PATIL HIRAN JAJOO & CO CHARTERED ACCOUNTANTS

144 subscribers

About PATIL HIRAN JAJOO & CO CHARTERED ACCOUNTANTS

Patil Hiran Jajoo & Co. is a multi service professional organisation of Chartered Accountants practising since 2000. The main object of the firm is to provide quality services to the clients in various fields in a professional manner. For More Information Visit:👇 *www.patilhiranjajoo.com*

Similar Channels

Swipe to see more

Posts

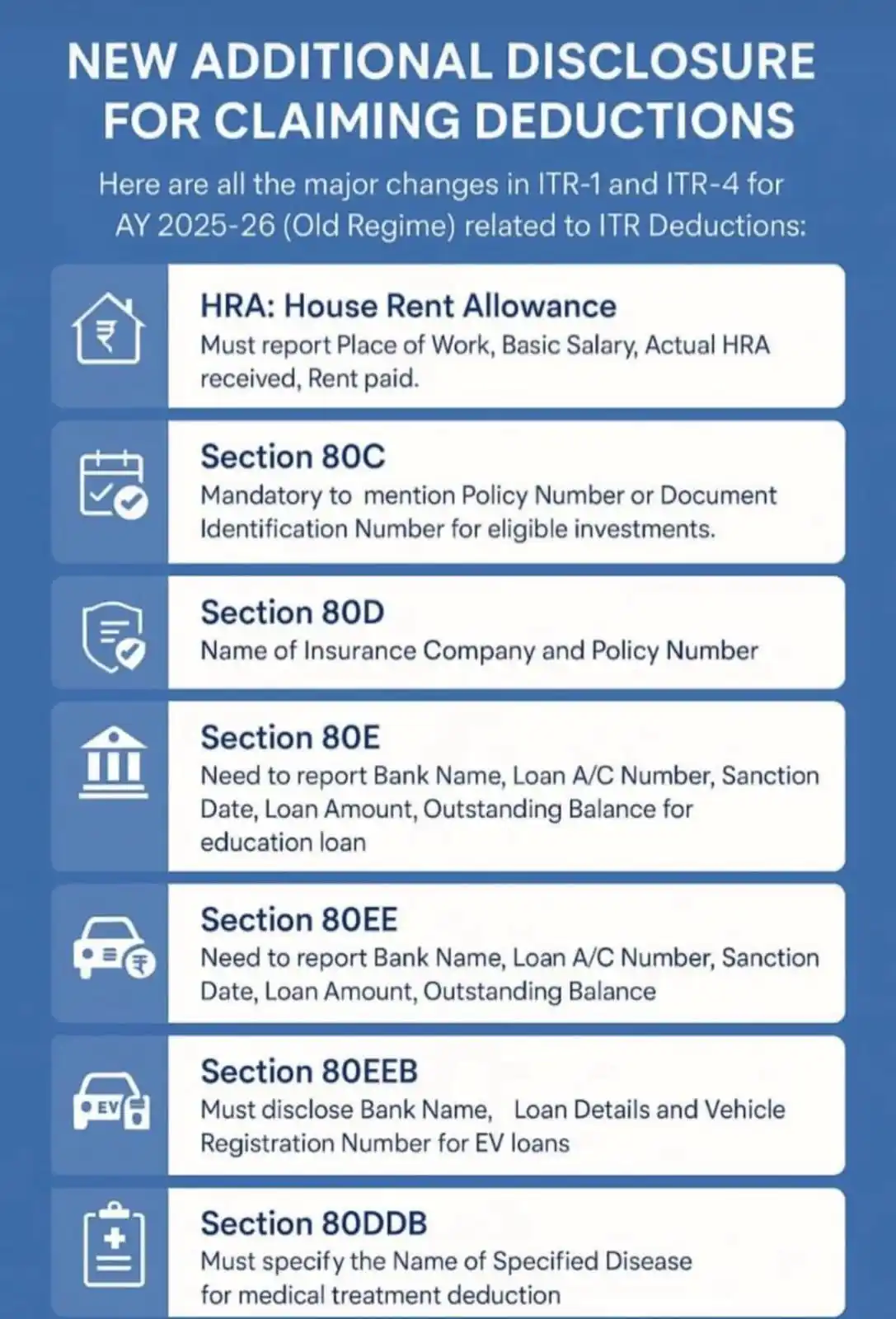

New ITR rules Life Insurance - Policy No. mandatory a Health Insurance - Insurer Name + Policy No. • Home Loan - Lender Name, A/c No., Loan details, Interest u/s 24(b) 2a EV Loan - All above + Vehicle Reg. No. #IncomeTaxReturn #ITR Follow https://whatsapp.com/channel/0029Va6mSySL7UVc3qWITX3w

