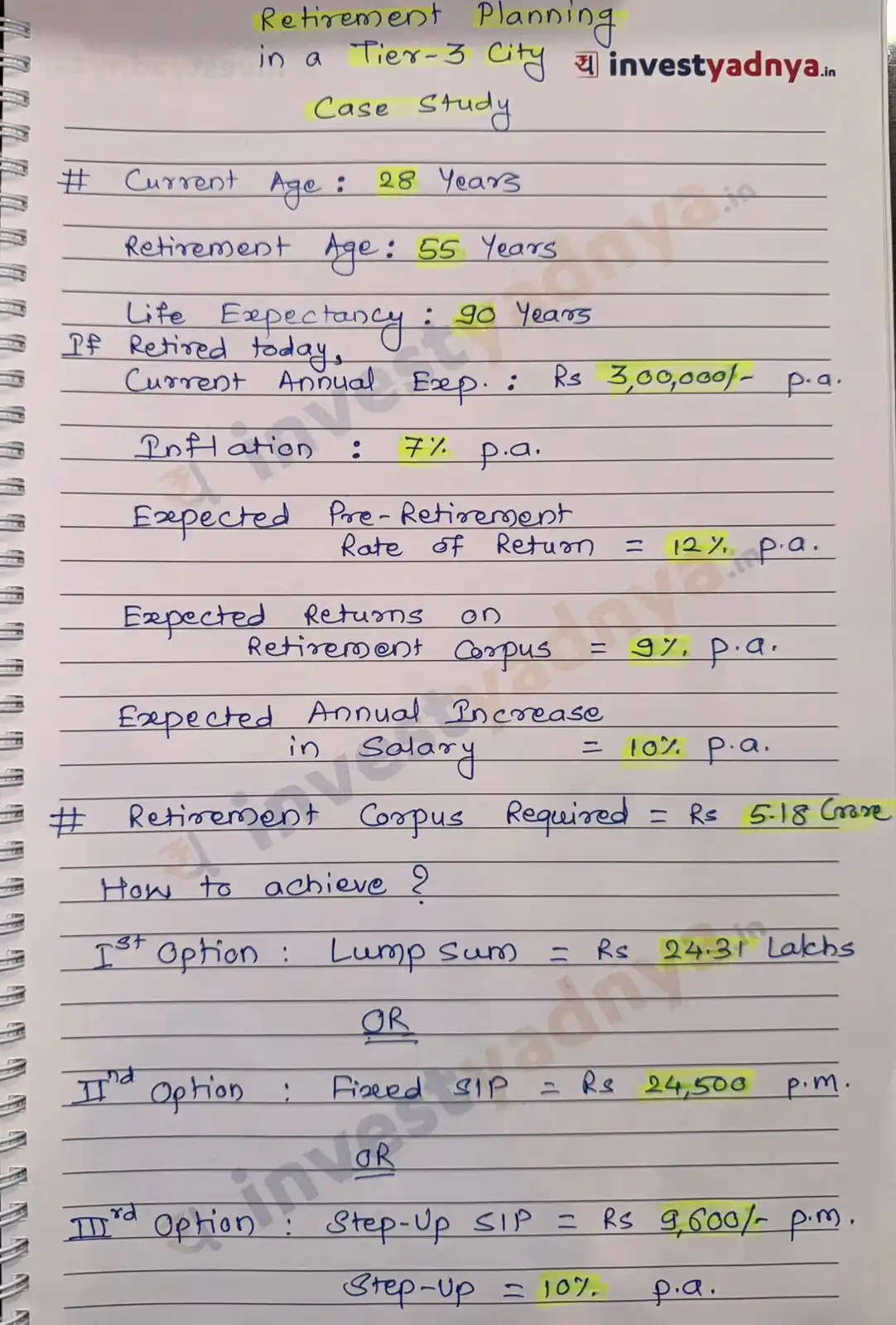

Retirement Planning in a Tier-3 City - Case Study!

The rare-earth export restrictions by China have serious potential implications for Indian Auto OEMs and auto ancillary companies, even if the current panic is centered in the US and Europe. Here’s a breakdown: 🇮🇳 Impact on Indian Auto OEMs (Original Equipment Manufacturers) 🔴 Negative Impacts: Component Shortages for EVs EVs heavily depend on rare-earth magnets (used in motors, sensors, pumps, etc.). Indian OEMs like Tata Motors, Mahindra Electric, and Ashok Leyland could face supply delays or cost spikes. Rising Input Costs Scarcity or limited access to rare-earth materials will push prices up. This can impact margins of Indian companies already operating in price-sensitive segments. Delayed EV Production/Launches Some models under development or in pilot stages may face sourcing issues, affecting rollout plans or volumes. Import Dependency Vulnerability India imports a majority of its rare-earth needs (either directly or indirectly via Chinese components). OEMs with lower localization will suffer more. 🏭 Impact on Indian Auto Ancillary Companies 🔴 At-Risk Segments: Motor & Magnet-Based Parts Suppliers Companies making EV traction motors, sensors, actuators, etc., will be directly hit due to rare-earth reliance. Export-Oriented Players Ancillaries supplying to global OEMs like Bosch, Continental, ZF may face demand compression or order deferments. EV Supply Chain Builders Startups or mid-sized firms betting big on EV components may face capital pressure or have to delay scale-up. 🟢 Opportunities for Indian Firms ✅ 1. Localization Push Crisis could accelerate India’s efforts to build rare-earth refining and magnet production capacities. Government PLI schemes could expand to cover critical materials and rare-earth supply chains. ✅ 2. Magnet-Free Innovations Indian firms innovating on non-rare-earth motors (like induction or switched reluctance motors) could gain edge and attract OEM interest. ✅ 3. Global Export Opportunity (Long-Term) If India builds a rare-earth value chain or becomes an alternate magnet base, it could serve global demand diversifying away from China.

