Wealthmojo ( Mutual Funds, Personal Finance, Stock Market )

2.2K subscribers

About Wealthmojo ( Mutual Funds, Personal Finance, Stock Market )

One Stop Solution for Learning Personal Finance. 🌊 Welcome to our (Wealthmojo) Personal Finance Channel! 📈🌊 The channel is not responsible for the article posted. Do consult your financial advisor before making any buy or sell decisions! Hare Krishna!🙏❤️

Similar Channels

Swipe to see more

Posts

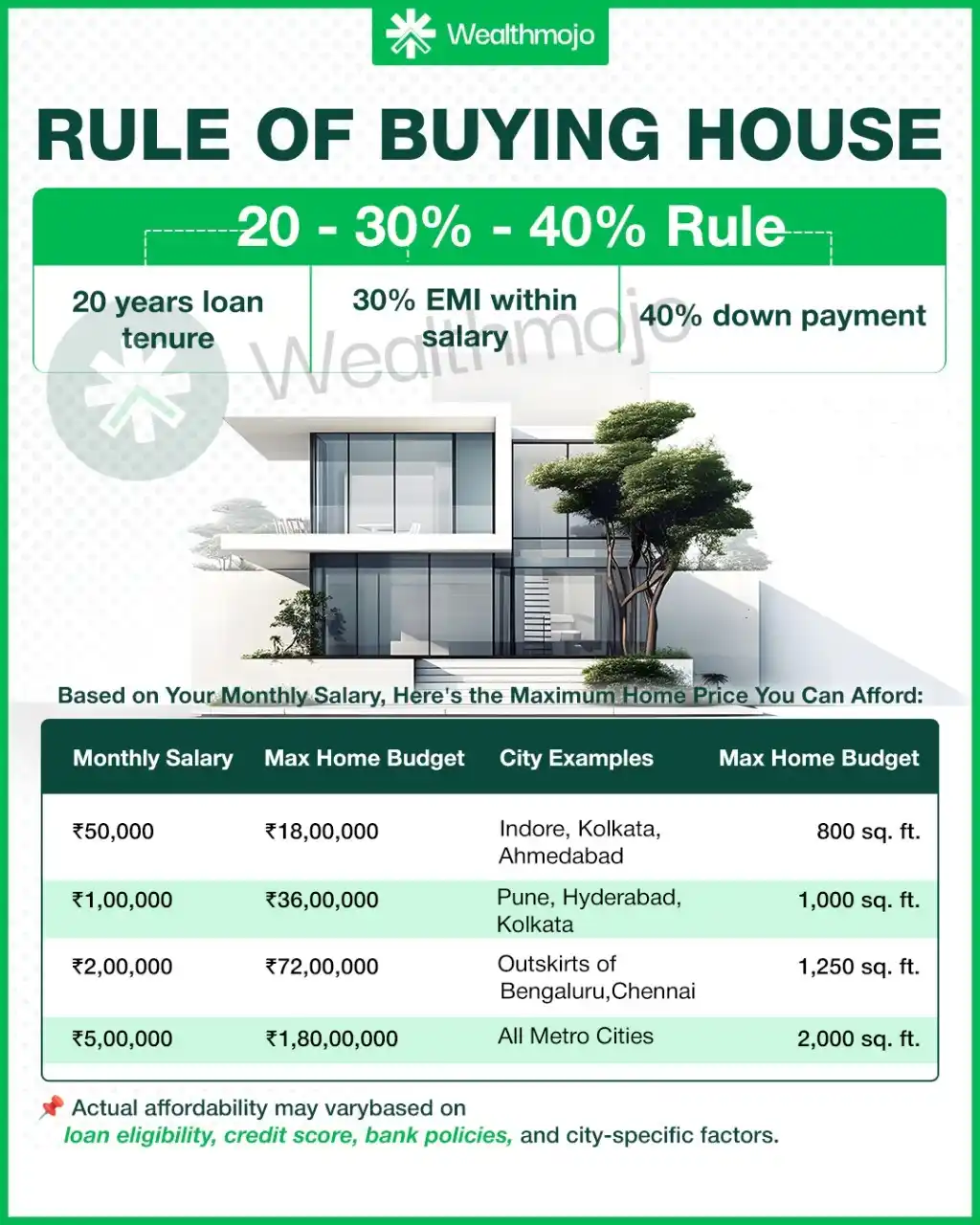

Rule of Buying House!💡

1.Started SIP at 38 with ₹8,000/month No side hustle, no inheritance—just regular investments through Systematic Investment Plans (SIPs). 2.Compounding is the real game-changer With 12% CAGR over 22 years, ₹8K/month grows to ₹77.3L. Increase SIP by 10% yearly? You reach ₹1.28 Cr! 3.Retirement strategy: SWP from Debt Funds At 60, shift corpus to a 7% Debt Mutual Fund, start a monthly SWP—generate ₹55K/month, with ₹2.85 Cr corpus still at 80. 4.Why this works—even with a late start No need for high-risk trading or massive SIPs. Just SIP → let it grow → switch to SWP for passive income. 5.My core rules for wealth creation ✅ 10% SIP hike yearly ✅ Invest in direct mutual funds (lower cost) ✅ Never stop SIP during market falls ✅ Annual goal review 6.The cost of doing nothing Without investing: inflation kills value, no pension or passive income, and you risk lifelong financial dependence. 7.Advice if you’re 35–45 & haven’t started Start SIPs with ₹5K–₹8K/month. Be consistent. Track every 6 months. You're not late—you're right on time.

