ICICI Direct

47.1K subscribers

Verified ChannelAbout ICICI Direct

27 Years, 1 Name. Join the revolution of digital investing. Instant Support 24x7 on WhatsApp: 9833330151 🪪SEBI Registration No: INZ000183631

Similar Channels

Swipe to see more

Posts

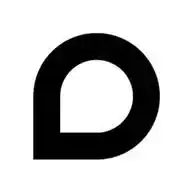

📚 *Introducing you to Word of the Day!* Imagine holding onto a stock for ages, waiting for the right moment to sell. One day, the opportunity finally arrives - but just as you’re ready to sell, you’re stuck in a maze of paperwork and lengthy verification processes. By the time you’re done, the moment has passed, and the opportunity is lost. But those days are in the past, *let’s take a closer look at DDPI*. 🤔 🔔 _Unmute notifications and give a 👍 for more such content!_ Disclaimer: bit.ly/full-disclaimer

🔔 Here is today’s *market wrap!* 📊 🔸Markets closed flat after yet another dull, range-bound session. 🔸Midcaps (-1.6%) and Smallcaps (-2%) saw deeper cuts. 🔸Barring Autos (+0.5%), every single sector got thrashed. _How did your portfolio perform today?_ 🤔 - Good 👍 - Bad ⬇️ - Very Good ❤️ - Very Bad 🔴 - Fine 🙏🏼

