Riddhi Siddhi Share Brokers News Channel

234 subscribers

About Riddhi Siddhi Share Brokers News Channel

Exclusively for News and Updates

Similar Channels

Swipe to see more

Posts

3 brokerages on M&M : Jefferies : 53% upside, tgt 4075 Elara : Revise Rating to buy, tgt 3654 Nomura: Prefer M&M as Top Pick

Bharti Airtel to increase stake in Airtel Africa (subsidiary) Bharti has 57.3% stake in Airtel Africa Plans to acquire upto 5% additional stake in Airtel Africa Airtel Africa market capitalisation is GBP 5.1 billion – Rs 55000 cr 5% stake purchase at CMP implies cash outflow of Rs 2500 cr Airtel Africa share price has jump 46% in past one year Bharti did Airtel Africa IPO in June 2019 at 70 pence Vs CMP of 138 pence Airtel Africa has dividend payout policy (including buyback) of 85% FCF Bharti Airtel is yet to come up with dividend policy Dividend policy is critical for visibility on capital allocation & rewarding investors, as per analysts This is key for holding/rerating valuation for Bharti Airtel, as per analysts

OPTIEMUS INFRACOM Approved the acquisition of 2.38 crore equity shares in BIGTech through a rights issue for ₹23.8 crore. Note ; BIGTech is setting up its manufacturing facility in Tamil Nadu for manufacturing of finished cover glass for use in mobile consumer electronic devices, and other cover glass applications, to meet the needs of next-generation mobile consumer electronic devices.

At 8.08 Lakh cr, UP Govt has presented the largest ever budget by any Indian state. Total budget - 8.08 Lakh cr Revenue expenditure - 5.83 lakh cr Capital expenditure - 2.25 lakh cr Total receipts - 7.79 lakh cr Key highlights:- 🧵 1. Education - Allocated 1.06 lakh cr (13% of the budget) to focus on educational infrastructure and access. 2. Infrastructure - 22% of the budget allocated - 4 new expressways to enhance connectivity. - Target to transform 58 municipalities into smart cities. 3. Agriculture - 11% of the budget allocated -1050 cr Farmer Welfare Fund - Target to achieve 5.1% agricultural growth rate 4. Tech and Innovation - 5 Cr allocated for developing an "AI city in Lucknow" (Not sure if it's for weekend drinks of Tech tycoons). Will get more clarity in future. It might be an initial investment with more to follow or plans to bring in private investments. 5. Welfare schemes - 2 free LPG cylinders annually to low income households - 2000 cr for stray cattle management 6. Health - 6% of the budget allocated The budget maintains fiscal discipline by adhering to Fiscal Responsibility and Budget Management (FRBM) limit of 3.5%.

*Riddhi Siddhi Share Brokers Latest after the Bell @ 4.00 PM -- Monday, February 24th 2025* NIFTY (-243, 22553) Sensex (-857, 74454) Bank Nifty (-329, 48652) *Nifty stays on the back foot for fifth-straight day amidst five- negative catalysts:* 1) Wall Street plunged in Friday’s trade where the Dow Jones Industrial Average posted its worst day of 2025. 2) The street fears ‘stagflation’ is returning in the US. 3) Trump tariffs set to begin April 2, could disrupt global trade and trigger retaliatory tariffs. 4) Fed’s January minutes were mostly seen reinforcing cautious approach to rate cuts this year. 5) Relentless FIIs selling: FIIs net sellers in this CY 2025 to the tune of Rs. 124349 crores. # Long story short: Nifty’s underperformance shall continue until FIIs return to their buying desk. Meanwhile, in today’s trade, all sectoral indices ended in red except Nifty FMCG (+0.38%) and Nifty Auto (+0.24%). Nifty IT index (-2.83%) was the biggest underperformer of the day, as INFY (-2.87%), TCS (-3.04%), and HCL TECH (-3.38%) were the biggest laggards. Please note, Nifty IT index is down 9% this CY 2025. Nifty Metal index also received drubbing, down 2.27% and most importantly, snapped its 5-day winning streak. The broader stock markets also scumbled to profit booking: Nifty Mid-cap (-0.94%) and Nifty Small Cap (-1.14%) indices inched lower and ended on a negative note. # *BUZZING STOCKS FOR THE DAY:* *Top Index Gainers:* M&M (+1.54%) DRREDDY (+1.14%) EICHERMOT (+1.09%) HEROMOTOCORP (+0.82%) NESTLEIND (+0.45%) *Top Index Losers:* WIPRO (-3.70%) HCLTECH (-3.41%) TCS (-3.04%) INFY (-2.87%) BHARTIARTL (-2.39%) # Adv-Dec 12—38 # INDIA VIX 14.44 (-0.62%) # NIFTY PCR (27th FEB) 0.62 # Nifty MidCap 50 (-0.85%, 14022) # NiftySmallCap (-1.02%, 15477) # BANK Nifty (-0.67%, 48652) # Nifty IT (-2.71%, 39447) # USD/INR Futures (+0.05%, 86.72) *Riddhi Siddhi Share Brokers OUR VIEW FOR TUESDAY’S TRADE* Technically, Nifty is at its lowest level since its downtrend began on September 27 at 26277.35 levels. Nifty is also way below its 200-DMA at 24070 mark. But before that, psychological 23000 mark is a crucial hurdle to cross for bulls to regain some hope. All eyes on Friday's GDP estimates as well which will determine RBI's stance for rate cuts in future. Bottom-line: Volatility and choppiness continue to be the new normal at Dalal Street. *ALL ABOUT NIFTY:* Nifty (CMP: 22553) Support: 22320/22170 Resistance: 22722/23001 Range: 22430-22680 21 DMA: 23185 50 DMA: 23397 200 DMA: 24070 Trend: Negative *BULLISH LOOKING STOCKS:* # VOLTAS # ITC # FEDERALBNK *BULLISH LOOKING STOCKS (LONG TERM):* # NMDC # NATIONALUM # HINDALCO *BEARISH LOOKING STOCKS:* # INFY # DLF # IEX *STOCKS TO AVOID:* # YESBANK # CONCOR # IGL *Disclaimer*: The investments & trading ideas recommended in the market analysis, research reports, etc. may not be suitable for all investors. This article or data points does not construe investment advice as stock market investments are subject to market risks so please refer to your financial consultant advice before Investing or trading. All information is a point of view, and is for educational, Learning and informational use only. The author or the group admin accepts no liability for any interpretation of articles or comments on this platform being used for actual investments. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investors must make their own investment decisions based on their specific investment objectives, goals and financial position only after consulting with registered market intermediaries.

