Capital TRUST Research

2.0K subscribers

About Capital TRUST Research

Welcome to the Capital Trust Research Channel where we provide you with the most up to date information and news that can impact your investment decisions. Providing you with market breaking news, economic updates and comprehensive research on companies, our highly informative reports and videos will provide you with valuable insights to support your financial decision-making enabling you to invest wisely. Our range of reports include; Daily Market Watch Weekly Market Update Weekly Treasury Bill Report Technical Analysis Alert Economic Reports Inflation and Interest Rate Outlook Monetary Policy Review Economic Updates Company Research Detailed Fundamental Analysis Technical Analysis Research Webinars

Similar Channels

Swipe to see more

Posts

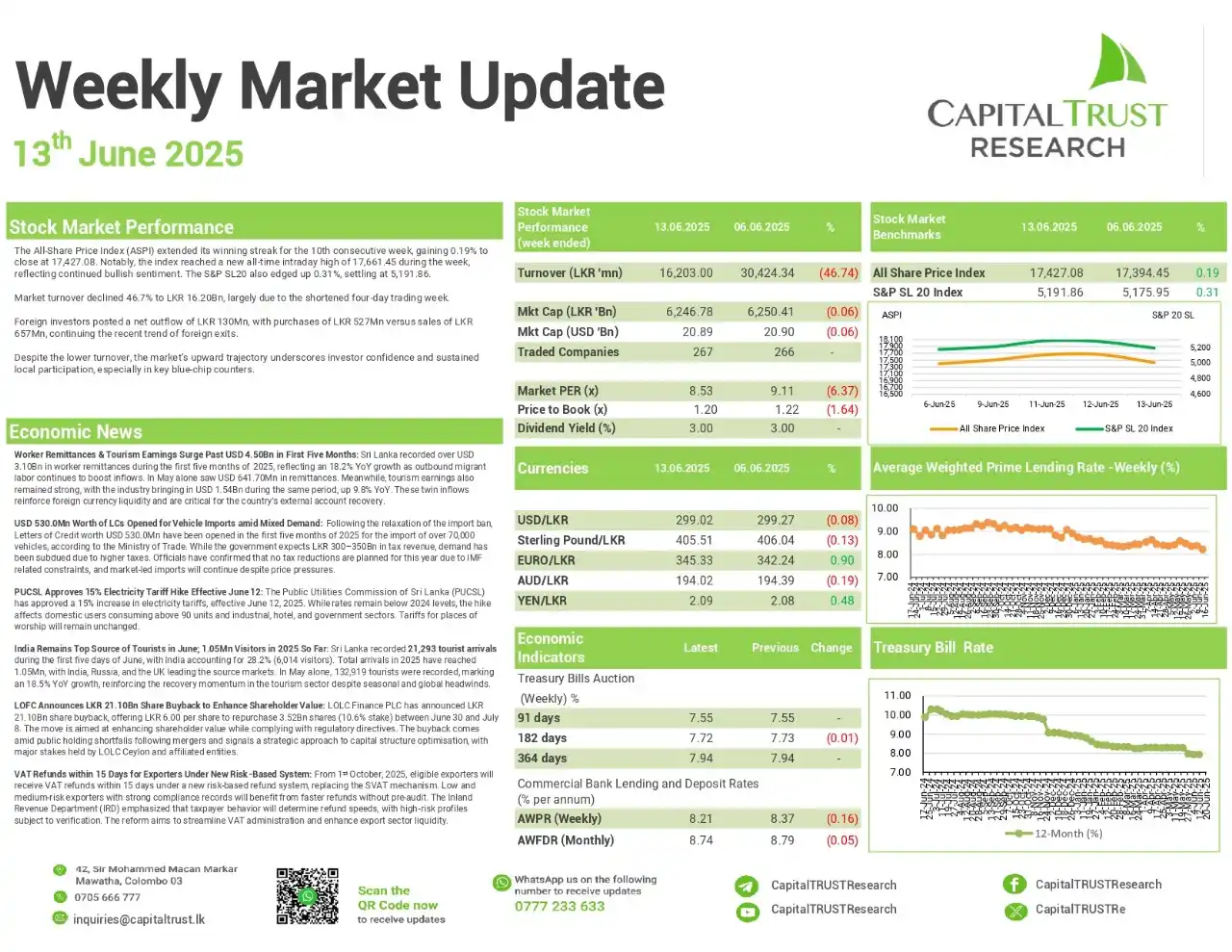

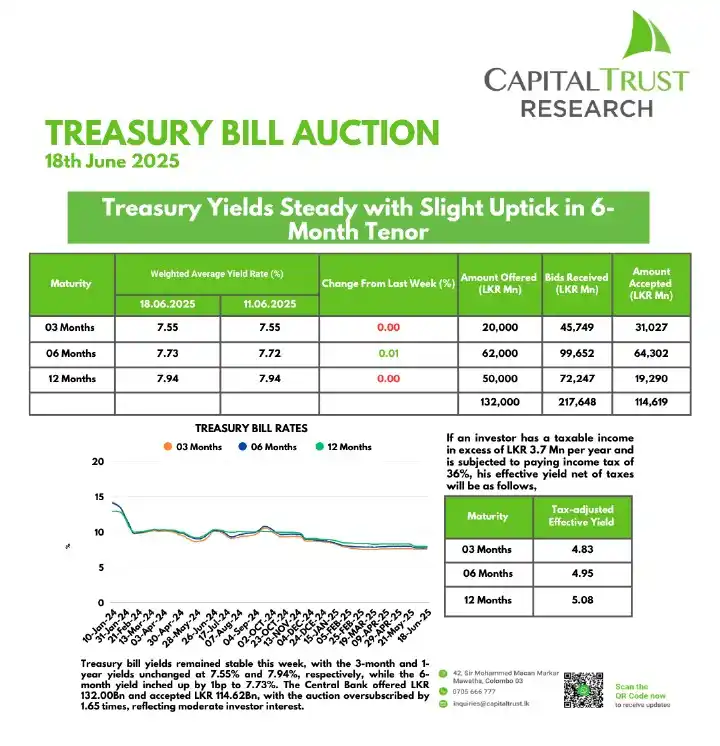

*Services Sector Expansion Slows Further in May 2025 Amid Mixed Sectoral Performance* Sri Lanka’s Services PMI recorded a value of 57.0 in May 2025, reflecting a continued but slower pace of expansion in services activities, in line with seasonal trends observed in the same period last year. Business activity growth was supported by sustained improvements in financial services, driven by increased lending, while professional services and wholesale and retail trade also recorded notable gains. However, the accommodation, food, and beverage sector experienced a contraction during the month, attributed to a decline in tourist arrivals on a month-on-month basis. New Business volumes increased, primarily led by growth in financial services. In contrast, Employment levels declined due to retirements and resignations reported across several companies. Backlogs of Work continued to ease during the month. Looking ahead, expectations for business activity over the next three months remained positive,supported by favorable macroeconomic conditions.

