Indian Labour Laws & HR

59 subscribers

About Indian Labour Laws & HR

Educational and Information Sharing platform on Indian Labour Laws & HR landscape. Official notifications, office circulars, gazette notifications, directives, FAQ, user guides, court judgements, clarifications, HR topics etc curated from different sources and media platforms and shared on this Channel. Please use your judgment before using/sharing any of the information shared on this channel. It is always better to seek expert advice and get more clarity on legal and HR matters. Although the Channel Admins Sunshine Consultants (www.sunshineconsultants.co.in) will take adequate care but do not take any responsibility for any factual errors or typos in the content shared on this channel or such content forwarded to contacts outside this Channel. All rights are reserved with their original creators.

Similar Channels

Swipe to see more

Posts

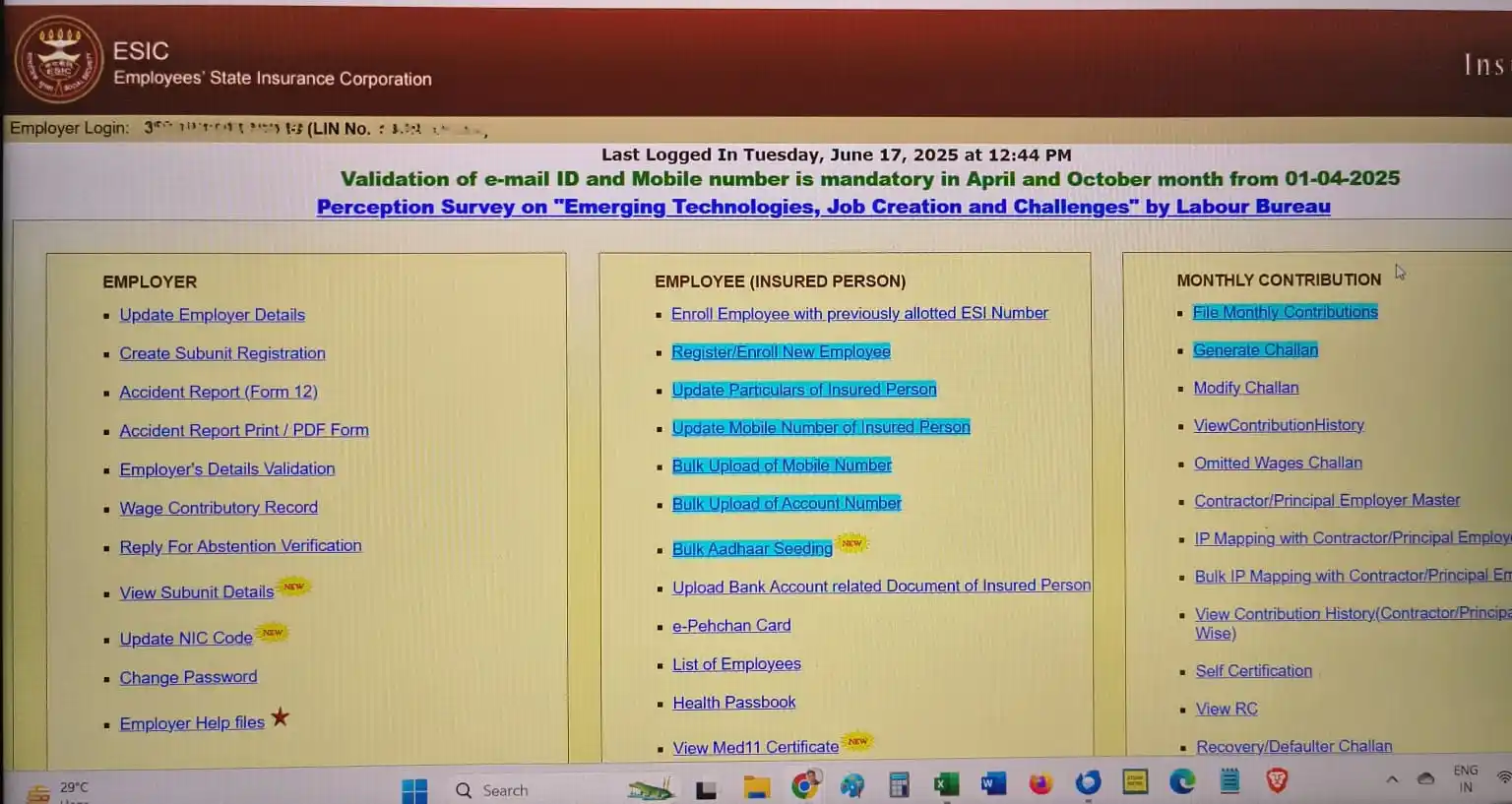

Validation of mobile number and email id mandatory on ESIC portal from 01st Apr 2025. This will be only necessary for Apr and Oct months every year.

GenZ compels companies to rezig their HR policies

Any allowance which is paid to only selected employees can not be considered universal allowance and hence not covered under the definition of basic wages

Can EPFO claim dues, interest and damages beyond 03 years. Answer is Yes and No both Only if it is established that such claims are prejudiced towards employer

Income for FY 2025-2026 is exempted till 12.75 Lac of salary under the New Tax Regime You can use the link below to get an approx idea about how much tax will be applicable on your salaried income: http://www.sunshineconsultants.co.in/income-tax-calculator-fy-2025-2026/

Can you take an undertaking from sales employee to achieve certain targets❓

Once Internal Complaints Committee formed under POSH Act concludes that the allegation of sexual harassment has been proved, then what is the role of Employer❓

Income Tax Act has been revamped....catch up with the zist of proposed changes👍

What all wages components are considered for calculating Gratuity❓

![SHIKSHA CLASSES [COMMITTED TO EXCELLENCE] WhatsApp Channel](https://cdn1.wapeek.io/whatsapp/2025/02/27/08/shiksha-classes-committed-to-excellence-cover_59bbbf7b3fb0711e76272d8a56fd5915.webp)