SB Dash - SAFAR

56 subscribers

About SB Dash - SAFAR

Intellectual level discussion and presentation on socio, political, economical, Commerce and Financial matters. Basically Education and Awareness channel with a goal to Enlightenment, Enrichment and Empowerment of public at large.

Similar Channels

Swipe to see more

Posts

*Merely producing invoices and making payments through banks is insufficient proof of actual supply.* Reliable Trading Company vs. Joint Director, DGGI Zonal Unit, Meerut [WRIT TAX No. – 1177 of 2025] The Allahabad High Court has ruled that availing Input Tax Credit (ITC) under the Goods and Services Tax (GST) regime without actual supply of goods or services constitutes fraud and is squarely covered under *Section 74 of the Central Goods and Services Tax (CGST) Act, 2017.* The division bench, comprising Chief Justice Arun Bhansali and Justice Kshitij Shailendra, upheld the department’s action and dismissed the writ petition. Relying on precedents including State of Karnataka vs. Ecom Gill Coffee Trading Pvt. Ltd. and Shiv Trading vs. State of U.P., the court emphasized that merely producing invoices and making payments through banks is insufficient proof of actual supply. SAFAR - SB DASH

*LANDMARK DECISION ON GST BY SC* *Proceeding name: CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS Vs M/s ABERDARE TECHNOLOGIES PRIVATE LIMITED & ORS. Ruling date: 21st March 2025* *Supreme Court says software limitations cannot be a good justification to deny right to do business* In a recent ruling, the Supreme Court has ruled that the businesses can rectify GST(Goods and Services Tax) returns even after prescribed due dates observing that human mistakes are normal. It has dismissed the petition filed by the Central Board of Indirect Taxes and Customs ( CBIC ). An SLP was filed by the CBIC. In the case , a Maharashtra GST registered seller quoted in his GSTR-1, the GST number of the buyer’s Delhi office when in reality the goods were supplied to the buyer’s Uttarakhand factory which had a different GST number. This resulted in the buyer facing the issue of loss of his input tax credit (ITC). By the time the seller realised this mistake, the time limit to revise his GSTR-1 return for March 2023 tax period was over. The buyer who was unaware about this mistake, claimed his input tax credit (ITC) and filed the GSTR-3B return for March 2023 based on the figures auto-populated from the seller’s faulty GSTR-1 return. Since the amount in question was more than Rs 14 lakh, the buyer told it will deduct this amount from money payable to the seller. So, this is how it created a ripple effect for the seller, as denial of this much money meant significant business losses. To be fair, the buyer also had no choice as denial of ITC would mean he suffers loss in his own business. Hence the reason why the seller fought till the end starting from the GST Joint Commissioner, to Bombay High Court and ultimately to the Supreme Court of India. Supreme Court says software limitations cannot be a good justification to deny right to do business According to the order of Supreme Court of India dated March 21, 2025, here are the details: The petitioner, Central Board of Indirect Taxes and Customs, must re-examine the provisions/timelines fixed for correcting the bonafide errors. Time lines should be realistic as lapse/defect invariably is realized when input tax credit is denied to the purchaser when benefit of tax paid is denied. The purchaser is not at fault, having paid the tax amount. He suffers because he is denied the benefit of tax paid by him. Consequently, he has to make double payment. Human errors and mistakes are normal, and errors are also made by the Revenue. *The right to correct mistakes in the nature of clerical or arithmetical error is a right that flows from the right to do business and should not be denied* unless there is a good justification and reason to deny benefit of correction. Software limitation itself cannot be a good justification, as software are meant to ease compliance and can be configured. Therefore, we exercise our discretion and dismiss the special leave petition. “We are not inclined to interfere with the impugned judgment which is, in fact, just and fair, as there is no loss of revenue. Hence, the present special leave petition is dismissed,” said the Supreme Court.