Hare Krishna, Everyone!🙏🌿❤️

Hare Krishna, Everyone!🙏🌿❤️

Retire Rich With ₹20 Crore By the Age of 60!💡

Hare Krishna, Everyone!🙏🌿❤️

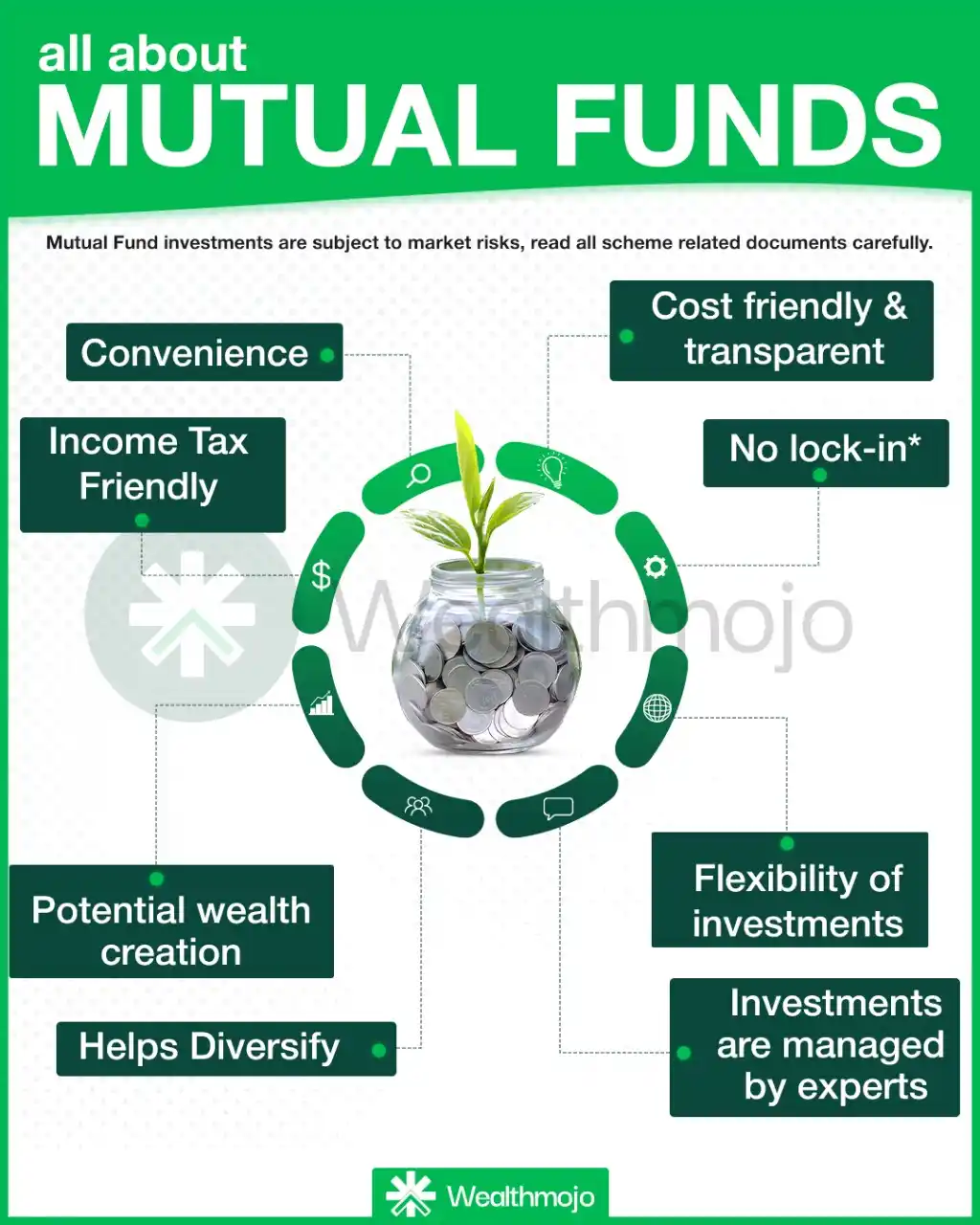

All About Mutual Funds!🎯💡

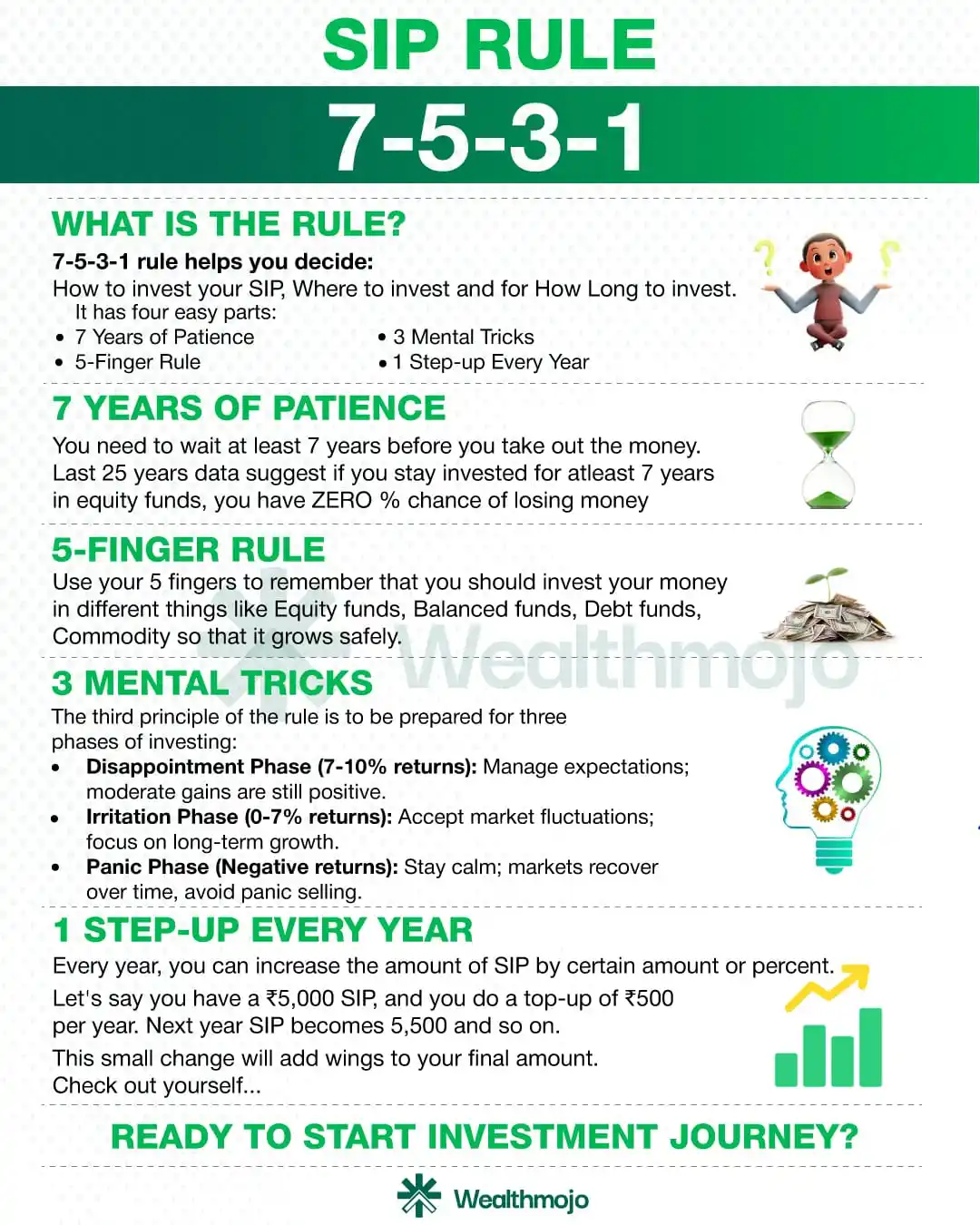

