Taxation_Update

85 subscribers

About Taxation_Update

Income Tax & GST Related Information

Similar Channels

Swipe to see more

Posts

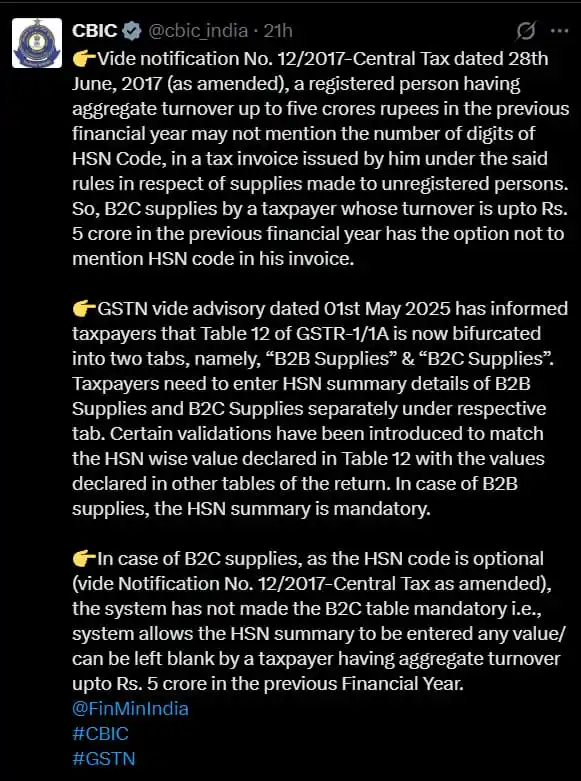

