Arodeal FinTech

23 subscribers

About Arodeal FinTech

"Arodeal FinTech" specializes in a comprehensive array of insurance and investment products, covering automobile, medical, and health insurance, along with term insurance. We also offer opportunities for stock market investment, mutual fund investment (SIP), gold, government bonds, retirement plans, and various saving plans. To open free investment & Insurance account just click in below link- *Mutual Fund:-* https://www.wealthy.in/p/mock958608 *Stock Market:-* https://wealthy.in/broking?rCode=mock958608 *Credit card,Insurance & others:-* https://sales.gromo.in/gp-website/g/D6wiuprFm1p65XOnU3yuN

Similar Channels

Swipe to see more

Posts

https://youtube.com/shorts/ez9A05Q_G9c?si=NebajiXjQAI9ZanA

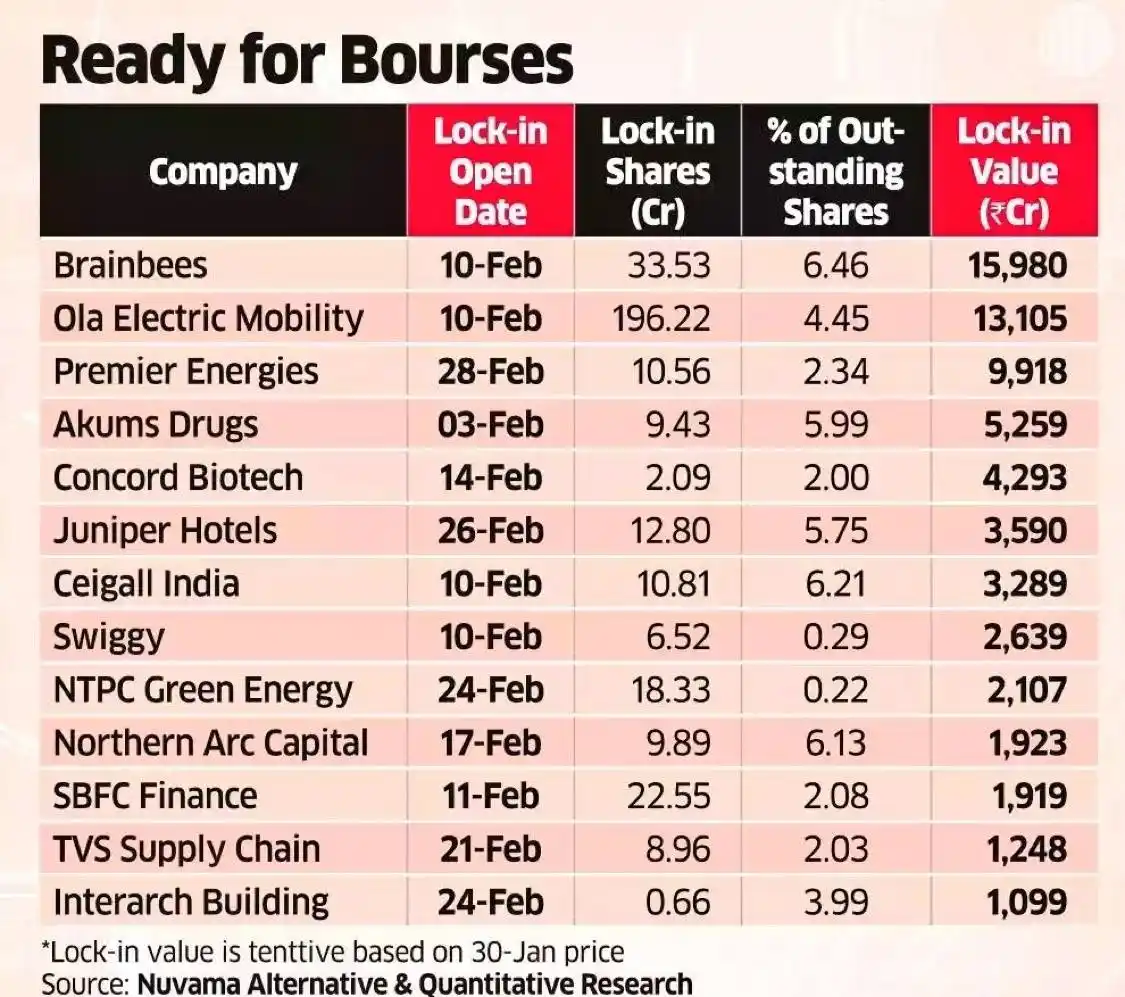

Market Alert : Lock-in period for shares worth ₹80,000 crores of 32 newly listed companies ends in Feb! Get ready for potential market volatility as promoters & investors unlock their shares

