Zerodha

50.0K subscribers

Verified ChannelAbout Zerodha

Welcome to your friendly neighbourhood brokerage. Support: https://support.zerodha.com.

Similar Channels

Swipe to see more

Posts

AI tools have become so good that you can have a reasonably competent personal financial assistant. To make this easier, we just launched Kite's Model Context Protocol (MCP). MCPs are a new way for AI systems to interact with real-world services like trading accounts, for example. With MCP, you can securely connect your @zerodhaonline account to an AI assistant like Claude and do a variety of things like get portfolio insights, plan trades, backtest strategies, build personal finance dashboards, and much more. For example, the screenshot shows an example of a personalized dashboard that can be built using Kite MCP with your Zerodha account data. All of it is free, just like Kite APIs. Read more: https://zerodha.com/z-connect/featured/connect-your-zerodha-account-to-ai-assistants-with-kite-mcp

The goal with Zerodha Fund House was to offer easy-to-understand, low-cost index funds and ETFs. Today, over 7 lakh investors trust us with ₹6,400 crore of their savings. Here's an update on our AMC. Read more: https://zerodha.com/z-connect/business-updates/update-on-zerodha-fund-house

Got a traffic challan on WhatsApp or SMS? Scammers are now sending fake challans on WhatsApp and SMS, using malware to steal everything once you click. We explain how this scam works and what you must do to stay safe👇 https://youtu.be/fUSrh5PjnXU?si=IlF0dkILr1DAYCLY

We just revamped the Kite MarketWatch and made it much cooler. 1. You can now create custom groups for instruments in your MarketWatch. You can group them based on strategies, themes, sectors, etc. For example, you can have a custom group with all the contracts required for an options strategy like an Iron Condor. 2. We've also added pre-built watchlists with all the stocks of broader indices, sector indices, and thematic indices like Bank Nifty. With a couple of clicks, you can quickly see what's happening within an index. 3. You can now create 25 different watchlists with 250 stocks per watchlist. There’s more. Check out this post to learn more: https://zerodha.com/z-connect/featured/introducing-new-marketwatch-on-kite