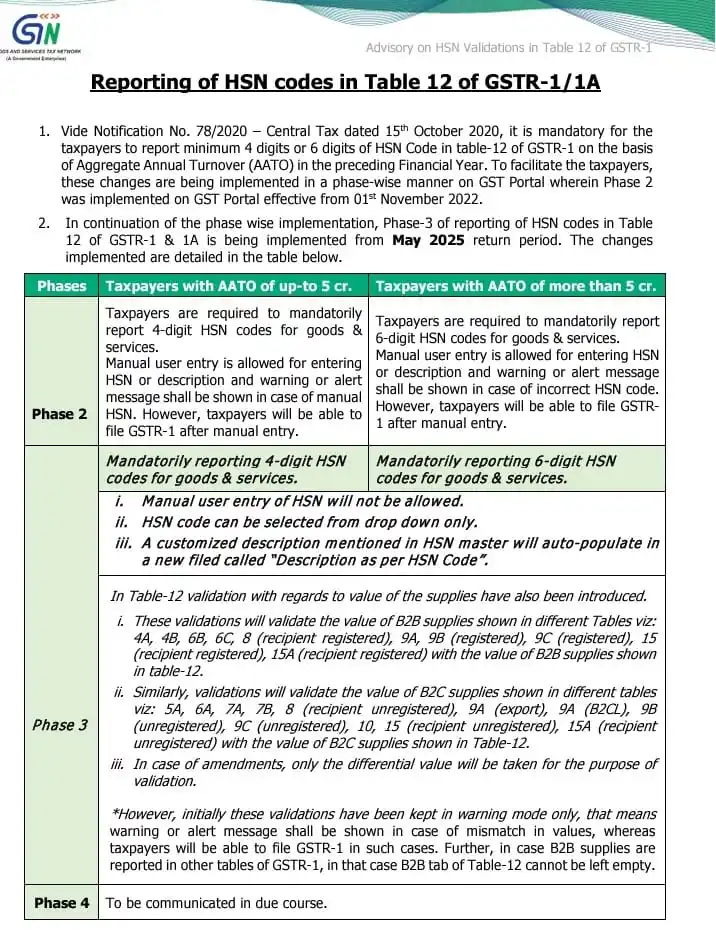

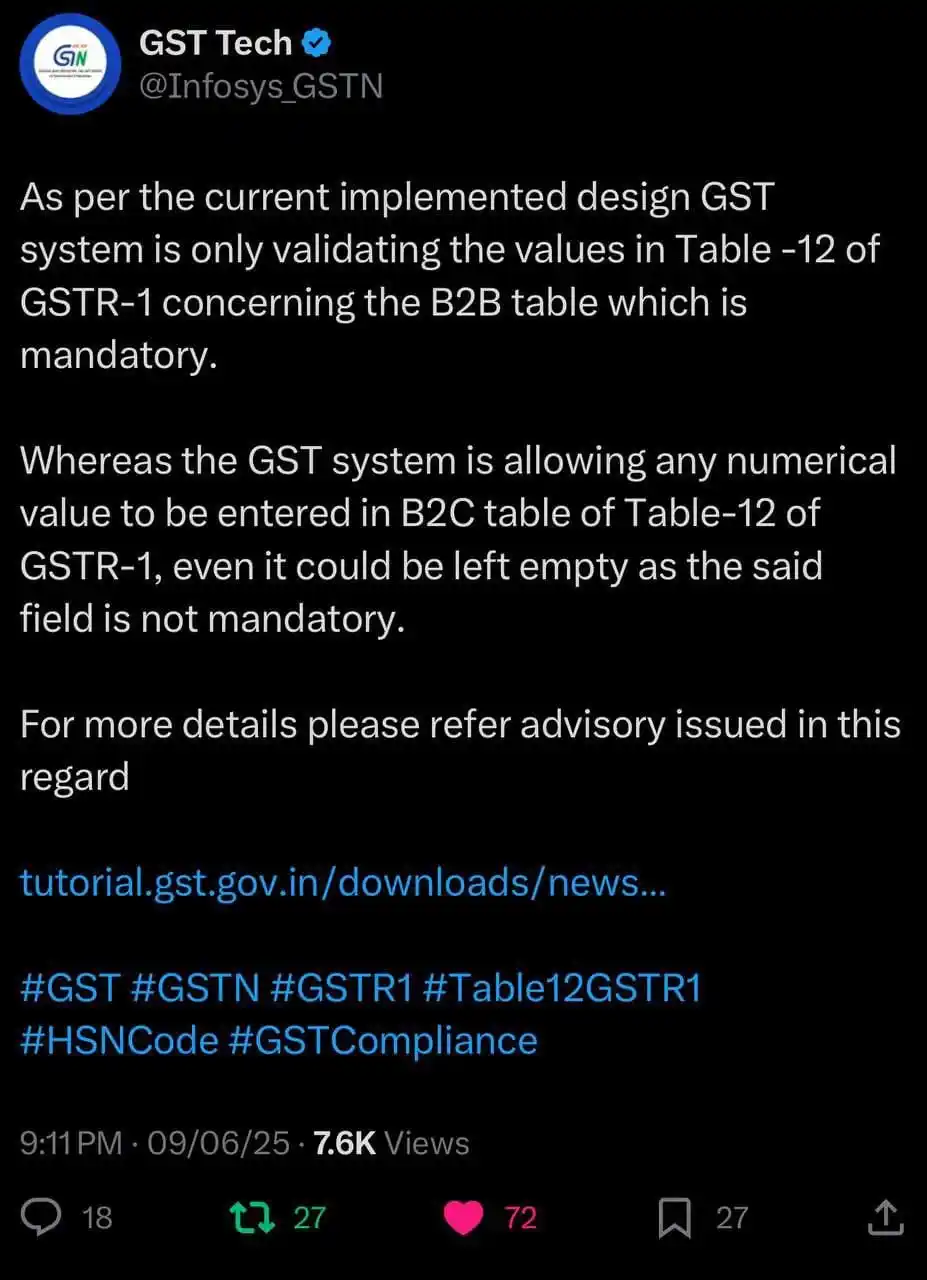

CBIC Clarifies HSN Code Rule: Mandatory for B2B, Optional for B2C Below Rs 5 Crore Turnover! #GST

