Ritesh Jain- Pinetree | NRIZEN

3.0K subscribers

About Ritesh Jain- Pinetree | NRIZEN

Pinetree Macro- Just as pine trees retain their foliage through all seasons, an efficient portfolio stays resilient in market volatility, safeguards capital, and adeptly navigates global asset allocations without erosion. Nrizen- Investing Solutions for NRIs. Like Zen, which brings inner peace and self-awareness, financial stability is about achieving long-term assurance and confidence in your goals. Let us guide you to your financial 'nirvana.

Similar Channels

Swipe to see more

Posts

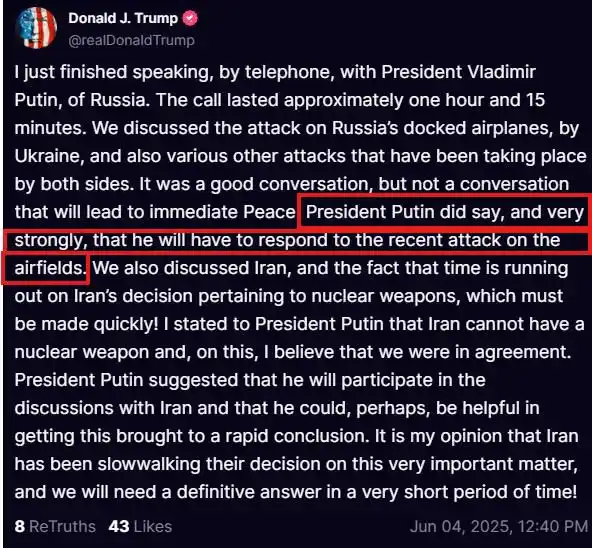

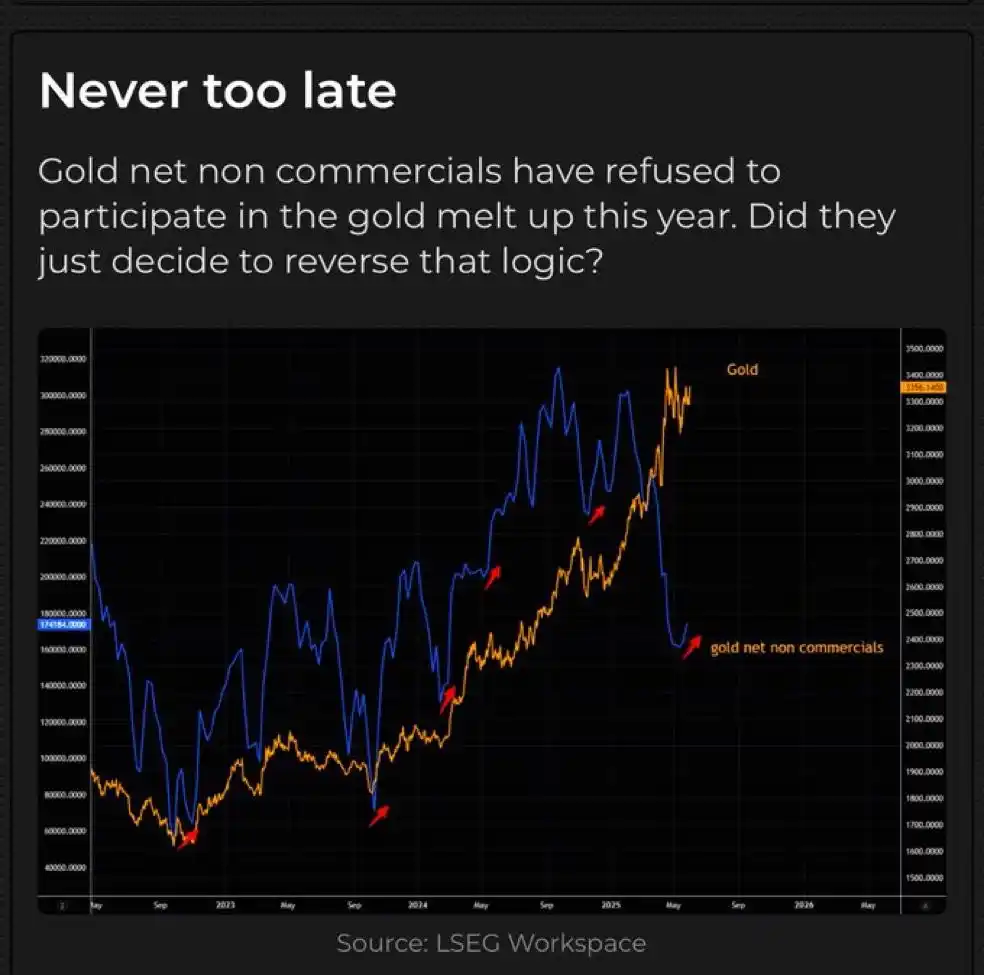

Nobody has participated in this rally

Our Monthly Global Macro Indicators are out for May * BOFA MOVE Index falls below 100 for the first time in 3 months—signaling relief in fixed income markets. * Japan’s 10Y yield is quietly rising, hinting at capital returning home as Japan exits ultra-loose policy. * Oil’s decline below $70 adds a deflationary tilt to the macro mix. https://open.substack.com/pub/pinetreemacroresearch/p/global-macro-indicators-may-25?r=1ci9u&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