Here are some top-performing mutual funds across various categories:- Equity Funds:- 1.DSP Value Fund: Offers a 5-star rating and has given 9.79% returns in the last 1 year. 2.DSP Top 100 Equity Fund*: Provides a 5-star rating, with 13.52% returns in the last 1 year. 3.Quant Small Cap Fund: Offers 43.61% 5-year returns, making it a top choice for lump sum investment. 4.Bank of India Small Cap Fund: Provides 35.25% 5-year returns, suitable for equity investment. Debt Funds:- 1.Aditya Birla Sun Life Medium Term Fund*: Offers 12.04% 5-year returns, suitable for debt investment. 2.Bank of India Credit Risk Fund: Provides 10.80% 5-year returns, ideal for credit risk investment. 3.JM Low Duration Fund: Offers 9.64% 5-year returns, suitable for low-duration investment. Hybrid Funds:- 1.Quant Multi Asset Fund: Provides 28.67% 5-year returns, suitable for multi-asset investment. 2.Bank of India Mid & Small Cap Equity & Debt Fund*: Offers 25.24% 5-year returns, ideal for mid and small-cap investment. 3.Quant Absolute Fund*: Provides 23.78% 5-year returns, suitable for absolute return investment. Please note that past performance is not a guarantee of future returns. It's essential to assess your risk tolerance, investment goals, and time horizon before investing in any mutual fund. Additionally, consider consulting with a financial advisor or conducting your own research before making investment decisions. Declaration:- This is not a buy or sell recommendation.

*The List Of Companies which Have Recieved SEBI Approval for IPO :* 1. Gold Plus Glass 2. Patel Retail Limited 3. Belstar Microfinance 4. SK Finance Limited 5. Shivalik Engineering 6. NSDL 7. Paras Healthcare 8. Avanse Financial Services 9. Rubicon Research 10. Metalman Auto 11.Kalpataru Limited 12.TruAlt Bioenergy 13.Ecom Express 14.Smartworks Coworking 15.Ivalue Infosolutions 16.Ather Energy Limited 17.Oswal Pumps 18.Fabtech Technologies 19.Schloss Bangalore (Leela Hotels) 20.Casagrand Premier Builder 21.Highway Infrastructure 22.Regreen Excel EPC India 23.JSW Cement 24.PMEA Solar Tech Solutions 25.Vikran Engineering 26.Scoda Tubes 27.All Time Plastics 28.Ellenbarrie Industrial Gases 29.Sambhv Steel Tubes 30.Varindera Constructions 31.SMPP Limited 32.Aditya Infotech 33.Brigade Hotel Ventures 34.Kumar Arch Tech 35.Solarworld Energy Solutions 36.IndoGulf Cropsciences 37.Prostarm Info Systems 38.Globe Civil Projects *IPO Approved By SEBI With Shareholder Quota.* ▪︎ Ather Energy Limited ( *Hero Motocorp Limited* ) ▪︎ Brigade Hotel Ventures Limited ( *Brigade Enterprises* )

https://youtube.com/shorts/oCeGXu9o92k?si=IxBwovpSKxdRdwl0

Here's a detailed analysis of today's share market prediction before market opening: Market Outlook:- The Indian stock market is expected to open on a cautious note today, with a slight positive bias. The SGX Nifty, which is a indicator of the Nifty 50, is trading at 17,433, up 30 points. Global Cues:- Global markets are trading mixed, with the Dow Jones up 0.2% and the Nasdaq down 0.1%. Asian markets are also trading mixed, with the Nikkei up 0.5% and the Hang Seng down 0.2%. Technical Analysis:- The Nifty 50 is expected to face resistance at 17,500 and support at 17,300. The RSI (Relative Strength Index) is at 55, indicating a neutral bias. Top Stocks to Watch:- 1.Reliance Industries: The company is expected to announce its quarterly results today. 2. HDFC Bank: The bank is expected to announce its quarterly results today. 3. Infosys: The company is expected to announce its quarterly results today. 4. TCS: The company is expected to announce its quarterly results today. Sectoral Outlook:- 1. IT sector: The sector is expected to be in focus today, with Infosys and TCS announcing their quarterly results. 2. Banking sector: The sector is expected to be in focus today, with HDFC Bank announcing its quarterly results. 3. Auto sector: The sector is expected to be in focus today, with Maruti Suzuki announcing its quarterly results. Economic Data:- 1. Inflation data: The inflation data for January is expected to be announced today. 2. Industrial production data: The industrial production data for December is expected to be announced today. Conclusion:- The market is expected to be volatile today, with a slight positive bias. Investors are advised to be cautious and watch the global cues and economic data announcements closely.