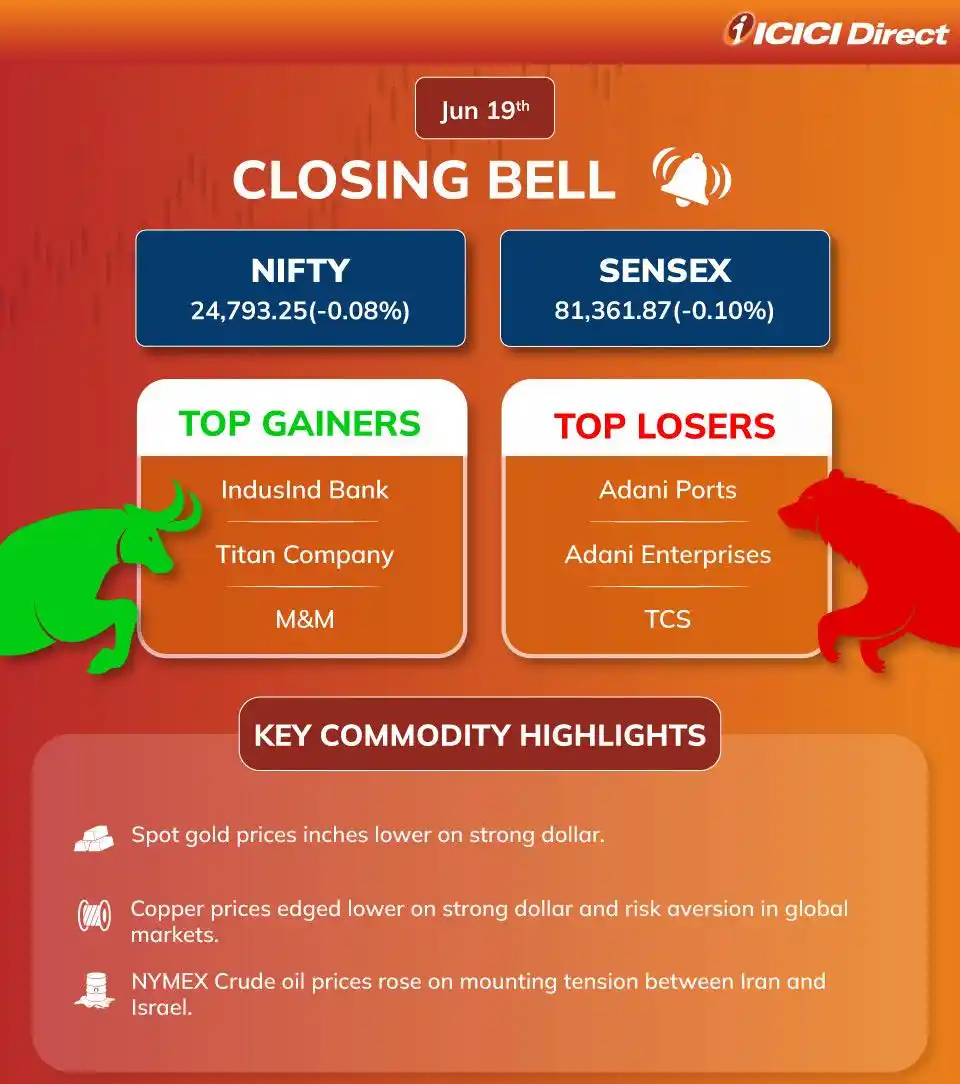

Madhya Pradesh and Uttar Pradesh recorded the highest number of e-transactions in India in FY25. On the other hand, for e-transactions per 1,000 population, Dadra & Nagar Haveli reported over 1 lakh transactions, followed by Jammu & Kashmir with 60,266.3 and Lakshadweep with 58,368.1 during the same period. 🩷 & 🔄 for better reach! Disclaimer: bit.ly/full-disclaimer

