CA Chauhan Chirag

280 subscribers

Verified ChannelAbout CA Chauhan Chirag

Income Tax, GST, Finance and Wealth Managment news and updates by CA Chirag Chauhan

Similar Channels

Swipe to see more

Posts

How Your Family Can Legally Hold ₹1 Crore in Gold! - Tax Rules Explained! https://youtube.com/shorts/_H3IKBKuJRc?feature=share Share it with someone who might need it

Taxpayers ITR Filing Is Now Available For The Tax Year 2025 Don’t wait till September, (extended deadline) file in June! Know why in just one minute video https://youtube.com/shorts/0Llo6RNztd4?feature=share Share with a Taxpayer

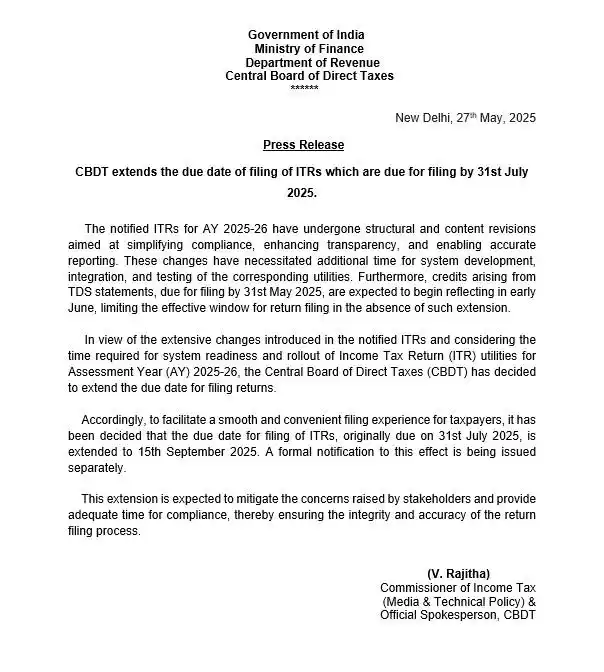

ITR filing due dates extended from 31 July 2025 to 15 September 2025 CBDT has decided to extend the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025

5 Cash Transactions Business Owners Must Avoid to Prevent Income Tax Penalties https://youtube.com/shorts/nYsuNJvpcCY?feature=share Share it with your friend who is in business

Economic Times: "Delay in releasing utility means delay in ITR filing, resulting in delay in refund. All the refunds which are being stuck will get delayed. Also, the government will have a huge bill of paying additional interest on tax refunds, which will be funded again by the taxpayer's money," says Chartered Accountant Chirag Chauhan. https://economictimes.indiatimes.com/wealth/tax/33-more-money-on-tax-refund-interest-this-year-for-income-taxpayers-due-to-itr-filing-deadline-extension/articleshow/121457413.cms

Excel Utilities of ITR-1 and ITR-4 for AY 2025-26 are released by Income Tax Department and are available for filing. Taxpayers can file ITR 1 and ITR 4 from Today onwards!

3 Tax Considerations in Case of Divorce https://youtube.com/shorts/T0UsqUDzWFg?feature=share Share and Spread Knowledge

Jan 2025 - I propose RBI to reduce interest rate by 2% In last 6th months RBI reduce rates by 50 bps and today again it reduced by 50 bps total 1%. Great news for businesses & corporates, stock markets, and individuals having a home loan! #RBIPolicy

11 Cases Where Taxpayers Cannot Use ITR 1 for Income Tax Filing. Salaried and others will get a Notice if they use wrong ITR form. So before using ITR-1 to file Tax Returns do check this video https://youtube.com/shorts/vfn2Zm5AltQ?feature=share Share this with a friend who might need this.

5 Strategies to Save Tax on ESOPs https://youtube.com/shorts/096u9SS2Juc?feature=share Share with someone who got ESOP