Market Intelligence

12.5K subscribers

About Market Intelligence

A platform dedicated to sharing breaking news, economic trends, result updates, and noteworthy information about trending stocks and sectors in the Indian equity market. Join us to explore investment opportunities through the study of listed companies in Midcap, Smallcap, Microcap, and SME sectors. (For educational purposes only)

Similar Channels

Swipe to see more

Posts

*New SME IPO ALLOTMENT RULES* 👉 Retail Is Now INDIVIDUALS Category You'll Need To Apply 2 Lot's & If Allotted You'll Get 2 Complete Lots... You Can Either Apply At Cut-Off Or Put Manual Bid At Maximum IPO Offered Price. So Applying At Cut-Off Or Without Cut-Off In Individuals Category Is Now Same Thing. 👉 SHNI You Need To Apply 3 Lot's & If Allotteed You'll Get 3 Complete Lots. Apply By Putting Manual Bid At Highest Offered IPO Price, Don't Select CUT-OFF 👉 BHNI, You Need To Apply For Above 10L Amount Bid, For Example In NR VANDANA 8 Lots = 10,80,000 AMOUNT Here If You Get Allotted Then You Will Be Getting 3 Lot's & The Remaining Lot's Amount Will Be Unblocked Post Allotment. Apply By Putting Manual Bid At Highest Offered IPO Price, Don't Select CUT-OFF 👉 During Listing Day The Lot's Will Be Traded In Single Lot Size, Means If You Get 2 or 3 Lot's Then You Can Either Sell Fully Or Partially According To Your Comfort 👉 SME UPI CUT OFF TIME IS NOW 4 PM ( ONLY FOR SME IPOs Coming With NEW RULES ). Mainbord IPOs Applied Via UPI Can Be Accepted Till Normal 5 PM As There's No Change. Hope This Clears Your Every Single Doubt