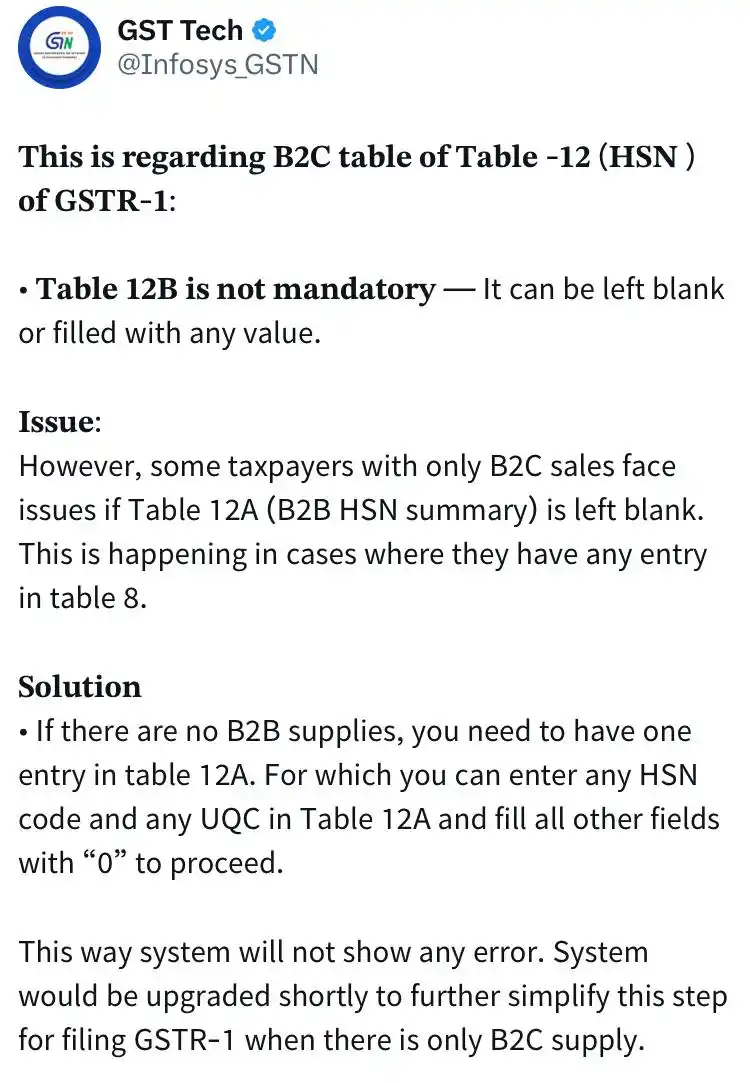

𝐓𝐡𝐢𝐬 𝐢𝐬 𝐫𝐞𝐠𝐚𝐫𝐝𝐢𝐧𝐠 𝐁𝟐𝐂 𝐭𝐚𝐛𝐥𝐞 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞 -𝟏𝟐 (𝐇𝐒𝐍 ) 𝐨𝐟 𝐆𝐒𝐓𝐑-𝟏: • 𝐓𝐚𝐛𝐥𝐞 𝟏𝟐𝐁 𝐢𝐬 𝐧𝐨𝐭 𝐦𝐚𝐧𝐝𝐚𝐭𝐨𝐫𝐲 — 𝖨𝗍 𝖼𝖺𝗇 𝖻𝖾 𝗅𝖾𝖿𝗍 𝖻𝗅𝖺𝗇𝗄 𝗈𝗋 𝖿𝗂𝗅𝗅𝖾𝖽 𝗐𝗂𝗍𝗁 𝖺𝗇𝗒 𝗏𝖺𝗅𝗎𝖾. 𝐈𝐬𝐬𝐮𝐞: 𝖧𝗈𝗐𝖾𝗏𝖾𝗋, 𝗌𝗈𝗆𝖾 𝗍𝖺𝗑𝗉𝖺𝗒𝖾𝗋𝗌 𝗐𝗂𝗍𝗁 𝗈𝗇𝗅𝗒 𝖡𝟤𝖢 𝗌𝖺𝗅𝖾𝗌 𝖿𝖺𝖼𝖾 𝗂𝗌𝗌𝗎𝖾𝗌 𝗂𝖿 𝖳𝖺𝖻𝗅𝖾 𝟣𝟤𝖠 (𝖡𝟤𝖡 𝖧𝖲𝖭 𝗌𝗎𝗆𝗆𝖺𝗋𝗒) 𝗂𝗌 𝗅𝖾𝖿𝗍 𝖻𝗅𝖺𝗇𝗄. 𝖳𝗁𝗂𝗌 𝗂𝗌 𝗁𝖺𝗉𝗉𝖾𝗇𝗂𝗇𝗀 𝗂𝗇 𝖼𝖺𝗌𝖾𝗌 𝗐𝗁𝖾𝗋𝖾 𝗍𝗁𝖾𝗒 𝗁𝖺𝗏𝖾 𝖺𝗇𝗒 𝖾𝗇𝗍𝗋𝗒 𝗂𝗇 𝗍𝖺𝖻𝗅𝖾 𝟪. 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧 • 𝖨𝖿 𝗍𝗁𝖾𝗋𝖾 𝖺𝗋𝖾 𝗇𝗈 𝖡𝟤𝖡 𝗌𝗎𝗉𝗉𝗅𝗂𝖾𝗌, 𝗒𝗈𝗎 𝗇𝖾𝖾𝖽 𝗍𝗈 𝗁𝖺𝗏𝖾 𝗈𝗇𝖾 𝖾𝗇𝗍𝗋𝗒 𝗂𝗇 𝗍𝖺𝖻𝗅𝖾 𝟣𝟤𝖠. 