IPO Wala

1.5K subscribers

About IPO Wala

Mainboard & SME IPO Updates, IPO Allotment Status, Buyback News. Note : Information Purpose Only. Not Sebi Registered.

Similar Channels

Swipe to see more

Posts

*Hexaware Technologies Limited IPO FINAL* Date : 12-14 February Price Band : 674-708 Lot Size : 21 Issue Size : 8,750 Cr (Full OFS) FV : 1 Retail : 35% Employee Quota : 90 Cr (Employee Discount 67/-) M.Cap : 43,024.8 Cr PE CY23 : 43.1× PE CY24 TTM Basis : 37.9× Promoter Holding Post-issue : 95.05%➡️74.71% Lots : Retail - 20,38,606 BHNI - 41,604 SHNI - 20,802 Hexaware Technologies Limited Is A Digital And Technologies Services Company With AI Serving Financial Services And Insurance, Manufacturing And Consumer, Hi-Tech And Professional Services, Banking, Travel And Transportation Industries Under Five Broad Services – ▪︎ Design And Build ▪︎ Secure And Run ▪︎ Data & Artificial Intelligence ▪︎ Optimization ▪︎ Cloud Services

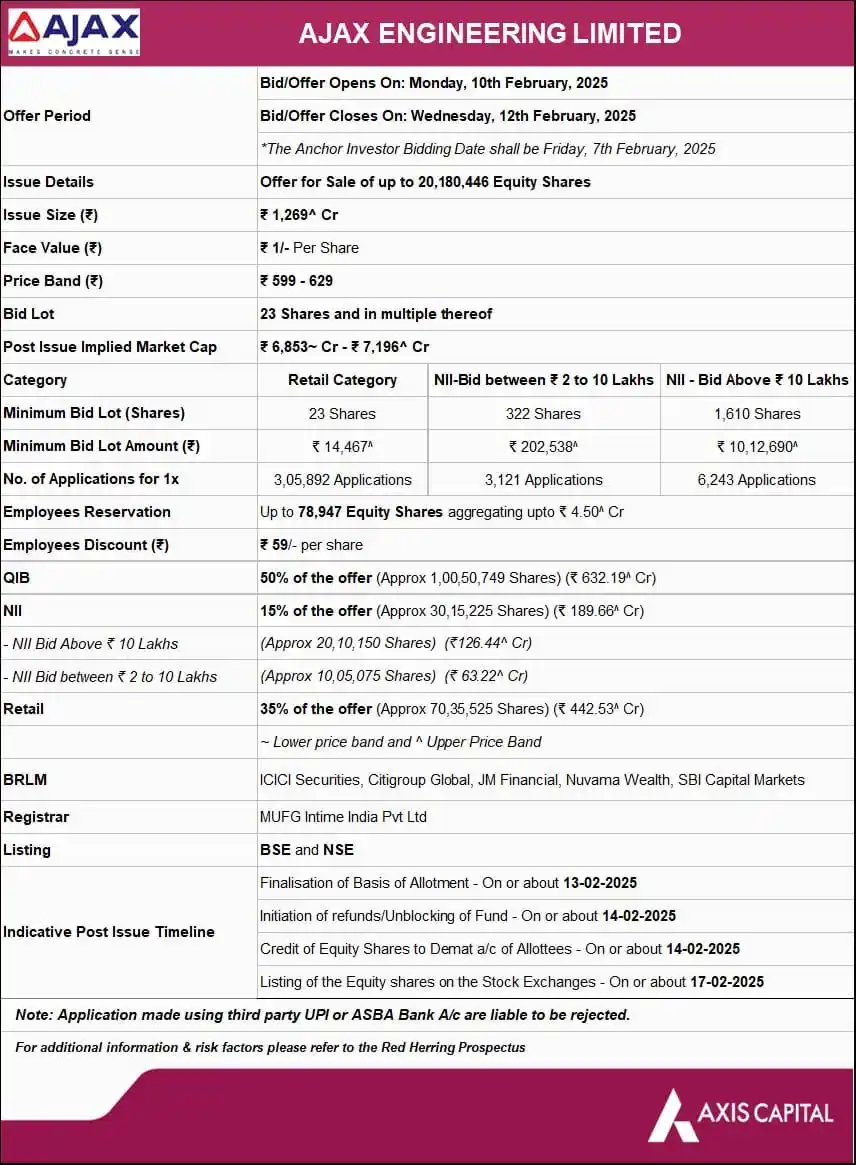

⚡ *Ajax Engineering Limited IPO Open Today* 🗓️ *Date* : 10 -12 Feb ,2025 🏷️ *Price Band* : ₹599-₹629 📦 *Market Lot* : 23 Shares 💰 *Appl Amt* : ₹14,467 📏 *Size* : ₹1269.35 Cr Approx 👦 *Retail Portion* 35% 🏷️ *Face Value* : ₹1 https://ipowala.in/ajax-engineering-ipo-date-price-gmp-review-details/

📣 *Malpani Pipes SME IPO Allotment Out* 🔔 https://ipowala.in/ipo-allotment-status/