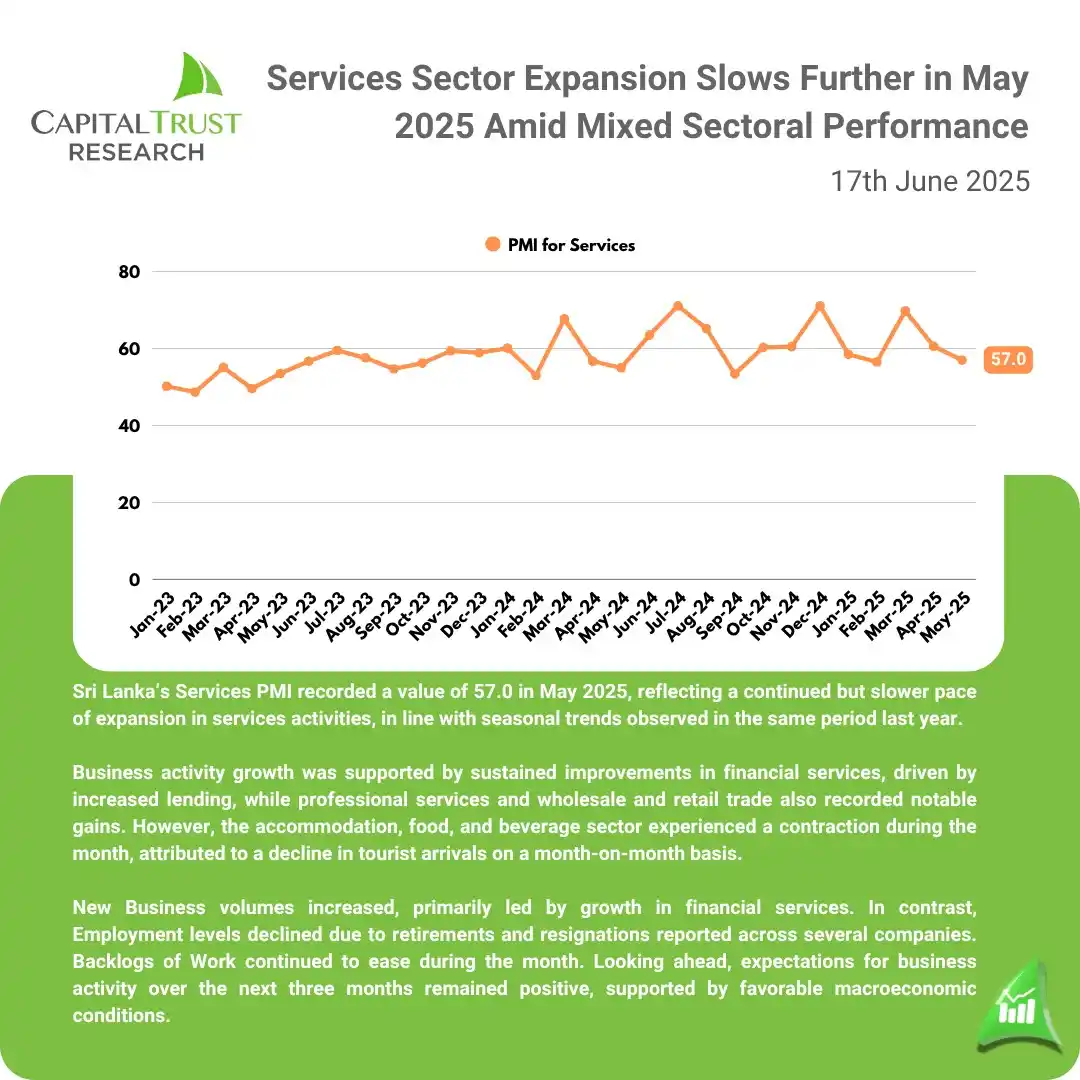

*Manufacturing PMI Rebounds in May 2025 Amid Recovery in Apparel Sector* Sri Lanka’s Manufacturing Purchasing Managers’ Index (PMI) rose to 55.5 in May 2025, signaling a recovery in manufacturing activity following the seasonal dip in April. All sub-indices returned above the neutral threshold, indicating broad-based improvement across the sector. The resurgence in New Orders and Production was largely driven by the textiles and apparel sector, which also supported a rebound in Employment. Stock of Purchases remained unchanged from the previous month, while Suppliers' Delivery Time continued to lengthen. Looking ahead, manufacturers anticipate a gradual rise in demand over the next three months, though concerns persist over potential cost pressures from revised electricity tariffs and geopolitical tensions in the Middle East.

