Stock News & Updates.

35 subscribers

About Stock News & Updates.

Market updates on Google sheet https://bit.ly/40hetu3

Similar Channels

Swipe to see more

Posts

📈 Indian Market Overview – June 17, 2025 SENSEX surged 677.55 points to close at 81,796.15 NIFTY 50 jumped 227.9 points, finishing at 24,946.5 🔼 Top Performing Sector: NIFTY IT (+1.57%) 🔽 Top Losing Sector: NIFTY AUTO (-0.18%) 💹 Market Mood Index (Tickertap): GREED – 53.77 📊 Futures Check: GIFT Nifty: 24,963 (-0.19%) SGX Nifty: 24,962 (-0.13%) 🌐 Global Markets: NASDAQ: 19,701.21 (+1.52%) DOW JONES: 42,515.09 (+0.75%) NASDAQ Futures: -0.55% Dow Futures: -0.42% 📉 FIIs sold stocks worth ₹2,539.42 Cr 📈 DIIs bought stocks worth ₹5,780.96 Cr 💱 Currency Watch: USD/INR: ₹86.13 US Dollar Index: 98.23 (+0.09%) 🪙 Cryptos: Bitcoin: ₹91.86 Lakh (+1.39%) Ethereum: ₹2.22 Lakh (+0.25%) 🪙 Commodities: Gold (MCX): ₹99,789 (-0.49%) Silver (MCX): ₹1,06,746 (+0.24%) Brent Crude: 74.34 +1.11 (+1.52%) Stocks Making Headlines 1. Zee Entertainment – Approved issue of up to 16.95 crore fully convertible warrants to promoters at ₹132 each 2. Asian Paints – Shares in focus following Reliance Industries’ stake sale 3. NTPC – Board meeting scheduled June 21 to consider raising ₹18,000 Cr via bond issue 4. Tanla Platforms – Approved share buyback; investor attention increasing 5. Hyundai Motor India – Started engine production at Talegaon plant --- 🔸 Analysts’ Stock Picks Apollo Hospitals – Recommended buy range ₹7,100–7,110; target ₹7,545; stop-loss ₹6,920 Persistent Systems – Buy at ₹6,010–6,020; target ₹6,300; stop-loss ₹5,840 GMR Airports, MCX, ABDL – Vaishali Parekh’s picks with clear entry/exit levels --- 🔹 Breakout/Technicals Thirumalai Chemicals, Parag Milk Foods, MCF, Control Print, VIP Industries – Sumeet Bagadia recommends buying on technical breakout setups --- 🔸 Market Movers Infosys & Wipro ADRs – Up ~3% on Wall Street optimism amid stability over Israel‑Iran tensions Top Nifty movers (Jun 16) – Gainers: SBI Life, UltraTech Cement, Bharat Electronics, HDFC Life, ONGC; Losers: Tata Motors, Dr Reddy’s, Adani Ports, Sun Pharma

📉 Indian Market Wrap – June 14, 2025 Sensex slipped 573 points to close at 81,118.6 Nifty 50 dropped 169.6 points, ending at 24,718.6 📈 Top Performing Index: Nifty Media (+0.17%) 📉 Top Losing Index: Nifty PSU Bank (-1.18%) 📊 Market Mood: GREED (Tickertape MMI: 50.61) --- 🌍 Global Market Snapshot NASDAQ: 19,406.83 (-1.3%) DOW JONES: 42,197.79 (-1.79%) NASDAQ Futures: +0.28% DOW Futures: +0.09% GIFT Nifty Futures: 24,805 (+0.22%) SGX Nifty Futures: 24,804 (+0.26%) --- 💰 Fund Flow FII Net: ₹ -1,263.52 Cr (Selling) DII Net: ₹ +3,041.44 Cr (Buying) --- 💹 Currency & Commodities USD-INR: ₹86.13 US Dollar Index: 98.27 (+0.47%) Bitcoin: ₹90.6 Lakh (-0.44%) Ethereum: ₹2.18 Lakh (Stable) Gold (MCX): ₹1,00,314 (+0.04%) Silver (MCX): ₹1,06,474 (-0.02%) 🔍 Stocks in Focus Sun Pharma: Its Halol plant has received eight observations from the U.S. FDA—will this affect future exports? . Syngene: Recently received a U.S. FDA inspection report; investors will scrutinize its implications . ONGC & Oil India: Could benefit from rising crude prices amid Middle East tensions . Adani Enterprises & Vedanta: Trading in focus today following market developments and company-specific updates . Nazara Tech & NTPC: Highlighted as key movers due to event-driven activity . Bajaj Finance: Begins trading ex-split and ex-bonus today—a structural shift that may impact liquidity and pricing . IndusInd Bank & IREDA & OMCs: IndusInd linked to RBI auditor appointment; oil-marketing companies are sensitive to crude price movements .

