Lendsqr

119 subscribers

About Lendsqr

Discover everything about launching your digital lending without the hassles of building your own tech

Similar Channels

Swipe to see more

Posts

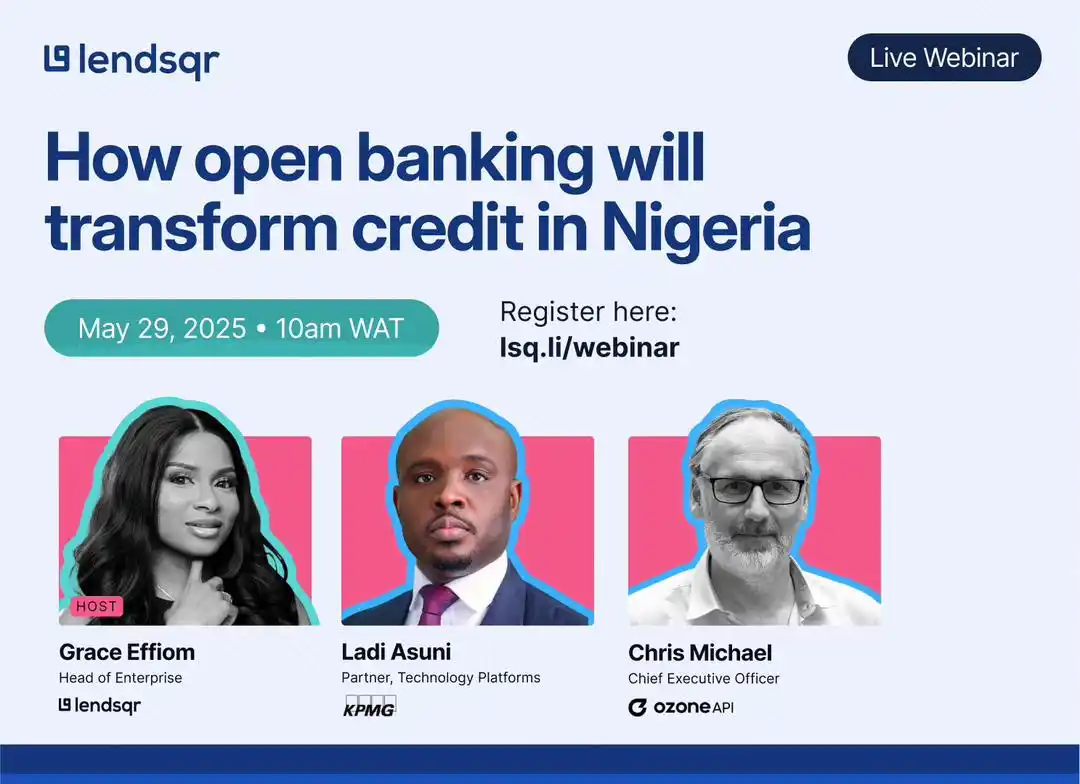

Thank you for joining us for our recent webinar, “How Open Banking Will Transform Credit in Nigeria.” We hope you found the session insightful and inspiring, as we explored the powerful impact open banking can have on Nigeria’s lending and financial services landscape. We were honored to host global and regional thought leaders including: Chris Michael (CEO Ozone API), Ladi Asuni (Head & Partner, Technology Platforms, KPMG Nigeria), Grace Effiom (Head of Enterprise, Lendsqr) Together, we unpacked how open banking is evolving beyond APIs to become a catalyst for credit innovation, financial inclusion, and ecosystem-wide transformation. 🔗 Access the resources ▶️ Watch the recording: https://lsq.li/open-banking-recording 📑 Download the slides: https://lsq.li/open-banking-slides 📘 Read our in-depth recap: https://lsq.li/open-banking-recap ❓Read the full Q&A recap: https:lsq.li/full-qa 📱Want to Stay Updated? Join our WhatsApp channel (https:lsq.li/wa-c) to be the first to hear about future events and follow

Every lender wants more borrowers. But ads are expensive, and not everyone who clicks will convert. You know what works better? Referrals. People trust people they already know. And your best customers already know others like them...reliable, creditworthy, and in need of a loan. With Lendsqr, you can set up a referral reward system that runs automatically. Decide how much to give, who qualifies, and what triggers the reward. The system handles the rest: tracking, assigning, and rewarding. This way, you grow your loan book with less effort and better-quality leads. Learn how you can set it up in minutes: https://lsq.li/sl24

