Uniglobe Markets

27 subscribers

About Uniglobe Markets

*Uniglobe Markets: Your Gateway to Global Leveraged Trading* Uniglobe Markets stands as a trusted leader in the world of online brokerage, specializing in leveraged products like forex and beyond. We empower traders of all experience levels to access an extensive range of financial instruments, from currencies to stocks and more. https://www.uniglobemarkets.com/open-live-account/

Similar Channels

Swipe to see more

Posts

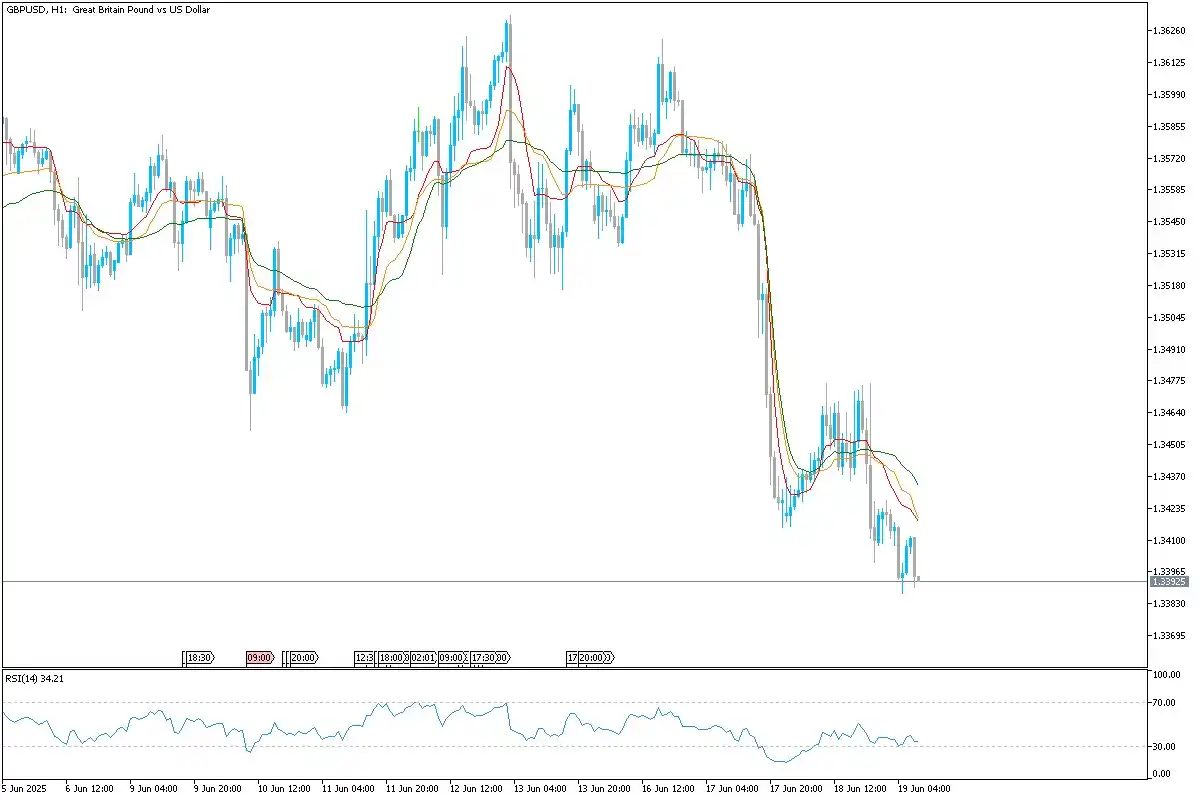

*GBP/USD Technical Overview* GBP/USD remains heavily bearish after a steep fall, with the pair hovering just above 1.3390. Momentum is weak as RSI hovers around 34, and moving averages continue to diverge downward. Support and Resistance Levels Support: 1.3380, 1.3335 Resistance: 1.3440, 1.3485 Buy Scenario Recovery above 1.3440 could provide short-term relief toward 1.3485. Sell Scenario Sustained weakness below 1.3380 may expose deeper declines to 1.3335.

*OIL Technical Overview* Crude Oil (WTI) continues to hold its bullish posture, consolidating around the 73.60–74.00 range after a steep upward leg. Price is respecting short-term moving averages, and RSI is mid-range, suggesting room for both sides. Support and Resistance Levels Support: 72.50, 71.00 Resistance: 74.40, 75.20 Buy Scenario Sustained breakout above 74.40 could drive continuation toward 75.20. Sell Scenario Break below 72.50 may open downside toward 71.00 in the near term.

