INVEST GURUKUL

299 subscribers

About INVEST GURUKUL

Hardcore Price Action Trader | Swing Trader | F&O Trader | SEBI-UNREGISTERED | Risk Management is the Key 🗝️ to remain unbeaten in Long term | Don't Take Losses to your Heart & Wins to Your Head | Trade like Monk.(9130425128) Social Media Platforms Instagram https://www.instagram.com/investgurukul/profilecard/?igsh=ZHg4dTh6Z2JlZDkx WhatsApp https://whatsapp.com/channel/0029VakAfzpAYlUReHLGVd3d Telegram https://t.me/ChartistArena X(Twitter) https://x.com/PRAMODT03258494?t=YTwXT_VdzC49Y2dXOP4fsQ&s=09 YouTube https://youtube.com/@investgurukul?si=-3f3l4lqfLAmu0Gr

Similar Channels

Swipe to see more

Posts

*Fund Houses Recommendations* Jefferies on *Indian Hotels:* Maintain Buy on Company, target price at Rs 980/Sh (Positive) Jefferies on *HDFC Bank:* Maintain Buy on Bank, target price at Rs 2380/Sh (Positive) Jefferies on *Indigo:* Maintain Buy on Company, target price at Rs 6300/Sh (Positive) Jefferies on *Max Fin:* Maintain Buy on Company, raise target price at Rs 1830/Sh (Positive) Macquarie on *Persistent:* Maintain Outperform on Company, target price at Rs 7330/Sh (Positive) Jefferies on *GMR Airport:* Maintain Buy on Company, target price at Rs 100/Sh (Positive) Jefferies on *Ambuja:* Maintain Buy on Company, target price at Rs 700/Sh (Positive) Antique on *HDFC Life:* Management reiterated their aspiration to grow APE ahead of industry average and double VNB every 4-4.5 years (Neutral) UBS on *Sun Pharma:* Maintain Buy on Company, target price at Rs 2450/Sh (Neutral) JP Morgan on *HDFC AMC:* Downgrade to Neutral on Company, target price at Rs 5000/Sh (Neutral) Jefferies on *BSE:* Maintain Hold on Company, raise target price at Rs 2900/Sh (Neutral) Jefferies on *HDFC Bank:* Maintain Buy on Bank, target price at Rs 2200/Sh (Positive) Jefferies on *Sai Life:* Maintain Hold on Company, target price at Rs 800/Sh (Neutral) Kotak on *NMDC:* Maintain Sell on Company, target price at Rs 55/Sh (Negative) Citi on *NMDC:* Maintain Sell on Company, target price at Rs 60/Sh (Negative) Citi on *Indusind Bank:* Maintain Sell on Bank, target price at Rs 700/Sh (Negative) https://t.me/ChartistArena

