Tax By KK - GST Litigation

621 subscribers

About Tax By KK - GST Litigation

We offer an unmatched learning experience for GST Professionals. Our GST lectures, GST Books and GST Premium Club is designed to enhance your skills in GST litigation, notice handling, and drafting replies. K K Agrawal, takes pride in commitment to excellence and dedication to helping our members succeed in the complex world of GST.

Similar Channels

Swipe to see more

Posts

🌟Key Learnings from the Patanjali Judgment: Section 74 and Section 122 | Circular Trading Litigation https://youtu.be/F2myAkHmHow 👀👆🏻 Watch Now

🌟What's the REAL difference? Right IN Goods vs Right TO USE 🤔 https://youtube.com/shorts/n5kO0TVCWNg 👀👆🏻 Watch Now

🌟GST: IMS Rejection Reversal: Understanding the Impact on Supplier Liability and Recipient ITC https://youtu.be/u7cWzfHNbQ4 👀👆🏻 Watch Now

🌟Patanjali's GST Paradox https://youtube.com/shorts/gjjkjMG8vf4 👀👆🏻 Watch Now

🌟GST Refund on Business Closure? High Court Says YES! ⚖️ https://youtube.com/shorts/s3x1O43r7tw 👀👆🏻 Watch Now

🌟The CRITICAL Difference Between 1(b) & 5(f) https://youtube.com/shorts/FqmY9ZI91nc 👀👆🏻 Watch Now

🌟Section 49(6) vs. 54(3): High Court Grants ITC Refund on Business Closure | Sikkim HC Ruling https://youtu.be/kV8v6DiuxC0 👀👆🏻 Watch Now

🌟🚨New GSTR-3B Advisory! Table 3.2 Auto-Populated & Uneditable? https://youtube.com/shorts/BVa1pCqeekk 👀👆🏻 Watch Now

🌟GST Appeal Withdrawal: Before vs After APL02! https://youtube.com/shorts/5aBIErqJVEc 👀👆🏻 Watch Now

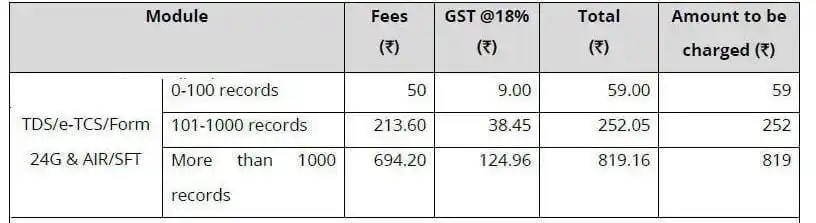

*LAST DATE OF FILING TDS RETURN FOR Q4 FY 2024-2025 IS 31.05.2025* If you are facing any problem in physical submission of TDS/TCS/24G Return or PAN/TAN, we can facilitate submission of your TDS/TCS/24G/ PAN/TAN Application at our authorised TIN Facilitation Center managed by NSDL. You just need to E-mail the 27A & FVU file to the E-mail [email protected] and in case of any issue call us at 9883388955. Receipt will be E-mailed on the same day. No Extra charges only the NSDL Upload Fee.