*XAU/USD Technical Overview* Gold is under sustained bearish pressure, trading in a defined downtrend channel. Price continues to close below all EMAs, with RSI at 32.36 – nearing oversold but not yet divergent, suggesting more downside is possible. Support and Resistance Levels Resistance: 3386, 3402 Support: 3345, 3328 Buy Scenario If RSI dips into oversold and price forms a double bottom at 3345 with bullish divergence, look for a retracement toward 3386. Sell Scenario A clean break below 3345 confirms bearish continuation toward 3328 and 3310 in extension.

*EUR/USD Technical Overview* EUR/USD has recently entered a short-term corrective phase following a strong bullish rally. The pair saw a rejection near 1.1620 and has since trended downward, testing the 1.1450 support zone. The RSI is below the 40 level, showing weakening momentum, while moving averages are starting to align bearishly. Support and Resistance Levels Support: 1.1445, 1.1390 Resistance: 1.1515, 1.1580 Buy Scenario A clear bullish reversal from 1.1445 with price closing above 1.1515 could signal a recovery toward 1.1580 and higher. Sell Scenario Sustained rejection below 1.1515 and a break under 1.1445 would confirm further downside toward 1.1390.

*XAU/USD Technical Overview* Gold (XAU/USD) is under consistent pressure, trading below its moving averages and testing key horizontal support near 3380. Momentum remains weak, with RSI approaching oversold territory. Unless a bullish catalyst emerges, downside bias remains intact. Support and Resistance Levels Support: 3380, 3330 Resistance: 3420, 3445 Buy Scenario A strong bullish candle closing above 3420 would suggest recovery potential toward 3445. Sell Scenario Break below 3380 confirms bearish continuation toward 3330.

*XAG/USD Technical Overview* Silver has seen a sharp sell-off, breaking below recent support with RSI deeply oversold at 16.08. Price is well below all EMAs, reinforcing strong bearish sentiment. Support and Resistance Levels Resistance: 36.20, 36.55 Support: 35.50, 35.30 Buy Scenario Monitor for RSI bullish divergence and bottoming candle patterns around 35.50 to consider a short-term rebound to 36.20. Sell Scenario Sustained momentum below 35.50 opens the door to 35.30 and 34.90.

*Oil Technical Overview* USOil has shown strong upward structure but is currently consolidating below 75.00 resistance. The short-term EMAs are flattening and RSI is neutral at 43.23, suggesting indecision at current levels. Support and Resistance Levels Resistance: 74.80, 75.50 Support: 72.90, 71.60 Buy Scenario Break above 74.80 with bullish volume can initiate a push toward 75.50. Sell Scenario A drop below 72.90 with strong bearish candles could target 71.60, especially if RSI dips below 40.