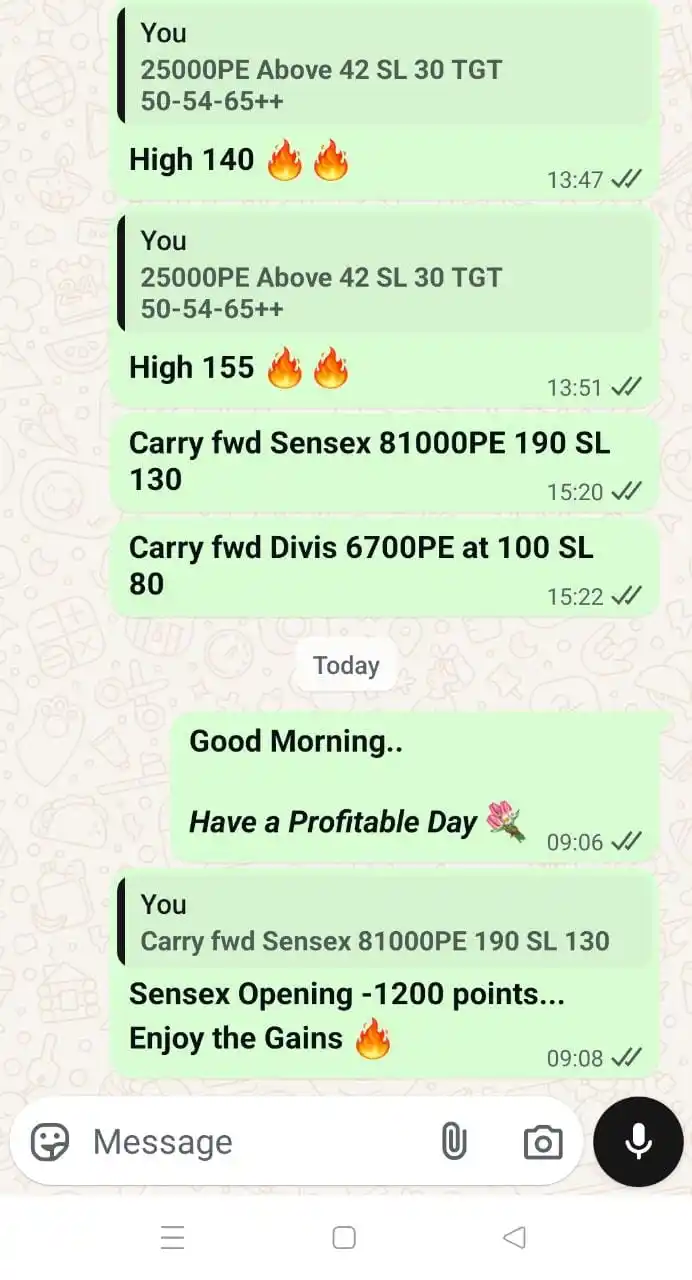

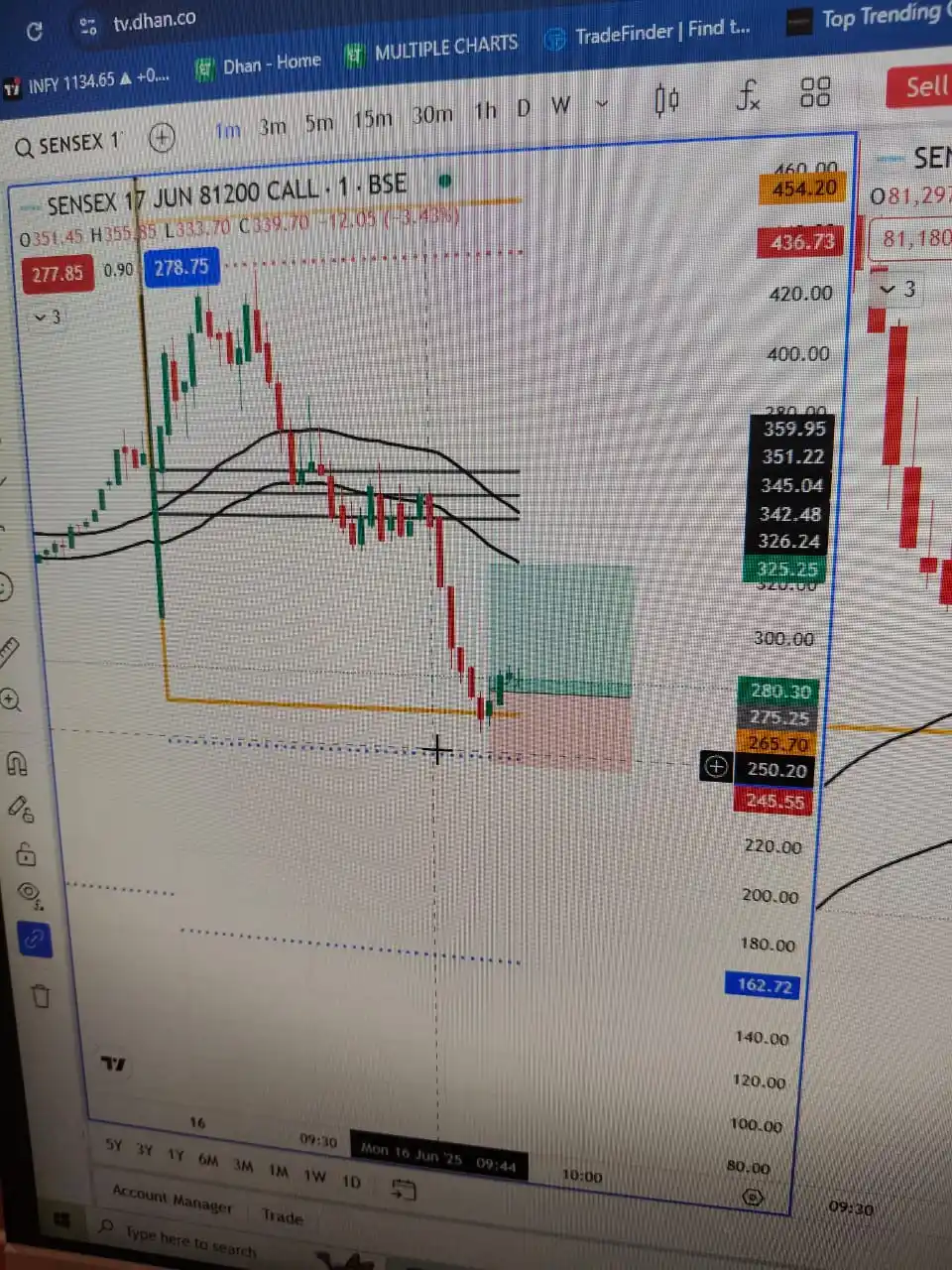

_*High 397 from 275*_ 🔥🔥 *#Sensex 81200CE Above 275 SL 245* *TGT 300✅ - 330++✅*

*`Most traders are looking for control in a game built on uncertainty.`* *"But control is an illusion."* *`The real edge is learning how to be in uncertainty without falling apart.`* _*#Psychology*_