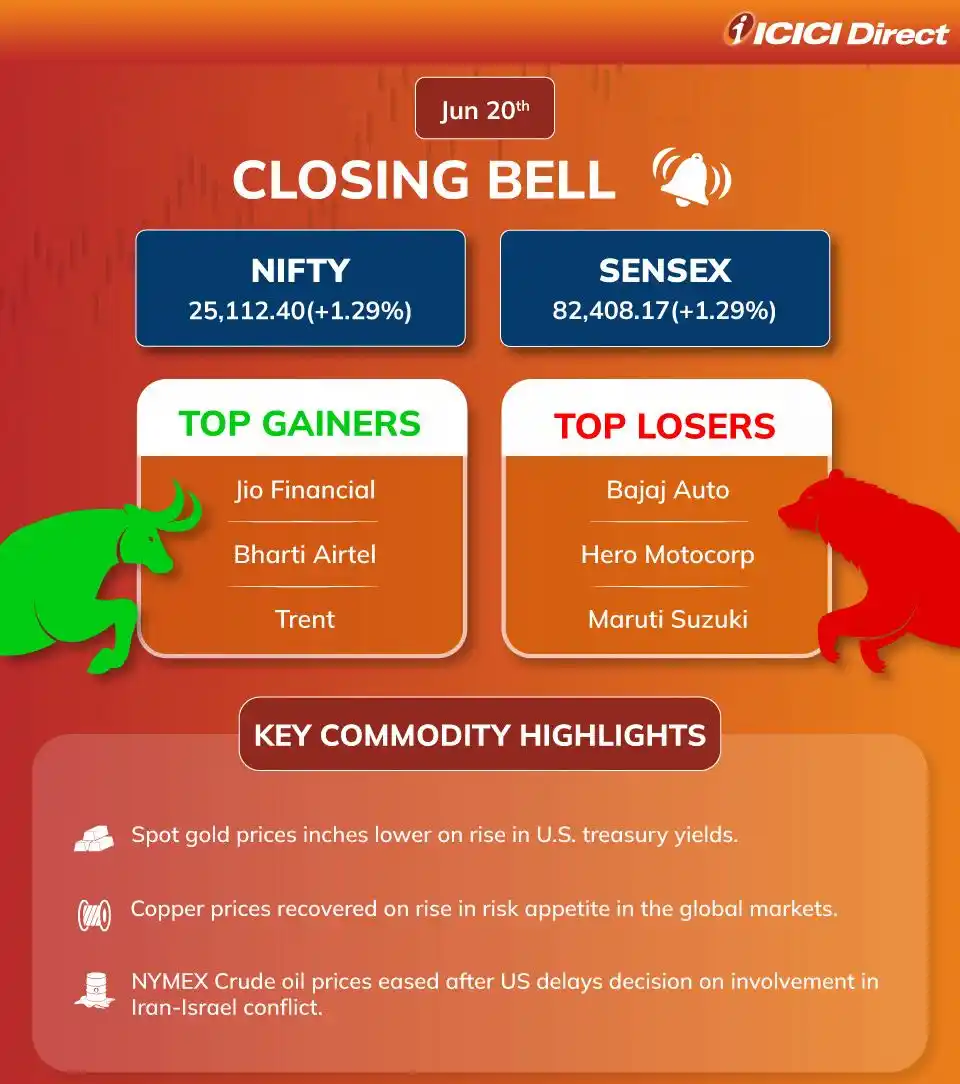

🔔 Here is today’s *market wrap!* 📊 🔸Markets bounced back after a dull week, as strong heavyweight buying propelled Nifty and Sensex +1.3% each. 🔸Midcaps (+1.5%) and Smallcaps (+1%) joined the party too. 🔸Real Estate (+2.1%) led the rally, followed by PSU Banks (+1.6%) and Metals (+1.1%). _How did your portfolio perform today?_ 🤔 - Good 👍 - Bad ⬇️ - Very Good ❤️ - Very Bad 🔴 - Fine 🙏🏼

