Trive India

74 subscribers

About Trive India

Trive International | Global Forex Broker ✔️ Transform Your Financial Journey ✔️ Trade Forex, Commodities, Cryptos, CFDs ✔️ Expert Analysis ✔️ Comprehensive Training ✔️ 24/5 Support #neverstandstill #forexbroker

Similar Channels

Swipe to see more

Posts

EURJPY short now TP 155 SL: 162 Type: Swing Analyst Confidence: 70% Trade Risk Suggestion: 1% risk of account Trade Responsibly.

UK CPI Data Released Today: Inflation Trends Under Market Focus The latest UK Consumer Price Index (CPI) report is out, providing critical insights into inflation trends and economic stability. As a key measure of price movements, this data could influence the British pound and shape future monetary policy decisions. - Will inflation exceed expectations? - How will the market react? - What impact will this have on interest rate outlooks? Feel free to share your views and discuss the market trend together! Stay informed with real-time updates and expert analysis. #TriveInternational #UKCPI #InflationData #MarketInsights #EconomicUpdate

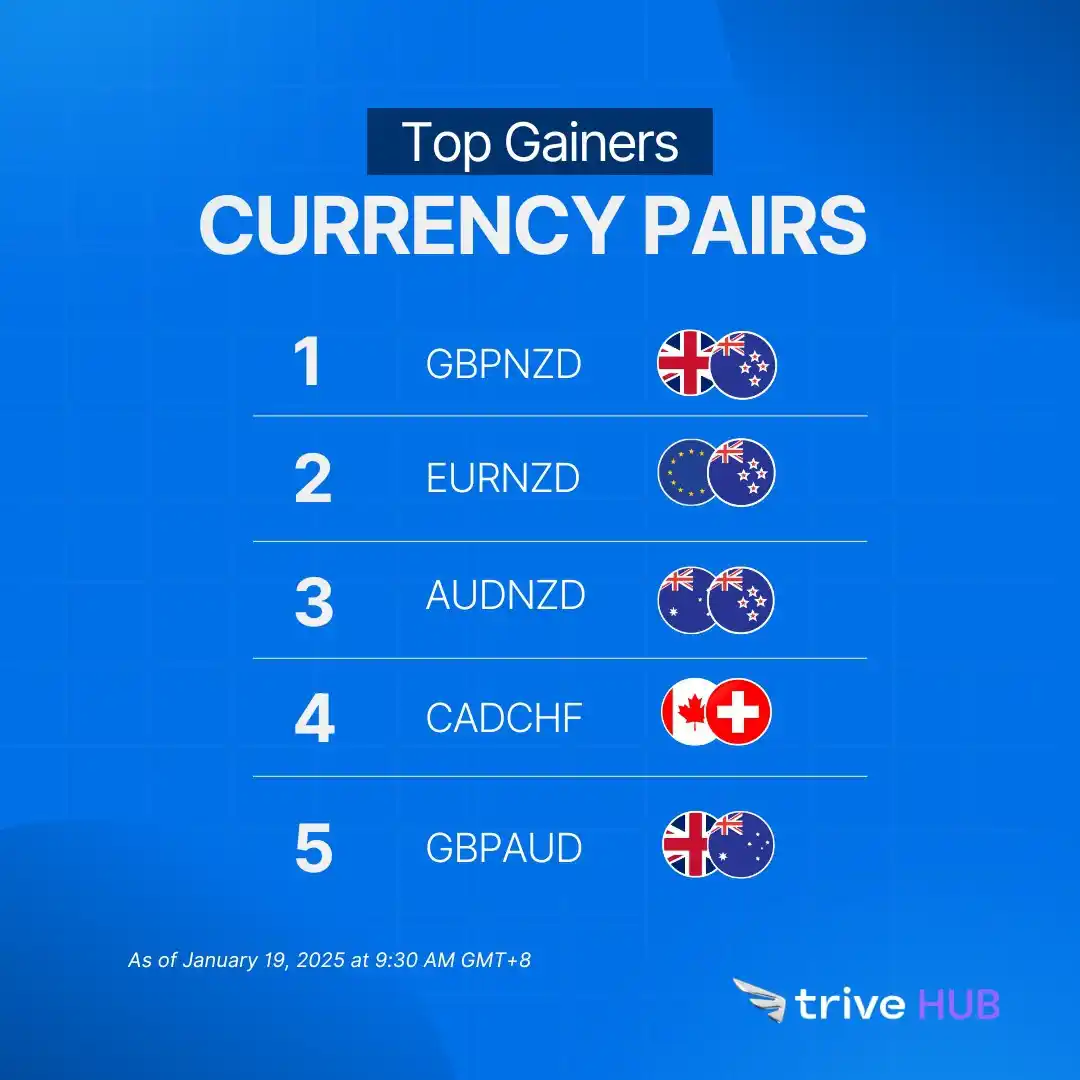

Today's top-performing currency pairs! Check out the biggest gainers as of February 19, 2025. Stay ahead in the market with insights from TriveHUB. #Forex #Trading #TopGainers #CurrencyPairs #ForexMarket #TriveHUB

USDCAD buy now TP 1.45000 SL: 1.40000 Type: Swing Analyst Confidence: 70% Trade Risk Suggestion: 1% risk of account Trade Responsibly.