Every student which wants to study in 5 eyes country would know 👇👇👇name. You might not know but they are also the co- owner of “IELTS” brand. As per press release “IDP Education, a key player in international student placements and language testing, is preparing for a tough fiscal 2025, with forecasts indicating a 30% drop in student placements and a 20% decrease in testing volumes. Shifts in policies across major countries have complicated enrollment and conversion processes, affecting the company's financial predictions.” My 2 cents The second derivative impact as per my understanding Indian student have an annual overseas study spending of $60-$70 billion in 2025…. This should be cut by half. India could save close to $30 billion annually and this lead to current account surplus.

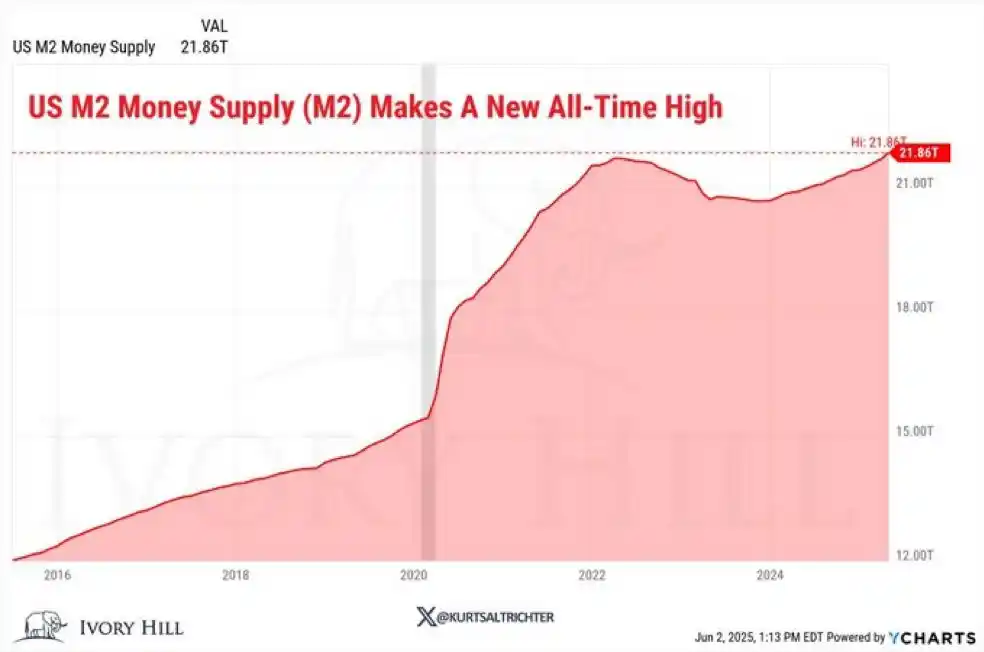

The money printer is back on. US M2 just hit a new all-time high at $21.86T. Liquidity is flowing back into the system. 👆how can markets correct… Americans simply cannot go on fiscal diet

BREAKING, TECH GIANT META SECURES NUCLEAR POWER "Beginning in June 2027, Meta will buy roughly 1.1 gigawatts of energy from Constellation’s Clinton Clean Energy Center in Illinois, which is the entire output from the site’s one nuclear reactor" Nuclear power 🤝 tech giants 👆uranium miners and U.S. infrastructure are core holdings in Pinetree. We prefer picks and shovels.

https://x.com/riteshmjn/status/1929981780846887187?s=46&t=C3rli2FHgt3dUJcWQCNaZg

MILEI ACHIEVES HISTORIC SURPLUSES President Milei has broken decades of deficit-driven policies, with previous governments posting deficits of 3% in 2021, 2.4% in 2022, and 2.9% in 2023. Milei recorded a primary fiscal surplus of 0.6% of GDP in 2025, following a 1.8% surplus in 2024, as reported by the Ministry of Economy. Milei’s “zero deficit” approach, achieved without raising taxes or devaluing the currency, marks a stark departure from past practices of uncontrolled spending and inflation-driven value erosion. This adjustment, described as a “civilizational change,” reflects a new philosophy where the state no longer overspends at citizens’ expense, redefining Argentina’s economic landscape. 👆ARGT Argentina etf continues to be core holding in Pinetree

*WHITE HOUSE PAUSES PLAN TO COLLECT STUDENT LOANS IN DEFAULT:CBS 👆caving on everything

There are currently 3,873 ETFs listed in the United States up from 3,159 one year ago