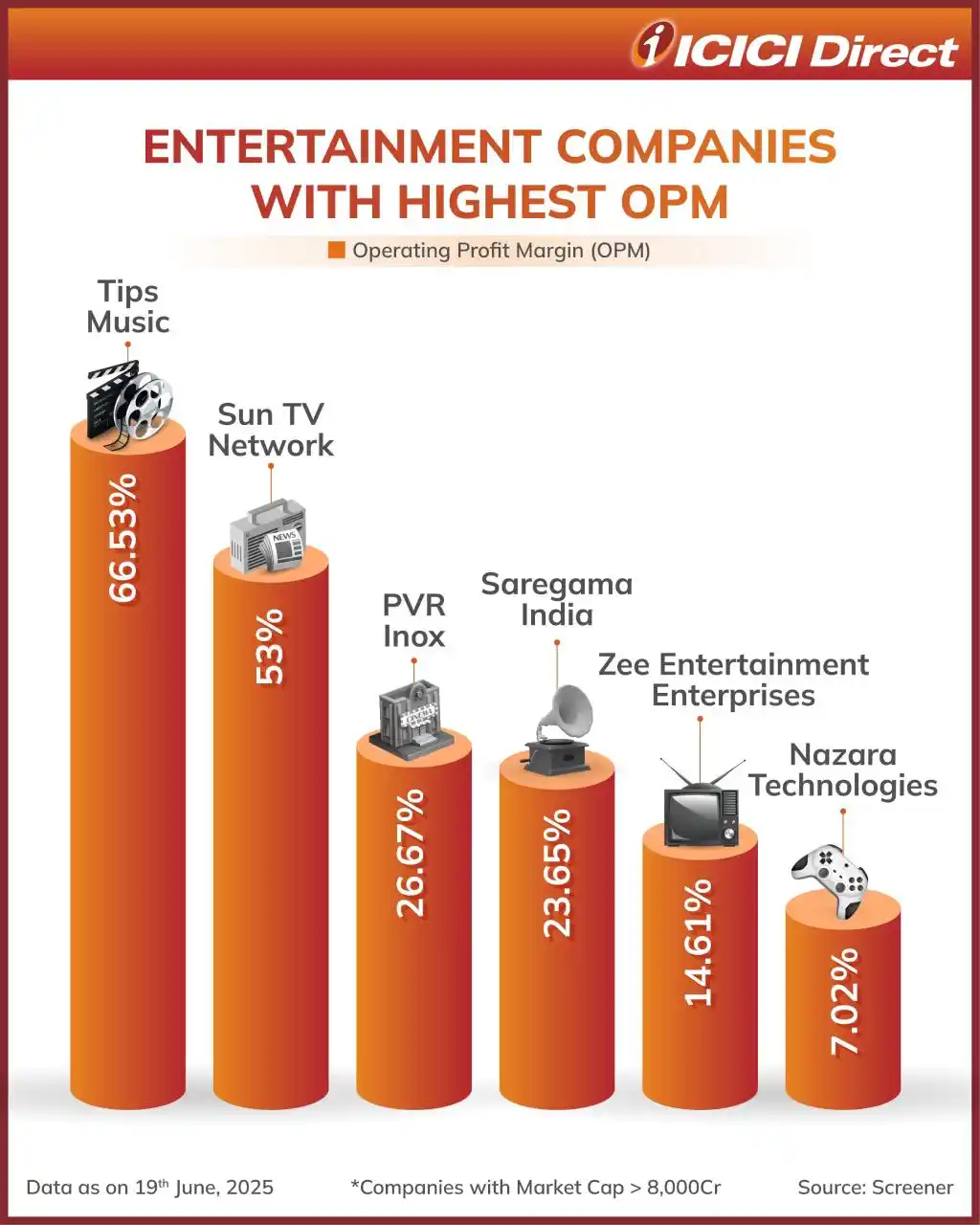

Zee Entertainment Enterprise plans to raise Rs 2,237.44 crore from promoter group entities, increasing their promoter holding to 18.4%. The board has approved the issuance of up to 16,95,03,400 fully convertible warrants to promoter group entities on a preferential basis, priced at ₹132 per warrant. 👆 *Check out India’s entertainment companies and their Operating Profit Margin.* Disclaimer: bit.ly/full-disclaimer

*📢 Webinar Alert!* *Episode #21 of Commodities – Insights, Trends & Forecast* Commodities Weekly Update 👉 The Iran-Israel Conflict 👉 Will Gold rise to ₹1,02,500? 👉 India’s Rare Earth Crisis 🕓 4 PM Today Join live at bit.ly/Commodity-Webinar-19th-June