FX Weekly: Trive’s Week Ahead Insights: Stay informed with our detailed analysis and projections. Check out the latest trends and key levels in today's report. This week highlights highlights include rate decisions from the RBA and RBNZ with minutes due from the January FOMC. PMI data will also be in focus, as will inflation data from Canada, UK and Japan. Read the full article: https://trivehub.com/blogs/market-outlook/fx-weekly-trive-s-week-ahead-insights-18 #WeeklyOutlook #TriveInternational #NeverStandStill

FX Daily Market Outlook: Trive’s Market Insights: Stay ahead with our latest analysis and key levels for the day. Get informed on market trends in today’s report. It is too early to say that the EUR has reached a turning point. A peace deal for Ukraine remains uncertain, while the Eurozone's outlook is still unclear, and the ECB may maintain its dovish stance. Meanwhile, Japan's economy continues to show strength, further reinforcing the BoJ’s rate hike trajectory—unless potential U.S. tariffs pose a negative surprise. Read the full article: https://trivehub.com/blogs/market-outlook/fx-daily-trive-bearish-on-eur-jpy-2 #DailyOutlook #TriveInternational #NeverStandStill

FX Weekly: Trive’s Week Ahead Insights: Stay informed with our detailed analysis and projections. Check out the latest trends and key levels in today's report. This week highlights include US Consumer Confidence, the Australian Monthly CPI, the Tokyo CPI and the US Core PCE index. Read the full article: https://trivehub.com/blogs/market-outlook/fx-weekly-trive-s-week-ahead-insights-18 #WeeklyOutlook #TriveInternational #NeverStandStill