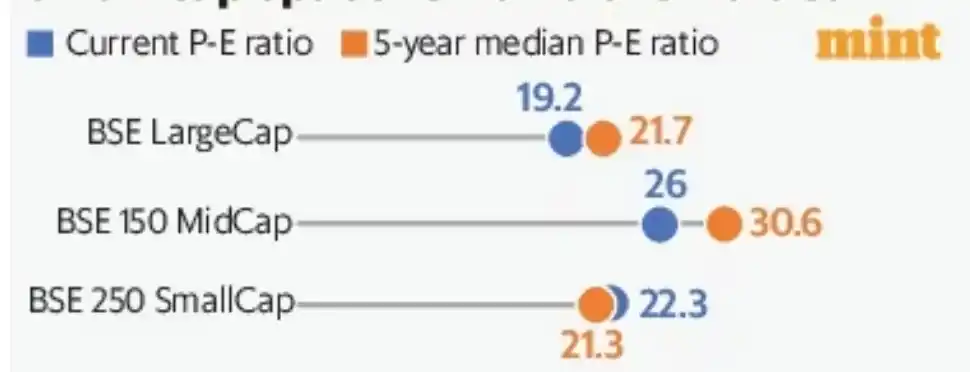

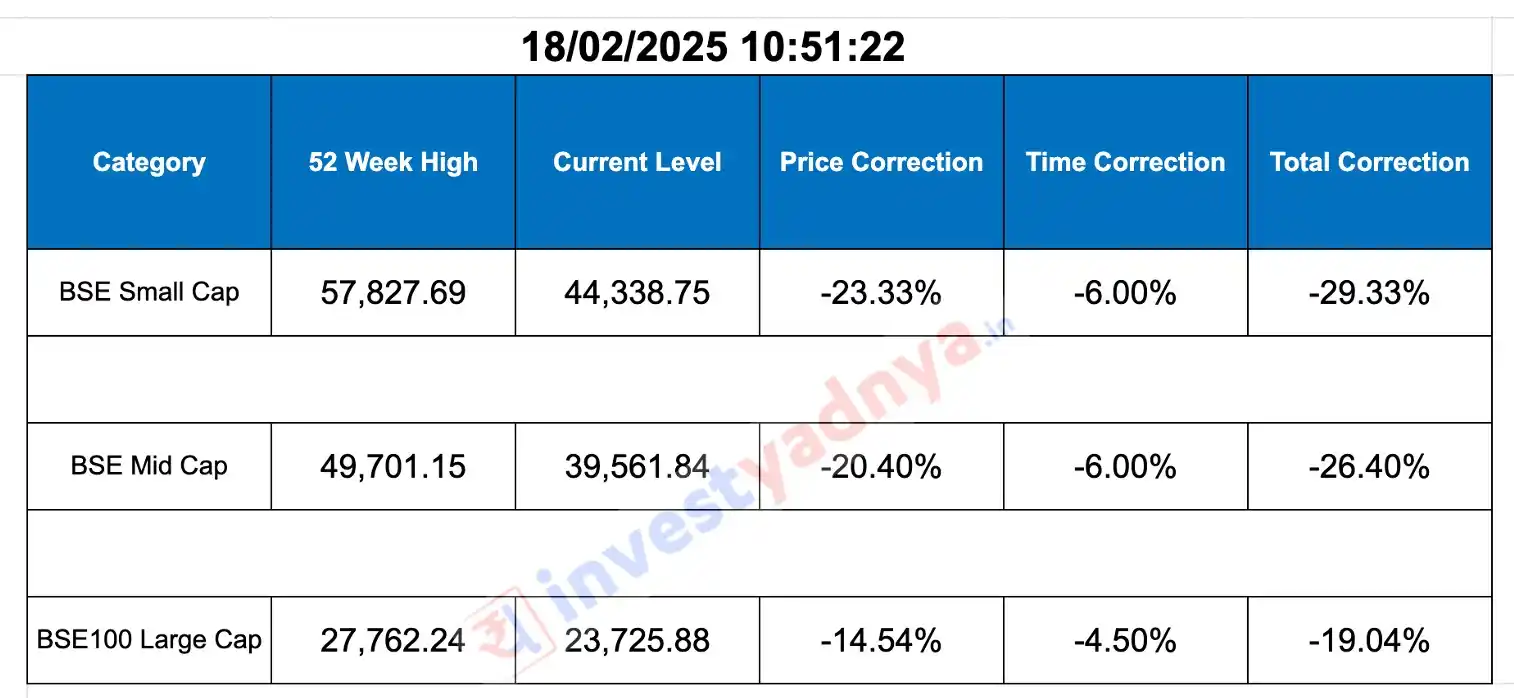

Price & Time Correction - Today's Level!