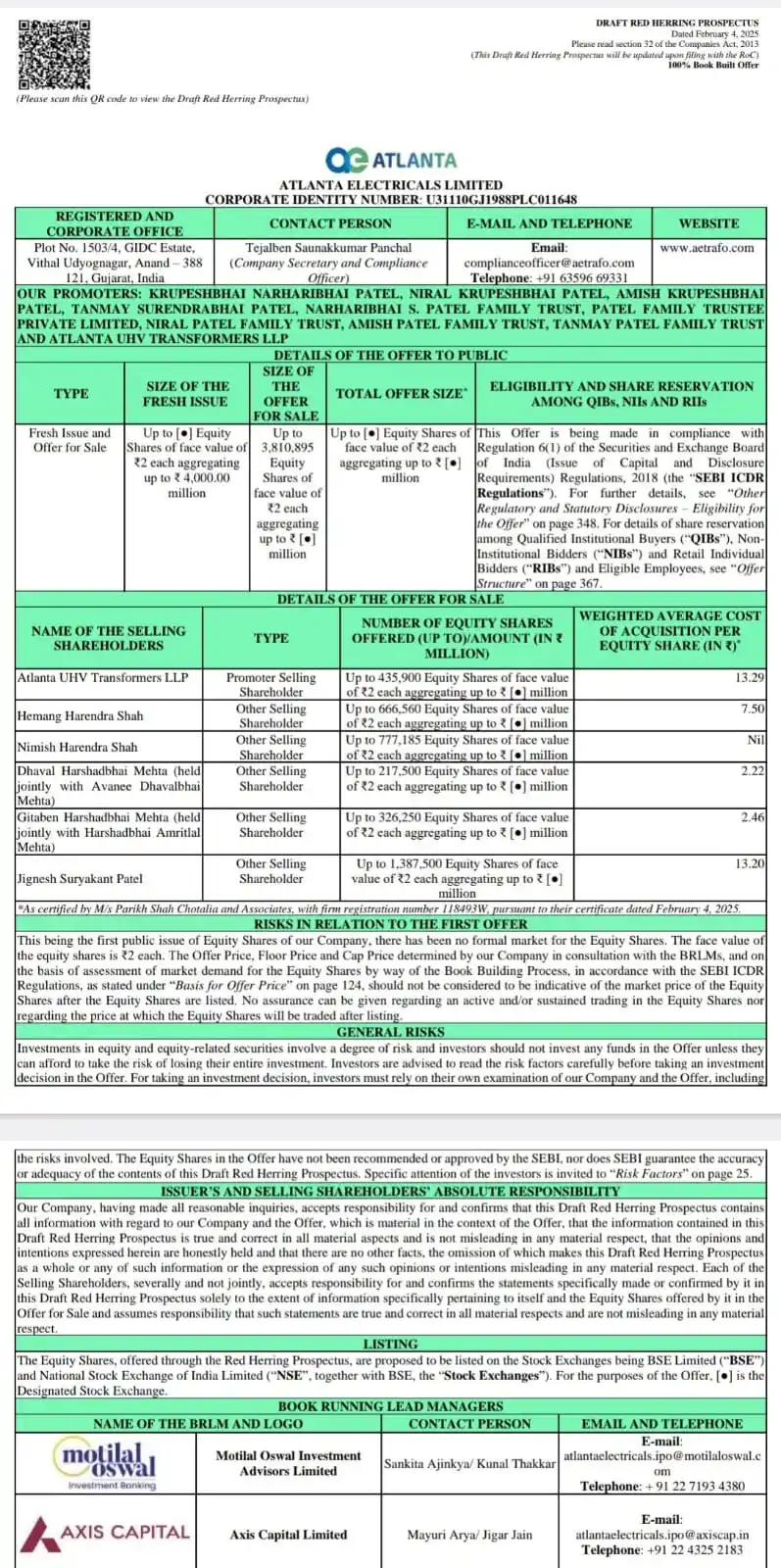

*Anand Based Leading Manufacturer Of Power, Auto And Invertor Duty Transformers* Atlanta Electricals Limited Files DRHP With SEBI Size : Fresh - 400 Cr OFS - 38,10,895 Shares FV : 2 Retail : 35% Employee Quota : Yes FY23 Revenue : 876.6 Cr PAT : 87.5 Cr FY24 Revenue : 872 Cr PAT : 63.5 Cr H1 FY25 Revenue : 573.9 Cr PAT : 51.7 Cr LM : Motilal Oswal, Axis Capital Atlanta Electricals' Product Portfolio : ▪︎ Auto Transformer : 66kV To 220kV ▪︎ Invertor Duty Transformer : 0.60 kV To 33kV ▪︎ Power Transformer : 11kV to 220kV ▪︎ Furnace Transformer : 0.43kV To 66kV ▪︎ Generator Transformer : 3.30kV To 220kV ▪︎ Special Duty Transformers : 0.43kV To 132kV Clientele : GETCO, Tata Power, Adani Green Energy, SMS India Orderbook : 1283.3 Cr Overall, A New Company In The Exciting Transformer Space Set To Enter The Markets !

*Sebi Observation Letter (Approval) Issued To Below IPOs Last Week End on 31st January 2025 :* ▪︎ SMPP Limited ▪︎ Aditya Infotech Limited ▪︎ Brigade Hotel Ventures (Shareholder Quota : Brigade Enterprises Limited) ▪︎ Kumar Arch Tech Limited ▪︎ Solarworld Energy Solutions ▪︎ Indogulf Cropsciences ▪︎ Prostarm Info Systems ▪︎ Globe Civil Projects Limited DRHP Withdrawn : ▪︎ Viney Corporation Limited 8 Companies Get SEBI Approvals For Floating IPO, Many Good And Much Awaited IPOs In It, Good Times Ahead !

