THE INVESTMENT BLUEPRINT 📊🌐

358 subscribers

About THE INVESTMENT BLUEPRINT 📊🌐

*This Channel is Created for educational purposes, Please don't consider any stock discussions as recommendations. Do your own analysis before Investing. None of the Admins are SEBI Registered Investment Advisors. Hence all views expressed here are personal and are only for educational purposes. Please consult your Investment advisor before Investing.*✅ *We Do Not Provide Any Call or Tips*📵❌ Join WhatsApp Community 📢🎯 https://chat.whatsapp.com/HzFPtAIZ18xBwgKvCr6vaE

Similar Channels

Swipe to see more

Posts

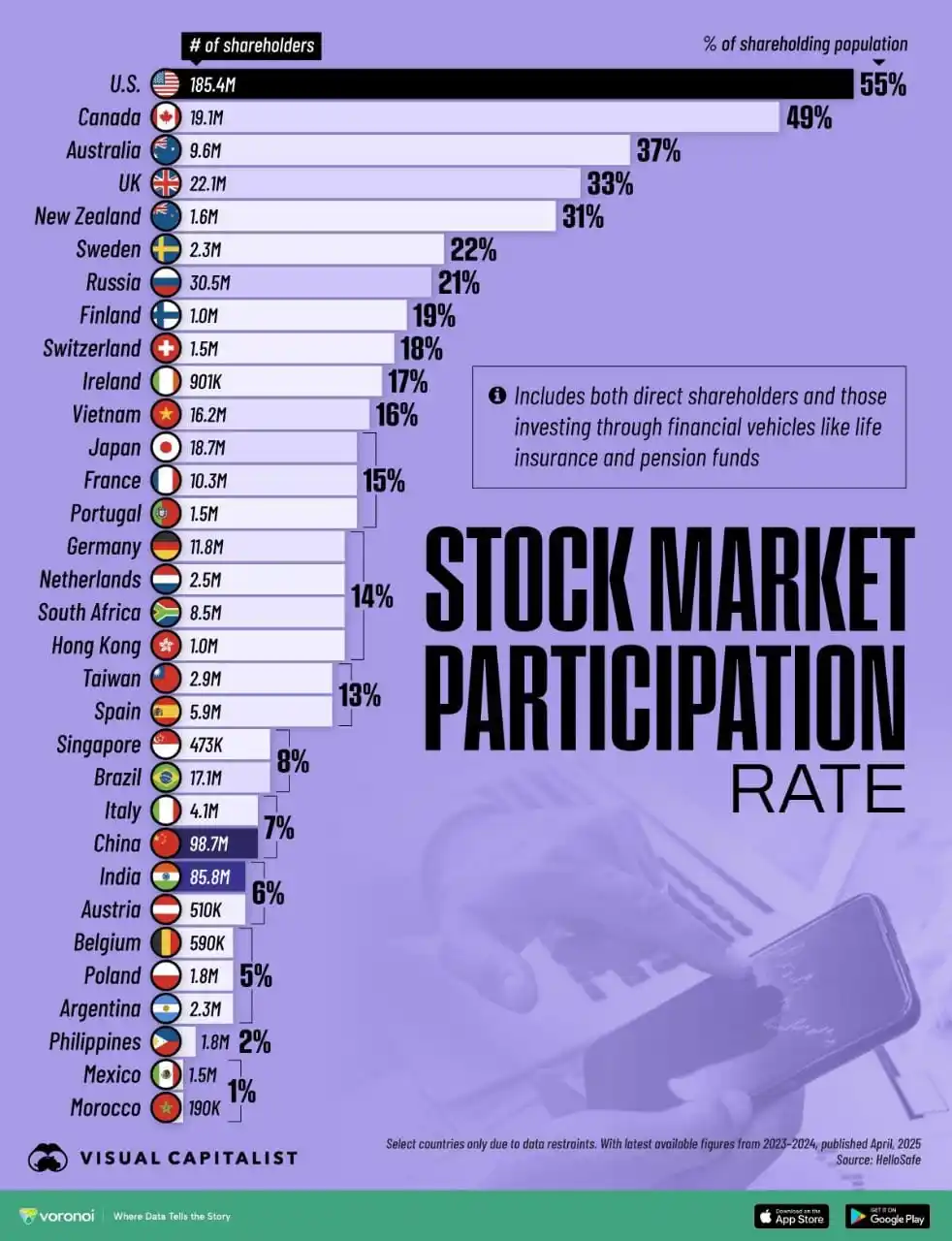

📊 India's stock market participation at 6% with 85.8M shareholders. With awareness & access increasing day by day, we are in for some tremendous growth here. Capital Market moved 12-15% on an average!😉📈 GenZ LIC main paisa nahi daalnewala, they will trade, invest, do SIP! People are moving away from FDs, less than 5% of household assets are in equities, imagine the growth here in next 10 yrs! #investing #india

*Protean eGov In Focus - Big negative.* 📉 Disclosed that it is no longer in contention for Government of India’s PAN 2.0 project It has been eliminated from the RFP race Government had plans to overhaul PAN/TAN services under PAN 2.0 with a Rs 1440 cr budget Despite earlier confidence, PROTEAN is now completely out of the running Equirus Says, This is a material negative, as PAN services contribute ~50% of the company’s revenue FY26 impact may be muted, expect a 75-100% collapse in this revenue stream over the next 2-3 years 35% decline in FY27 overall revenue Segment has historically generated free cash that funded new initiatives — now under threat Additional headwinds include an impending NPS pricing revision in FY27 and stagnant ONDC retail volumes Downgrade to Sell from Add; Cut TP to Rs 900 from Rs 1730.