You need to pay attention to the Bond Markets

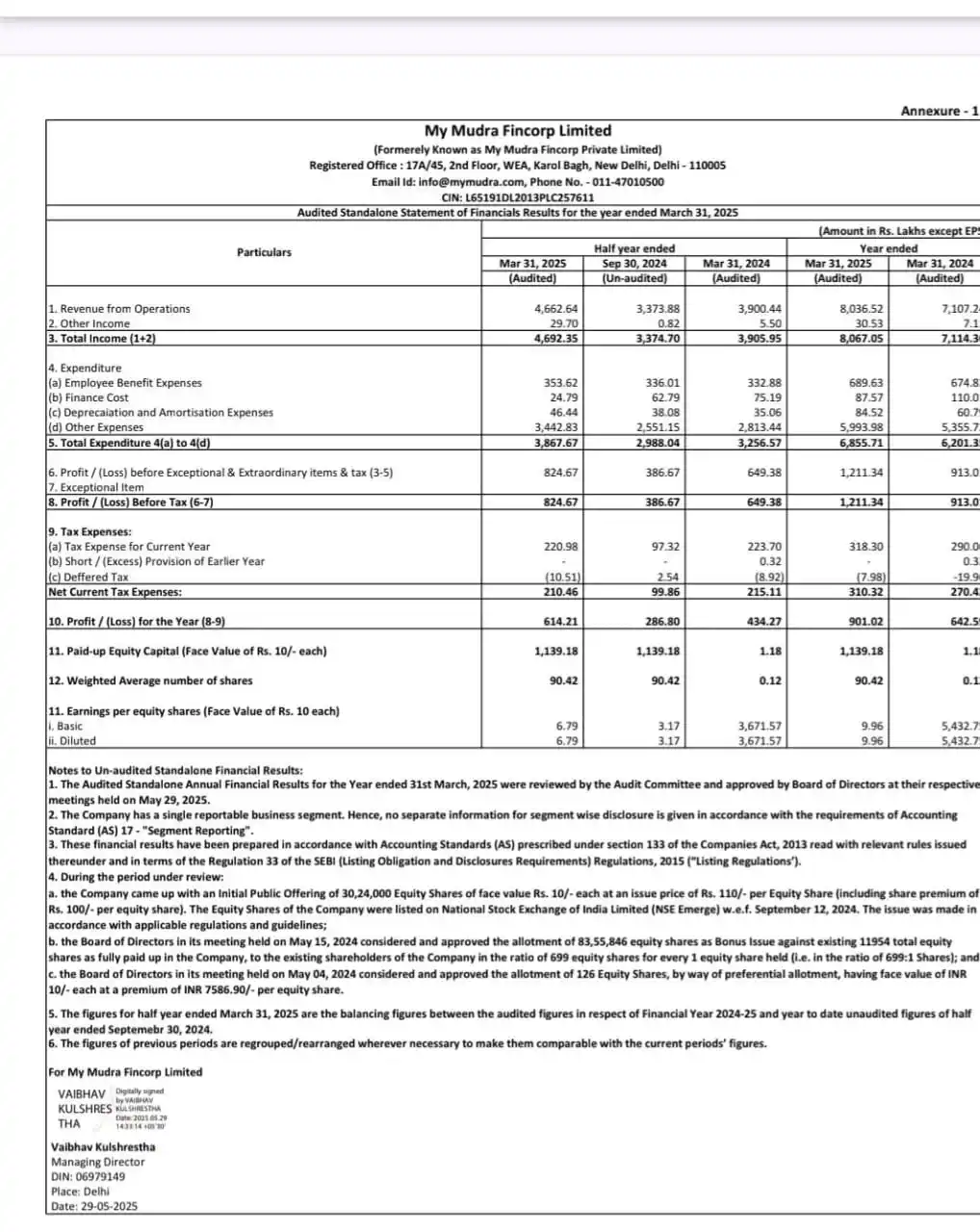

🚨 SME Results Season: Reality Check for All! 🚨 1️⃣ This season, a staggering 90-95% of SMEs reported disappointing numbers. Despite all the hype during the bull run, most couldn’t back it up with real performance. 2️⃣ Bull Market Illusions: When markets soared, many SMEs flashed impressive results—mostly to attract QIP/funding. Now, with the rally cooling off, it’s clear those “great” numbers were often just for show. 3️⃣ Even Experts Got Trapped: Let’s be honest—even seasoned investors got caught up in the euphoria and backed the wrong stories. This is a humbling reminder: we’re all human. Don’t take anyone’s words as gospel. Always DYOR (Do Your Own Research). 4️⃣ Broken Promises: #TGL and many others promised the moon, but reality turned out the opposite. No wonder investors are rethinking their approach to SMEs. 5️⃣ Smart Money Shifting: Now, funds are moving out of weak SMEs and into those with real fundamentals—where both results and guidance inspire confidence. Only the best will thrive from here. 6️⃣ Look Beyond Stories—Focus on Promoters: In SME investing, the real edge isn’t in chasing stories—it’s in spotting good promoters. Any promoter giving aggressive future guidance without a solid track record (especially in the first few quarters after listing) is a red flag. Always check how the company has performed for 2-3 quarters post-listing before trusting their projections. 7️⃣ Beware the Listing Euphoria: Most SME IPOs debut with lots of buzz, but 95% will eventually trade below their issue price. Before investing long-term, always read the RHP/DRHP, and watch the promoter’s interviews on YouTube to judge intent and clarity. Never trust an SME IPO before it’s proven itself with at least 1 year of results. 8️⃣ Kedia Sir Was Right: As @VijayKedia1 always says: “In the long run, only quality prevails. Stories fade, but solid execution stands tall.” 🔍 Bottom line: The SME shakeout is ON. Stories won’t cut it anymore—focus on consistent results, credible guidance, and promoter quality. Nobody is infallible in the markets. Among the top 5% of good SMEs, only about 1% will become future multibaggers. Your edge? Deep research, patience, and the discipline to ignore the noise. 🎥 At the end, do watch this clip by @VijayKedia1 to get a reality check again: youtube.com/shorts/mh46fvr… These are my personal views and not a financial recommendation of any sort. Please do your own research before making any investment decisions. #SME #Investing #StockMarket #Results #Multibagger #DYOR https://x.com/nimxor1/status/1928462758250692653?t=hhGl6CY26lCkUU__vZ-zWA&s=19

