GST IT TDS Tax Update

2.5K subscribers

About GST IT TDS Tax Update

This channel is created for tax related updates problems, solutions. For GST, INCOMETAX, TDS.

Similar Channels

Swipe to see more

Posts

*Attention Partners in Firms and LLP's Big TDS Update Effective 1st April 2025: The Finance (No. 2) Bill, 2024 introduces a new provision—Section 194T—to the Income Tax Act, bringing TDS @10% on certain payments made by firms to their partners. *Key Highlights:* ✅ Who’s Affected? All partnership firms and LLPs making payments to partners. ✅ What’s Covered? Payments like salary, remuneration, commission, bonus, and interest on capital. ✅ Threshold: TDS applies only if payments to a partner exceed ₹20,000 in a financial year. ✅ When to Deduct? At the time of credit to the partner’s account (including capital account), OR At the time of payment (cash, cheque, or any other mode)—whichever is earlier. *Exclusion:* Share of profit remains exempt from TDS under this section. *Example to Understand:* Quarterly Commission: ₹30,000 Annual Interest on Capital: ₹40,000 Total Payment for the Year: ₹1,70,000 Since this exceeds the ₹20,000 threshold, the firm must deduct TDS @10% on the full amount: TDS = ₹1,70,000 × 10% = ₹17,000 This new rule aims to boost tax transparency and ensure timely tax collection from partnership firms and LLPs.

https://t.me/+Ka6X8MriAbUxMmQ1 Now regular updates are available on the above telegram link.. Here we can share documents files also. Rules are the same... Don't post any irrelevant messages.. Thanks.

*Citation*: Sanjay Sodhi vs. ITO, Ward 2, Rohtak in ITA No. 4079/Del/2024 *dated 12.2.2025*. *Assessment year*: 2017-18 *Appeal before*: ITAT "G" Bench, New Delhi. *Facts of the case*: (1) Cash deposited into Bank account during demonetization period to the time of 4,06,50,589/-. (2) Assessment completed ex parte u/s 144 of the Act. (3) CIT(A) dismissed the appeal observing that six notices u/s 250 were issued for hearing but the appellant failed to make submissions in support of the Grounds of Appeal. (4) CIT(A) dismissed appeal- (a) Without considering *adjournment application*. (b) Without *adjudication upon and deciding the Grounds of Appeal in terms of section 250(6)*. *Argued before ITAT*: (1) It was argued before ITAT a specific request for adjournment was made u/s 250(3) of the Act vide letter dated 17.6.2023. (2) The request for adjournment was neither considered nor discussed in the appellate order.l (3) Therefore, the effective opportunity of being heard was not allowed. *ITAT held*: (1) Appellate order set aside and restored to the file of CIT(A) for fresh adjudication of the Grounds of appeal. (2) The assessee may be allowed adequate opportunity of being heard. (3) Appeal allowed for statistical purposes.

Section 62 of the CGST Act, 2017, deals with the assessment of non-filers of returns. If a registered taxpayer fails to file their returns despite notices, the GST officer can assess their tax liability based on available information and issue a best judgment assessment order. However, the assessment order is deemed withdrawn if the taxpayer submits the pending returns within 30 days. Few Important Judgments on this issue: 1. Recovery notices set aside where best judgment assessments denied input tax credit, for reconsideration in light of legislative amendments allowing belated ITC claims. FA'2024 had incorporated amendments allowing for the adjustment of ITC, even for past assessment years where the credit was not claimed in time. Tvl. SRP Communications - Madras High Court (2024) 23 CENTAX 187 2. Where assessee could not file GST return as its ITC was blocked and amount was appropriated to show negative balance, since assessee had filed representation for unblocking of ITC, same was to be dealt with expeditiously and assessee was at liberty to file return within 30 days thereafter. Amit Metaliks Company - Orissa High Court (2024) 24 CENTAX 329 3. Where assessee could not reply to notices issued under Section 62 and impugned assessment order due to fact that its Managing Director had met with an accident and was hospitalized, impugned assessment order was to be set aside and matter was to be remitted back to authority concerned to pass fresh order after affording assessee an opportunity of being heard. Tvl. Pearlport Industries India Pvt. Ltd. -Madras High Court (2024) 88 GSTL 221 4. Intention of department was only to ensure statutory compliance and as long as dealer complied with same and paid necessary late fee charges, delay in filing returns in GSTR-3B although beyond period of 30 days from date of order under section 62(1) was to be deemed to have been condoned. P. Senthil Kumar - Madras High Court (2024) 22 CENTAX 428 5. Notice under Form GSTR-3A issued, on 15-1-2019 for filing of GSTR-3B returns for the period from February to December, 2018 under Section 46 of Central Goods and Services Tax Act, 2017 received on 15-1-2019, itself - However, without waiting for statutory period stipulated under the Act, assessment Order issued in Form GSTR ASMT-13 under Section 62 ibid., on 29-1-2019, directing the Petitioner to pay huge sum of money including penalty. Impugned order being without following the principles of natural justice, matter remanded to the authorities concerned to deal with the same afresh, in accordance with law, after giving an opportunity of hearing to the Petitioner. S.P.Y. AGRO INDUSTRIES LTD. - Andhra Pradesh High Court (2021) 44 GSTL 337 I hope you will find this useful.

