CA Narendra Ramdasee

1 subscribers

About CA Narendra Ramdasee

Narendra Ramdasee & Associates Chartered Accountant

Similar Channels

Swipe to see more

Posts

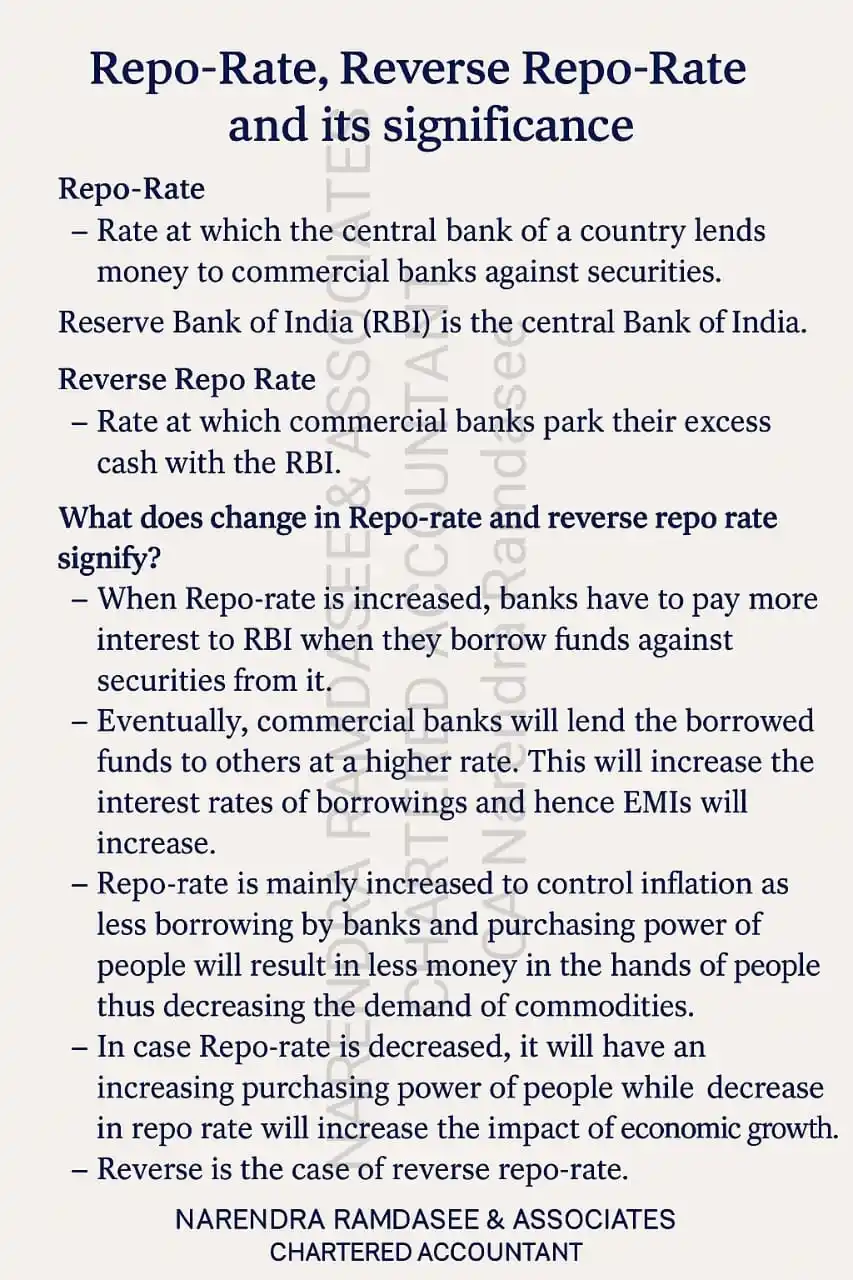

Repo Rate, Reverse Repo Rate & it's Significance

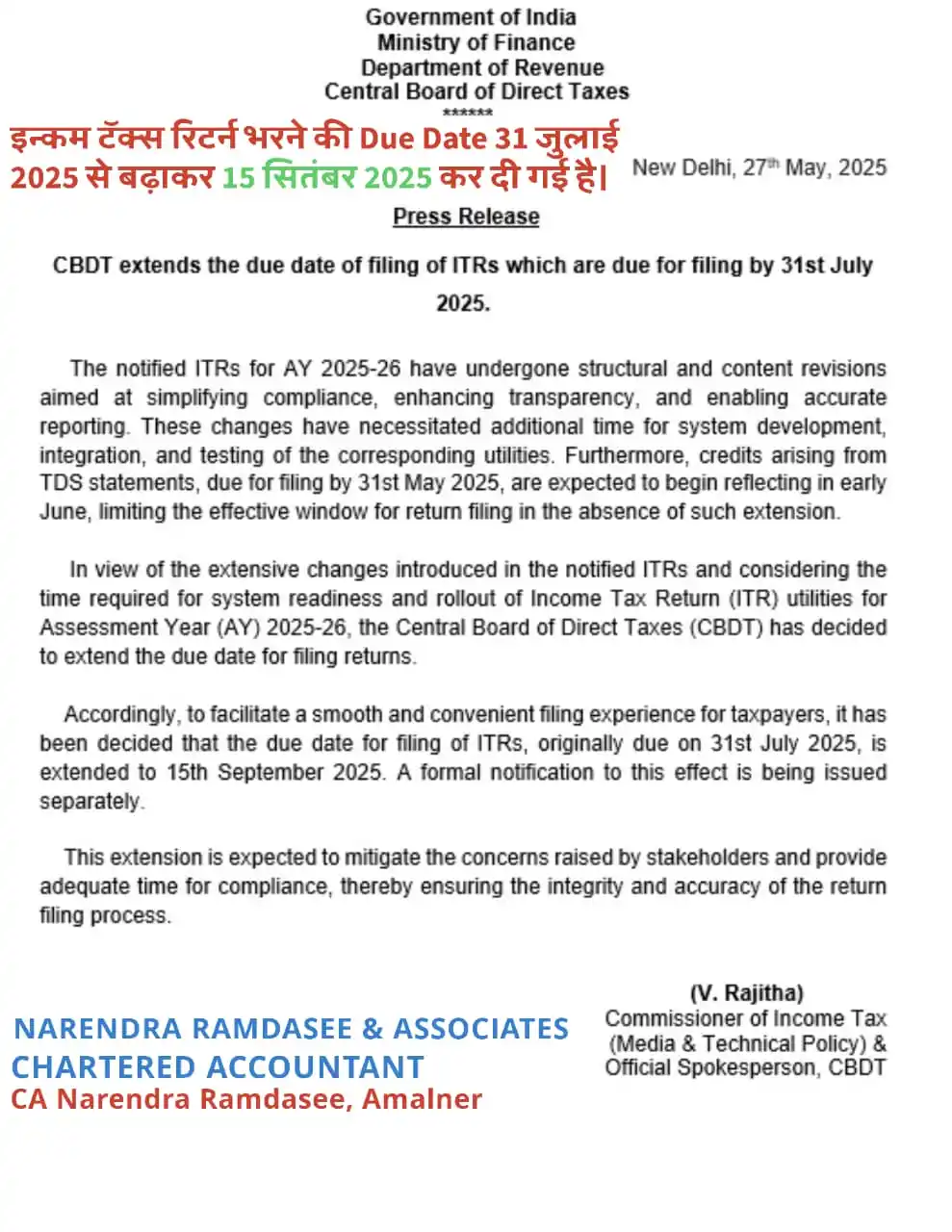

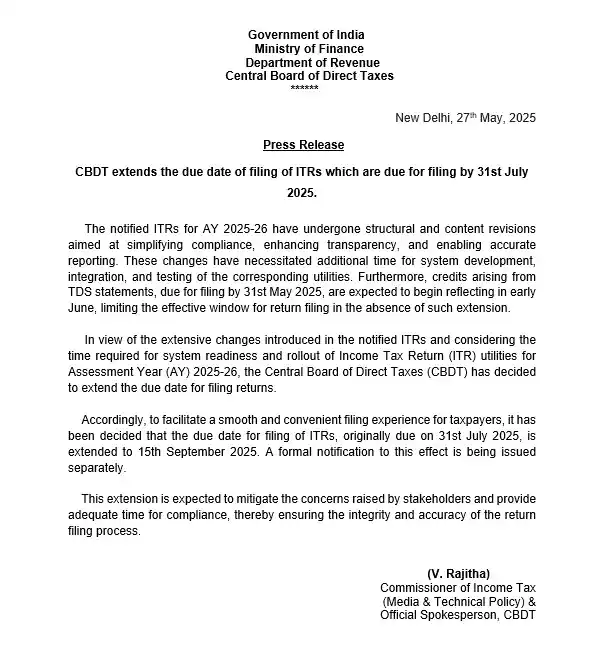

CBDT has extended the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025

Here is a breakdown of tax increases and decreases in the Budget 2025-26: 📉 Tax Decreases (Relief Measures) 1️⃣ Personal Income Tax Reduction ✅ New tax slabs for individuals (New Regime) No tax up to ₹12 lakh (₹12.75 lakh for salaried taxpayers after deductions). New Tax Slabs:₹0-4 lakh → 0% ₹4-8 lakh → 5% ₹8-12 lakh → 10% ₹12-16 lakh → 15% ₹16-20 lakh → 20% ₹20-24 lakh → 25% Above ₹24 lakh → 30% 📝 Impact: Significant tax savings for the middle class. ✅ TDS & TCS Reductions Section 194LBC (Income from securitization trust)Before: 25% (Individual/HUF) & 30% (Others) Now: Reduced to 10% Timber & Forest Produce TCS reduced from 2.5% to 2%. Liberalized Remittance Scheme (LRS) TCS on education loans removed. ✅ Corporate & Business Tax Benefits Presumptive Taxation for Electronics Manufacturing: A simplified tax