Munyumba - 💼 Financial Advisor & 📊 Investment Analyst

2.2K subscribers

About Munyumba - 💼 Financial Advisor & 📊 Investment Analyst

"Welcome! I'm Munyumba Mutwale, a Zambian investment analyst and financial advisor with a passion for wealth management and macroeconomics. Here to share insights and advice on personal finance and market trends. Let's achieve financial success together!"

Similar Channels

Swipe to see more

Posts

💡 Myth-Busting Money Day: The ‘Kwacha is Weak’ Lie 💰 When you hear someone say, “The Kwacha is weak because of politics,” it’s only part of the story. Let’s uncover the real forces that move Zambia’s currency: 🔍 1. Copper Prices: Zambia is a top copper exporter. When copper prices fall, our dollar inflows drop, putting pressure on the Kwacha. 🌍 2. Remittances: Zambians abroad sending money home create demand for Kwacha. More remittances mean a stronger currency. 📊 3. Bond Demand: Foreign investors buying Zambian government bonds need Kwacha. High demand for bonds boosts the Kwacha’s value. 📈 4. Global Dollar Strength: A strong US dollar can weaken the Kwacha, even if our economy is steady. Global markets play a huge role. ✅ The Truth: Currency values are shaped by multiple factors. Knowing this can help you make smarter financial decisions. #Financial_Advisor #zambiaseconomy #Financial_Literacy_Week_Zambia #zatufinance

📖 Biblical Wisdom for Financial Success 💰 “Go to the ant, you sluggard; consider its ways and be wise!” — Proverbs 6:6 In the Bible, the ant is praised for its discipline, planning, and diligence. It works hard in the present to secure its future. 💡 Financial Lesson: Just like the ant, you must plan, save, and invest wisely. Don’t wait for a crisis to force you into action—prepare now for the future you want. 🔹 Start an emergency fund. 🔹 Save consistently. 🔹 Invest in assets that build wealth. 🙏 Let the wisdom of the Bible guide your financial decisions. #FinancialWisdom #BibleAndMoney #WealthBuilding

💡 Did you know? There are three things that tend to rise when inflation hits: 🏠 Real Estate: As currency loses value, property becomes a safer bet. 💰 Currency Value: Some strong currencies appreciate as weaker ones decline. 🛒 Consumer Goods: Prices of essentials go up, hitting your wallet harder. Want to learn how to protect your money during inflation? Check out our Basics in inventing course here: https://www.zatufinancial.com/participant-page/575d0dac-e898-4aec-8a95-824206dca2d4?programId=575d0dac-e898-4aec-8a95-824206dca2d4&participantId=37af4119-2d6e-481c-b722-dccfac8dbede

💸 Welcome to the Financial Matrix — Are You Awake or Asleep? Most people are trapped in The Financial Matrix and don’t even realize it. It’s a system designed to keep you: ⛓️ Earning just enough to survive… ⛓️ Spending more than you save… ⛓️ Borrowing for things that lose value… ⛓️ Paying interest instead of earning it. The Financial Matrix rewards ignorance and punishes discipline. It pushes: ❌ Consumption over investment ❌ Immediate pleasure over long-term gain ❌ Debt dependence over financial independence So how do you escape it? ✅ Learn how money really works ✅ Live below your means ✅ Invest in assets that pay you ✅ Avoid unnecessary debt ✅ Think long-term — not just salary-to-salary You don’t beat the matrix by working harder. You beat it by thinking smarter. Break free. Build wisely. #FinancialMatrix #WealthAwakening #ZambianFinance #FinancialFreedom #BreakTheCycle

Two Girls, Two Futures — The Cost of Not Knowing” Meet Lisa and Tamara. They’re both final-year university students — bright, ambitious, and with big dreams. But their financial stories couldn’t be more different. Lisa – The Investor in a White Coat Lisa is studying Medicine. In her first year, her parents enrolled her in a financial literacy program called MoneyWise University Edition. She learned about budgeting, saving, investing in government bonds, stocks, and even planning for retirement. By the end of first year, she started investing K300 monthly in bonds. By third year, she was earning coupon payments every 6 months — small but consistent income. She reinvested everything. Learned about compound interest. By final year, her investment value had grown and her knowledge even more. She speaks about inflation, tax planning, unit trusts, and risk like a pro. She's already planning to invest part of her first salary, and her goal is to own a home by 30 — not with a loan, but with her own savings and bond income. Tamara – Banking, But No Bank Tamara is studying Banking and Finance ironically — but didn’t get any early financial literacy. Her parents assumed she’d “figure it out” in class. She has no investments. Her bank account is dry by mid-month, most of her money goes to food, transport, and airtime. She's only vaguely heard of bonds or stocks, and “inflation” just means “things are expensive.” She has no emergency fund, no plan for her first salary, and no clue how tax or NAPSA even works. She plans to “figure it out after graduation.” Two Futures Lisa is already building wealth before earning her first salary. Tamara is still financially starting from scratch. In 5 years, Lisa might be earning from 3–5 sources. Tamara will likely still be tied to one job. It’s not about what you study. It’s about what you understand about money. Financial literacy isn’t a luxury — it’s a life skill. MoneyWise teaches students the language of money, investment, and wealth-building — before the world demands it of them. If you have a child, or sibling or are a guardian to a child that has completed high school or is in university please share this link with the. It's a link to a quiz that will test their knowledge on basic financial literacy http://bit.ly/3H1Udbm.