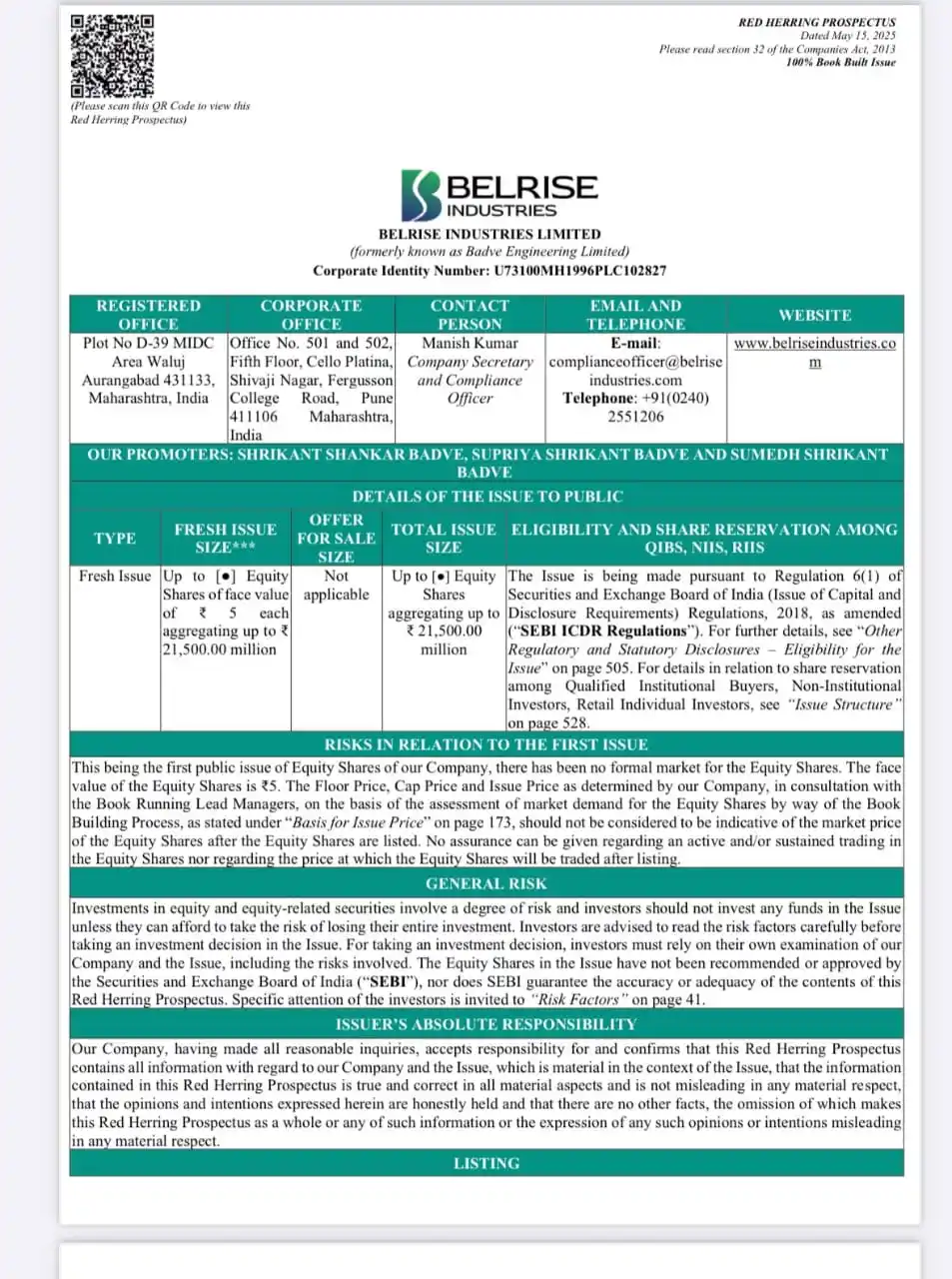

*New Mainboard IPO Alert: Belrise Industries Ltd (Formerly Badve Engineering)* 📊💰 *IPO Date:* May 21 – 23 *Issue Size:* ₹2,150 Cr (Full Fresh Issue) *Face Value:* ₹5 | Retail Quota: 35% *Lead Managers:* Axis Cap, HSBC, Jefferies, SBI Cap *Business Snapshot:* Belrise is a key automotive components manufacturer serving 2W, 3W, 4W, CVs & agri vehicles with safety-critical & polymer-based solutions. EV-ready + Entering solar panel component production in Q4 FY25. *Financials:* •FY23: Revenue ₹6,621 Cr | PAT ₹313.7 Cr •FY24: Revenue ₹7,557 Cr | PAT ₹323 Cr *Utilization of Funds:* •Debt repayment: ₹1,618 Cr (This improves financial leverage significantly.) *Product Segments:* 1.Automotive – 2W/3W: Sheet metal, braking, polymer parts, motors & chargers 2.Automotive – 4W: Suspension systems, sheet metal, polymer parts 3.Non-Auto: Refrigerator components *Clientele:* Bajaj Auto, Hero, TVS, M&M, Honda, Tata, TAFE, Ford, Fiat, Volkswagen, LG, Exide, Volvo, Hero Electric, and more. ⸻ *Verdict:* Belrise rides on a strong OEM client base, growing EV/solar exposure, and deleveraging plans. Watch for valuations, margins & peer comparison before applying.

*BIG ORDER WIN FOR SIEMENS* themetrorailguy.com/2025/05/18/dra…,(NHSRCL). *DRA Infracon – Siemens JV this Thursday was declared as the lowest bidder for the signalling and telecommunication (S&T) system contract of 508.17 km Mumbai – Ahmedabad High Speed Rail (MAHSR Bullet Train) project by India’s National High Speed Rail Corporation Ltd. (NHSRCL)* DRA – Siemens JV beat Alstom Transport – Larsen & Toubro JV for this long-delayed systems package with a scope that includes end to end design, installation and commissioning works for India’s first high speed rail line which will connect Mumbai and Ahmedabad through 12 stations at an estimated cost of Rs. 1.1 lakh crore (US $15 billion).

