Investolane

118 subscribers

Verified ChannelAbout Investolane

Discover hidden gems in India's rising stars: Invest in Startups, Unicorns, pre-IPO shares of companies like NSE, Goodluck, OYO, Vikram Solar, Polymatech, InCred and many more! Unlock exclusive opportunities to invest in promising startups and unicorns before they go public. Diversify your portfolio and gain early exposure to India's next big brands. Contact us to know more: https://wa.me/investolane

Similar Channels

Swipe to see more

Posts

*IPO-bound NSE's Q4 results* ✅ For the March quarter of FY25, NSE reported a 7% YoY growth in its consolidated net profit at Rs 2,650 crore. The same stood at Rs 2,488 crore in the same quarter of the last financial year. ✅ Further, NSE’s revenue from operations declined 18% YoY to Rs 3,771 crore against Rs 4,625 crore reported in the year-ago period. The same declined 13% on a sequential basis. ✅ The Earnings Per Share (EPS) for FY25 stood at Rs 49.24, marking a significant rise from Rs 33.56 in FY24. The book value per share increased to Rs 122.64 in FY25, up from Rs 96.87 in the previous fiscal. The return on equity (RoE) improved to 45% in FY25, compared to 37% in FY24. 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

*NSE shareholder army crosses 1 lakh milestone, largest among all unlisted companies* ✅ The National Stock Exchange of India (NSE) is preparing for its IPO, boasting over 1 lakh shareholders, surpassing many listed firms. NSE's Q4 FY25 net profit rose 7% YoY to Rs 2,650 crore, despite an 18% revenue decline. The exchange has approached SEBI for a No Objection Certificate to advance its listing plans, addressing previous concerns. ✅ Earlier in February 2025, NSE overtook Serum Institute of India as the most valuable unlisted company, according to a joint study, which was conducted by Axis Bank’s Burgundy Private and Hurun India. ✅ The list features the top 500 private companies in terms of value for 2024. The cumulative value of all the 500 companies rose 40% to $3.8 trillion, which is higher than India’s Gross Domestic Product (GDP). 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

*Sebi's Chairmain Tuhin Kanta Pandey on NSE IPO: All outstanding issues to be resolved, will move forward 'soon'* ✅ “NSE and SEBI are in discussions on several key points — governance, technology, litigation, and the clearing corporation. Hopefully, these issues will be resolved with a clear roadmap, and then the IPO can move forward,” Pandey had told Moneycontrol. ✅ NSE filed its IPO prospectus in December 2016. *Shares of the exchange are one of the most actively traded in the unlisted space.* Earlier this year, in March, NSE wrote to SEBI seeking a No Objection Certificate (NOC) that would allow it to take further steps towards listing of its shares. ✅ In February, SEBI had responded to NSE’s letter seeking an NOC, highlighting certain observations on issues like "colocation matter". 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

*Tata Capital Q4 Results: IPO-bound NBFC posts 31% profit growth to ₹1,000 crore* ✅ IPO-bound Tata Capital reported 31 per cent year-on-year surge in its consolidated profit after tax to ₹1,000 crore for three months ended March 2025. Total revenues from operations rose nearly 50 per cent to ₹7,478 crore. The company logged a profit after tax of ₹765 crore in the year-ago period. ✅ Total revenues from operations rose nearly 50 per cent to ₹7,478 crore in the January-March period of FY25 from ₹4,998 crore in the year-ago period, Tata Capital said in a regulatory filing. ✅ For financial year 2024-25, Tata Group's financial services firm reported a PAT of ₹3,655 crore as compared to ₹3,327 crore in FY24, and revenues surged to ₹28,313 crore from ₹18,175 crore. 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

*Check for a blue checkmark ✅️ to chat confidently with Investolane* Did you know businesses with a badge have been verified by Meta? Your safety is important to us, so we’ve made it easier to chat more securely with Investolane.

