Sauti Ya Bajeti - PFM Truth

444 subscribers

About Sauti Ya Bajeti - PFM Truth

Sauti Ya Bajeti is a public education platform by the Institute of Public Finance and whose goal is to provide factual PFM information that educate citizens on public budgets. We bring you clear information on how taxes are collected, spent and how they can be tracked

Similar Channels

Swipe to see more

Posts

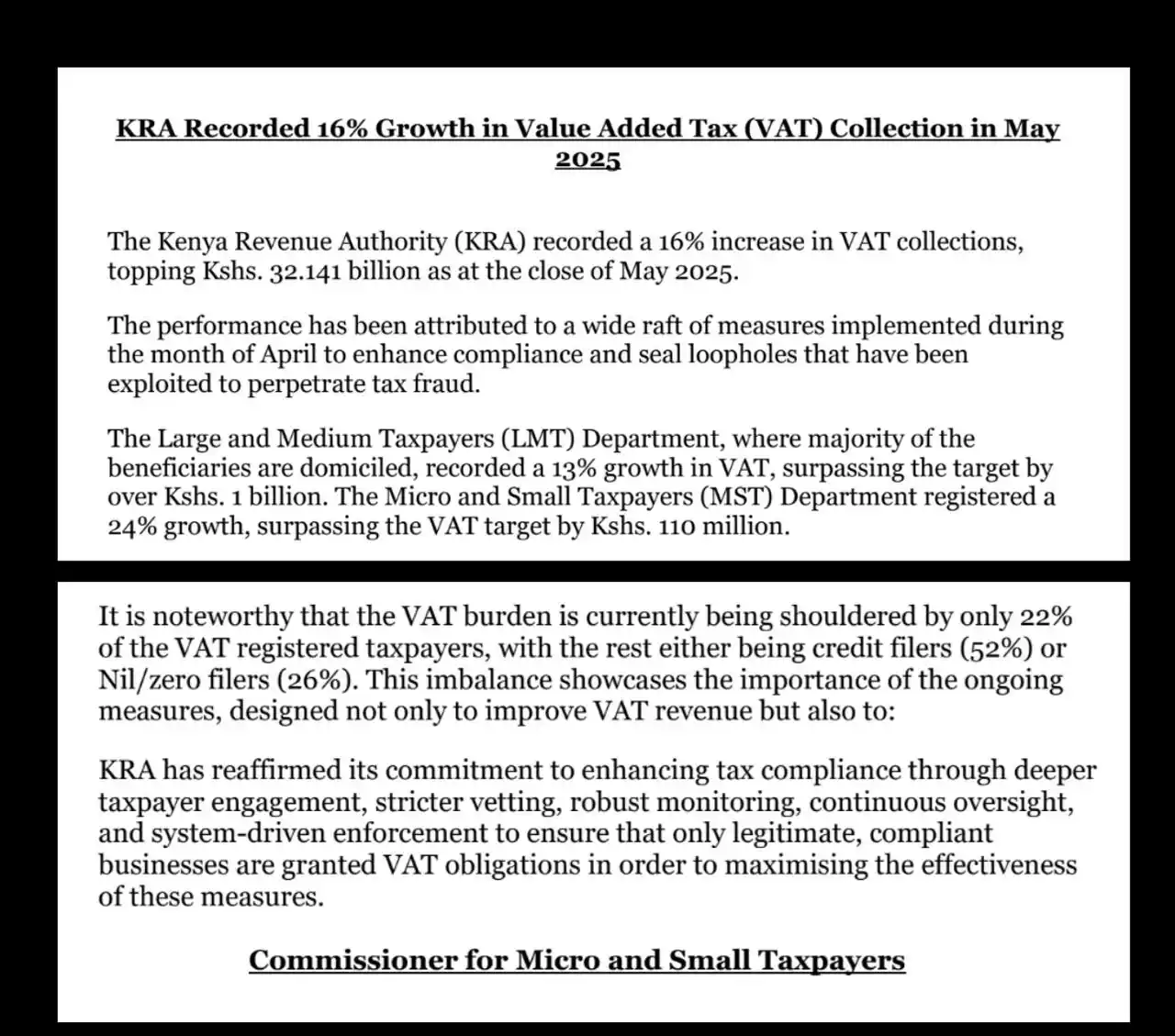

*From Pressure to Ambition: Kenya’s Revenue Race Continues* As the curtain closes on 2024/25, *As per the Exchequer Releases for April 2025* Treasury faces a high-stakes sprint to hit the revised revenue target of Ksh 2.4 trillion, it must collect a massive KSh 600B in just May and June. That’s a quarter of the year’s revenue in just two months. *But there’s no slowdown in sight, In the freshly announced 2025/26 budget, the bar is raised even higher* KSh 2.75 Trillion in Ordinary revenue is now expected to power the bulk of a KSh 4.29 Trillion budget. That’s a bold jump, especially when the current year is struggling to meet targets. *The big question is Can tax performance catch up with Treasury’s ambition?*