𝖥𝗈𝗋 𝗐𝗁𝗂𝖼𝗁 𝗒𝗈𝗎 𝖼𝖺𝗇 𝖾𝗇𝗍𝖾𝗋 𝖺𝗇𝗒 𝖧𝖲𝖭 𝖼𝗈𝖽𝖾 𝖺𝗇𝖽 𝖺𝗇𝗒 𝖴𝖰𝖢 𝗂𝗇 𝖳𝖺𝖻𝗅𝖾 𝟣𝟤𝖠 𝖺𝗇𝖽 𝖿𝗂𝗅𝗅 𝖺𝗅𝗅 𝗈𝗍𝗁𝖾𝗋 𝖿𝗂𝖾𝗅𝖽𝗌 𝗐𝗂𝗍𝗁 “𝟢” 𝗍𝗈 𝗉𝗋𝗈𝖼𝖾𝖾𝖽. 𝖳𝗁𝗂𝗌 𝗐𝖺𝗒 𝗌𝗒𝗌𝗍𝖾𝗆 𝗐𝗂𝗅𝗅 𝗇𝗈𝗍 𝗌𝗁𝗈𝗐 𝖺𝗇𝗒 𝖾𝗋𝗋𝗈𝗋. 𝖲𝗒𝗌𝗍𝖾𝗆 𝗐𝗈𝗎𝗅𝖽 𝖻𝖾 𝗎𝗉𝗀𝗋𝖺𝖽𝖾𝖽 𝗌𝗁𝗈𝗋𝗍𝗅𝗒 𝗍𝗈 𝖿𝗎𝗋𝗍𝗁𝖾𝗋 𝗌𝗂𝗆𝗉𝗅𝗂𝖿𝗒 𝗍𝗁𝗂𝗌 𝗌𝗍𝖾𝗉 𝖿𝗈𝗋 𝖿𝗂𝗅𝗂𝗇𝗀 𝖦𝖲𝖳𝖱-𝟣 𝗐𝗁𝖾𝗇 𝗍𝗁𝖾𝗋𝖾 𝗂𝗌 𝗈𝗇𝗅𝗒 𝖡𝟤𝖢 𝗌𝗎𝗉𝗉𝗅𝗒.

Two separate plane crashes, one in 1998 involving a Thai singer and the Air India Flight 171 crash on June 12, 2025, each had a lone survivor seated in 11A, creating a chilling coincidence.