*India Quarterly & Annual GDP and GVA estimates* In Q4 of FY 2024-25, the Real GDP or GDP at Constant Prices reached an estimated ₹51.35 lakh crore, showing a 7.4% increase from ₹47.82 lakh crore in Q4 of FY 2023-24. The Nominal GDP or GDP at Current Prices demonstrated a 10.8% growth, reaching ₹88.18 lakh crore in Q4 of FY 2024-25, compared to ₹79.61 lakh crore in Q4 of 2023-24. The overall Real GDP or GDP at Constant Prices for FY 2024-25 is projected to reach ₹187.97 lakh crore, indicating a 6.5% growth from the First Revised Estimates (FRE) of ₹176.51 lakh crore in FY 2023-24. Additionally, the Nominal GDP or GDP at Current Prices is expected to achieve ₹330.68 lakh crore in FY 2024-25, displaying a 9.8% increase from ₹301.23 lakh crore in FY 2023-24. The fourth quarter of FY 2024-25 shows Real GVA estimates of ₹45.76 lakh crore, compared to ₹42.86 lakh crore in the corresponding quarter of FY 2023-24, demonstrating a 6.8% increase. The Nominal GVA for Q4 FY 2024-25 stands at ₹79.46 lakh crore, whilst Q4 FY 2023-24 recorded ₹72.51 lakh crore, indicating a 9.6% growth. For the entire fiscal year 2024-25, Real GVA calculations reach ₹171.87 lakh crore, as opposed to the First Revised Estimates of ₹161.51 lakh crore for FY 2023-24, displaying a 6.4% growth. The Nominal GVA figures for FY 2024-25 are projected at ₹300.22 lakh crore, in comparison to ₹274.13 lakh crore in FY 2023-24, exhibiting a 9.5% increase. Q4 GDP Growth Data: Sector-wise numbers The Indian economy's Real GDP is projected to expand by 6.5% in FY 2024-25, whilst the Nominal GDP shows an increase of 9.8% during the same period. For the fourth quarter of FY 2024-25, the estimates indicate Real GDP growth of 7.4%, with Nominal GDP displaying a robust increase of 10.8%. The sectoral analysis reveals that 'Construction' leads the growth trajectory with 9.4% in FY 2024-25. This is complemented by strong performances in 'Public Administration, Defence & Other Services' at 8.9%, whilst 'Financial, Real Estate & Professional Services' registers 7.2%. The quarterly performance for Q4 FY 2024-25 demonstrates significant growth in 'Construction' at 10.8%. Additionally, 'Public Administration, Defence & Other Services' achieves 8.7%, whilst 'Financial, Real Estate & Professional Services' records 7.8% growth. The Primary Sector demonstrated an improved performance with a 4.4% growth rate, up from 2.7% in the preceding financial year. The sector's growth in Q4, FY 2024-25 reached 5.0%, significantly higher than the 0.8% recorded in Q4 of the previous year. The Private Final Consumption Expenditure (PFCE) exhibited robust growth, achieving 7.2% in FY 2024-25, surpassing the previous financial year's rate of 5.6%. The Gross Fixed Capital Formation (GFCF) displayed strong performance with a 7.1% growth rate throughout FY 2024-25, whilst achieving a notable 9.4% growth in Q4, FY 2024-25.

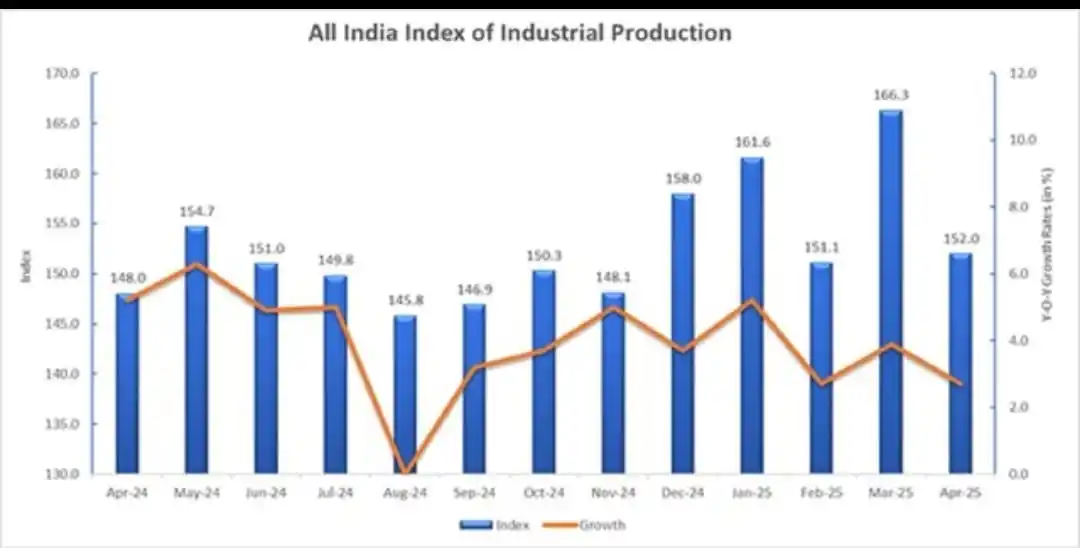

India’s industrial activity showed moderate growth in April 2025, with the Index of Industrial Production (IIP) rising 2.7 per cent year-on-year, according to data released by the Ministry of Statistics and Programme Implementation. This marked a slight slowdown from the 3.94 per cent expansion recorded in March 2025. Growth also remained below the levels seen in the same month last year.