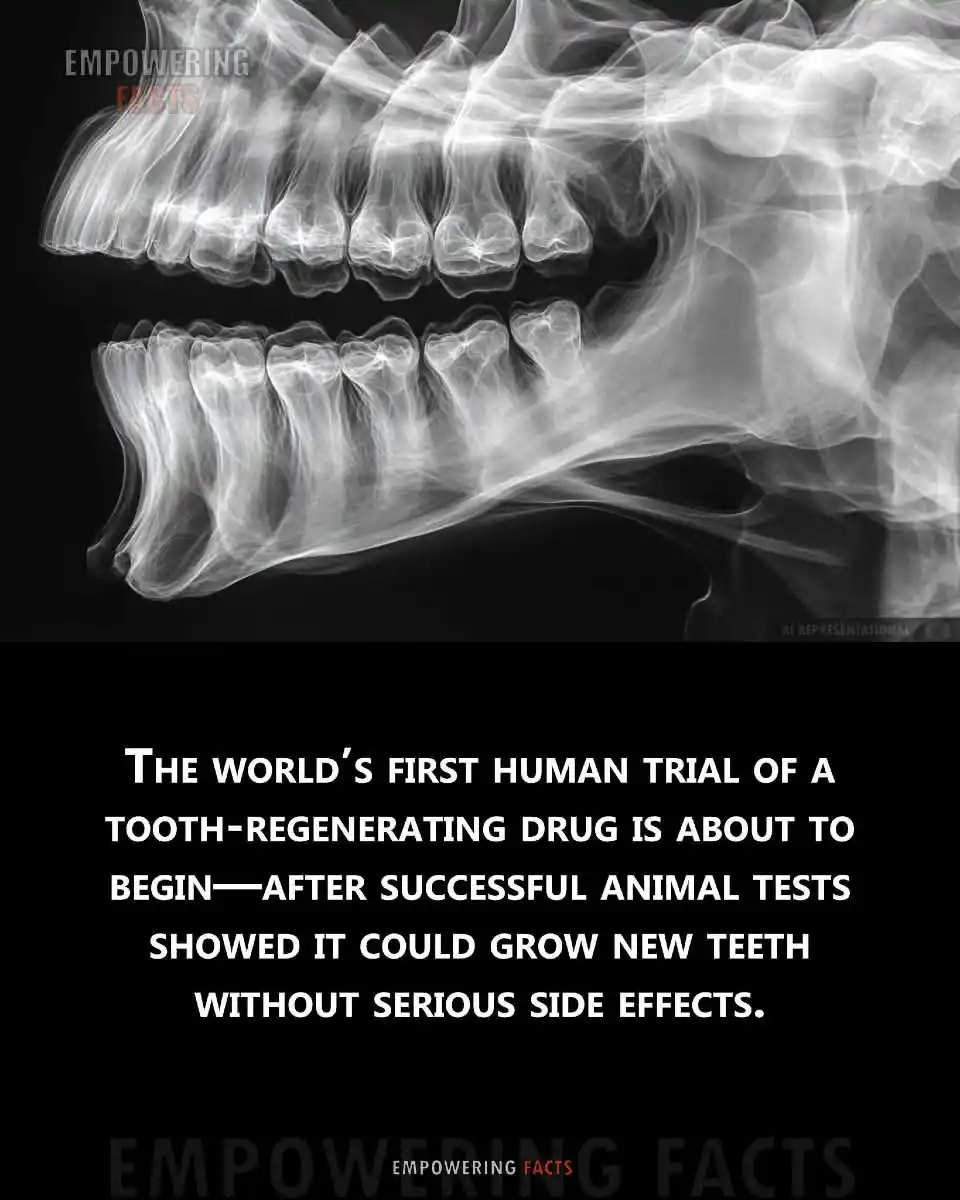

Developed by Japanese researchers, this groundbreaking drug targets a protein that suppresses tooth growth. In animal trials, it stimulated the growth of entirely new teeth, including in species that had stopped growing them. Now, in 2024, scientists are ready to test it on humans missing at least one molar, with hopes of regenerating natural teeth instead of relying on implants or dentures. If successful, this treatment could revolutionize dentistry, helping millions worldwide. From congenital tooth loss to age-related gaps, the idea of “regrowing your smile” might soon be science fact—not fiction. 🦷✨ #ToothRegeneration #DentalBreakthrough #FutureOfMedicine

