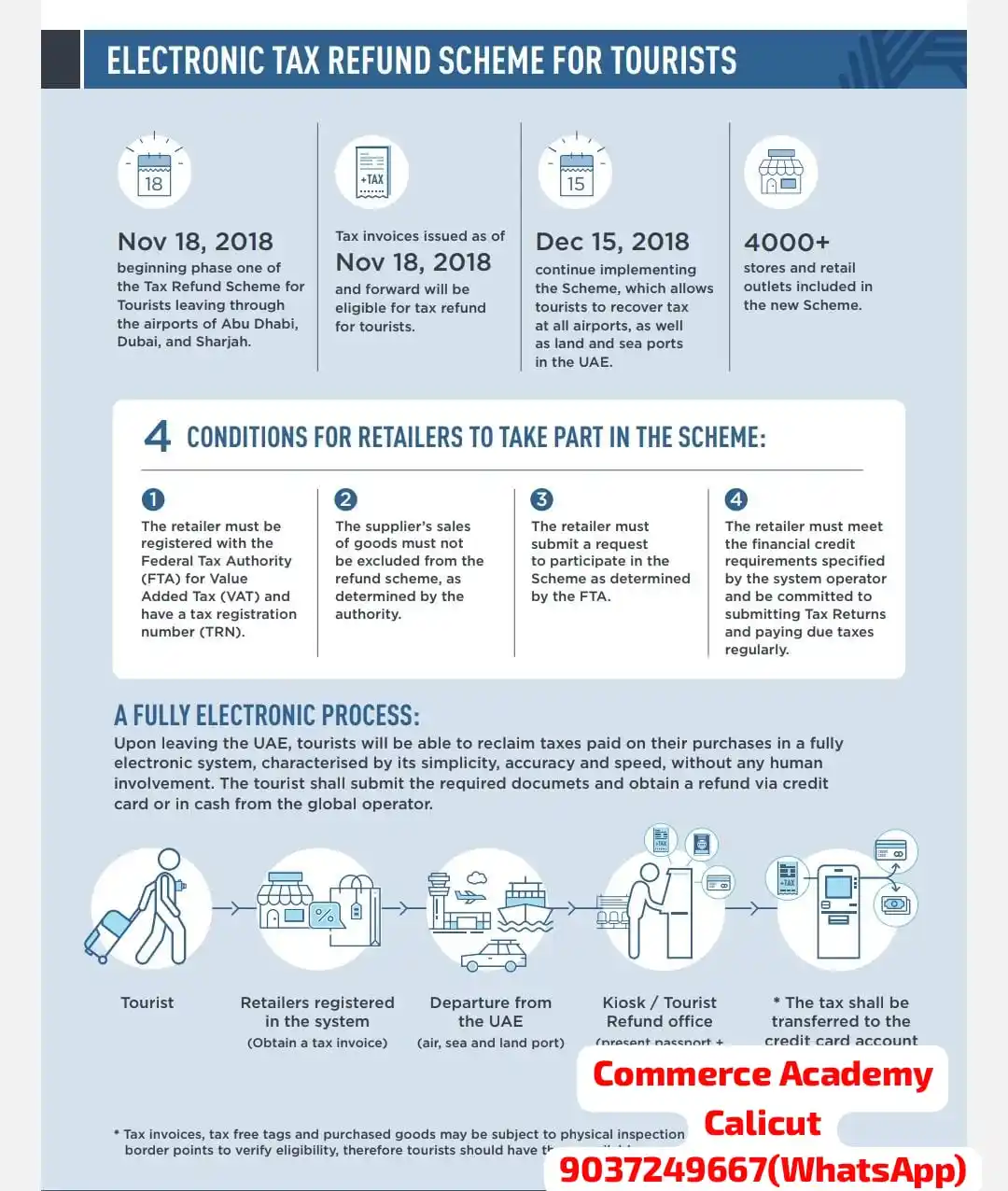

COMMERCE ACADEMY CALICUT

4.3K subscribers

About COMMERCE ACADEMY CALICUT

WhatsApp - 9037249667

Similar Channels

Swipe to see more

Posts

COMMERCE ACADEMY CALICUT

5/28/2025, 4:45:34 AM

https://www.instagram.com/reel/DKLqIIzpxEO/?igsh=MTVqc2JhZm95ODdyYQ==

👍

3

COMMERCE ACADEMY CALICUT

5/29/2025, 4:47:13 AM

https://youtube.com/shorts/MpGRtmntQTA?si=IkyhxkAcN_fnDBh5