Capital Insights

34 subscribers

About Capital Insights

Hi, if you are interested in finance & economy, and you want regular updates on it , join capital Insights with Jaymin. What to expect? - finance news and updates. - ongoing trends in economy and stock market - summary of learnings from various authors, blogs ,books and videos -etc

Similar Channels

Swipe to see more

Posts

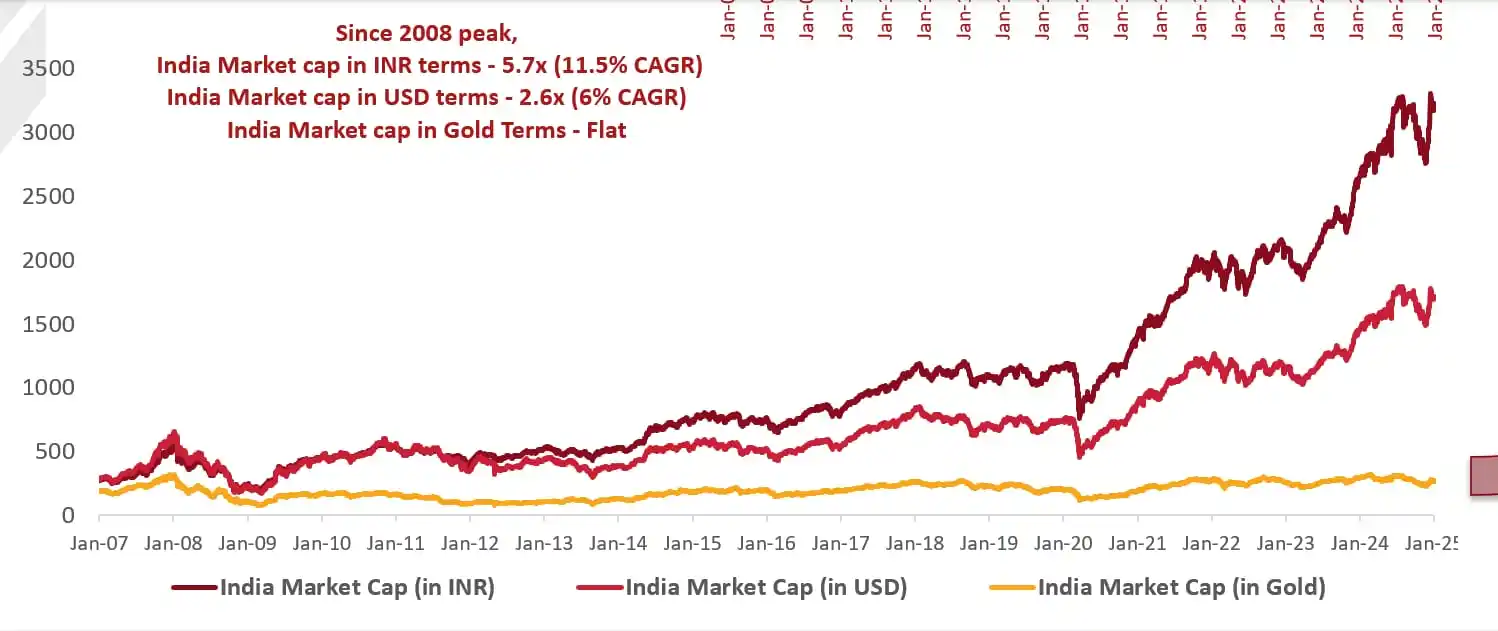

Fun Fact – Since 2008, gold and Indian equity returns are now the same. Look at it this way: Ram and Shyam graduated in 2008. Both received ₹1 lakh as a gift from their parents. Ram listens to business channels, absorbs slick presentations by mutual funds, and invests in the stock market. Shyam, on the other hand, listens to his grandmother and invests in gold. Fast forward to 2025 – they’ve both made the same amount of money. From: Neil Borate _This highlights the importance of asset allocation.You should have exposure to all asset classes—commodities, debt, and equity mutual funds—to balance risk and returns effectively._

*_Quant investing is growing steadily in India,_* where investment decisions do not require human intervention. _*Quant assets account for less than 1% of the total in India, compared with around 35% in the US.*_ *What is quant investing?* Quant investing uses math and data to choose investments. Instead of relying on gut feelings, computer models analyze historical data to identify patterns and make objective decisions.