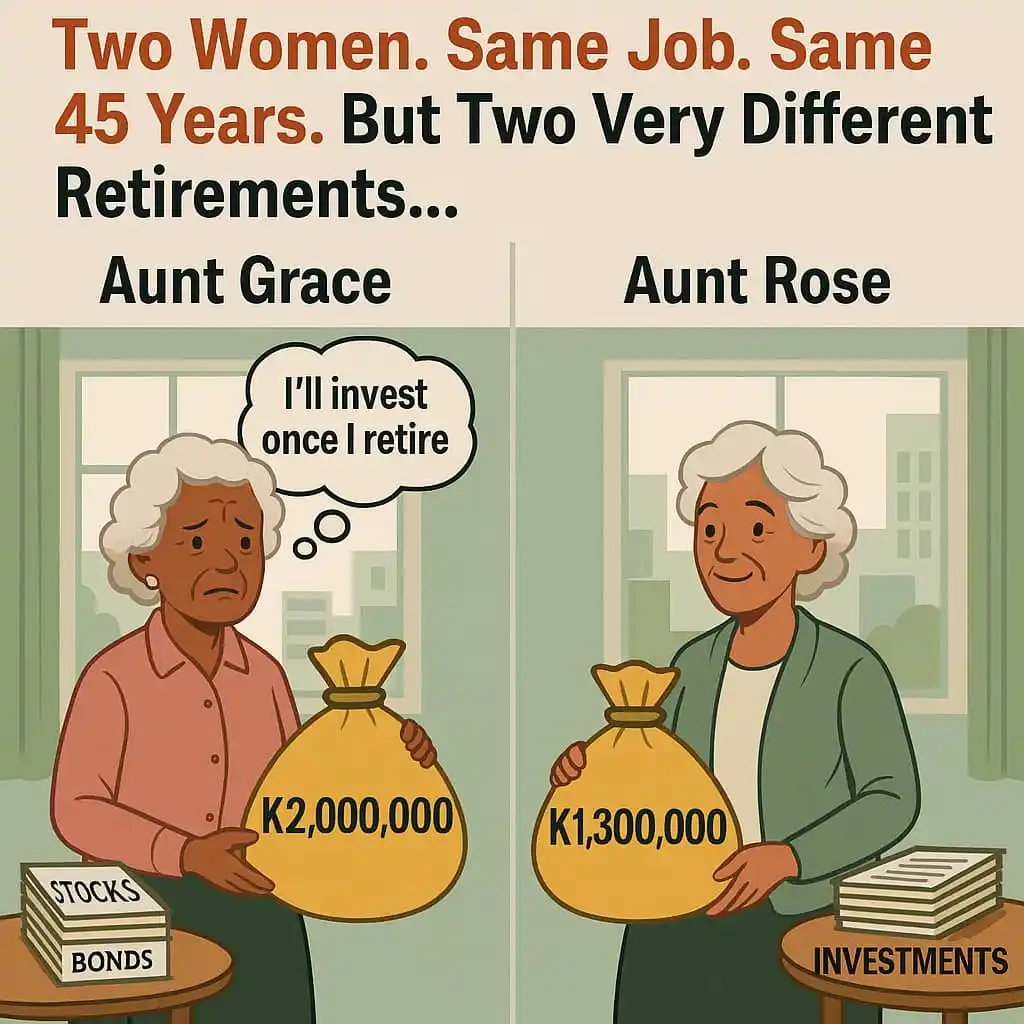

Two Women. Same Job. Same 45 Years. But Two Very Different Retirements… Meet Aunt Grace and Aunt Rose. Both are 65. Both started working at age 20. Both served faithfully in civil service for 45 years. And both are retiring this month. But here’s where it gets interesting… Aunt Grace is walking away with K2,000,000 in pension. Aunt Rose is leaving with only K1,300,000. Sounds like Grace is better off, right? Not quite. While Grace always said, “I’ll invest once I retire,” Rose thought differently. 10 years ago, Rose began investing small portions of her income in government bonds, stocks, and a SACCO. Even with a lower salary, she made smart moves. Today, while Grace is wondering what to do next, Rose’s investments have matured. She has: A diversified portfolio paying her monthly income. Rental property from reinvested bond interest. Zero debt and a clear plan. Aunt Rose may be retiring with less cash, but she’s retiring with more freedom. Grace has money. Rose has a financial system. Lesson? In Zambia, NAPSA and your pension are just part of the picture. They won’t be enough on their own. Start investing early. Retirement should be lived, not survived. It’s not about how much you retire with, it’s how well you retire on. Please take retirement seriously. Don't be filled with envy and jealousy after seeing your friends well off while you seek hand out in retirement all because they planned while working and you didn't. Join the our RetireWise community and get organised before it's too late and you become like aunt Grace. Contact 977964002

Remember you can always take our Investing in bonds course on its own for only k500. Over 2000 people have taken the course. contact 977964002