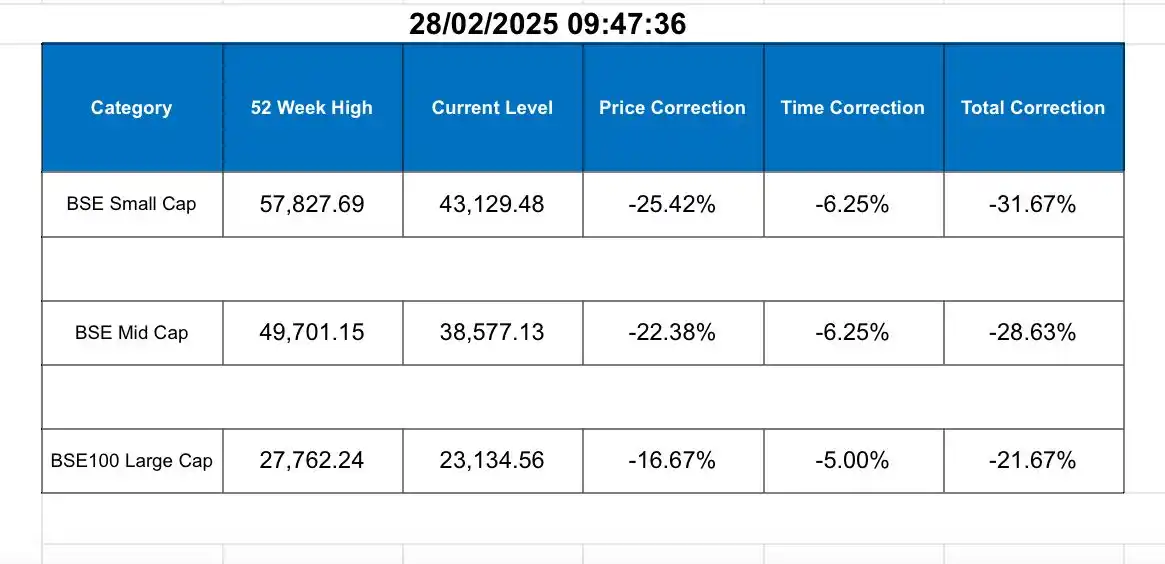

Price and Time Correction- Today’s Level!

Just keep SIPping. Super humans will criticise SIPs but we should ignore the noise🙏🏻

*Key Takeaways from Uday Kotak’s Speech at Kotak Institutional Equities' Chasing Growth 2025 Conference:* *1. Risks of Over-Financialization* - Excessive financialization can hurt the economy if investors shift all savings into equities without understanding valuations. - Stock market valuations are steep, posing a risk to uninformed investors. *2. Impact of the ‘Trump Era’ on India* - Global capital flows have shifted due to the strengthening US dollar. - US equities now account for 70% of global market capitalization. - Trump’s focus on reducing the US trade deficit may pressure India’s *Current Account Deficit (CAD)*, currently at 1.2-1.3% of GDP (~$50B). - India has a *$40B trade surplus* with the US, but reciprocal tariffs could alter trade dynamics. - India imposes *10% tariffs* on US goods, while the US imposes *3% tariffs* on Indian goods. *3. Strategies for India* - *Avoid protectionism* and enhance *global competitiveness*. - Improve *manufacturing share in GDP* and enhance *productivity*. - Ensure *efficient execution* of macro and microeconomic policies. - Move toward *fiscal consolidation* while maintaining *free and fair markets*. - Strengthen stock markets to remain attractive for *foreign investors*. *4. Market and Economic Outlook* - *Tax rebates* are making deposit-taking businesses competitive, but unsecured loans (e.g., microfinance) are showing signs of stress. - *Quick Service Retail (QSR)* has the potential to create *global consumer brands*. - *AI’s impact on jobs* in education and financial sectors calls for *new opportunities*. *5. Changing Entrepreneurial Mindset* - Post-pandemic, *risk-taking has reduced*, with next-gen promoters focusing on *family offices & investments* rather than starting businesses. - *Hard work & entrepreneurship* are key to India’s long-term success. *6. Disruptions in BFSI Sector* - *PhonePe’s dominance* in UPI, *Zerodha’s profitable broking model*, and a *Brazilian bank with a $65B market cap & 7,000 employees* show new business models. - *Traditional banks must adapt* to these emerging trends.

Do you know ICICI Pru Value Discovery Fund has more than Rs 5,000 Crore allocation to Small and Midcap Stocks? Where is Lock Stock Barrel Sale? 😉