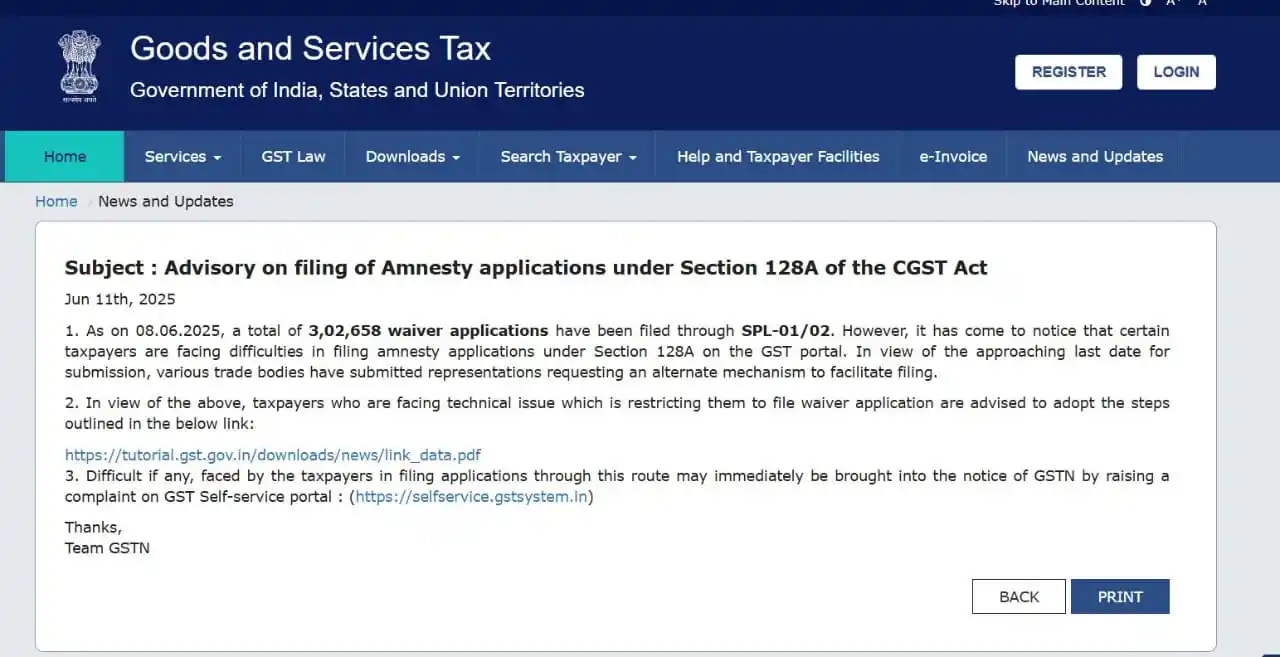

3 lakh+ GST Amnesty applications filed under Sec 128A – but portal issues still hit many. 🔹 As of 8 June 2025, over 3,02,658 GST Amnesty waiver forms filed via SPL-01/02. 🔹 Facing portal glitches? GSTN has issued an advisory + alternate filing link. 🔹 Don’t wait till the last minute — tech issues won’t extend deadlines.