No rate cut from the Fed. Interest rate remains unchanged at 4.25%-4.5%.

Govt set to offload up to 20% stake in 5 PSU banks via QIP & OFS in the next 6 months. Likely names: UCO Bank, Bank of Maharashtra, Central Bank, Punjab & Sind Bank, Indian Overseas Bank. Merchant banker appointments are in the final stage. - Report by CNBC Awaaz

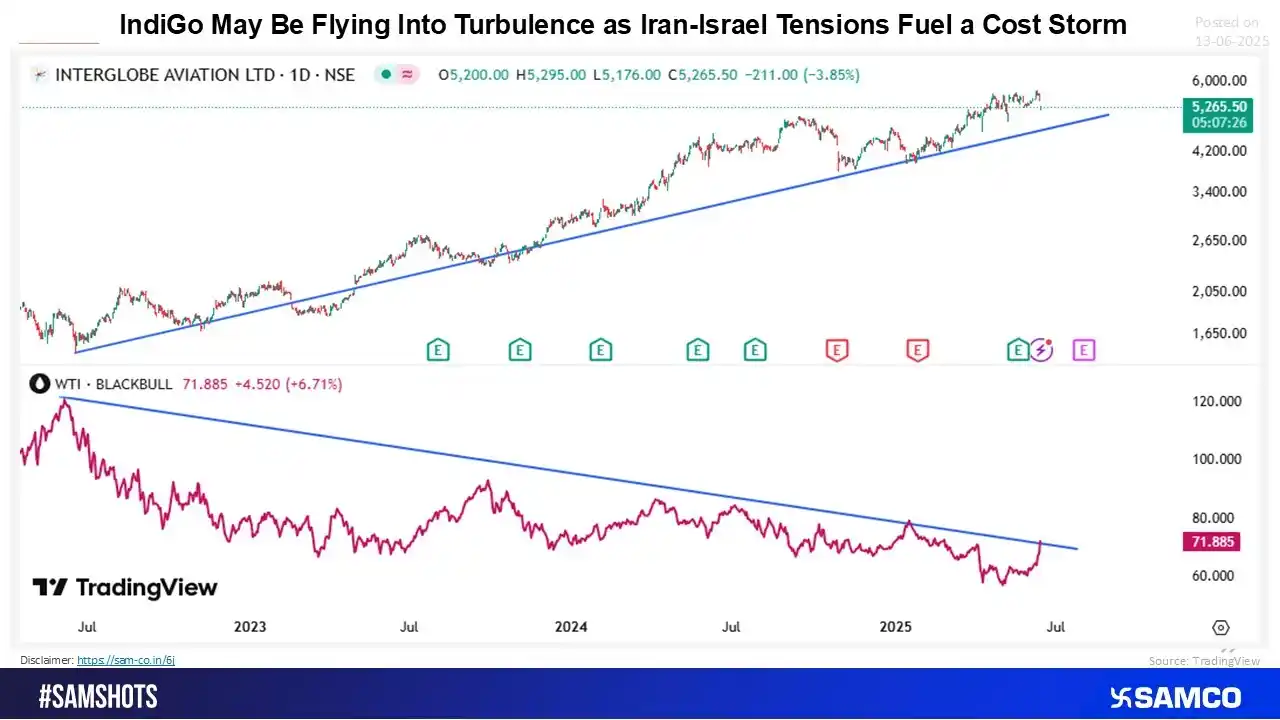

IndiGo May Be Flying Into Turbulence as Iran-Israel Tensions Fuel a Cost Storm✈️🌩️ With Israel-Iran tensions rising, key air routes over the Middle East are becoming risk zones.⚠️This is shrinking viable airspace, forcing airlines like IndiGo to take longer routes directly impacting fuel consumption⛽ Add to that the recent breakout in crude oil prices, and we have a double whammy: rising operational costs just when margins were under pressure😨 Technically, while IndiGo has been in a long-term uptrend, the seasonality chart paints a cautionary picture June and July have historically been weak months, with more downside closes📉 All factors combined geopolitical risks, fuel price pressure, and seasonal weakness suggest IndiGo may be heading for some turbulence ahead. Traders and investors might consider this a time for caution, not celebration🚨 Stay updated, visit 👉 https://sam-co.in/6S