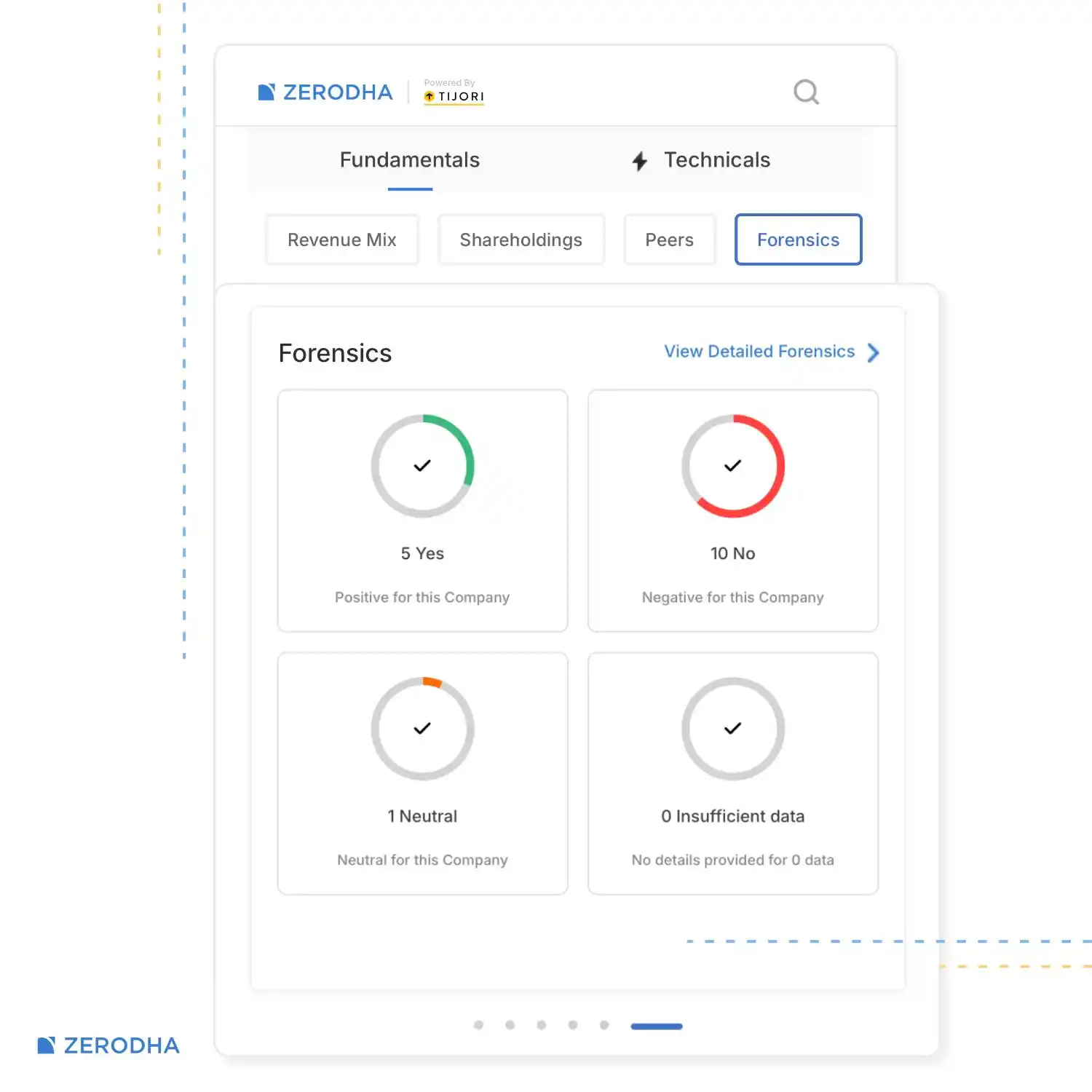

Before investing in any company, it’s important to do your own research. The problem is, fundamental data like what the company does, the financials, peer comparisons, news, and other parameters and data points are often scattered across different websites. To make your stock research easier, we’ve built Stock Pages powered by Tijori, bringing together all the key data points and insigths about a company, such as business overview, financials, technicals, and sector data, in one place. Learn more: https://youtu.be/ycWpDAUy-RU?si=xODxJez1VQP6bUwK Check out stock pages: https://zerodha.com/markets/stocks/

NSE will be adding 4 stocks to the F&O segment from June 27, 2025. Keep track of all the updates here: https://zerodha.com/marketintel/bulletin/

The way we communicate and manage money has changed completely. We communicate through WhatsApp, Telegram, Instagram, and X. We invest, borrow, and send money instantly using various apps. But this convenience has also increased the risk of falling victim to scams, as they have become harder to spot, better disguised, and often look like genuine opportunities. SEBI too recently issued a warning about scammers misusing social media platforms to target investors. Fraudsters are impersonating SEBI-registered brokers, CEOs, and influencers to gain trust and trick people into transferring money. Here's a look at some of the most common scams and how you can stay safe👇 https://tradingqna.com/t/common-online-scams-and-how-to-avoid-them/183022

We've improved the Margin Trading Facility (MTF) feature on Kite: - Easily convert MTF positions to delivery. - Increased limits: Trade up to ₹5 crore per stock and ₹25 crore per account. - Use MTF for over 1,300 stocks with up to 5X leverage. - Place GTT and AMO orders. Learn more👇 https://zerodha.com/z-connect/featured/mtf-updates