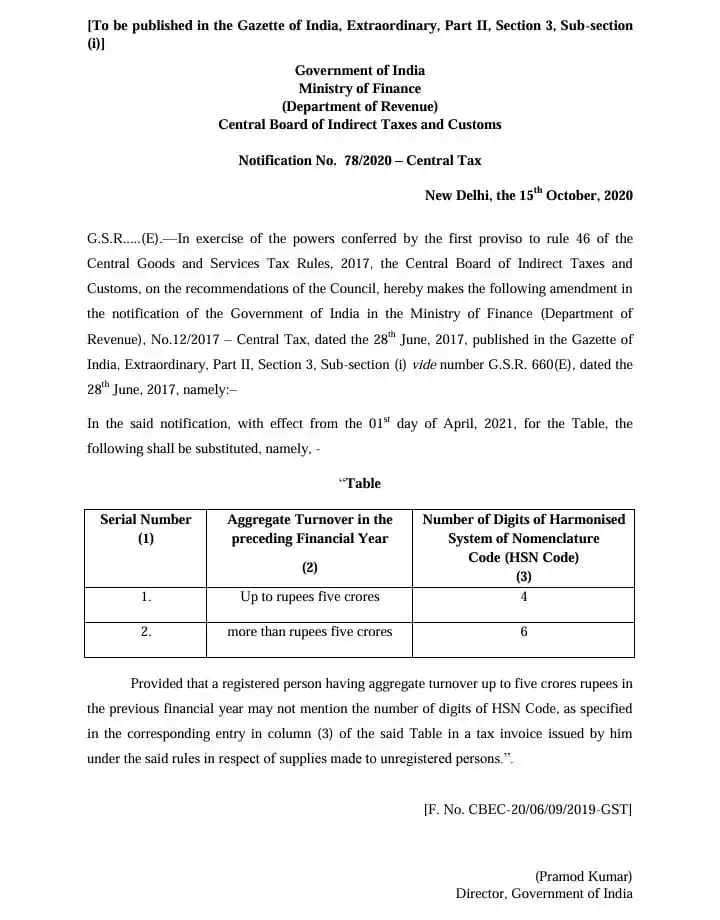

Notification 78/2020 makes B2C HSN optional for Taxpayers having T/O upto 5 crores. GSTN advisory dated 01.05.2025 mandates B2C HSN for everyone.

The Ministry of Finance Clarification Regarding UPI payment transaction Charge Will Charge By MDR NO charged By MDR any of Digital Transction Through UPI

चाहे आपकी turnover unregister क्यों ना हो पर फिर भी आपको B2B SUMMARY भरनी mandatory है चाहे आप ब्लैंक ही क्यों ना भरे

