Stock Takk - Keshav Kumar

5.7K subscribers

About Stock Takk - Keshav Kumar

This is official and only channel of Stock Tak YouTube channel. YouTube - https://www.youtube.com/@StockTakk2 Telegram - https://t.me/Stock_Tak_Official

Similar Channels

Swipe to see more

Posts

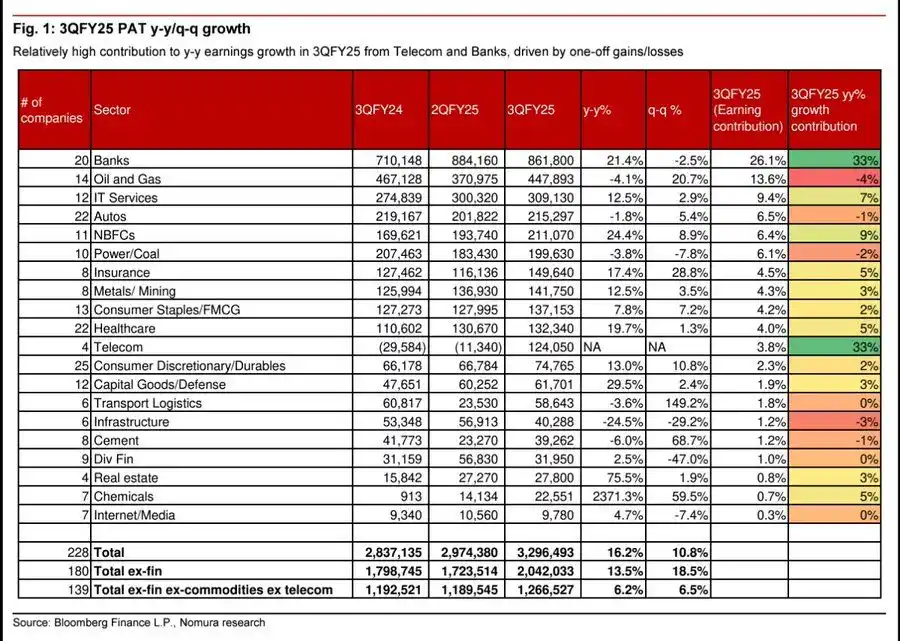

Earning compare to sector wise. Y-0-Y & Q-0-Q Q3FY25 Banking & telecom top performer.

*Sector rotation journey of last 13 year* ♻️

*Nifty50 will be no longer undervalued* NSE to add Zomato and Jio Finance in Nifty50 index - It will inflate the PE ratio of Nifty by almost 10% from 20.4 currently to around 22.8 Current PE ratio of stocks that will be removed from Nifty50 - BPCL: 7 Britannia: 54 While PE of stocks that will be added are - Zomato has 335 and Jio: 92 Current Weightages - BPCL: 0.60% Britannia: 0.64% While Zomato would have a weightage of 0.70% to 0.80%, and Jio Financial: 0.55% to 0.65%, Weighted P/E Contribution of Outgoing Stocks - BPCL:0.60%×7=0.0060×7=0.042 Britannia:0.64%×54=0.0064×54=0.3456 Total Contribution Out:0.042+0.3456=0.3876 Weighted P/E Contribution of Incoming Stocks- Zomato:0.75%×300=0.0075×300=2.25 Jio Financial Services:0.60%×92=0.0060×92=0.552 Total Contribution In:2.25+0.552=2.802 Net Change in P/E Contribution - Net Change = Total Contribution In - Total Contribution Out 2.802−0.3876=2.4144 Impact on Nifty 50 P/E: New Nifty P/E = Current P/E + Net Change 20.4+2.4=22.8 ( Based on 23rd February calculation ) *So we are no longer in undervalued zone, and Nifty can correct further.*

Where are we in the Market Cycle? My guess is we are probably in "Denial" stage.

Reciprocal tariffs impact on Developing countries.

PSU Stocks correction from all time high. That’s why I repeat this in every session that PSU theme is not good for next 2-3 year - except some exceptions.

*Mutual Funds Fall from 52 week high.* Look which fund houses are on top and which are on bottom.

Nifty Small-cap Index past falls and recovery time.