regime introduced for foreign companies supporting electronics manufacturing. Tonnage Tax for Inland Vessels: Now available for inland ships, reducing their tax burden. Startups (Section 80-IAC):Tax benefits extended for startups incorporated before April 1, 2030. Investment Date Extension for Sovereign & Pension Funds: Extended to March 31, 2030 for investments in infrastructure. ✅ Customs Duty Reductions Leather Export Duty (Crust Leather - Hides & Skins) removed (was 20%). Lab-Grown Diamond Seed Imports: Import duty exemption continued. Export of Handicrafts: Duty-free export time increased from 6 months to 1 year. ✅ Crypto & Digital Asset Compliance Simplified Reporting for Virtual Digital Assets (VDA) (Crypto transactions) has been clarified to remove tax ambiguity. ✅ Charitable Trusts & Institutions Registration period extended from 5 years to 10 years for small charitable institutions, reducing compliance costs. 📈 Tax Increases (New Burdens) 1️⃣ Customs & Import Duty Increases ❌ Textile Sector Import duty on knitted fabrics increased to 20% or ₹115/kg, whichever is higher. ❌ Electronics & Consumer Goods Interactive Flat Panel Display import duty increased from 10% to 20%. Import Duty on High-End Watches & Luxury Goods Increased (exact percentage not specified in budget speech). ❌ Personal Use Imports (Luggage & Baggage) BCD (Basic Customs Duty) on baggage items remains high at 35%. 2️⃣ Capital Gains Tax & Securities Taxation ❌ Tax Parity for Non-Residents on Securities Transfer Non-residents will now be taxed at the same capital gains rate as residents, removing previous tax advantages. 3️⃣ Indirect Tax & Trade Restrictions ❌ Compliance Burden for Crypto Holders Mandatory reporting for crypto-asset transactions in certain cases. 📌 Key Takeaways ✅ Who Benefits from Tax Reductions? Middle-Class Earners: No tax up to ₹12 lakh. MSMEs & Startups: Lower tax on businesses & electronic manufacturers. Exporters: Lower duties on leather, lab-grown diamonds, and handicrafts. ❌ Who Faces Higher Taxes? Luxury Imports: Higher taxes on watches, electronics, and textiles. Non-Resident Investors: Equal capital gains tax treatment for foreign vs domestic investors. 📊More tax relief for individuals & businesses, but higher import duties on luxury goods & select electronics. Follow us @ramdasee

*87A Rebate Rs 60000 of income-tax is not available on tax on incomes chargeable at special rates (for e.g.: capital gains u/s 111A, 112 etc.)*