*Summary of the key decisions announced by RBI Governor Sanjay Malhotra:* *Major Policy Decisions* 🔻 *Repo Rate Cut: 50 Basis Points* * *New Repo Rate*: 5.50% (down from 6.00%) * This marks the third consecutive rate cut since February 2025 🏦 *Cash Reserve Ratio (CRR) Reduction* * *CRR cut by 100 basis points: From 4% to 3%* * Implementation will be staggered in four tranches of 25 bps each * Timeline: September 6, October 4, November 1, and November 29, 2025 * Liquidity injection: ₹2.5 lakh crore will be released to the banking system by November 2025 ⚖️ *Policy Stance Change* * Stance changed from 'Accommodative' to 'Neutral' * RBI indicated limited space left for further monetary support to growth *Economic Projections* 📈 GDP Growth Forecast * *FY26 GDP growth maintained at 6.5%* * Quarterly breakdown: * Q1FY26: 6.5% * Q2FY26: 6.7% * Q3FY26: 6.6% * Q4FY26: 6.3% 📉 *Inflation Outlook* * *FY26 CPI inflation revised down to 3.7%* (from 4.0% earlier) * Current inflation at 3.2% - lowest since July 2019 *Key Takeaways:* • Home loan EMIs expected to decrease following rate cuts • Banks anticipated to pass on benefits through lower lending rates • Real estate sector expected to benefit significantly • Boosting private consumption a major focus

*List of Key Forms Migrating to V3* The new forms cover a comprehensive range of statutory requirements, including: *1️⃣Annual Filing Forms:* •MGT-7 and MGT-7A (Annual Returns) •AOC-4 series (Financial Statements) •MGT-15 (AGM Report) •CSR-2 (Corporate Social Responsibility Report) •AOC-4 (XBRL) (XBRL Filing of Financial Statements) *2️⃣ Audit and Cost Audit Forms:* •ADT-1 to ADT-4 (Auditor Appointment, Removal, Resignation, and Reporting) •CRA-2 and CRA-4 (Cost Auditor Appointment and Report) *3️⃣ Other Key Forms:* •GNL-1 (Application with ROC) •INC-22A (ACTIVE Company Tagging) •CSR-1 (CSR Implementing Entity Registration) •CRL-1 (Subsidiary Layers Information) •LEAP-1 (Foreign Listing Prospectus) •Investor Complaint Form *4️⃣ Legacy Forms under Companies Act, 1956:* •23C, 23D, 23B, I-XBRL, A-XBRL, 20B, 21A, 23AC, 23ACA, 23AC-XBRL, 23ACA-XBRL, 66

*INCOME TAX BREAKING:* CBDT extends Processing Deadline for AY 2023-24 ITRs Filed Under Section 139 of the IT Act to 30.11.2025

Failure to file GSTR-3B and non-payment of tax constitute suppression of facts and attract penalties. Andhra Pradesh High Court judgment (Sriba Nirman Company vs The Joint Commissioner of Central Tax; W. P. No. 25826 of 2023; 29-Jan-2025) affirmed by the Supreme Court (Sriba Nirman Company vs The Commissioner (Appeals), Guntur) The petitioner failed to file monthly GSTR-3B returns and did not pay the necessary GST, which the AP High Court ruled constitutes suppression of facts. Under Explanation 2 to Section 74, suppression includes failing to declare required information in statutory returns or reports. Non-filing of returns amounts to suppression of facts, but a penalty under Section 74 requires that this suppression be willful. The petitioner argued that they couldn’t pay taxes due to non-payment by their sole client, but the evidence showed that some payments were received. The appellate authority found that the petitioner had no valid impediment and determined that the suppression was willful, upholding the penalties. Additional penalties were automatically imposed due to the finding of willful suppression. The Supreme Court reviewed and upheld the AP High Court’s decision, declining to interfere with the judgment. https://whatsapp.com/channel/0029Va6mSySL7UVc3qWITX3w

CBDT has decided to extend the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025. As the utilities were not provided till date, this timely extension is a welcome step. However, as the date for ITR now stands 15-Sep, the date for Tax Audits and ITR where Audits are compulsory should also be extended timely.

https://search.app/JsMpnJx4gGXjzJJ18 Supreme Court dismisses Safari Retreats Case Review Plea by GST Dept [Read Judgement] Source: Taxscan