Findependent - Be Financially Independent

52 subscribers

About Findependent - Be Financially Independent

**************************** Update: 👋 We are a NISM Certified Research Analyst now. Next Step: 📈 To become SEBI registered **************************** Money grows on the Tree 🌳 Yes, that's true! But as with the tree, you need to be patient, disciplined, and consistent with your money. Findependent assists you in your financial journey to help you grow the money tree that will keep you Financially Independent for your lifetime. The aim is to become Findependent (Financially Independent) by: 1. Continuously Learning (because knowledge removes fear) 📚 2. Using Time Wisely ⏰ 3. Being Disciplined 🚦 4. Staying Patient 🧘♀️ 5. Maximizing Savings 💰 Let's learn and grow our money tree and help others grow theirs. Let's become a Findependent 💪😎 Disclaimer: 1. Please stay away if you are looking for "get rich overnight" schemes. This is not the place for you. 2. The suggestions and research ideas posted on this channel may not ensure guaranteed returns. Please note that only you are responsible for your actions. So act diligently. 3. The trading strategies or investment options discussed here may not be suitable for all. Please analyse your situation first and then make a decision. PS: The content on this channel will be 100% free, forever! - Team Findependent 🤞🏼 [email protected]

Similar Channels

Swipe to see more

Posts

In which asset class you have the majority of your investments?

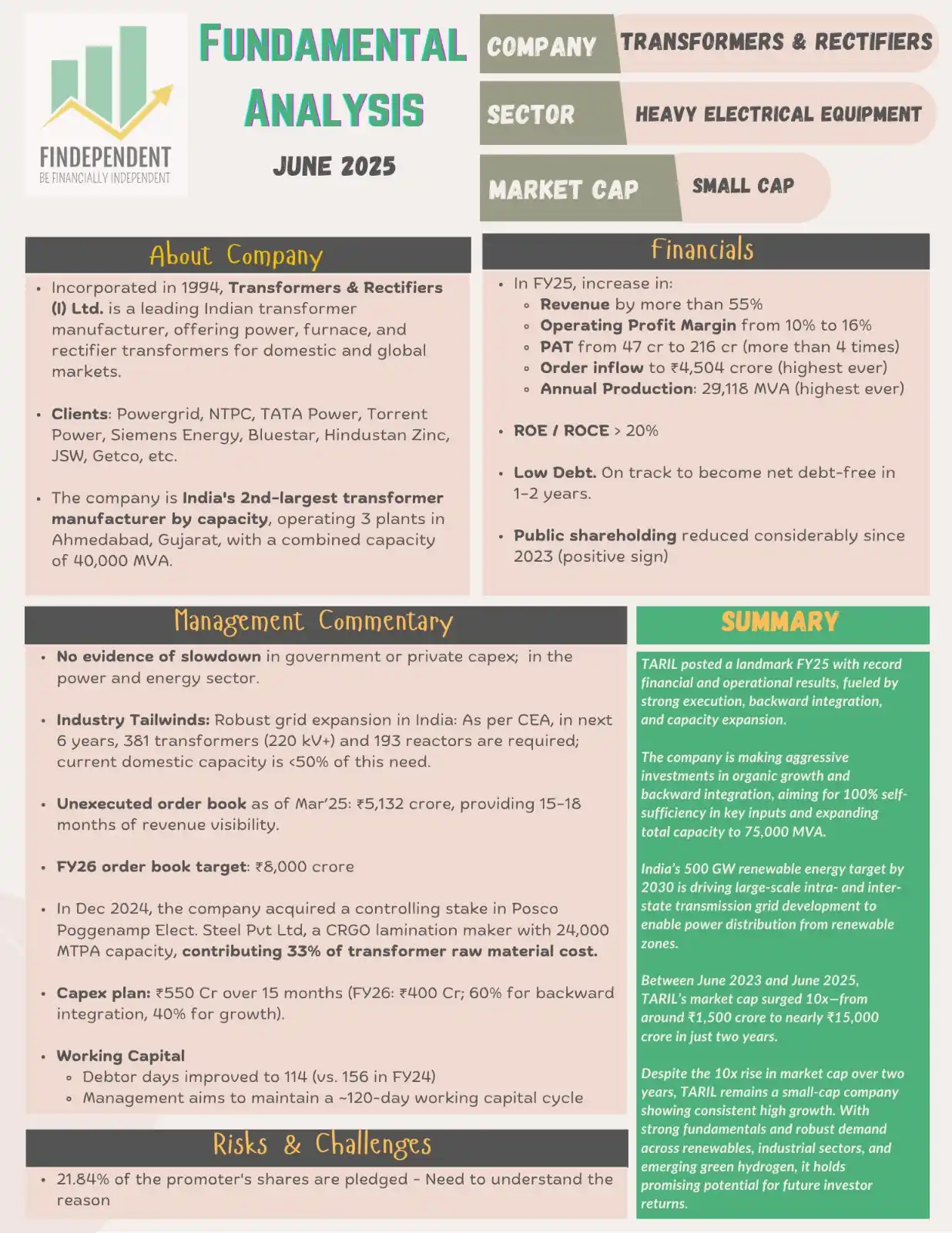

👆 *High Level Fundamental Study of TARIL (Small Cap Company)* 👆 *Disclaimer* : - This is not a BUY/SELL recommendation - The fundamental analysis provided above is a high-level overview intended for educational purposes only - To make any informed investment decision, a more detailed analysis is required—this includes reviewing annual reports, assessing management behaviour, evaluating risks and opportunities, understanding expansion strategies, and more - In addition to fundamental analysis, technical setup study and valuation analysis must also be done to build conviction -- _Findependent : Be Financially Independent_ 💪🤓

*High risk doesn’t promise high return — it just opens the door to more extreme outcomes.*

- _DLF sells ₹11,000 crore worth of luxury flats in a week, meeting 50% of annual sales targets._ - _Vedanta Chairman Anil Agarwal has launched the 'Vedanta 2.0' roadmap to position the company as a global leader in transition metals and energy, backed by a record year, strong cost leadership, and a nearly complete demerger._ - _Tata Elxsi has partnered with Infineon Technologies to develop ready-to-deploy EV solutions across 2W, 3W, PV, and CV segments for the Indian market._ - _Reliance Infra's subsidiary Reliance Aerostructure has partnered with Dassault Aviation to build Falcon 2000 business jets in India. This is the first time these jets will be manufactured outside of France_ -- *Findependent: Be Financially Independent* 💪🏼🤓

💡 *Investing Wisdom & Life Lessons*💡 #WeekendWisdomDose💪🏼🤓 https://youtu.be/Uk2c3-w8PL0?si=weTjE2XVpuguBRko

💡 *Key characteristics of a High Quality Business* 👆🏼

_Knowing yourself is the key to success in:_ - Personal Life - Professional Life - Investing _How to know yourself?_ - Spend time alone (without any gadgets) in nature - Meditate for at least 20-30 minutes daily - Read spiritual (Bhagvat Gita) and other non fictional books _This will help you stay calm in difficult situations and will assist you in taking better decisions in all aspects of life. 😊_ -- *Findependent: Be Financially Independent* 💪🏼🤓

*Drone Companies in Focus* Drone makers have caught the fancy of Dalal Street punters, spurred by the extensive use of these aerial systems in the recent India-Pakistan conflict. Shares of companies that make drones, such as *Hindustan Aeronautics, Bharat Electronics, Paras Defence and Space Technologies, Ideaforge Technology and Zen Technologies,* have jumped as much as 50% since May 7 - the day India launched its military response, dubbed Operation Sindoor, in response to a terrorist attack at Pahalgam on April 22.