Kotak Securities

26.8K subscribers

Verified ChannelAbout Kotak Securities

Transcending research & innovation in trading and investing for 25+ years. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed SEBI prescribed limit. The securities are quoted as an example and not as a recommendation. Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051. SEBI Registration No. INZ000200137(Member of NSE, BSE, MSE, MCX & NCDEX), Member Id: NSE-08081; BSE-673; MSE-1024; MCX-56285; NCDEX-1262. For compliance T&C and disclaimers, Visit bit.ly/ksecdisc.

Similar Channels

Swipe to see more

Posts

New upcoming IPO! Schloss Bangalore Limited, a luxury hospitality company, is launching its initial public offering (IPO) with an issue size of ₹3500 crore. 🔗: https://youtu.be/40MeavvQ14A

GMR, InterGlobe Aviation, ITC in focus | BUY call for IRB Infra | Nifty Strategy for you We believe the intraday market structure is non-directional, and as long as it is trading between 24,650 and 25,000, the range-bound structure is likely to continue. 🔗: https://youtu.be/zei37RLTiwA

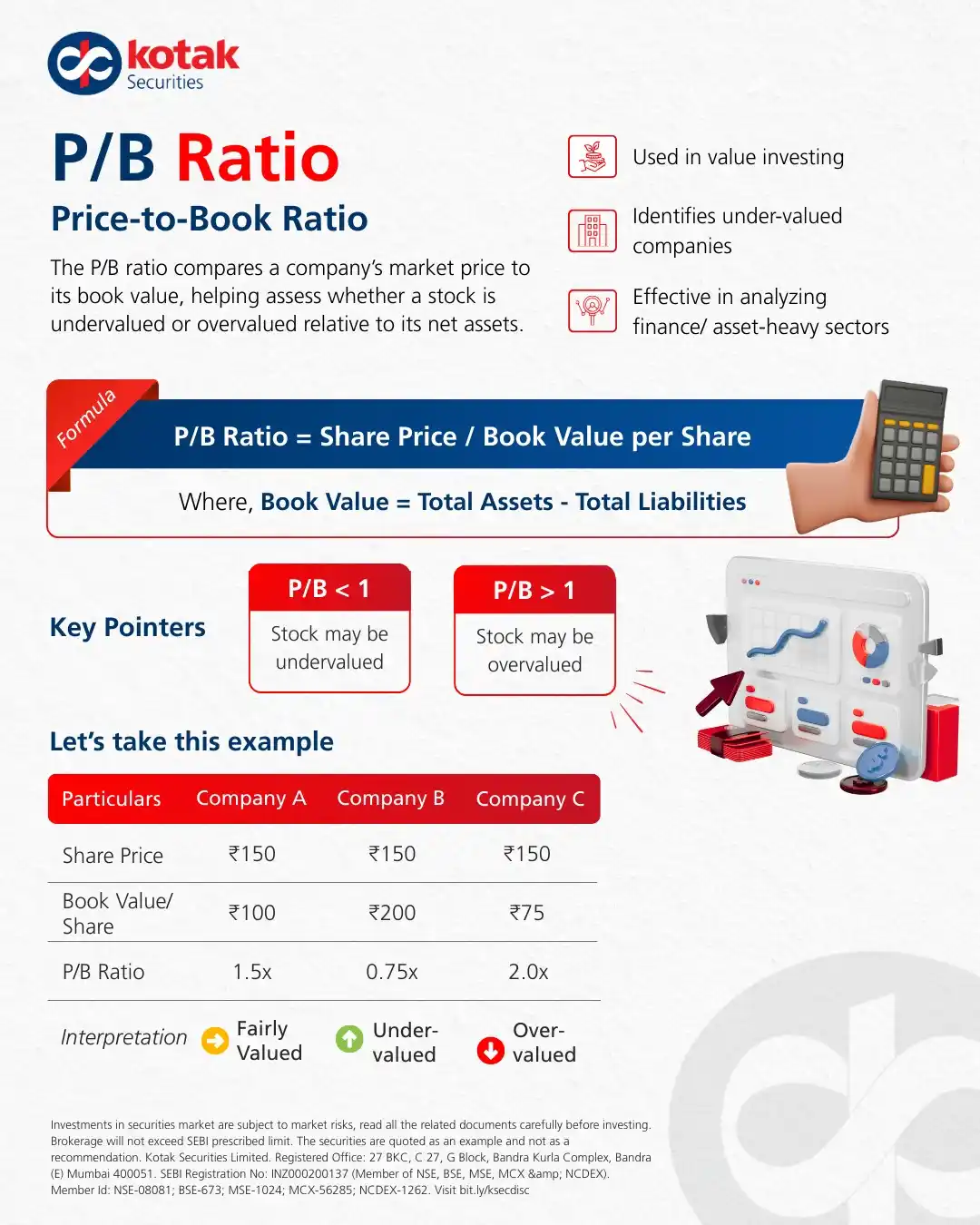

Is a stock overpriced or a hidden gem? The Price-to-Book (P/B) ratio helps you decode whether a company is trading above or below its true worth. Understand how the market values a business compared to its net assets.

Today’s Trade Set-up For You! Nifty and Sensex have formed bearish candles on daily charts and are holding a lower top formation on intraday charts, which is largely negative. 🔗: https://youtu.be/epJwXwN89uw?si=n9d3JBhML7BeUPOM

Daily Trade Talk Podcasts English: 🔗: https://youtu.be/V9VENKm4swU

Aegis Vopak Terminals IPO Review | IPO Details, Financials & Launch Date | Upcoming IPO 2025 🔗: https://youtu.be/YdcydEiXj5I

Daily Trade Talk Podcasts English: 🔗: https://youtu.be/ukA2mGJ9jps Hindi: 🔗: https://youtu.be/Db0n0IjbFw0

The time was around late 1970s, two Texas oil tycoons set out to corner the silver market. Drove the prices up by 400% in just months. What followed was one of the wildest boom-and-bust tales in financial history — with lessons investors still talk about today. Nelson Bunker Hunt and William Herbert Hunt weren't your average traders. They were oil-billionaires from Texas, heirs to one of America’s wealthiest families. But they wanted more and their idea was simple. Inflation was rising and the Hunt brothers feared that the US dollar would lose value. If the dollar weakened, investors would turn to metals like gold and silver, driving prices higher. Gold was expensive, while silver appeared to be the more affordable, undervalued alternative. So, the brothers turned their attention to silver. With their wealth, the Hunt brothers began acquiring silver in large amounts. They purchased physical silver and stored it in warehouses. Further, they bought futures contracts on silver, which gave them the right to buy more silver at a later date. The futures contracts are generally settled in cash. Traders usually do not take delivery of the metal. But, the Hunt brother chose to do things differently. Read on: https://www.kotaksecurities.com/investing-guide/articles/brothers-who-broke-the-silver-market?utm_source=social&utm_medium=wa&utm_campaign=kotak-insights

Commodity Market Analysis and Outlook - 26th May 2025 to 30th May 2025. 🔗: https://youtu.be/WYmleGpEuaI

![THOPFAN🔥[THE HOUSE OF PRAYER FOR ALL NATIONS ] WhatsApp Channel](https://cdn1.wapeek.io/whatsapp/2025/02/28/12/thopfanthe-house-of-prayer-for-all-nations-cover_9acbf6af367a65681068b8eb67439c06.webp)