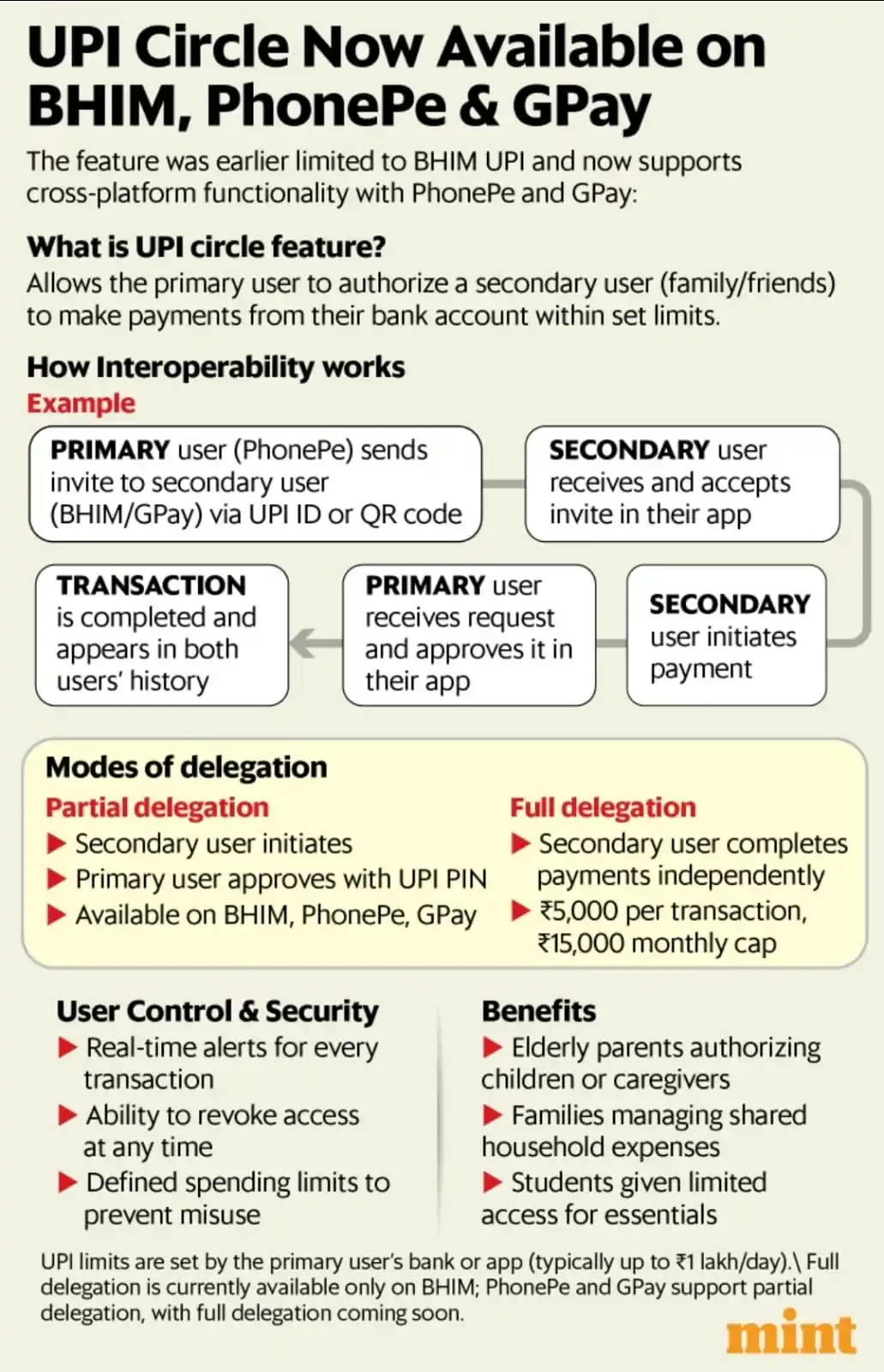

UPI Circles is now interoperable. You can give your kids money more easily or authorize spends by your employees on your behalf. Possibilities are endless!