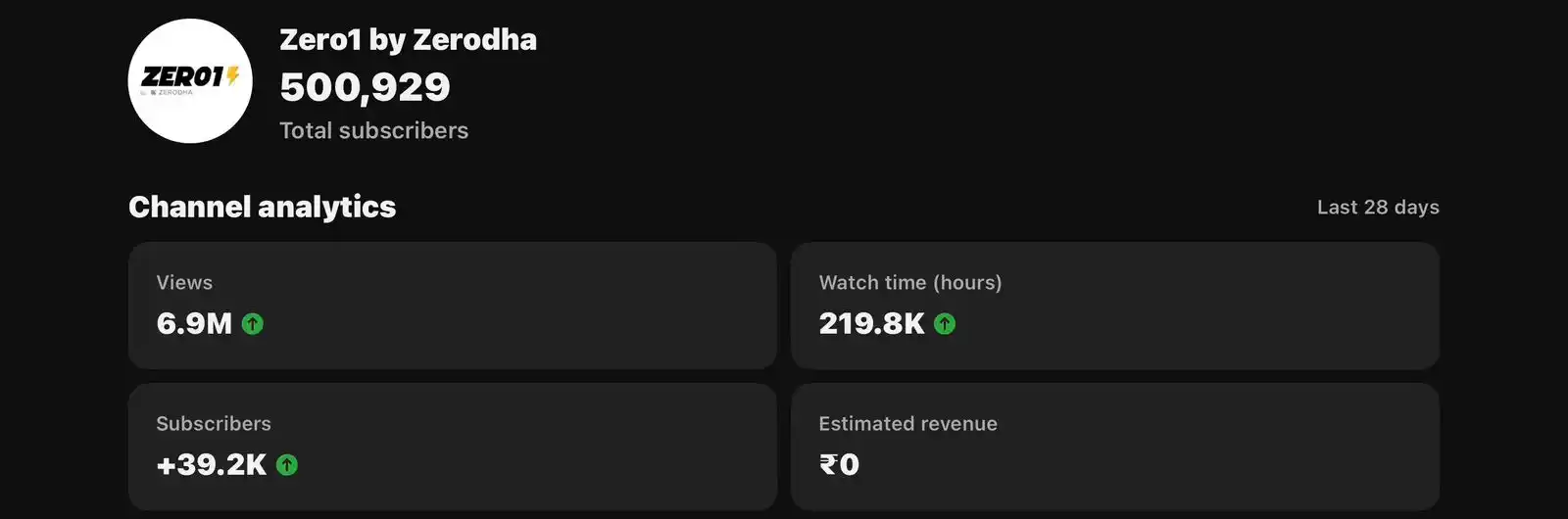

A couple of years back, a new team member pointed out that we didn't have a good strategy for video content, and he was right. In hindsight, it was obvious 😀 We were publishing educational content in text form on Varsity, Z-Connect, etc., but we weren't focusing on videos. We had become like an incumbent, not adapting to the times. Since then, we've put in significant efforts to publish high-quality video content on all things finance, and slowly but steadily, we've become the go-to destination for people to understand finance and markets. Our video strategy is the same as it always was: share everything we know and publish content that people will genuinely find useful, regardless of whether it helps Zerodha or not, and whether it gets views or not. But since the world judges a video by views, and we have never done any performance marketing, our numbers over the last approximately 2 years. And this is just on YouTube, doesn’t include Insta, Twitter, LinkedIn, etc. Zero1 By Zerodha: ~ 6 crore views Zerodha Varsity: ~2.4 crore views Zerodha Markets: ~1 crore views Zerodha: ~1 crore views All of this excludes Nikhil's WTF, which he has been hitting out of the park, along with all the amazing creators in the Zero1 network. Why mention it today? Because Zero1 just hit 500k subscribers in less than 2 years, and maybe we should acknowledge that our video strategy, which was lacking, is in place. So thanks to Prateek, Swati, Karthik, Bhuvan, Sagar, and everyone responsible.

Charlie Munger famously said, “Avoiding stupidity is easier than seeking brilliance.” This is so true when it comes to investing. We’ve added a new feature on the recently launched stock pages by Tijori to help you avoid the obvious stupid mistakes. Under forensics, we show a count of potential red flags and issues that you need to watch out for. You can then visit Tijori to dive deeper into those issues.