*Market reaction to the Union Budget* _The overall market impact has been minimal, with the broader market showing little reaction.The key highlight was the easing of taxation, which benefits the common man and is expected to boost consumption. As a result, consumption-focused companies have responded positively. However, government capex-related companies have reacted negatively._

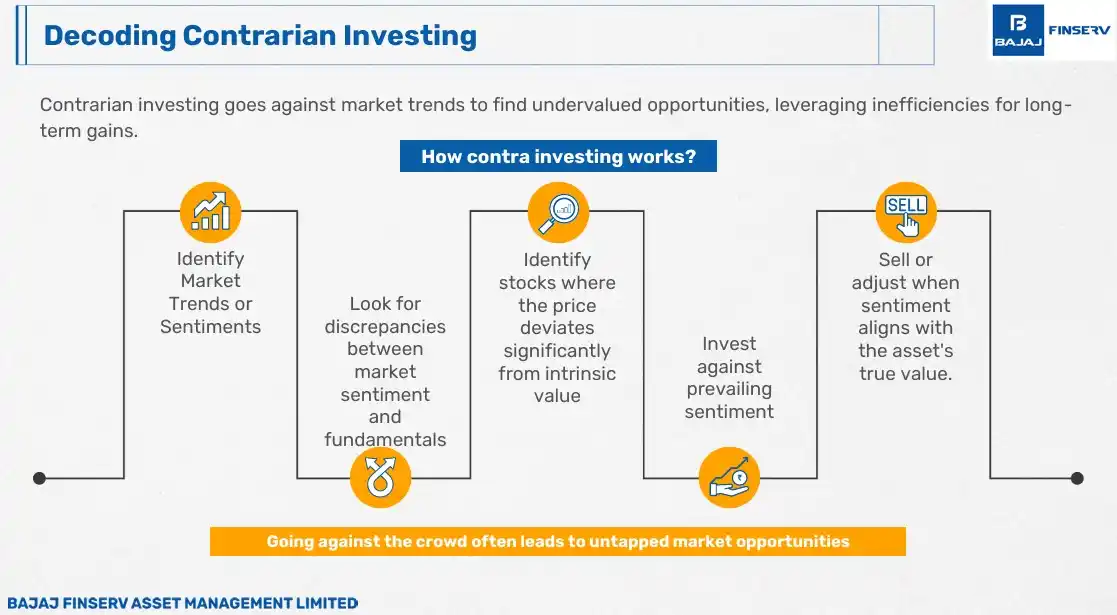

There are times when the clear difference between value and price becomes evident, and the market environment is favorable for buying at a lower cost with a long-term perspective. The new NFO from Bajaj Finserv looks interesting with its contrarian strategy, offering an opportunity to invest in a well-diversified manner. DM to know more. https://wa.me/919586572928

*For Direct Equity Investors* Though there has been a small recovery in the first week of February, the broader market is still very weak. I believe the correction phase has extended to at least 3 to 4 months. Don't rush to buy just because things seem cheap—what's cheap today may become even cheaper. The market has provided ample time to exit and book profits, and it will also offer good enough time to accumulate. Don't be in a rush. Happy Investing. Jaymin

In absolute terms, Nifty has fallen by around 9% from its peak. It is time to gradually increase your inflows into equities.