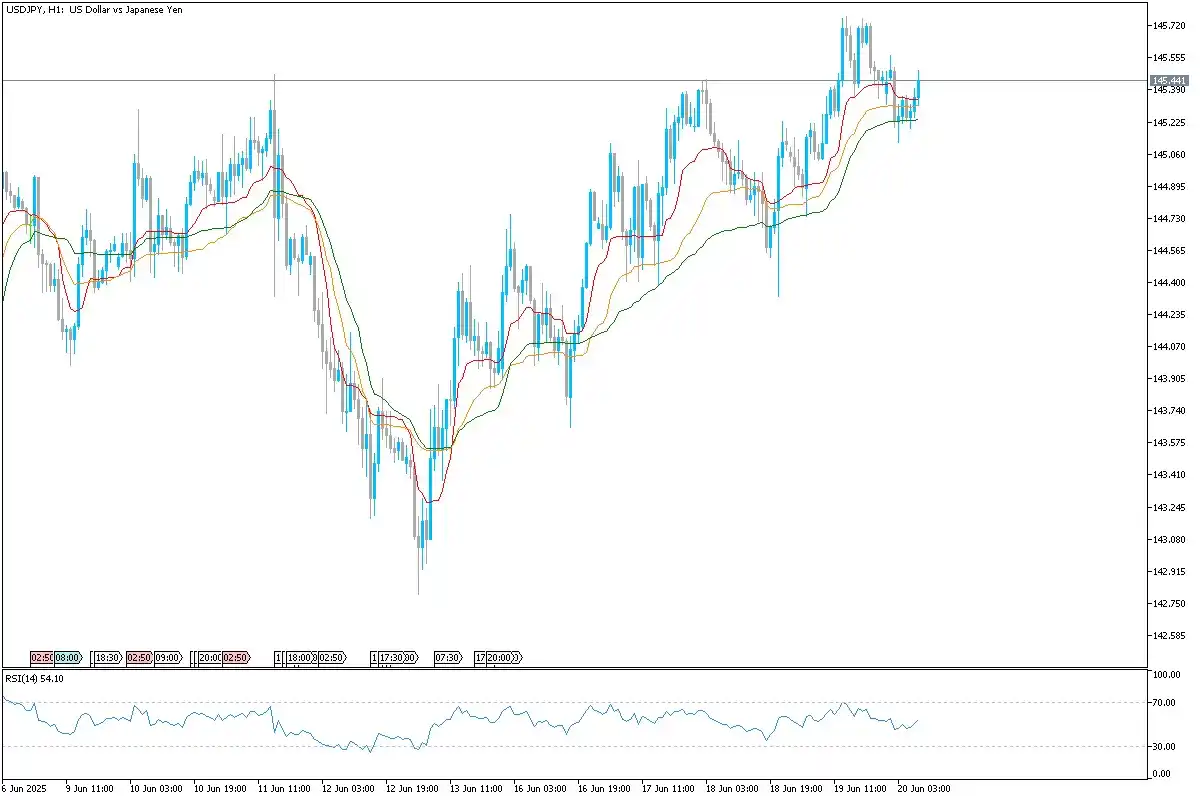

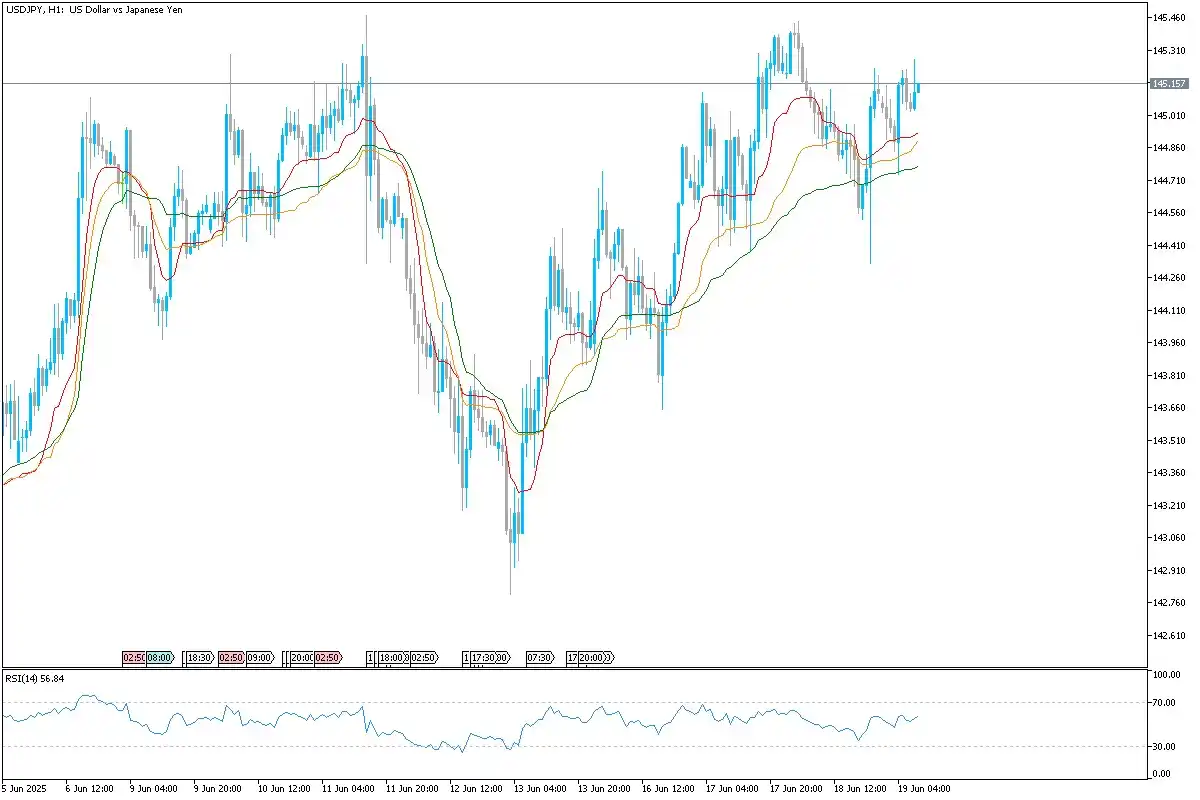

*USD/JPY Technical Overview* USDJPY is in a steady uptrend, consolidating just under 145.50 after breaking a prior resistance level. RSI is balanced at 54.10 and EMAs are supportive of continuation. Support and Resistance Levels Resistance: 145.60, 145.85 Support: 145.00, 144.65 Buy Scenario Break and hold above 145.60 could see further advance toward 145.85 and 146.00. Sell Scenario Failure to break 145.60 with bearish engulfing candles could initiate a short-term correction to 145.00.