*REMMITANCE TAX BY US* A proposed US bill seeks to levy a *5% tax on remittances by non-citizens,* potentially affecting NRIs sending money to India for family, education or investments. A new bill introduced by the House Republicans proposed a 5% tax on all international remittances made by non-citizens, marking a significant policy departure. The remittance tax component has stirred concern, particularly among the immigrant community in the United States, including Non-Resident Indians (NRIs). For many, sending money home is not a luxury but a necessity, supporting families, education, and long-term financial goals in India. *Why This Matters to the Indian Diaspora:-* India remains the largest recipient of remittances globally, receiving over $83 billion annually, a substantial share of which originates from the United States. The newly proposed tax could significantly impact this flow. If implemented, NRIs would lose 5% of every dollar sent back to India. For example, on a ₹1 lakh remittance (equivalent in USD), ₹5,000 would be diverted to the US Internal Revenue Service (IRS) before the money reaches its intended destination. This tax would apply regardless of the purpose, be it family support, school fees, or home loans. Previously, remittances were not taxed by the US government, making this a noteworthy reversal in fiscal policy affecting immigrants. The House aims to fast-track the bill, targeting its passage by Memorial Day (26 May 2025), and potentially enacting it into law by 4 July. If approved, the remittance tax could take effect soon after, with collection handled by financial institutions and money transfer providers. The levy would be deducted at the point of transaction, and applies universally across all legitimate remittance channels, including: Traditional bank wire transfers NRE/NRO account transactions Digital remittance platforms. This limits any scope for legal workaround or exemption. Implications for Personal and Financial Planning For NRIs, this tax introduces a new cost variable in cross-border financial transactions. Whether one is sending monthly allowances, paying for a sibling’s education, or making property investments, every transfer will now be marginally reduced in value. Key areas of concern include: Reduced transfer value: Every $1,000 remitted would incur a $50 tax. Impact on long-term planning: Property investments and educational funding may require higher remittances to meet the same financial objectives. Changes to remittance habits: Some may consider shifting from frequent small transfers to fewer, larger ones to better manage reporting and associated costs.

INDUSIND BANK - INSIDER TRADING The Securities and Exchange Board of India (Sebi) has barred former IndusInd Bank CEO Sumant Kathpalia and four other senior officials from trading in the securities market, following allegations of insider trading linked to a massive accounting discrepancy. In an interim order issued on May 28, Sebi said that these individuals had traded in IndusInd Bank shares while being in possession of unpublished price sensitive information (UPSI), violating insider trading rules. An internal review had uncovered issues following the implementation of the RBI’s 2023 Master Direction on derivative accounting. The bank estimated an adverse impact of “approximately 2.35 per cent of Bank’s Net Worth as of December 2024.” Sebi found that senior management had been aware of the issue since at least December 2023 but failed to disclose the information to the public in time. It can be prima facie inferred that the MD & CEO was aware about the probable huge impact of the discrepancy in the account balances of the Derivative portfolio. Despite internal estimates indicating a hit of ₹1,749.98 crore — later confirmed to be ₹1,572 crore for the quarter ending September 2023 — the bank only informed the stock exchanges in March 2025. Meanwhile, Sebi observed that the five officials sold shares during this UPSI period, potentially avoiding losses worth nearly ₹20 crore. Sumant Kathpalia alone sold 125,000 shares, while Arun Khurana offloaded nearly 350,000 shares. *Sebi has impounded their bank accounts and directed the officials to deposit the avoided loss amounts in fixed deposits with a lien in favour of Sebi.* The trading done by insiders, while being in possession of UPSI caused notional monetary loss to the innocent investors who did not have free and equal access to the crucial/material information. The five individuals are prohibited from buying, selling, or otherwise dealing in any securities, either directly or indirectly.

Registry is Not Ownership: Supreme Court’s Landmark Judgment on Property Rights. In K. Gopi v. Sub‑Registrar & Ors (2025), the Supreme Court struck down Tamil Nadu's Rule 55A(i). It ruled that a Sub‑Registrar cannot refuse to register a deed solely based on lack of title documents—their role is administrative, not judicial The Court reiterated: a registration officer cannot assess or verify title—that's for civil courts . *What is the difference between registry and ownership?* Registry is an administrative act of recording property details, whereas ownership refers to the legal right to possess and control the property. *How does this ruling affect property transactions?* It clarifies the legal requirements for ownership, requiring property transactions to be more transparent and legally sound. *Will property values be impacted?* Yes, property values may be influenced by the clarity of ownership rather than just registry status, affecting market dynamics. *What steps should property holders take post-ruling?* Property holders should ensure their ownership is legally recognized and consult legal experts to align their documents with the new ruling. Although registration grants a presumption of due execution, it does not confirm true ownership rights. To establish true legal ownership beyond registration, one must examine: Sale deeds, previous title documents Encumbrance certificates, mutation records Possession history, tax receipts, historical chain of title records. The apex court stressed that possession, encumbrance status, and past due diligence remain crucial. Buyers who skip thorough verification cannot claim “innocent purchaser” status later. This is exemplified in a landmark SC ruling (K. Gopi) and other precedents, which stress that due diligence before registration is paramount.