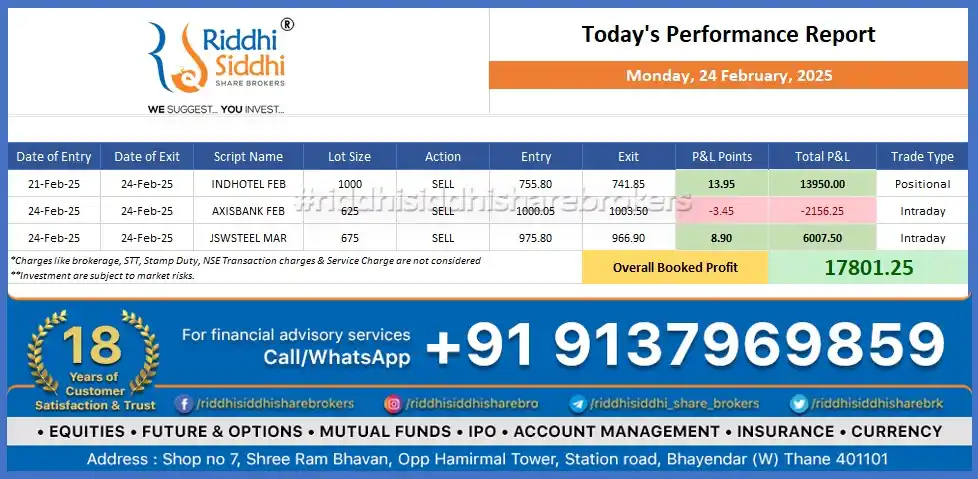

📊 Today's Trading Update 📊 At Riddhi Siddhi Share Brokers, we’ve finalized our profits for today! 💰 These profits include both intraday trades and positions carried forward from previous days. The numbers reflect the cumulative results of trades posted across various accounts we manage. These are purely booked Profit —open positions are still in play, and we'll update you when we exit. 💼 *Profit Booked Today: ₹ 17801.25* Please note, the figures represent total profits or losses from our trades and are not tied to any single account. 📲 Connect with us for account management on WhatsApp: https://wa.me/919987553455 ✔️ We suggest... you invest! #TradingUpdate #ProfitAndLoss #BookedProfits #OpenPositions #RiddhiSiddhi #WeSuggestYouInvest #riddhisiddhisharebrokers 💹📈 https://www.riddhisiddhisharebrokers.com 🌐

*Trump Orders Fort Knox Gold Inspection Amid Revaluation Speculation* 📢 President Donald Trump has announced that his administration will inspect Fort Knox to verify the existence and accuracy of U.S. gold reserves, fueling market speculation about a potential gold revaluation. 💰 *Key Highlights:* 🔸 Fort Knox Stores 147.3 Million Ounces – Over 56% of U.S. gold reserves are stored in the Kentucky facility. 🔸 Total U.S. Gold Reserves: 261.5 Million Ounces – Officially valued at $11.04 billion but worth over $510 billion at market prices. 🔸 Speculation on Gold Revaluation – Rumors suggest the U.S. Treasury may re-peg gold at a higher value, potentially unlocking $400+ billion in financial gains. 🔸 Gold Last Revalued in 1934 – The Gold Reserve Act increased gold’s official price by 69%, from $20.67 to $35 per ounce. 🔸 Gold Prices Up 80% Since 2020 – Trading near $1,950 per ounce, with the possibility of further spikes if revaluation talks intensify. 🔸 First Major Gold Audit Since 1953 – Raising questions on whether Fort Knox’s gold stockpiles remain intact. 📈 Market Impact: Gold prices may see increased volatility as investors react to Trump's remarks and speculation about Treasury’s next move.

Today Listing Quality Power Electrical Equipments Limited IPO Detail. BSE Code:-544367 NSE Symbol:-QPOWER Group:-B ISIN:-INE0SII01026 Issue Price:-425/- Lot Size:-26 Shares Face Value:-10/- Listing At:-NSE,BSE Today Listing Royalarc Electrodes Limited NSE SME IPO. NSE Code:-29730 Symbol:-ROYALARC Group:-ST ISIN:-INE0EO401019 Issue Price:-120/- Market Lot:-1200 Shares Face Value:-10/- Listing At:-NSE SME