📉 Indian Markets End Lower SENSEX: 81,583.3 (▼ 212.85 points) NIFTY 50: 24,853.4 (▼ 93.1 points) 📊 Sector Performance Top Gainer: NIFTY IT (+0.72%) Top Loser: NIFTY PHARMA (▼1.89%) 📈 Market Sentiment Market Mood Index (Tickertap): GREED (52.02) 🌐 Global Markets NASDAQ: 19,521.09 (▼0.91%) DOW JONES: 42,215.8 (▼0.7%) NASDAQ Futures: +0.19% | DOW Futures: +0.08% 📉 Futures Snapshot GIFT Nifty: 24,841.5 (+0.16%) SGX Nifty: 24,841.5 (▼0.09%) 💸 Institutional Activity FII Net: ₹1,482.77 Cr (Buying) DII Net: ₹8,207.19 Cr (Strong Buying) 💱 Currency & Commodities USD/INR: ₹86.39 Dollar Index: 98.72 (+0.58%) Gold (MCX): ₹99,438 (+0.26%) Silver (MCX): ₹1,08,750 (+2.05%) 🪙 Crypto Update Bitcoin: ₹90,00,010 (▼1.75%) Ethereum: ₹2,16,767 (▼3.42%) 🔍 Key Stocks in Focus 1. Hindustan Zinc Promoter Block Deal: Vedanta plans to sell ~6.67 crore shares (~1.6% stake) via block deals at ~₹452.5/share—equating to ~₹3,000–7,500 Cr. piled pressure on the stock . 2. BSE Derivatives Expiry Change: SEBI approved shifting BSE’s equity derivatives expiry to Thursday (NSE to Tuesday), effective September 1. This structural change may impact BSE volumes and market share . 3. UGRO Capital Acquisition Move: UGRO is reportedly set to acquire 100% of Profectus Capital (~₹1,400 Cr) to strengthen its MSME lending presence . 4. Delhivery Named among stocks to watch, likely on operational or investment announcements . 5. Mahindra & Mahindra (M&M) SML Isuzu Deal: CCI approved M&M’s acquisition of SML Isuzu (pegged at 43.9% stake + open offer). Also singled out in lists of focus stocks . 6. Vishal Mega Mart Highlighted among stocks in news, possibly due to block deal activity . 7. Ola Electric 0% Commission Model: Launched a driver-friendly move allowing drivers to keep full fares across autos, bikes, cabs—no income cap. This innovation could impact market dynamics . 8. Bharat Forge, Polycab, RailTel, SML Isuzu, EMS, GMR Airports, Alembic Pharma Also featured in "stocks to watch" lists due to sector interest, contracts, or updates . --- 💡 Analyst Picks & Trading Ideas Suggested Buys: Voltas, ONGC, TCS from Times of India; plus Sumeet Bagadia’s breakout calls: Intellect Design Arena, Navin Fluorine, Maan Aluminium, Nelcast, Steel Strips Wheels . Trade Setup: Analysts observe Nifty in a tight range (24,700–25,000); watch support at 24,700/55,000 and resistance near 25,000/56,100 zones . --- 🔎 Quick Takeaways Category Summary Macro triggers Middle East risk & Fed policy; steady FIIs/DII flows continue . Structural change BSE/NSE expiry shift may reshape derivatives trading on Thursdays. Promoter actions Block deals by Vedanta (HZ) and acquisition moves (UGRO/M&M) are immediate catalysts. Strategic updates Ola’s 0% commission at scale, UGRO’s MSME push, Polycab’s BSNL deal—sector plays to track.