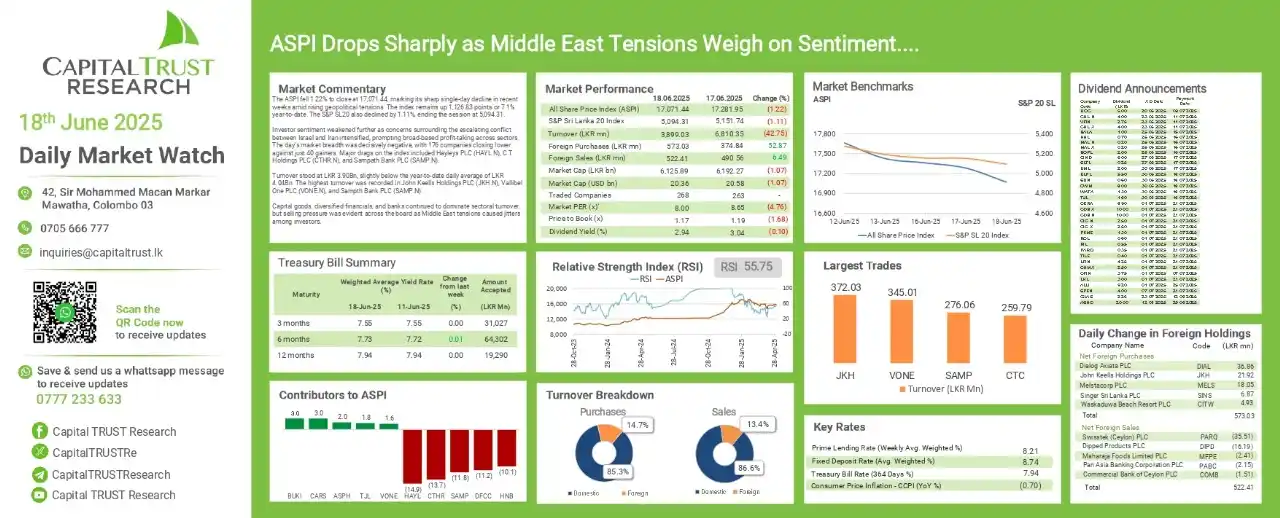

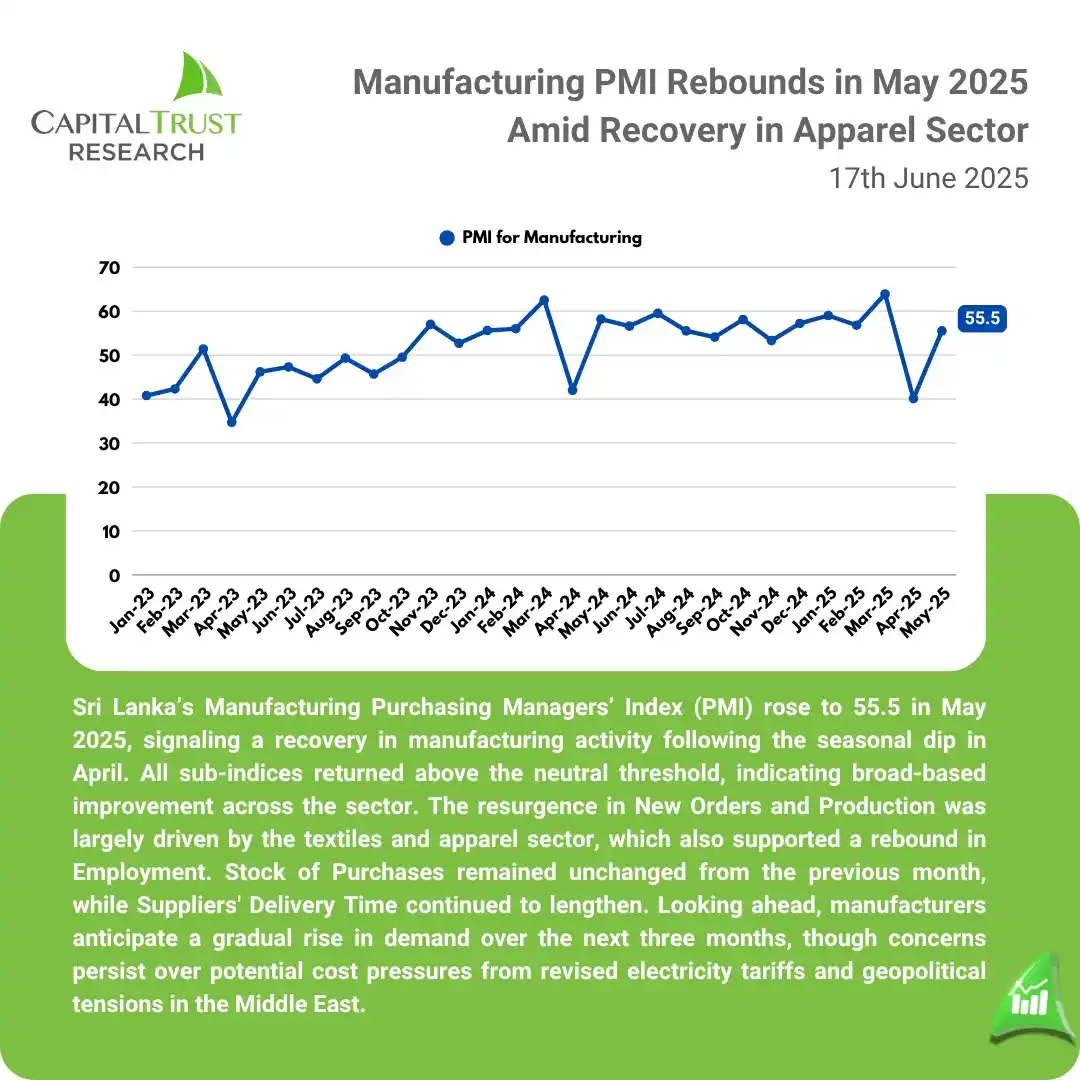

*Treasury Yields Steady with Slight Uptick in 6-Month Tenor* Treasury bill yields remained stable this week, with the 3-month and 1-year yields unchanged at 7.55% and 7.94%, respectively, while the 6-month yield inched up by 1bp to 7.73%. The Central Bank offered LKR 132.00Bn and accepted LKR 114.62Bn, with the auction oversubscribed by 1.65 times, reflecting moderate investor interest.

