Cytonn Investments

96 subscribers

About Cytonn Investments

Cytonn is an alternative investment company situated in Nairobi, offering privately placed alternative investment solutions.

Similar Channels

Swipe to see more

Posts

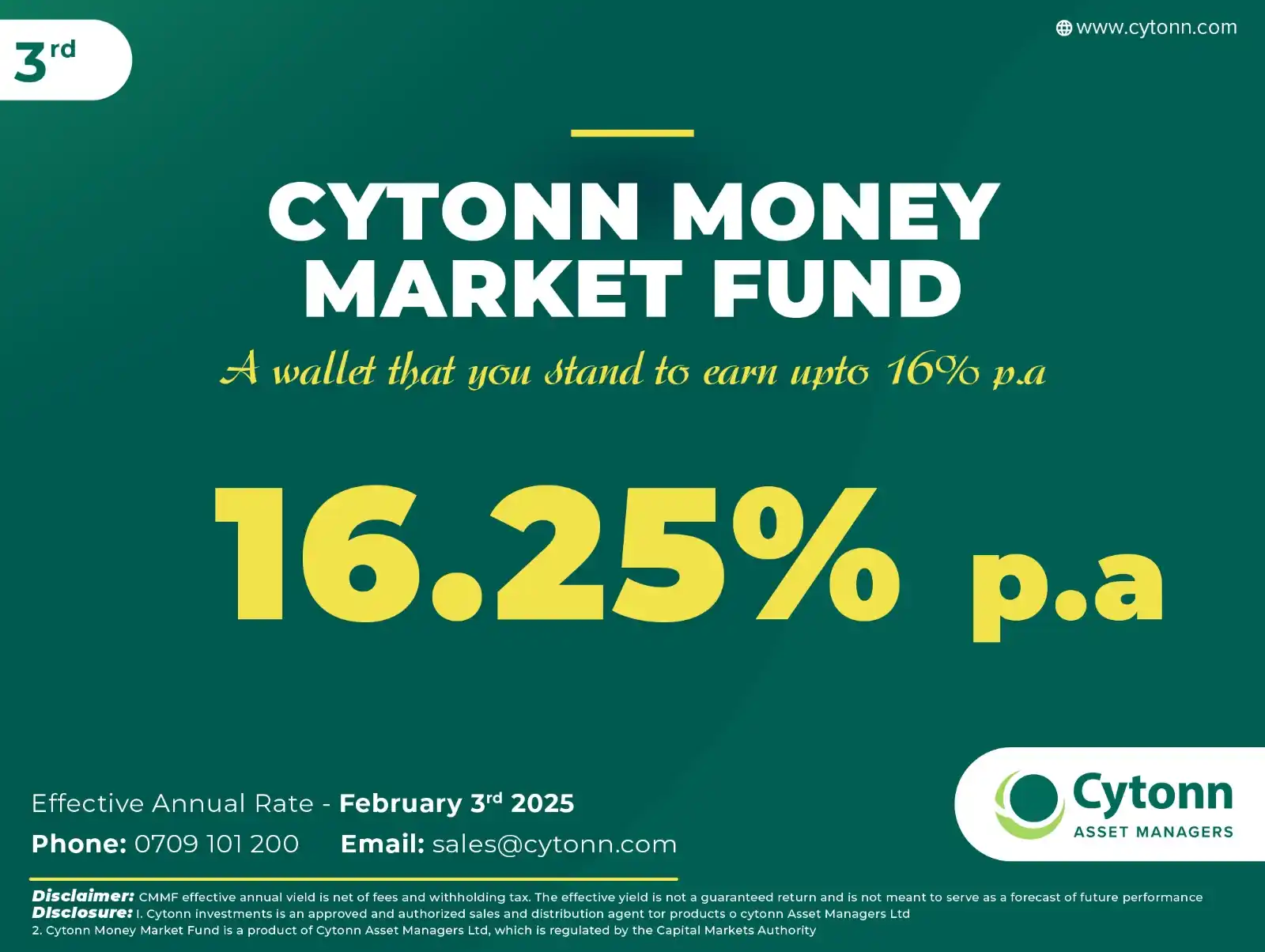

Cytonn Money Market Fund posted an Effective Annual Rate of 16.25% as of 3rd February, 2025. Invest, withdraw, and redeem to pay bills instantly 24/7, by just dialing *809# or sign up at https://clients.cytonn.com/apply/investment Cytonn Wallet ,a wallet that you stand to earn high returns of up to 16% p.a

*Flowers are sweet, but what else will you be giving?** 💰✨ This Valentine's, we’re making it extra special! 💕 Tell us: What will you do for your loved one besides flowers? 👉 Tag them and share your plan in the comments. The most thoughtful answer wins KES 1,000 courtesy of #Cytonn Wallet Dial *809# or Download the Cytonn App here - https://clients.cytonn.com/mobile or Sign up at clients.cytonn.com