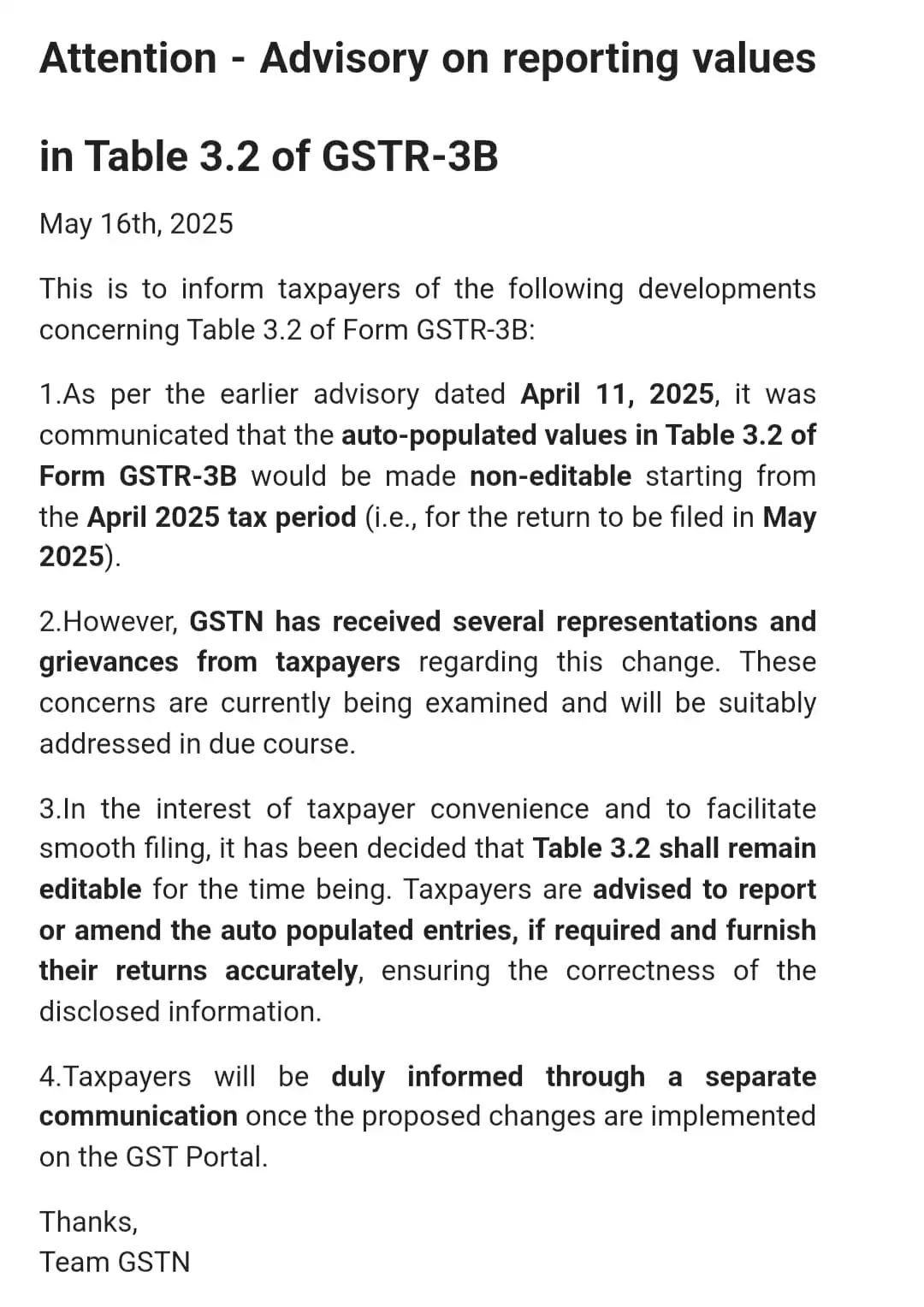

Advisory on reporting value in Table 3.2 of GSTR-3B

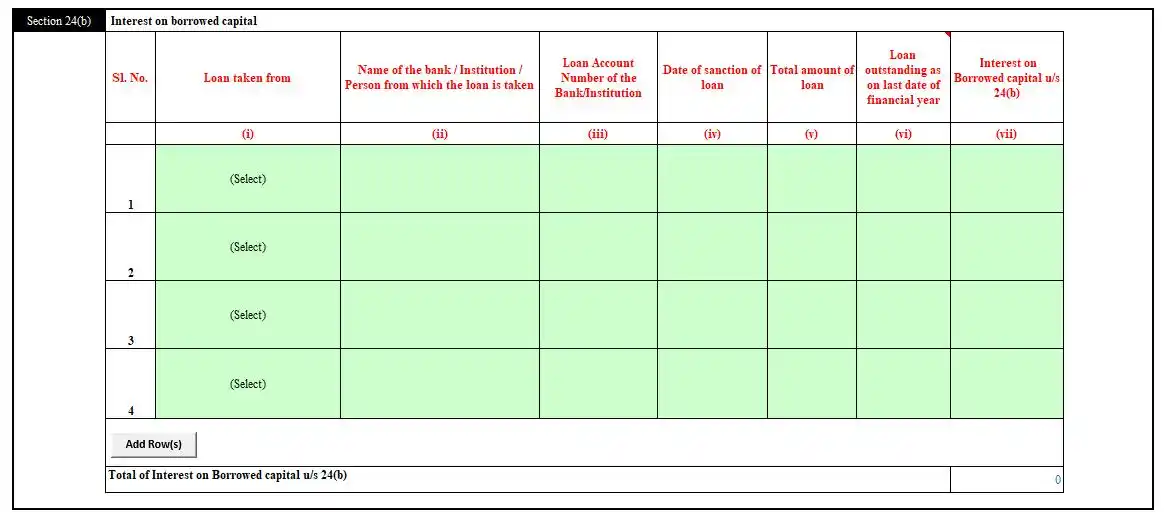

New change in section 24(b) interest on borrowed capital Following details required to claim deduction for Interest on borrowed capital u/s 24(b) New Schedule "Schedule 24(b) inserted in ITR forms