*USD/JPY Technical Overview* USD/JPY is consolidating after rebounding from 143.00, trading slightly above 145.00. The RSI suggests mild bullish momentum, and the moving averages are showing supportive alignment. Support and Resistance Levels Support: 144.70, 144.00 Resistance: 145.30, 145.45 Buy Scenario A breakout above 145.30 could test 145.45 and potentially extend further. Sell Scenario Failure to hold 144.70 support would risk pullback toward 144.00.

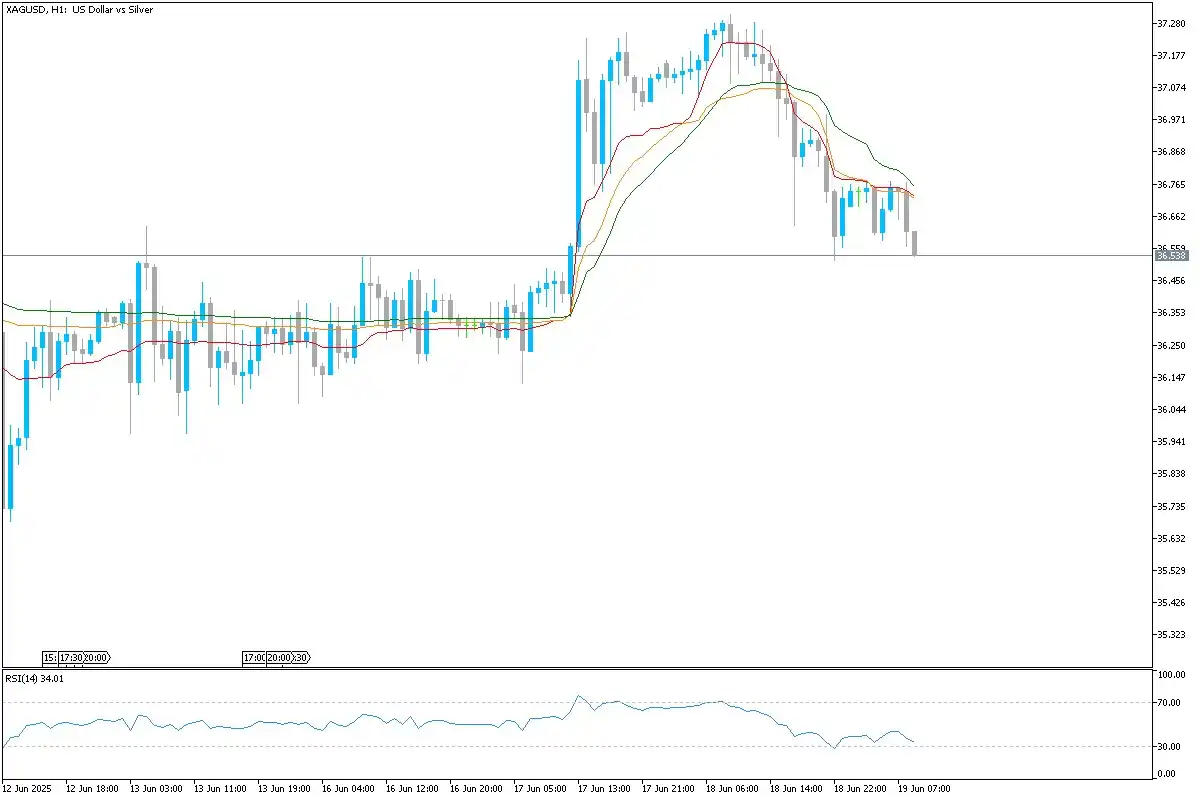

*XAG/USD Technical Overview* Silver (XAG/USD) has reversed from recent highs and now shows a developing bearish pattern, with RSI near 34 and price testing short-term support. The slope of moving averages signals early bearish momentum gaining traction. Support and Resistance Levels Support: 36.50, 36.00 Resistance: 37.00, 37.28 Buy Scenario A close back above 37.00 would offer potential toward 37.28, provided momentum picks up. Sell Scenario Break below 36.50 opens up risk for further decline toward 36.00.