CA Ankur Mundhra

36 subscribers

About CA Ankur Mundhra

Update of all GST, Income Tax , Companies Law and other misc updates

Similar Channels

Swipe to see more

Posts

🙏 New TDS rule for Partnership Firms & LLPs from Budget 2024 (Finance Act 2024)! 💼 Under Section 194T (effective 1st April 2025), deduct 10% TDS on salary, remuneration, commission, bonus, or interest to partners if total payments exceed ₹20,000/year. 🔑 Key Points: ✅ https://x.com/caankurmundhra/status/1925749094305161365?s=51

🚧 Scheduled Maintenance Alert! 🚧 To enhance your experience, the GST Portal will be unavailable on: 🗓️ 27th May 2025 🕐 From 01:00 AM to 07:30 AM Kindly plan your filings accordingly. We regret the inconvenience 🙏 https://x.com/caankurmundhra/status/1926893675369439418

🚀 New Excel Generation Utility Ver. 3.2 is here! 📊 Easily convert your Justification Report from TXT to XLS. Download the latest version from @IncomeTaxIndia now! Perfect for deductors to track defaults. 💻 #TDS #IncomeTax #TRACES #JustificationReport #TaxFiling https://x.com/caankurmundhra/status/1925743255817183479?s=51

Missed something in your Income Tax Return? 📝 No worries! File an Updated ITR-U to fix errors or add income. Check out this easy guide! 🎥 #ITRU #IncomeTax #TaxFiling #TaxTips https://t.co/6UX3r9THOi https://x.com/caankurmundhra/status/1926121266987053276?s=51

🚨 Big News for Exporters! Govt. restores RoDTEP benefits for ✅ SEZ Units, ✅ EOUs & ✅ Advance Authorization holders — effective 1st June 2025! 🔄 Reinstated to support India's export power 💼🌍 #RoDTEP #Exports #MakeInIndia What’s in it for taxpayers/exporters? ✅ Reimbursement of hidden taxes/duties ✅ Increased export competitiveness ✅ Level playing field for all exporters ✅ Transparent, digital process ✅ Coverage of over 10,000 product lines ✅ ₹18,233 Cr allocated in FY 2025-26 📈 Scheme already disbursed ₹57,976 Cr+ till March 2025! 🗣️ A step towards Atmanirbhar Bharat & global trade leadership. #IndianEconomy #ExportIncentives #SEZ #EOU #ForeignTrade #WTOCompliant #GoI #EaseOfDoingBusiness #DigitalIndia

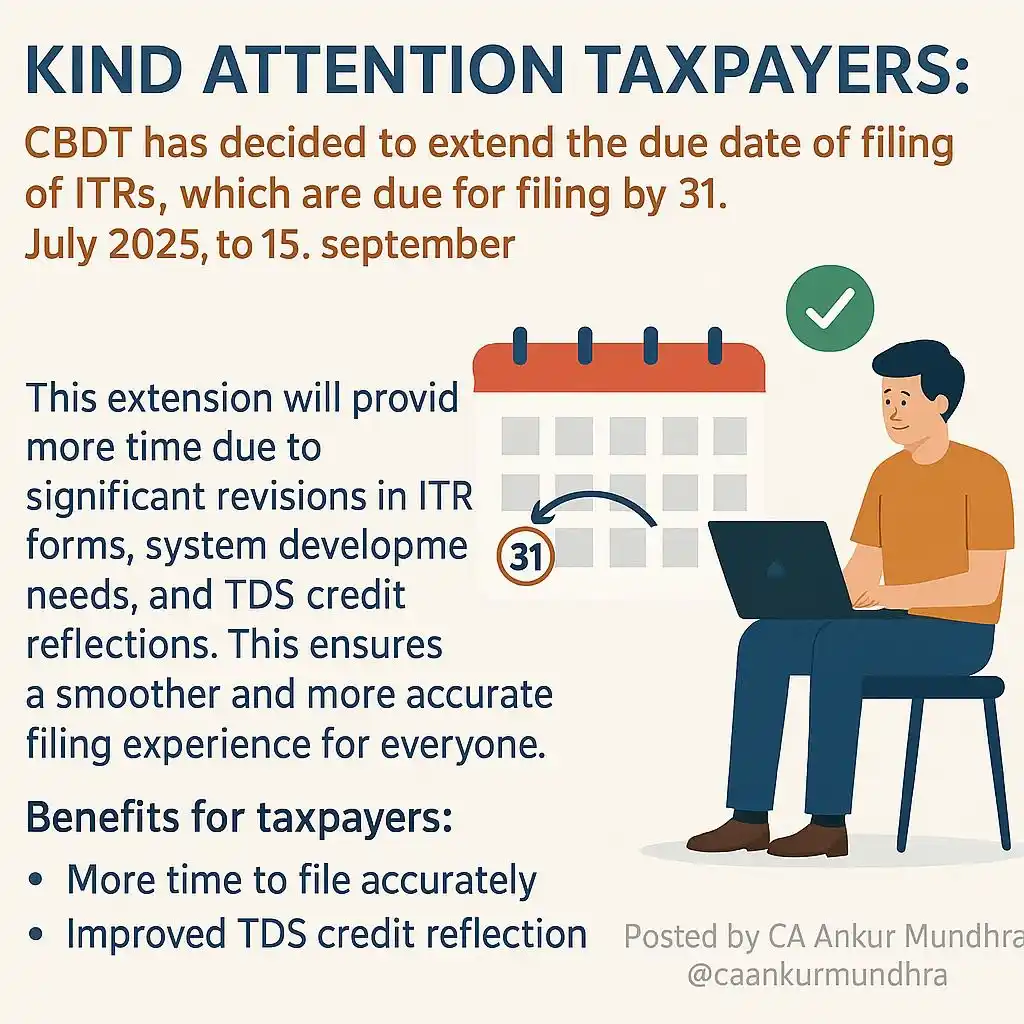

📢 Taxpayers, wait till after *June 15* to file ITR for FY 2024-25! Avoid errors & save time. Why Wait? *Accurate TDS*: Form 16/16A ready by June 15. *No Mismatches*: Form 26AS updated post-May 31. *Skip Refiling*: Avoid missing data. *Smooth Filing*: ITR tools fully ready. Deadline: Sept 15, 2025 File smart! https://x.com/caankurmundhra/status/1927548910219731274

Kind Attention Taxpayers! 🔔 Great news! @IncomeTaxIndia extends the ITR filing deadline from 31st July to 15th Sept 2025! 📅 Why? New ITR forms, system upgrades & TDS credit updates need extra time for a smooth filing experience. Benefits for you: ✅ More time to file accurately ✅ Avoid last-minute rush ✅ Better TDS credit reflection ✅ Stress-free filing Stay tuned for the official notification! #TaxFiling #ITR2025 #CBDT #IncomeTax https://x.com/caankurmundhra/status/1927335200523944308

Confused about New vs Old Tax Regime for AY 2025-26? 📊 Watch this simple video breaking down tax slabs & benefits for both! Choose what saves you more! #TaxSlabs #Budget2025 #IncomeTax #TaxSaving https://t.co/qAZ2UKfv6P https://x.com/caankurmundhra/status/1926121621586096415?s=51

Good news for senior citizens! 🎉 Learn about exemptions, deductions & benefits under the Income Tax Act, 1961 in this simple video! Save more with these tips! 📚 #SeniorCitizens #TaxBenefits #IncomeTaxIndia https://t.co/pbwnGyCPUN https://x.com/caankurmundhra/status/1926120930108981406?s=51