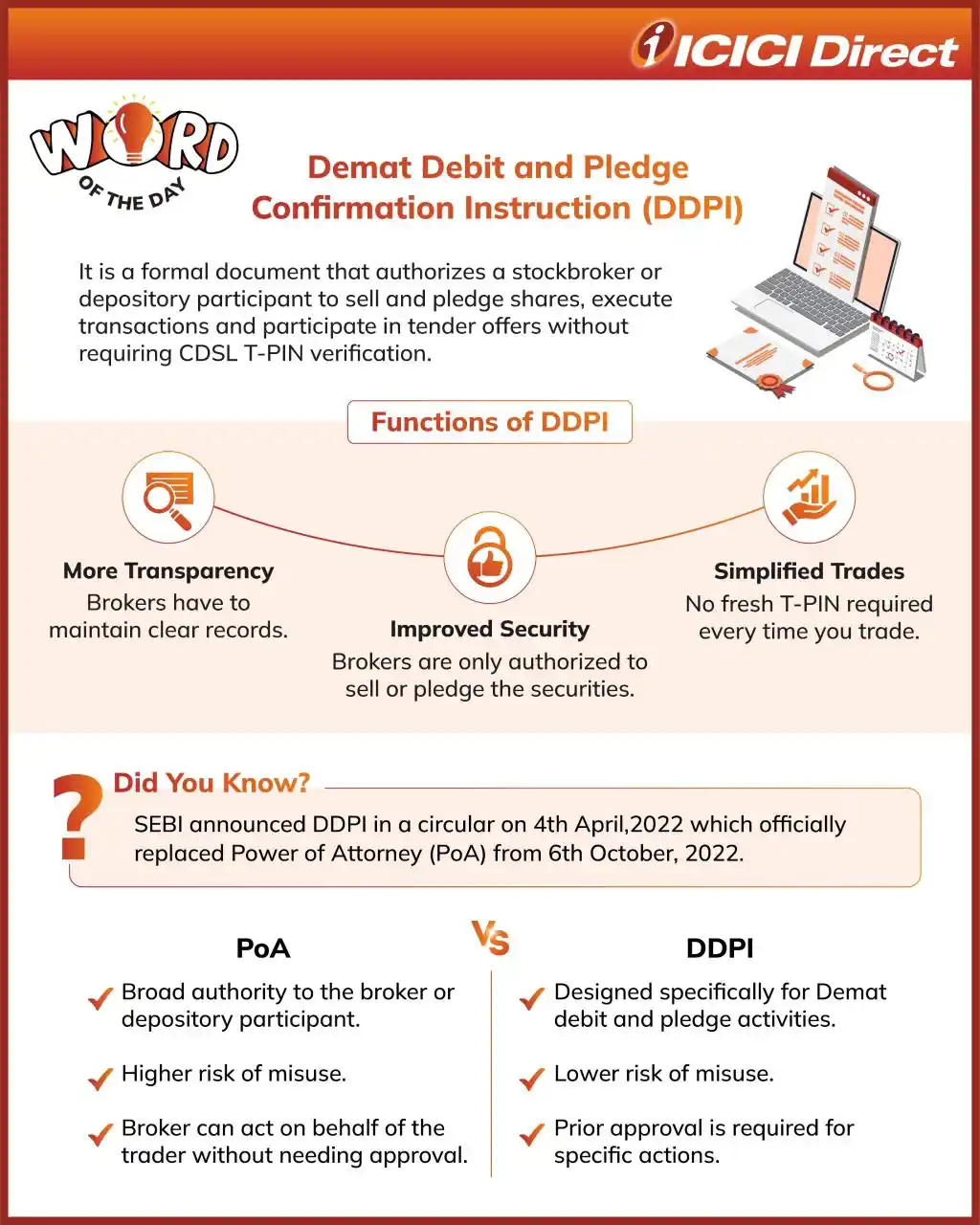

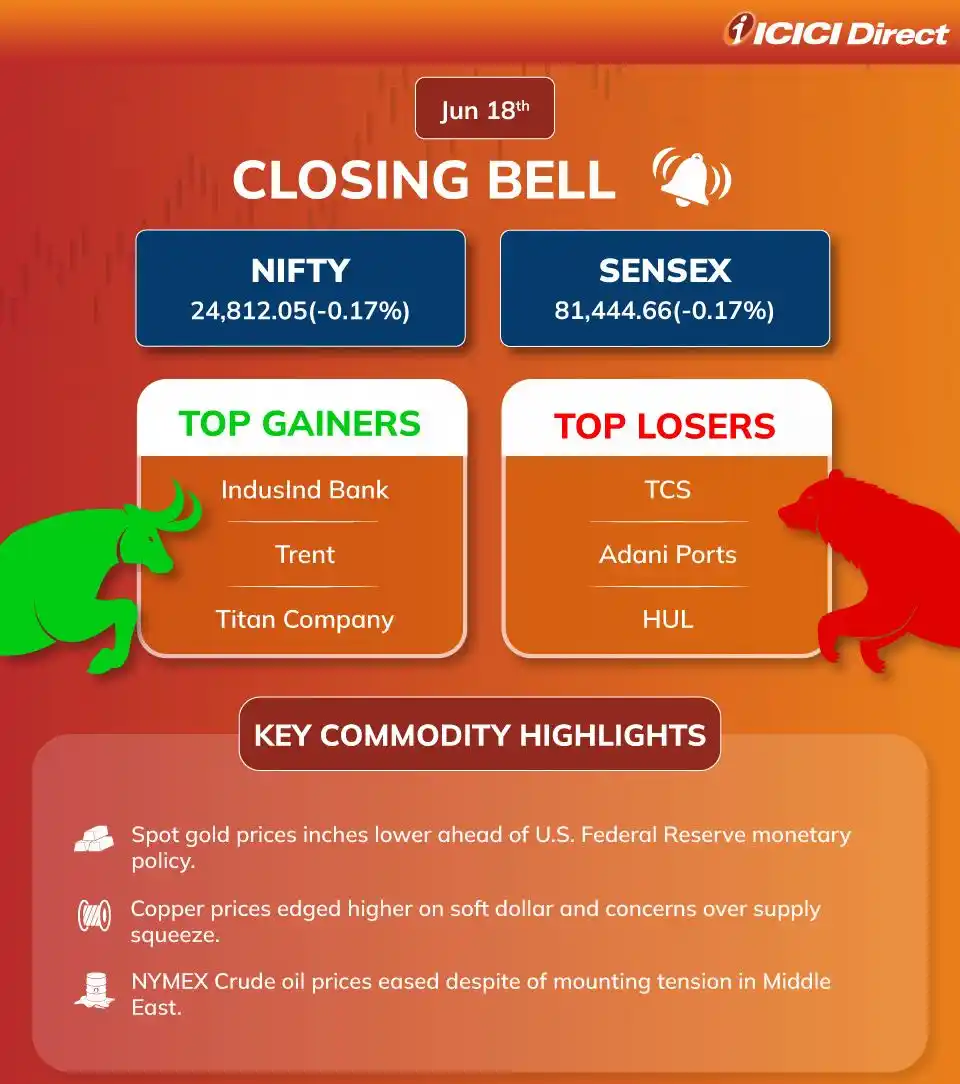

🔔 Here is today’s *market wrap!* 📊 🔸For the second day in a row, markets cooled off sharply from the highs to end with minor losses. 🔸Autos (+0.4%) and Banks (+0.2%) ended in the green. 🔸Meanwhile, IT (-0.8%) and Metals (-0.7%) saw profit booking. _How did your portfolio perform today?_ 🤔 - Good 👍 - Bad ⬇️ - Very Good ❤️ - Very Bad 🔴 - Fine 🙏🏼

🚨 *Important Update* Bajaj Finance has announced a *stock split* in *2:1* and *bonus issue* in *4:1* with the record date for *16th June 2025.* To see the impact of this corporate action on Futures & Options (F&O) positions. 👉 *Read the full article here* : www.icicidirect.com/futures-and-options/articles/bonus-and-spilt-adjustments-in-bajaj-finance-on-f-o-positions

*Government Capex starts with a bang in FY26E!* April 2025 Capex surged 60% YoY to ₹1.6 lakh crore — that's already 14% of FY26E’s ₹11.2 lakh crore target. 📊 📌 What does the data reveal? 📌 Which 4 stocks can benefit from this momentum? Check out the full thread: https://x.com/ICICI_Direct/status/1934238790412882019 Hit 👍 for more such insights! Disclaimer: http://bit.ly/full-disclaimer