📣 *Dr Agarwal Healthcare IPO Allotment Out* 🔔 https://ipowala.in/ipo-allotment-status/

*Hexaware IPO Update:* This is important to note that The delisting price for Hexaware Technologies Ltd. shares in 2020 was rs 475 per share. The company voluntarily delisted its shares on November 2, 2020.

*4 New SME IPOs And All Are Large Sized Offerings* *▪︎ Ken Enterprises Limited SME IPO* Date : 5-7 February Issue Price : 94 Lot Size : 1,200 Issue Size : 83.66 Cr Fresh - 58.27Cr OFS - 25.38 Cr LM : Corporate Capital *▪︎ Eleganz Interiors Limited SME IPO* Date : 7-11 February Issue Price : 123-130 Lot Size : 1,000 Issue Size : 78.06 Cr LM : Vivro Financial *▪︎ Amwill Health Care Limited SME IPO* Date : 5-7 February Issue Price : 105-111 Lot Size : 1,200 Issue Size : 60 Cr Fresh - 48.9 Cr OFS - 11.1 Cr LM : Unistone Capital *▪︎ Readymix Construction Machinery Limited SME IPO* Date : 6-10 February Issue Price : 94 Lot Size : 1,000 Issue Size : 37.6 Cr LM : HEM Securities

*Biggest Mutual Fund Contributor* *Mutual Funds का सबसे बड़ा निवेश* 1) Maharashtra 40% 2) New Delhi: 8% 3) Gujarat: 7% 4) Karnataka: 6.90% 5) West Bengal: 5% 6) Tamil Nadu: 4.50% 7) UP 4.70% 8) Haryana: 3.30% 9) Rajasthan: 1.90% 10) Telangana: 1.70%