+VE GMR AIRPORTS, ADANI ENETERPRISES, SPICEJET, INTERGLOBE AVIATION 31. Mining sector reforms+ policy for recovery of critical minerals +VE NMDC, GMDC, VEDANTA 32. Special Window for Affordable and Mid-Income Housing (SWAMIH) +VE AAVAS FINANCIER, AADHAR HOUSING, HOME FIRST FINANCE, HDFC BANK, SBI, PNB 33. Top 50 tourist destination sites in the country will be developed in partnership with states+ Special focus on destinations related to the life and times of Lord Buddha. +VE EASEMYTRIP, IHCL, ITC HOTELS, CHALET HOTELS, LEMON TREE, INTERGLOBE AVIATION, IRCTC, IXIGO, THOMAS COOK, SPICEJET 34. Medical Tourism and Heal in India will be promoted in partnership with the private sector +VE SHALBY, ASTER DM, APOLLO, FORTIS, RAINBOW CHILDREN 35. To start a National Geospatial Mission to develop foundational geospatial infrastructure and data +ve Genesys, MapMyIndia 36. Export Promotion Mission, with sectoral and ministerial targets +ve PHARMA, EMS STOCKS 37. A national framework will be formulated as guidance to states for promoting Global Capability Centres in emerging tier 2 cities. T +VE FOR EMBASSY REIT, MINDSPACE REIT, DLF 38. The scope for fast-track mergers will also be widened and the process made simpler. +ve for Special Situation Stock 39. Rationalisation of Customs Tariff Structure for Industrial Goods +ve ABB, Siemens, Thermax 40. To add 36 lifesaving drugs and medicines to the list of medicines fully exempted from Basic Customs Duty (BCD). +VE DRL, CIPLA, AUROBINDO PHARMA, SUN PHARMA 41. To fully exempt cobalt powder and waste, the scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals. +VE FOR AMARA RAJA, EXIDE 42. To add two more types of shuttle-less looms to the list of fully exempted textile machinery. To revise the BCD rate on knitted fabrics covered by nine tariff lines from “10% or 20%” to “20% or ` 115 per kg, whichever is higher”. +VE FOR TEXTILE COMPANIES-WELSPUN, INDOCOUNT, NAHAR SPINNING 43. Manufacture of such Open Cells, the BCD on these parts will now stand exempted. +VE DIXON, PG ELECTROPLAST, EPACK DURABLE 44. To add 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing +VE DIXON TECH, RATTAN INDIA, EXIDE, AMARA RAJA 45. To continue the exemption of BCD on raw materials, components, consumables or parts for the manufacture of ships for another ten years. +VE FOR SHIPPING INDUSTRY 46. Domestic MROs for Railway Goods +VE RITES 47. To reduce BCD from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds. +VE MUKKA PROTEIN, SHRIMP STOCKS 48.NO GST FOR- Ground installation for satellites including its spares and consumables+ Goods used in the building of launch vehicles and launching of satellites +VE L&T, SUNDARAM FASTENERS, APOLLO MICRO 49.NO MAJOR ANNOUNCEMENT ON CAPITAL GAIN TAXATION -VE FOR ANGELONE, MOTILAL, ICICI SECURITIES, IIFL SECURITIES 50. Reduces custom duty on import of propane/butane/LPG to 2.5%/2.5%/5% from 15% earlier -VE FOR Gujarat Gas and +VE OMCs

https://youtube.com/shorts/ejz2Hnkl5iQ?si=BkBcLGyPCE-gIo0C

Here are some top-performing ETFs in India for recent days:- Equity ETFs:- 1.Nippon India ETF Junior BeES: Tracks the Nifty Next 50 Index, offering exposure to the next 50 largest companies after the Nifty 50, with 15.45% 1-year returns and 125.92% 5-year returns. 2.SBI NIFTY NEXT 50 ETF: Also tracks the Nifty Next 50 Index, providing exposure to potential future large-cap stocks, with 16.32% 1-year returns and 126.35% 5-year returns. 3.KOTAK NV 20 ETF: Focuses on value stocks within the Nifty 50 by tracking the Nifty50 Value 20 Index, with 14.58% 1-year returns and 156.13% 5-year returns. Debt ETFs:- 1.SBI 10 YEAR GILT ETF: Tracks 10-year Government of India bonds, offering exposure to government securities, with 8.63% 1-year returns and 24.87% 5-year returns. Gold ETFs:- 1.Invesco India Gold ETF*: Tracks domestic gold prices, offering exposure to gold without physical ownership, with 24.12% 1-year returns and 94.07% 5-year returns ¹. Other notable ETFs:- 1.UTI BSE Sensex ETF: Tracks the BSE Sensex, offering exposure to the 30 largest and most actively traded stocks on the BSE, with 12.3% 1-year returns and 14.8% 5-year returns. 2.Motilal Oswal Midcap 100 ETF*: Tracks the Nifty Midcap 100 Index, offering exposure to mid-cap stocks, with 25.2% 1-year returns and 27.9% 5-year returns. Please note that past performance is not a guarantee of future returns. It's essential to assess your risk tolerance, investment goals, and time horizon before investing in any ETF. Additionally, consider consulting with a financial advisor or conducting your own research before making investment decisions.This is not a buy or sell recommendation.