*Kenya Plans to Borrow More from Abroad After a Year of Borrowing Less* As of April 2025 with two months left in the 2024/25 financial year Kenya had borrowed: KSh 732 Billion from domestic sources KSh 314 Billion from foreign external lenders Compared to FY2023/24, this shows a clear shift Local borrowing went up by 22% Foreign borrowing went down by 38% But in the new 2025/26 budget just announced, things are changing again The government now plans to borrow KSh 635.5B from foreign lenders And only KSh 287.7B from local sources So after a year of pulling back from foreign loans, the government is now planning to borrow more from external lenders to help fund its KSh 4.29 trillion budget. Source: https://x.com/KeTreasury/status/1933157002504478870?t=gMQ_5WbShhjBy_TVIjMg1w&s=19

*Budget Day 2025 is here* This afternoon, the Cabinet Secretary for the National Treasury and Economic Planning, Hon. FCPA John Mbadi Ng’ongo, EGH, will present the Budget for the Financial Year 2025/2026.

*Budget Estimates* Each year, the National Treasury prepares Budget Estimates outlining how the government plans to spend public funds—and how it intends to raise that money. Alongside the Budget Estimates, a Finance Bill is submitted to Parliament, proposing tax measures to generate revenue for the upcoming financial year. *In today’s post, we break down the proposed budget estimates that shows* Key changes in revenue and expenditure A sector-by-sector look at funding priorities The ten major government sectors and how their allocations are shifting Read the analysis here: http://bit.ly/4iZvnGp

From software taxes to dividend exemptions for big investors, and minor PAYE tweaks—are these changes helping you? Which one concerns you the most?

*Big Fish, Bigger Breaks?* The Finance Bill 2025 proposes to exempt dividends from income tax—but only for companies certified by the Nairobi International Financial Centre (NIFC) and investing at least KES 250 million locally. It’s meant to attract major investors—but it risks creating a two-tier tax system where multinationals get the breaks, while local businesses and Small and Medium Enterprises (SMEs) are left behind. At a time when the government is cutting spending and expanding the tax base, this kind of preferential treatment raises serious questions about fairness, equity, and transparency.

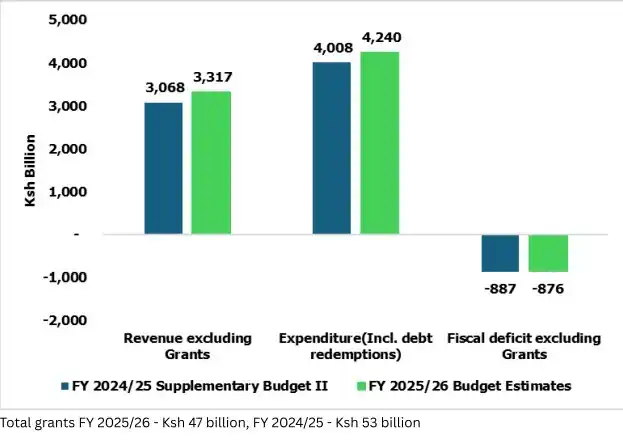

The FY 2025/26 Budget Estimates propose a 6% increase in total spending—from Ksh 4.0 trillion in the FY 2024/25 Supplementary II Budget to Ksh 4.2 trillion. Revenues are projected to grow by 8% The fiscal deficit is expected to decline from 5.1% to 4.5% of GDP To close the financing gap, the government plans to borrow: Ksh 592 billion domestically Ksh 284 billion externally However, given the government’s track record of missing deficit targets, there is a high likelihood that the deficit will be revised upward in future supplementary budgets—raising fresh concerns about growing public debt. Source: http://bit.ly/4iZvnGp

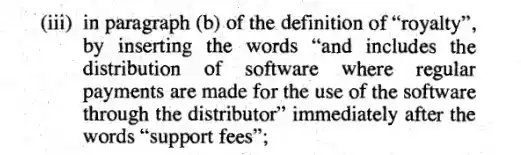

*Return of the Controversial Definition of Royalties, Rejected Within the Finance Bill 2024* Imagine paying for software to run your business, then being taxed again, as if you had purchased the rights to the software itself. That’s the practical implication of a proposal in the Finance Bill 2025, which seeks to classify regular payments for software use as royalties. This provision, previously dropped from the 2024 Bill due to legal and technical concerns, has resurfaced—albeit with revised language. If enacted, it risks double taxation on standard software transactions, a move that could significantly burden digital businesses and end users. Kenyan jurisprudence and the OECD Model Tax Convention both make a clear distinction between the use of software and the transfer of copyright. Taxing ordinary software purchases as royalties undermines this distinction and contradicts established legal standards. It’s time for Kenya’s tax laws to reflect both legal precedent and the practical realities of the digital economy. Read the finance bill here: https://new.kenyalaw.org/akn/ke/bill/na/2025-05-06/the-finance-bill-2025/eng@2025-05-06

*Finance Bill 2025* From your monthly salary to that side hustle you’ve been building, *proposed amendments to the Income Tax Act* could soon change how much you take home. Whether you’re employed, self-employed, or running a business, these changes matter. *Today, we walk you through the key proposals, what’s new, what’s going up, what’s being scrapped, and most importantly, how it could affect your wallet.*