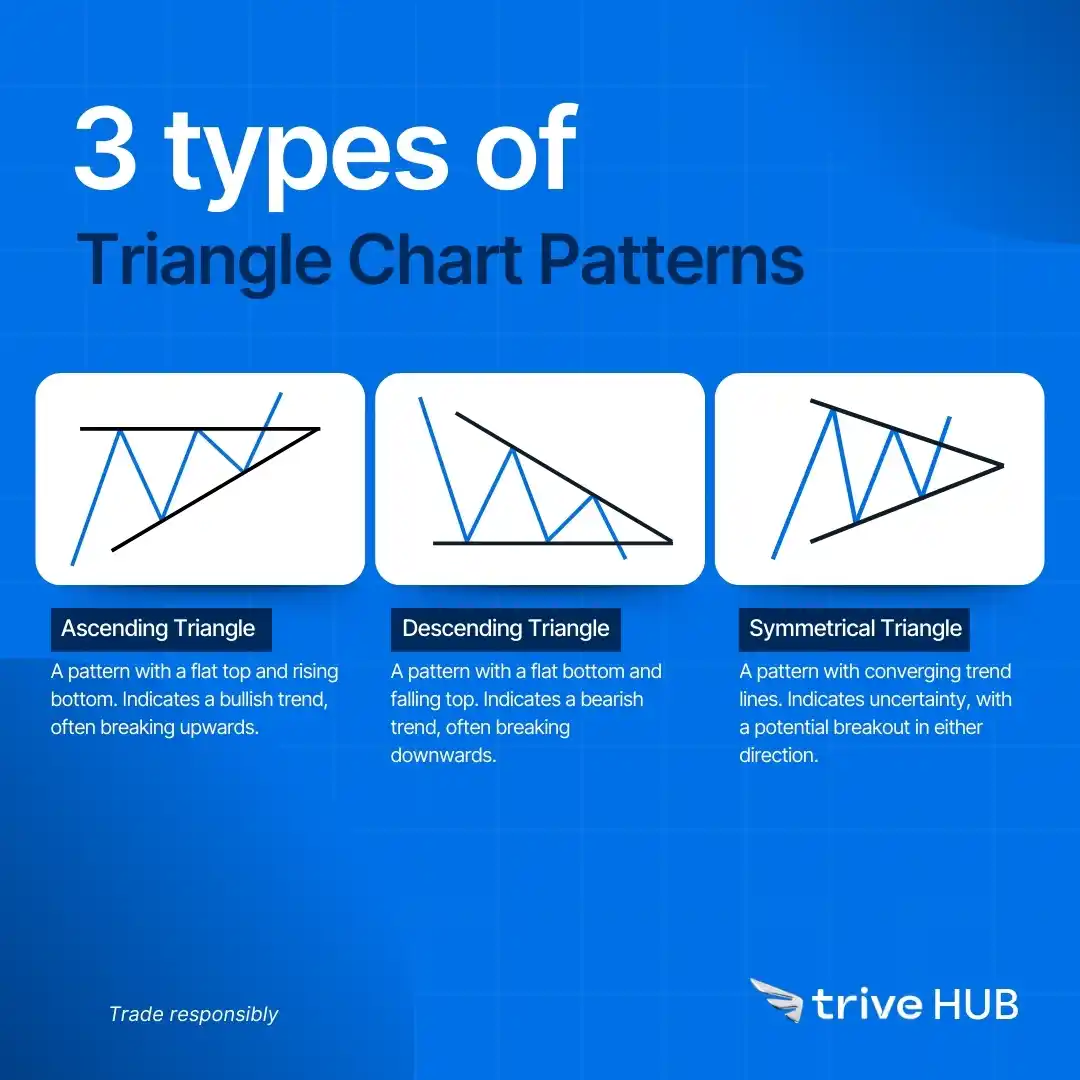

Master key chart patterns for smarter trading decisions. Understand how Ascending, Descending, and Symmetrical Triangles signal market movements and potential breakouts. Stay ahead with #TriveInternational #TriveInternational #TriveHUB #ChartPatterns #SmartTrading

FX Daily Market Outlook: Trive’s Market Insights: Stay ahead with our latest analysis and key levels for the day. Get informed on market trends in today’s report. It is too early to say that EUR/USD has reached a turning point. A peace deal for Ukraine remains challenging, while the Eurozone's outlook remains uncertain, and the ECB may maintain its dovish stance. Meanwhile, the U.S. economy remains resilient, and the threat of tariffs is a more significant driver for the USD and the FX market. Read the full article: https://trivehub.com/blogs/market-outlook/fx-daily-trive-bearish-on-eur-usd-12 #DailyOutlook #TriveInternational #NeverStandStill

FX Daily Market Outlook: Trive’s Market Insights: Stay ahead with our latest analysis and key levels for the day. Get informed on market trends in today’s report. The hotter-than-expected January US CPI reinforces the Fed’s stance of ‘no rush to cut.’ Meanwhile, the ongoing US tariff threat remains the key driver for the CAD, keeping it under pressure for now. Read the full article: https://trivehub.com/blogs/market-outlook/fx-daily-trive-bullish-on-usd-cad-6 #DailyOutlook #TriveInternational #NeverStandStill