SIP Rule 7-5-3-1!🎯

Hare Krishna, Everyone!🙏🌿❤️

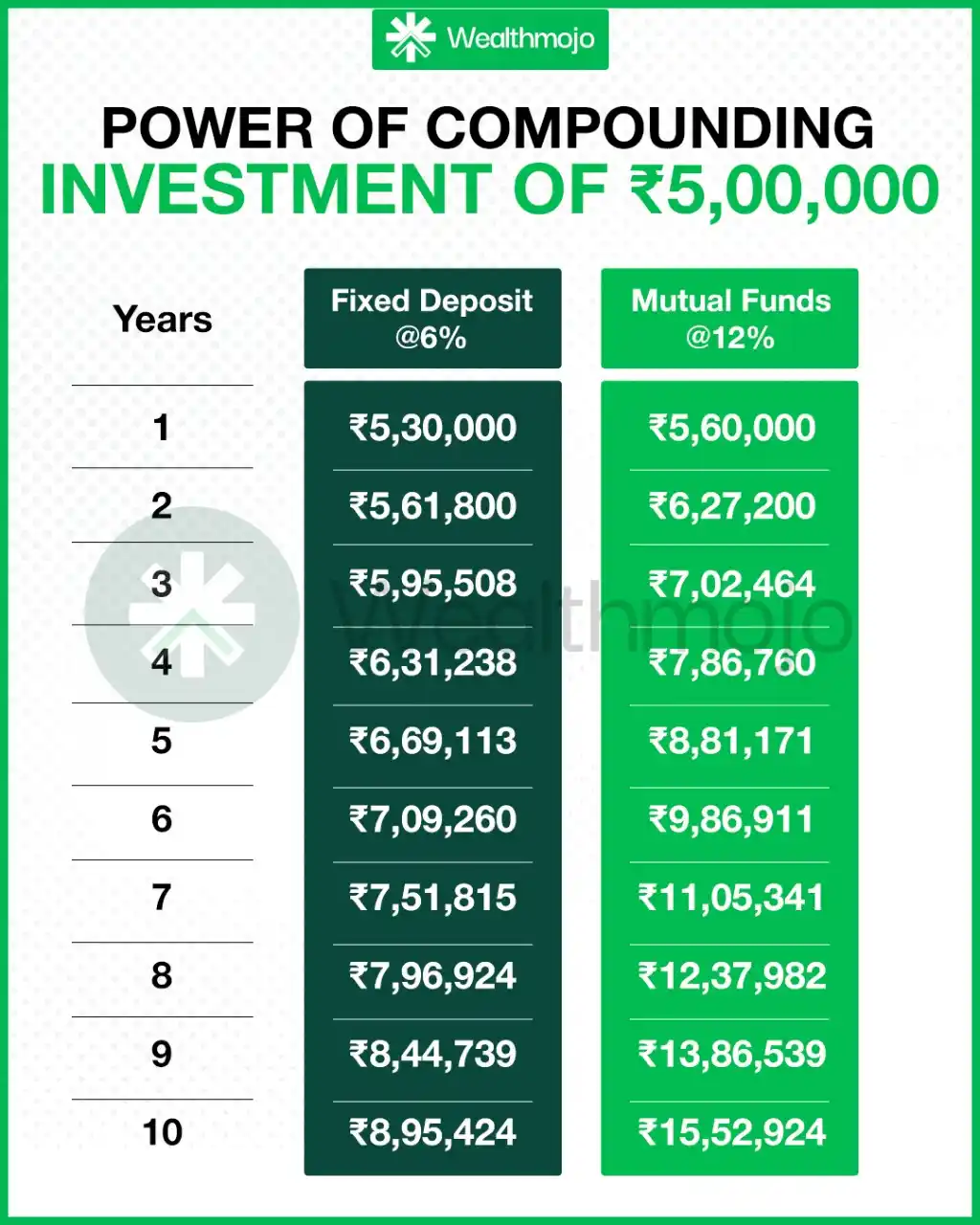

Power of Compounding Investment of ₹500000!💡