*Weekly Hidden Gem!* 💎 *Techno Electric & Engineering Company Ltd* (#TECHNOE) 🛒 CMP: ₹1,454.20 ⭐ Rating: Buy 🎯 Target Price: ₹1940 📈 Potential Upside: 33% 🟢 Market Cap: ₹16,915 crore 🔸 Techno Electric is a key *EPC player in power transmission* (68% of order book), distribution, and generation, with a growing focus on data centres. 🔸 Posted record FY25 performance: • Revenue: ₹2269 Cr (+51%) • PAT: ₹386 Cr (+40%) 🔸 Robust *orderbook* of ₹11,000 Cr, led by ₹7500 Cr in transmission (including EHV) and ₹1450 Cr in FGD segment. FY25 order inflows at ₹4150 Cr; similar momentum expected in FY26E. 🔸 *Data centre* expansion in motion: • Gurgaon edge DC live • Chennai & Mumbai centres to go live in FY26 • ₹8000 Cr capex lined up for 10 edge DCs • Target: 250 MW DC capacity by 2030 🔸 Guidance for FY25–27E: • Revenue CAGR ~39% • EBITDA CAGR ~66% • PAT CAGR ~40% 🔸 *Strong tailwinds from infra capex + high-margin digital infra biz = valuation re-rating candidate* If this one’s in your watchlist, hit 👍🏻 Disclaimer: http://bit.ly/full-disclaimer