🚨🚨 *HDB Financial's ₹12,500 crore IPO* opens on June 25 — Check out its *price band and other* details https://www.cnbctv18.com/market/hdb-financial-ipo-price-band-subscription-opens-on-june-25-check-gmp-lot-size-valuation-hdfc-bank-shares-19624019.htm?utm_medium=social&utm_source=whatsapp&utm_campaign=regular-editorial

📉 Market Wrap – 18 June 2025 🕒 Last Updated: 15:31 IST 📊 Indices: SENSEX: 81,444.66 (🔻 -138.64) NIFTY 50: 24,812.05 (🔻 -41.35) 🏆 Top Gainer: NIFTY Private Bank (+0.39%) 📉 Top Loser: NIFTY Media (-1.27%) 📉 Market Mood Index: FEAR (41.57) 🌍 Global Futures: GIFT Nifty: 24,776 (🔻 -0.13%) SGX Nifty: 24,776 (🔻 -0.14%) NASDAQ Futures: 🔻 -0.4% DOW Futures: 🔻 -0.21% 💰 Investor Activity: FII Net: ₹890.93 Cr DII Net: ₹1,091.34 Cr 💱 Currency & Commodities: USD-INR: ₹86.62 Dollar Index: 99.07 (🔺 0.21%) Bitcoin: ₹90,00,010 Ethereum: ₹2,16,767 Gold (MCX): ₹99,510 (🔻 0.03%) Silver (MCX): ₹1,08,535 (🔻 0.03%) 🔍 Stocks in Focus Today • Siemens Energy India Expected to debut today following its spin‑off via demerger—analysts view it as a strong renewable‑energy growth play . • Hero MotoCorp Launching the Vida VX2 electric scooter under a Battery‑as‑a‑Service (BaaS) model from July 1—likely to grab attention . • Jio Financial Services Has completed full acquisition of Jio Payments Bank from SBI for ₹104.5 Cr, making it a wholly‑owned subsidiary—big for both financials and fintech investors . • Abbott India Partnering with MSD Pharmaceuticals to distribute oral anti‑diabetes drugs—expanding its pharma footprint . • HDFC Bank The Chief HR Officer, Vinay Razdan, has resigned effective June 18—corporate governance and leadership-watch . • ESAF Small Finance Bank, Jio Fin, Vodafone Idea, Zydus Lifesciences, Tata Elxsi Also flagged as trending or “stocks to watch” due to recent corporate updates or market interest . --- 📈 Analysts’ Pick Lists Vaishali Parekh (Prabhudas Lilladher) advises buying Reliance Power, IndusInd Bank, and Graphite India today . Sumeet Bagadia (Choice Broking) suggests break-out stocks: Sakar Healthcare, Yuken India, DEE Development Engineers, NDR Auto Components, Pearl Global Industries . --- ✅ What to Track Today Focus Area Details Global cues Fed decision, Israel‑Iran tensions, crude prices Market mood Investors favor quality large-caps amid uncertainty F&O expiry Watch for rollover activity and volatility near expiry limits --- 🔔 Summary Watch for Siemens Energy, Hero MotoCorp, Jio Financial, Abbott, and HDFC Bank today. Analyst favorites: Reliance Power, IndusInd, Graphite India, plus breakout picks from Sumeet Bagadia. Overall tone: cautious, with focus on large‑caps and event‑based movers in a sensitive macro environment.

*Key Stock Updates* 🔸 *CSB Bank* : RBI approves reappointment of Mr. Pralay Mondal as MD & CEO for another 3 years from Sept 15, 2025. ✅ *Our View* : Ensures strategic continuity and supports ongoing digital and retail growth initiatives. 🔸 *NTPC* : Unit 3 of North Karanpura & Barh Super Thermal Projects (660 MW each) complete trial ops; group capacity reaches 82,028 MW. ✅ *Our View* : Adds 1,320 MW in FY26 so far; expected to generate ~₹4,000 crore in an additional annual revenue. 🔸 *HCLTech* : Selected by Volvo Cars as a strategic supplier for global engineering services. Expands role beyond digital and product lifecycle management (PLM) to full-scale engineering. ✅ *Our View* : Enhances revenue visibility. Media reports peg deal value at over $1 billion. _Hit 👍 for daily market insights_ Disclaimer: bit.ly/full-disclaimer

Apple’s Foxconn ramps up iPhone exports from India to the US! Between March and May 2025, 97% of Foxconn’s $3.2B iPhone exports from India went to the US, up from 50% last year. A clear move to bypass Trump’s China tariffs.