NEW GNL 1 FORM FOR COMPANIES - GNL-1 is the e-Form prescribed under the Companies Act, 2013 in India. It's used to intimate the Registrar of Companies (RoC) about the board resolutions and agreements that are not required to be filed in other specific forms (like MGT-7, AOC-4, etc.). It is a catch-all form under Rule 12(2) of the Companies (Registration Offices and Fees) Rules, 2014. If a document or resolution must be filed with the RoC but there's no prescribed form for it — GNL-1 is used. The Ministry of Corporate Affairs (MCA) has notified the Companies (Registration Offices and Fees) Amendment Rules, 2025 making amendments to Form GNL-1. These amendments, issued through G.S.R. 360(E), are set to take effect from 14th July 2025 and it must be Certified by Whole Time CA/CS/Cost Accountant. The new form automates and establishes the application process for a number of purposes, such as compounding offenses, extending the time for the Annual General Meeting(AGM), and approving plans like merger or arrangement, among others. The updated form requires detailed disclosures based on the application's goal. Details including the type of default, the parties involved, the duration of the default, the corrective actions taken, and any ongoing investigations must be disclosed, for example, in the case of compounding of offenses. Relevant reference numbers and dates must be included in applications submitted suo motu or in response to regulatory notices. The financial year-end date, the statutory AGM due date, and the proposed extended date must now be mentioned by companies requesting an extension to convene their AGM. The required certification by a practicing professional, chartered accountant, company secretary, or cost accountant, which verifies the accuracy of the submission based on company records, is an essential part of the new form. Professionals are required to attest that no material information has been withheld and to indicate compliance with the Companies Act's restrictions. The notification restates that Sections 447, 448, and 449 of the Companies Act, 2013, which address penalties for fraud, false statements, and false evidence, respectively, impose liability on applicants and certifying professionals.

*CIVIL / CRIMINAL LIABILITY OF A PARTNER OF A CA FIRM* - The Gujarat High Court cancelled a case filed by the Registrar of Companies (ROC) against a partner at Deloitte Haskins and Sells. The case was about not reporting related party transactions in the audit report of Mafatlal Industries Limited. A criminal case was filed by the Registrar of Companies (ROC) in 2018 under section 143 of the Companies Act, against Rayan Salivati, Deloitte’s partner. The filed complaint reported that, as an auditor, he did not properly disclose some transactions with related parties in the financial statements. This was against the legal rules, especially Accounting Standard 18. Because of this, he could be prosecuted under Section 147(2) of the Act. A formal investigation was also started based on this complaint. A petition was registered by Salivati for cancelling the proceedings. The petitioner raised an argument that the Registrar of Companies (ROC) failed to notify how he himself was involved in commission of the reported crime. It was argued that an individual partner of the audit firm cannot be personally held responsible for a crime that is said to have been committed by Deloitte Haskins, which is a partnership firm. Therefore, taking legal action against the petitioner as an individual is not valid. The High Court has dismissed the ROC’s criminal complaint against Deloitte. The High Court stated, “ *In order to bring a partner of the partnership firm within the outline of civil or criminal liability, it has to be proved that they acted in a fraudulent manner or colluded in any fraud. If it is not proved, then the partner cannot be held for punishment under Sections 139 to 146 of the Companies Act.” * It further stated, “While examining the questioned in light of the aforesaid law, this court is of the opinion that the petitioner, who has been joined in an individual capacity without joining M/s. Deloitte Haskins as an accused, is not needed to be sent for facing trial.”

*TAX FILING TIPS* Small investors will not have to file Complex ITR Form - If your profit is less than Rs 1.25 lakh or less in a year by selling mutual funds or shares, then you are not required to file a complex form like ITR-2 or ITR-3. You can directly file ITR-1 (Sahaj) or ITR-4 (Sugam) This change is a big relief for those who earn from salary or are small businessmen and also earn a little from investment. *New tax option for those selling their house or any other immovable property* If you bought a house or land *before 23 July 2024 and are now selling it* , then you have two options: 1. You can *pay 12.5% tax, but it will not get the indexation benefit.* 2. Alternatively, you can *pay 20% tax in which the indexation benefit can be availed.* As regards ITR-2, the updated form will have a separate LTCG reporting provision for transactions done before and after July 23, 2024, accommodating revised norms for indexation and tax rates. Also, buyback proceeds after October 1 last year need to be shown under ‘Income from Other Sources’ and as well as ‘Nil’ consideration in the capital gains section. Till now, people who had total assets of more than Rs 50 lakh, had to give details of everything they have – like house, car, loan – in ITR. Now this limit has been increased to Rs 1 crore. That is, now only those people will have to give this detail whose property is more than ₹ 1 crore. This will reduce the burden on the middle class a bit.