🚨 Meet Chris Michael, a global force in open banking Chris is one of the speakers at our upcoming webinar on "How Open Banking Will Transform Credit in Nigeria" and he’s no stranger to building the future of finance. With 30+ years of experience building high-performing tech teams and leading innovation across industries, Chris helped shape the UK’s open banking journey from the ground up. He chaired the UK’s Open Banking Technical Design Authority, co-founded Ozone API, and has played a major role in designing frameworks in Saudi Arabia and the UAE. Chris brings a rare, firsthand perspective on how open banking transformed access to credit in the UK and what Nigeria can learn as it takes its first steps. 🎙 Don’t miss this conversation. 📅 May 29, 2025 🔗 Register now: https://lsq.li/webinar

Open banking isn’t just coming, it’s already moving. Banks are preparing. Fintechs are building. Regulators are greenlighting. In just a few months, the way credit works in Nigeria will take a bold new turn. Tomorrow, we’re creating space to understand exactly where things are headed and what you need to do to be part of it. No guesswork. No recycled slides. Just the truth about what’s changing and how to win in the new system. 📅 May 29, 2025 🕒 10 AM WAT 🔗 Grab your seat now → https://lsq.li/webinar One day to go. Don’t watch from the sidelines.

Three days from now, we’re bringing together the people who’ve built the foundation of open banking not to predict the future, but to show you how to use it. This webinar isn’t just about what open banking is. It’s about how to win with it. Here’s what this session will help you do: ✔ Understand the data shift coming to lending ✔ Learn how to rethink credit models in a permission-based world ✔ Hear how global markets avoided early mistakes and how you can too ✔ See how access to real-time customer data will change your entire playbook If you’re in credit, product, growth, risk, or strategy, this one matters. 📅 Wednesday, May 29 🕒10 AM 🎙 Chris Michael | Ladi Asuni | Grace Effiom 🔗 Reserve your spot → https://lsq.li/webinar The credit game is changing. Don’t sit on the sidelines.

On April 29, 2025, the CBN approved the launch of open banking, set to begin operations this August. With that, Nigeria becomes the first African country to take this bold step toward a more open and connected financial system. But what exactly is open banking? Why is it such a big deal? And how does it affect your access to credit or the way you lend money? Whether you're a fintech, a lender, or someone just trying to make sense of it all, this shift changes everything. Join us for a live conversation on what open banking means for credit in Nigeria. We’ll be joined by two people who understand it better than most: 📅 Date: Thursday, May 29, 2025 🕙 Time: 10:00 AM WAT 📍 Location: Online 🎤 Speakers: Chris Michael, Ladi Asuni, Grace Effiom You’ll learn: • What open banking really is and why it matters • How it changes credit decisions, scoring, and data access • What opportunities it creates for lenders, fintechs, and customers Save your seat now: https://lsq.li/webinar

In 2 days, the conversation begins. Open banking is no longer a theory. In August, it becomes a reality in Nigeria and everything about how we access, assess, and deliver credit is about to shift. From how data flows between banks and lenders, to how creditworthiness is determined, we're entering a new system. And the people who understand it now will be the ones ahead tomorrow. If you work in credit, finance, lending, or fintech, this isn’t something to read about later. It’s something to prepare for now. 📅 May 29, 2025 🕒10 AM WAT 🔗 Register now → https://lsqli/webinar We’re bringing the experts who’ve built it and you’ll walk away with the clarity and direction you need to move forward.

🔍 Meet Ladi Asuni, a strategy and analytics expert shaping Nigeria’s financial future Ladi is a featured speaker at our webinar on "How Open Banking Will Transform Credit in Nigeria" and he’s bringing deep insights from the frontlines of finance and technology. Ladi Asuni is Partner and Head of Tech Platforms at KPMG in Nigeria. As a seasoned technology consulting leader with over two decades of experience advising financial institutions across Africa on digital transformation, core banking modernisation, and operations improvement. He has led numerous landmark projects, helping banks to navigate complex technology-driven transformation and harness emerging technologies to drive innovation and growth. He has also been instrumental in shaping the discourse on open banking in Nigeria as an active contributor to Open Banking Nigeria. Ladi will break down how open banking can reshape credit, improve access, and give lenders better tools for customer insights and risk management. 📅 May 29, 2025 🎙 Don’t miss it 🔗 Register now: https://lsq.li/webinar

Think about how much time (and peace of mind) you lose when your team has to manually check BVNs on one site, NINs on another, and bank accounts somewhere else. Not to mention the logins, the API keys. And yet, all you really want to know is one thing: Is this person real, and can I trust them with money? That’s why we built Data Lookup directly into the Lendsqr dashboard. From one place, you can run BVN validation, NIN verification, and even confirm that a bank account actually belongs to your borrower.

We’re just 15 minutes away from going live! Join us as we unpack how open banking will transform credit in Nigeria and what this shift means for lenders, fintechs, and anyone building in financial services. 📅 Today 🕒 Starts in 15 mins 🔗 Join here → https://lsq.li/webinar See you shortly!