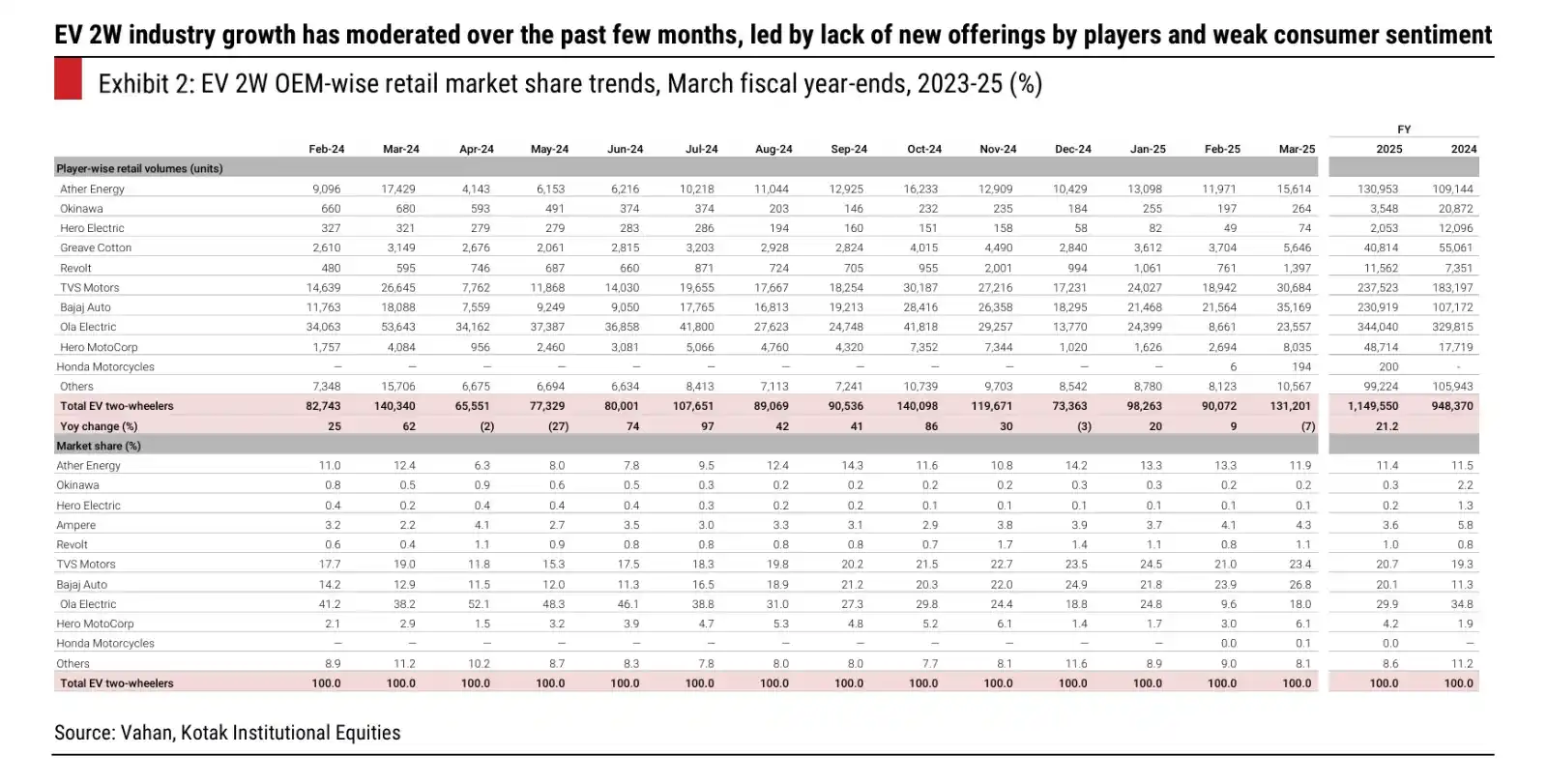

*EV 2W Industry - Market Share Trend* Source: Kotak Securities

https://stratnewsglobal.com/united-states/u-s-plays-trade-deficit-victim-heres-how-it-mints-billions-from-india/