INVESTOR VIVEK BHARNUKE

99 subscribers

About INVESTOR VIVEK BHARNUKE

Disclaimer: 🔸I Share My Opinion Only For knowledge . It Can Be differentiable. 🔸I'm Not Sebi Registered. 🔸This Channel Is For Knowledge Purpose Only. 🔸Only analysis and knowledge. 🔸Kindly Contact Your Financial Adviser Before Taking Any Trade.

Similar Channels

Swipe to see more

Posts

Borana Weaves IPO listed at INR 243 Sidha book karo😂

Borana Weaves IPO Square Off Process (Post-Listing) Step 1: Check Listing Price (from 9:45 AM to 10:00 AM) • Open your trading app (e.g., Zerodha, Angel One, Upstox, Groww, etc.) • Go to Market Watch and search “Borana Weaves” • See the live listing price and chart movement. ⸻ Step 2: Monitor Initial Volatility (10:00 AM to 10:15 AM) • Stocks can be highly volatile just after listing. • Wait 5–15 minutes to avoid panic selling. • Check if the price sustains above GMP (around ₹280–₹290). ⸻ Step 3: Place Sell Order Once you’re ready to square off: 1. Go to your Holdings/Portfolio 2. Tap on “Borana Weaves” 3. Click on SELL 4. Enter Quantity (generally 1 lot = number of shares allotted) 5. Select “Limit Order” if you want a specific price • Or use “Market Order” to sell instantly 6. Confirm & Execute Order ⸻ Step 4: Check Order Status • Go to “Order Book” • Make sure the order is executed • Funds will be added to your trading account by end of the day ⸻ Tips: • Don’t panic sell in the first 1–2 minutes • If stock is moving higher, trail with SL (Stop Loss) • Avoid greed; stick to your plan of exiting on listing day

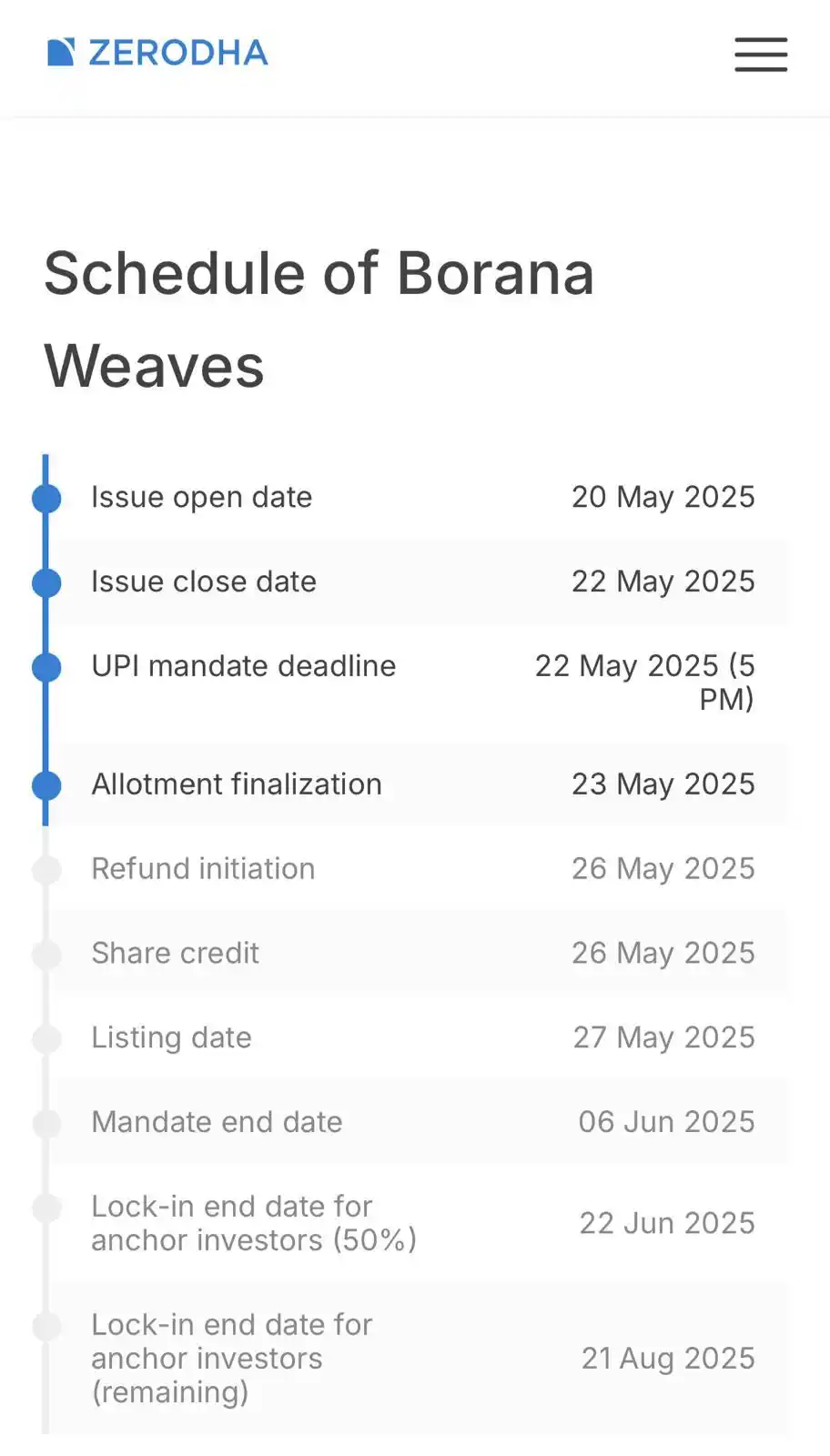

https://ipostatus.kfintech.com/ Borana Weaves IPO Allotment status is available on Registrar's website

🚨 Important Update for My Students & Followers 🚨 As many of you know, I have been actively sharing live market analysis, charts, and buy/sell insights with my group. However, due to SEBI’s new regulations on financial influencers, I will no longer be able to provide real-time stock market updates or trading instructions. 🔹 SEBI’s new rules state that stock market educators cannot use live stock prices or mention any stock names based on data from the past 3 months. 🔹 This means I can no longer share live charts, stock names, or buy/sell calls as I used to. 🔹 From today onwards, there will be no live updates from me. 🔹 My focus will now shift towards pure educational content that aligns with SEBI’s guidelines. I appreciate your support and understanding in this transition. My goal remains the same—to help you learn and grow in the stock market the right way! 📈 Stay tuned for more updates! 🚀 #SEBI #StockMarketEducation #TradingRules

I have been admitted to the hospital for the past two days, so I haven’t been able to monitor my trading setup. I will also be unavailable for the next two days. All classes and one-on-one lectures will remain canceled. If I feel better, I might conduct a lecture on Sunday.