In our Cytonn Report this week, we analyzed the performance of Kenya’s Equities, Fixed Income, and Real Estate markets for the ended week, with a special focus on review of Real Estate Investments Trusts (REITs) in Kenya. Below are the highlights.; a) Fixed Income: During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 296.6%, a reversal from the subscription rate of 56.1% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 10.0 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 250.0% significantly higher than the undersubscription rate of 61.6% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased to 240.0% and 371.9% respectively, from the 28.6% and 81.3% recorded the previous week. The government accepted a total of Kshs 59.7bn worth of bids out of Kshs 71.2 bn bids received, translating to an acceptance rate of 83.9%.The yields on the government papers were on a downward trajectory with the yields on the 364-day paper decreasing the most by 55.5 bps to 10.8% from 11.3% recorded the previous week, while the yields on the 182-day and 91-day papers decreased by 50.9 bps and 40.6 bps respectively to 9.5% and 9.1% from 10.0% and 9.5% respectively recorded the previous week; During the week, the government announced its first-ever domestic treasury bond buyback aiming to buyback Kshs 50.0 bn of Kshs 185.1 bn for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.7%, 11.8% and 12.5% respectively. The total outstanding amounts for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 are Kshs 104.5 bn, Kshs 60.6 bn and Kshs 19.9 bn each respectively. The period of the buy-back opened on 7th February 2025 and will close on 17th February 2025 with a settlement date of 19th February 2025. Our expectation is that the bond buyback will be undersubscribed, given the remaining short-term tenors to maturity of the bonds, as most investors may prefer to wait till maturity rather than sell at a potential discount. Additionally, if the government’s buyback price is not attractive then investors may prefer not sell leading to an undersubscription; Click the link below to read the Cytonn Weekly report: https://cytonnreport.com/research/review-of-real Click the link below to subscribe to our Weekly Report: https://cytonnreport.com/subscribe

Show your loved one you care—secure their future with Cytonn Wallet! Smart investing, effortless saving, and a future you can build together. 💰❤️ Dial *809# or Download the Cytonn App here - https://clients.cytonn.com/mobile or Sign up at clients.cytonn.com #LoveAndWealth #CytonnWallet #SmartInvesting

In our Cytonn Report this week, we analysed the performance of Kenya’s Equities, Fixed Income, and the Real Estate markets for the week ended 21st February 2024, with a 2025 review of the Kenyan currency and Interest rates. Below are the highlights; a) Fixed Income: During the week, T-bills were oversubscribed for the third consecutive week, with the overall subscription rate coming in at 137.3%, albeit lower than the subscription rate of 184.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 113.1%, a reversal from the undersubscription rate of 63.2% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 123.6% and 160.6% respectively from the to 236.2% and 181.1% recorded the previous week. The government accepted a total of Kshs 32.90 bn worth of bids out of Kshs 32.94 bn bids received, translating to an acceptance rate of 99.9%. The yields on the government papers were on a downward trajectory with the yields on the 182-day paper decreasing the most by 9.8 bps to 9.3% from 9.4% recorded the previous week, while the yields on the 91-day and 364-day papers decreased by 2.2 bps and 6.8 bps respectively to 8.9% and 10.5%, from 9.0% and 10.6% respectively recorded the previous week; Also, during the week, the Central Bank of Kenya released the auction results for the buyback of the treasury bonds FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.8%, 11.7% and 12.5% respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds. The weighted average yield for the accepted bids for the FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 came in at 9.1%, 8.9% and 9.1% respectively. The yields are largely in line with the T-bill rates making the refinancing cost to the same. In the primary bond market, the government is looking to raise Kshs 25.0 bn through the reopened bond; FXD1/2018/25 with a tenor to maturity of 18.3 years and a fixed coupon rate of 13.4%. The period of sale opened on Friday, 21st February 2025, and will close on 5th March 2025. Our bidding range for the reopened bond is 13.85%-14.55%. The bond is currently trading at 13.34% in the secondary market; Click the link below to read the Cytonn Weekly report: https://cytonnreport.com/research/kenya-currency-and-interest-rates-review-2025-and-cytonn-weekly-082025

✨ You handle the hustle, we handle your investments. Let your money grow effortlessly with CMMF. 📈📲 📲 Download the Cytonn App 👉 https://play.google.com/store/apps/details?id=com.cytonn&pcampaignid=web_share 💻 Invest via the Cytonn Client Portal 👉 https://cytonn.com/ 🌐 Learn more 👉 www.cytonn.com 📞 *Dial 809# to start investing today! #SmartInvesting #CMMF #WealthMadeEasy