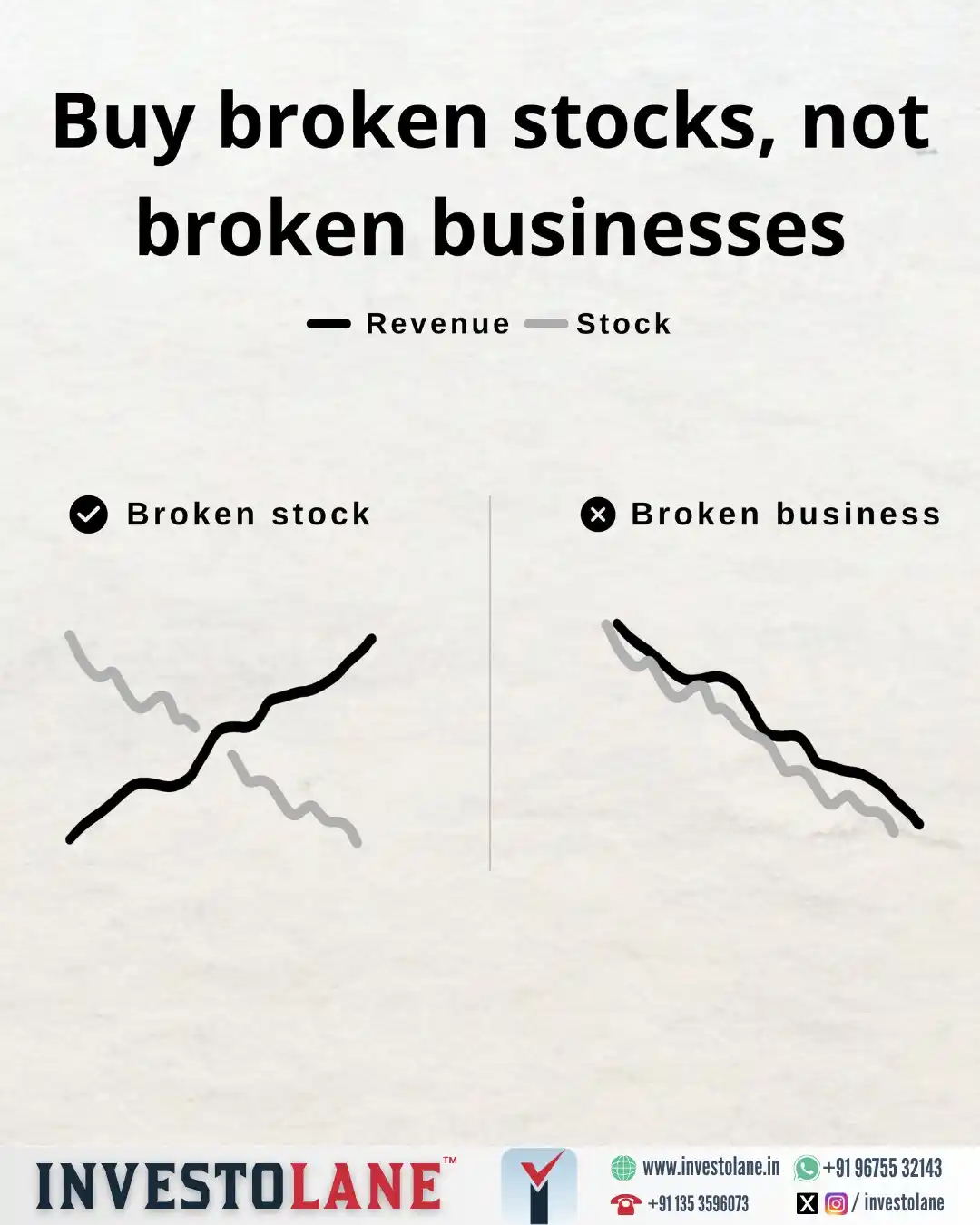

Target stocks that are down due to market overreactions, not businesses that are truly failing. 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G

*DISCOVERING UNLISTED SHARES: NATIONAL E-REPOSITORY LIMITED (NERL)* ISIN: INE878X01013 ✅ NeRL is a Commodity Repository in India, established in February 2017 and promoted by institutions of national stature like NCDEX, NABARD, State Bank of India & ICICI Bank. ✅ NeRL launched as a national level market infrastructure institution that records and store Warehouse Receipts in electronic form in the Indian commodities market under the aegis of WDRA. WDRA has granted a certificate of registration to NeRL for providing an electronic Repository platform for the creation and management of electronic warehouse receipts (eWR) both Negotiable and Non-Negotiable. ✅ The main objectives of WDRA ecosystem is to implement the electronic Negotiable Warehouse Receipt (eNWR) system in the country, improve the fiduciary trust of the depositor and the Banks, increase liquidity in rural areas, and encourage scientific warehousing of goods. 👉🏼 Follow us to stay informed about the latest NeRL updates!

*VC Firm 247VC Targets ₹250cr for its First Fund - To fund 30 cos, with ₹7cr average cheque size* ✅ Early-stage venture capital firm 247VC, founded by operator investors Yagnesh Sanghrajka and Shashank Randev, has launched its first India-focused fund with a base corpus of ₹200 crore and a green shoe option of ₹50 crore. ✅ The fund, registered as a Category II Alternative Investment Fund (AIF) with the Securities and Exchange Board of India (Sebi), will offer institutional seed cheques to startups across sectors such as consumption, enterprise tech, deep tech, and Industry 5.0, which includes advanced manufacturing, industrial and allied domains, managing partner Sanghrajka told ET in an interaction. ✅ 247VC plans to invest in around 30 startups over the next three years, with an average cheque size of about ₹7 crore, including follow-on investments in top-performing portfolio companies. The firm is targeting the first close of the fund within the next four months.

*NSDL trims offer size to 50.15 million shares ahead of IPO deadline* ✅ The markets regulator SEBI had given the depository an extension until the end of July to launch its highly-awaited public offering worth ₹3,000 crore. ✅ Six existing shareholders will dilute their stakes, including National Stock Exchange (NSE), IDBI Bank, and HDFC Bank. NSE will offer to sell 18 million shares, or 9 per cent of the 24 per cent stake it holds currently. ✅ India’s largest depository had filed its draft prospectus with the SEBI in 2023 and received approval for the same in 2024. 🔖 To keep the Unlisted Buzz coming, follow our WhatsApp Channel: https://whatsapp.com/channel/0029VaABeGILNSZvt6OrBq0G