📊 *DLF:* Q4 CONS NET PROFIT 12.8B RUPEES VS 9.2B (YOY); EST 8.03B | 10.6B (QOQ) DLF: Q4 REVENUE 31.3B RUPEES VS 21.35B (YOY); EST 17.1B DLF: Q4 EBITDA 9.8B RUPEES VS 7.54B (YOY); EST 3.5B || Q4 EBITDA MARGIN 31.30% VS 35.32% (YOY); EST 21% DLF: CO RECOMMENDED DIVIDEND OF 6 RUPEES PER EQUITY SHARE

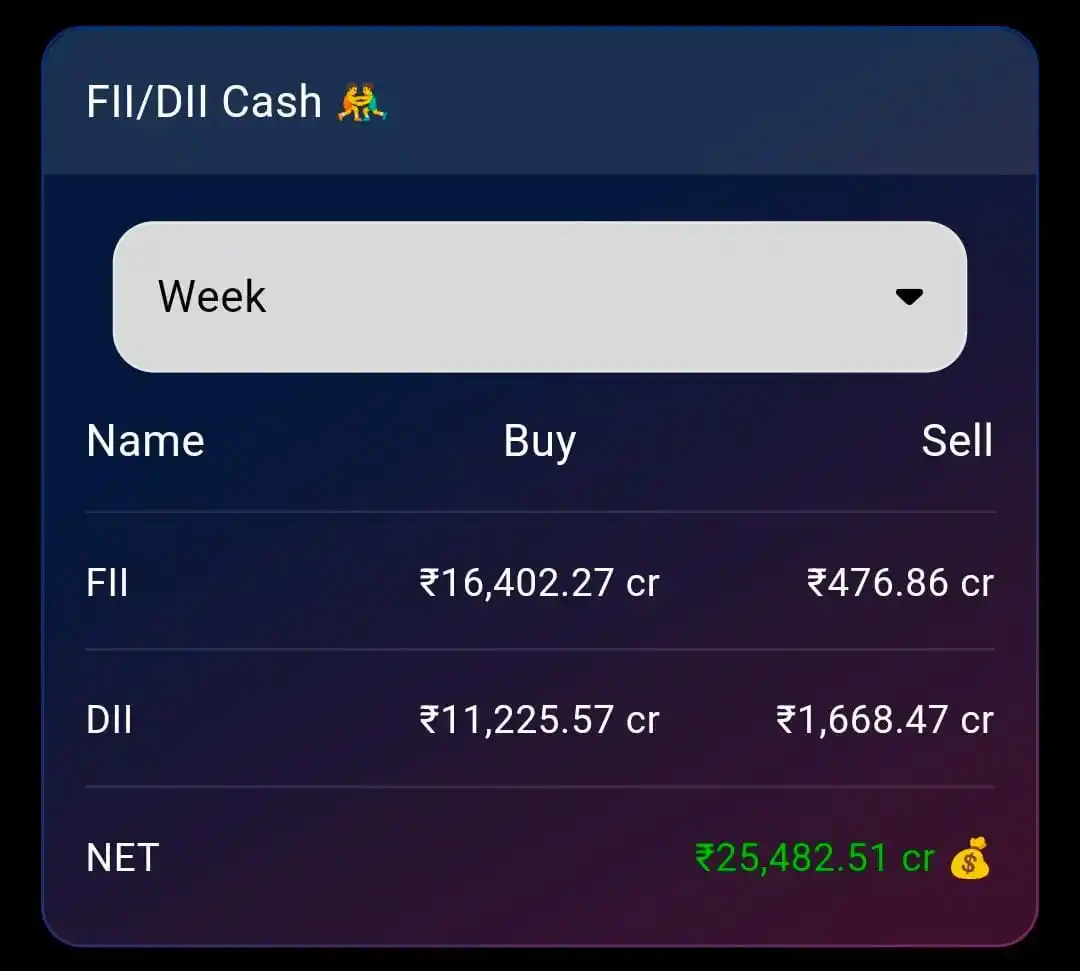

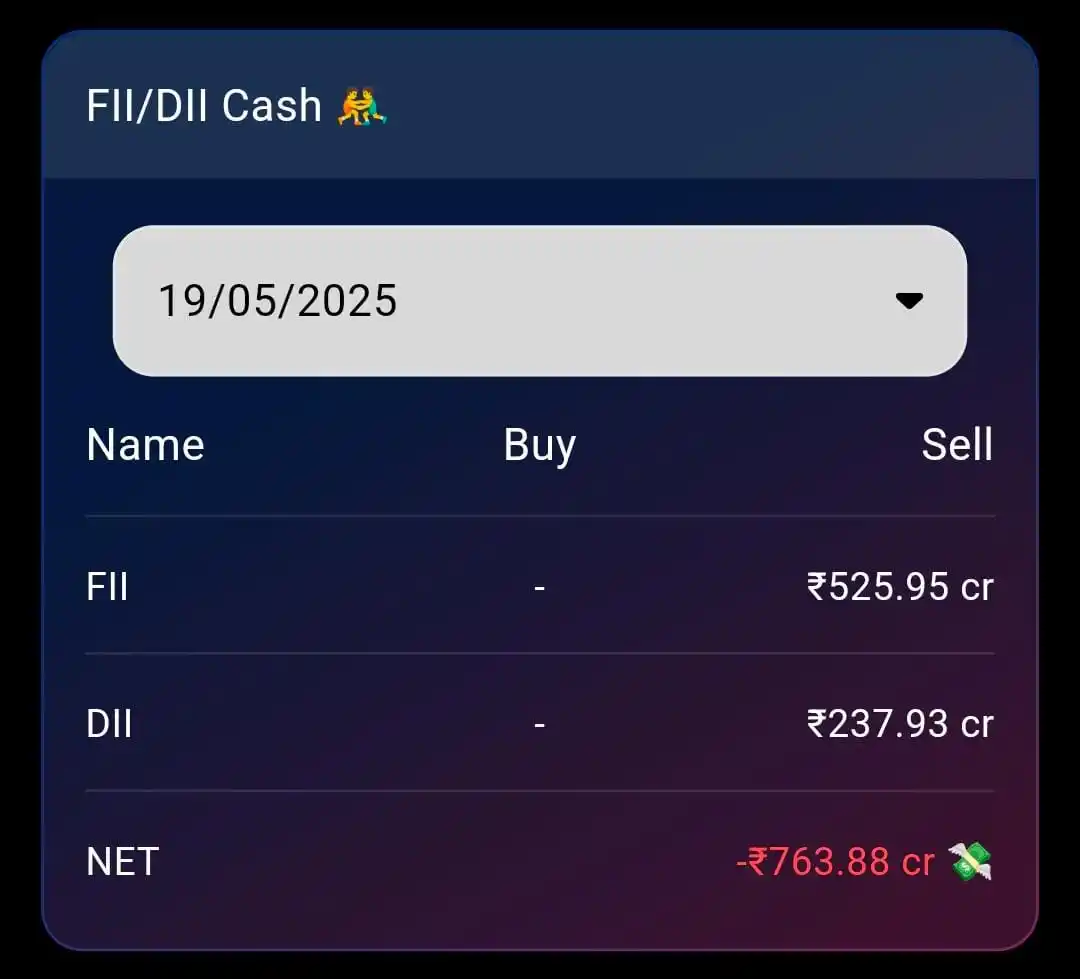

*Nifty 50 crossed the 25,000 mark for the first time since October 17, 2024, with 49 of the 50 Nifty constituents ending in the green.* Hero MotoCorp led the gains on the index, while Tata Motors jumped over 4%. Metal stocks continued their recent upward trend, with JSW Steel rising more than 4%. Realty stocks also saw strong momentum, with Macrotech Developers amongst the top gainers. *_Check out the top sectoral indices that drove today’s momentum_*📈

*New Mainboard IPO Alert: Belrise Industries Ltd (Formerly Badve Engineering)*📊