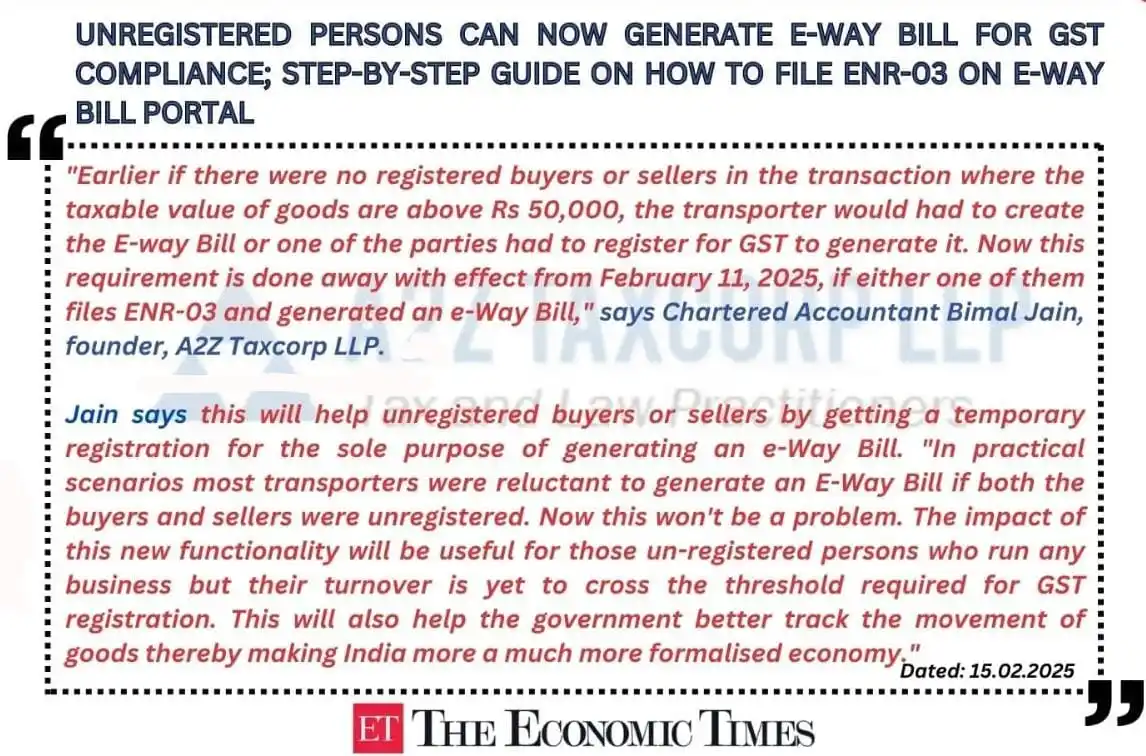

*Unregistered persons can now generate e-Way Bill for GST compliance; Step-by-step guide on how to file ENR-03 on E-Way Bill portal* *Read Complete Article reported By Neelanjit Das, ET Online at:* https://economictimes.indiatimes.com/wealth/tax/unregistered-persons-can-now-generate-e-way-bill-for-gst-compliance-step-by-step-guide-on-how-to-file-enr-03-on-e-way-bill-portal/articleshow/118277322.cms

*Notice issued to a revenue officer for contempt due to arresting assessee without waiting for compliance of summons: HC* THE HON'BLE BOMBAY HIGH COURT IN THE CASE OF *Mishal J Shah HUF Vs State of Maharashtra*, decided on 20-12-2024 👉 *Issue:-* ✔️ _Is it correct that the revenue officer can arrest the assessee without waiting for compliance of the summons?_ 👉 *The Hon'ble High Court Judgement:-* ✔️ _Arresting the assessee without waiting for compliance of summons issued to him for his appearance might interfere with the administration of justice and Contempt of Court; notice was to be issued to the revenue officer._

*🟥 [MUST WATCH] Whether High court can condone delay in filing of Appeal beyond the timeline prescribed u/s 107 of the CGST Act* *🎥 Watch Complete Video:* https://youtube.com/shorts/erZRfF3iBV4?si=gPXTj4vFvawv6xhU

Case Citation: Moonlight Equity P Ltd v. Union of India Writ Petition (C) No. 6443/2023 Assessment Year: 2014-2015 Order Date: 30-01-2025 Counsel: Adv. Mani Bhadra Jain The hon’ble Delhi High Court quashed the notice issued under Section 148 of the Income Tax Act and set aside the order under Section 148A(d), both of which were directed at the amalgamating (predecessor) company after the approval of the amalgamation scheme. The court reaffirmed the principle that reassessment notices cannot be issued to a non-existent entity.

*Important Update on New IT Bill* Section 64(1)(ii) of the Income Tax Act, 1961, is set to undergo a significant change with the introduction of the Income Tax Bill 2025. Currently, Section 64(1)(ii) provides for the clubbing of income of a spouse, specifically when it comes to remuneration received from a concern where the assessee has a substantial interest. However, there's an important exception to this provision: if the remuneration received by the spouse is solely attributable to their technical or professional knowledge, experience, and qualification, then the clubbing provision is not applicable. But here's the catch: this exception is NOT present in Clause 99(1) of the Income Tax Bill 2025! What does this mean? The clubbing provision may apply even if the remuneration is attributable to the spouse's technical or professional qualifications!