Is your wallet feeling a little too light? 💸 Don't stress—let Cytonn Wallet be your financial companion, helping you save, invest, and grow your money effortlessly! Dial 809# or Download the Cytonn App here - https://clients.cytonn.com/mobile or Sign up at http://clients.cytonn.com. #InvestWisely #CytonnWallet #FinancialFreedom #MoneyMatters #SecureYourFuture

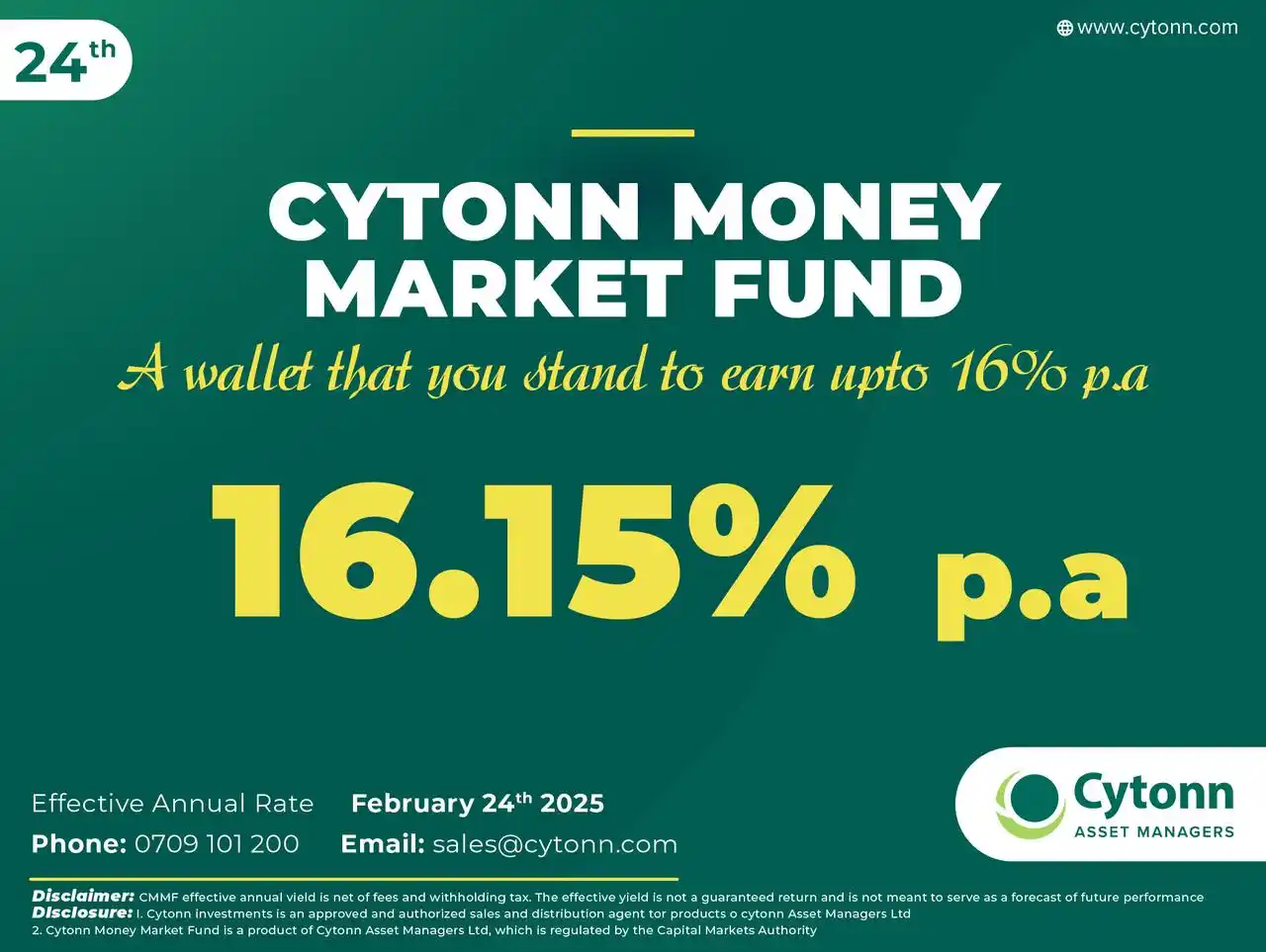

Cytonn Money Market Fund posted an Effective Annual Rate of 16.15% as of 24th February, 2025. Invest, withdraw, and redeem to pay bills instantly 24/7, by just dialing *809# or sign up at https://clients.cytonn.com/apply/investment Cytonn Wallet ,a wallet that you stand to earn high returns of up to 16% p.a