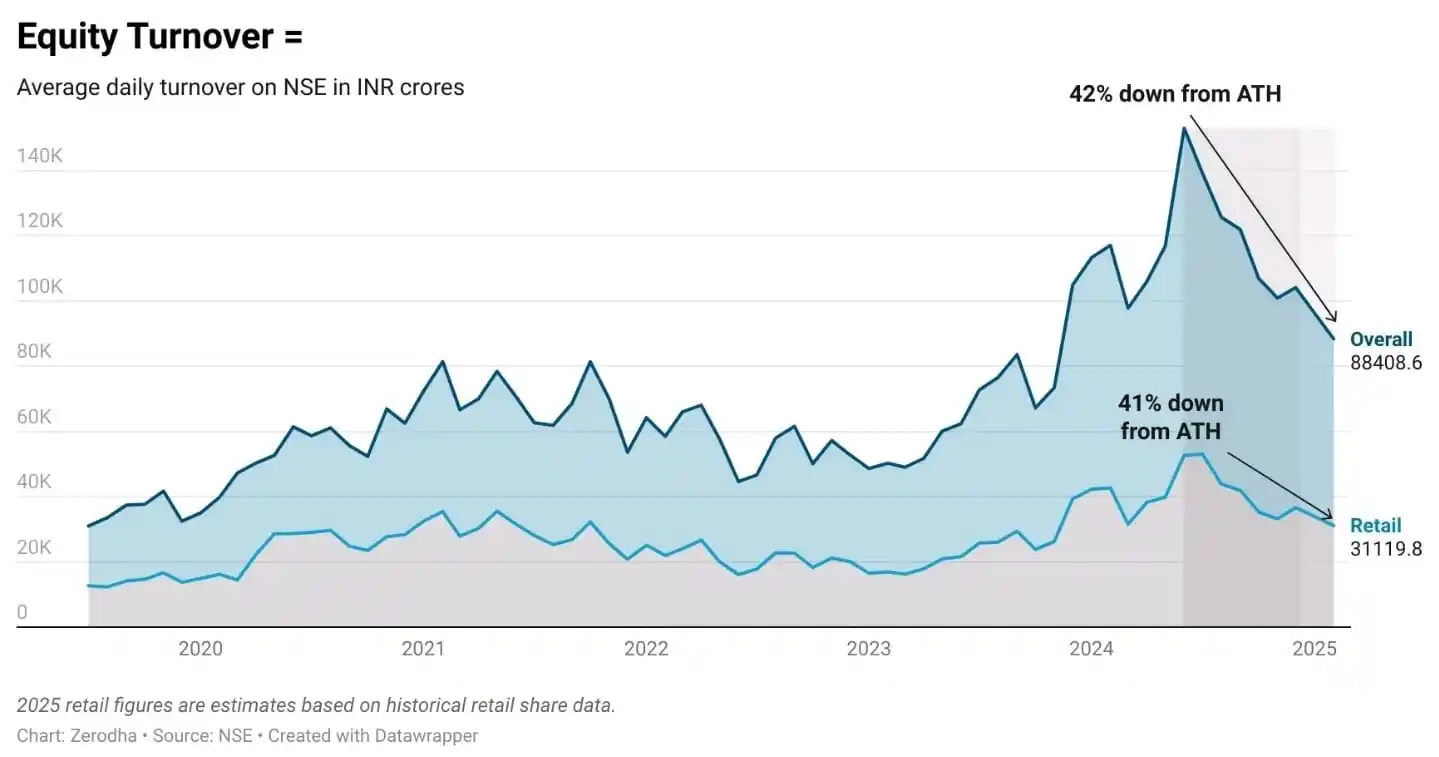

Nithin Kamath, founder of Zerodha, highlighted a sharp decline in trading activity amid the market correction, with volumes across brokers dropping over 30%. This marks the first business degrowth for Zerodha in 15 years, driven by market conditions and regulatory changes. He noted that Indian markets remain shallow, with participation limited to 1-2 crore traders. Kamath also warned that if this trend continues, STT collections in FY25/26 could fall below ₹40,000 crore—50% lower than the government's ₹80,000 crore estimate.

Auto companies and banks have seen smaller declines, whereas realty and healthcare companies have experienced steeper losses.

Largecaps continue to trade at lower valuations and small-midcaps at Higher valuations.

Key Takeaways from RBI's Monetary Policy Statement (Feb 7, 2025): ✅ Rate cut of 25 bps to 6.25% to boost growth. ✅ GDP expected to grow at 6.7% in 2025-26, driven by consumption & investment. ✅ Inflation projected at 4.2% for 2025-26, barring major shocks. ✅ Global risks (geopolitics, trade policy, financial volatility) remain key concerns. ✅ Neutral stance maintained to allow flexibility in response to changing conditions.