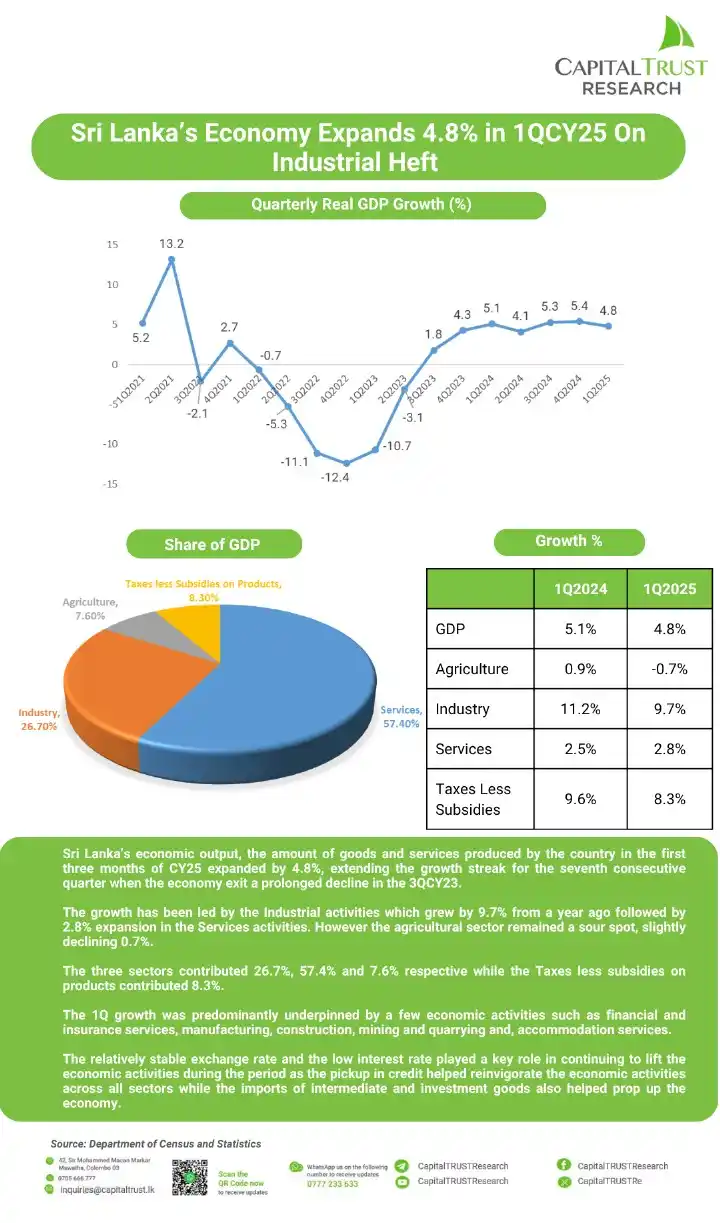

*Sri Lanka’s Economy Expands 4.8% in 1QCY25 On Industrial Heft* Sri Lanka’s economic output, the amount of goods and services produced by the country in the first three months of CY25 expanded by 4.8%, extending the growth streak for the seventh consecutive quarter when the economy exit a prolonged decline in the 3QCY23. The growth has been led by the Industrial activities which grew by 9.7% from a year ago followed by 2.8% expansion in the Services activities. However the agricultural sector remained a sour spot, slightly declining 0.7%. The three sectors contributed 26.7%, 57.4% and 7.6% respective while the Taxes less subsidies on products contributed 8.3%. The 1Q growth was predominantly underpinned by a few economic activities such as financial and insurance services, manufacturing, construction, mining and quarrying and, accommodation services. The relatively stable exchange rate and the low interest rate played a key role in continuing to lift the economic activities during the period as the pickup in credit helped reinvigorate the economic activities across all sectors while the imports of intermediate and investment goods also helped prop up the economy.

LMD Brands Annual 2025 Edition. LMD Readers’ Choice - Most Loved Brands. Read the full article here: https://online.fliphtml5.com/pgkmm/jieq/