Etaxindia

317 subscribers

About Etaxindia

Subscribe for more GST , Income Tax update and other laws & Act 🙏 https://www.youtube.com/@etaxindia Join telegram group https://t.me/+Hl4Vis2iC0hjZWQ1 Join Instagram channel https://instagram.com/e_tax_india?igshid=MzNlNGNkZWQ4Mg==0

Similar Channels

Swipe to see more

Posts

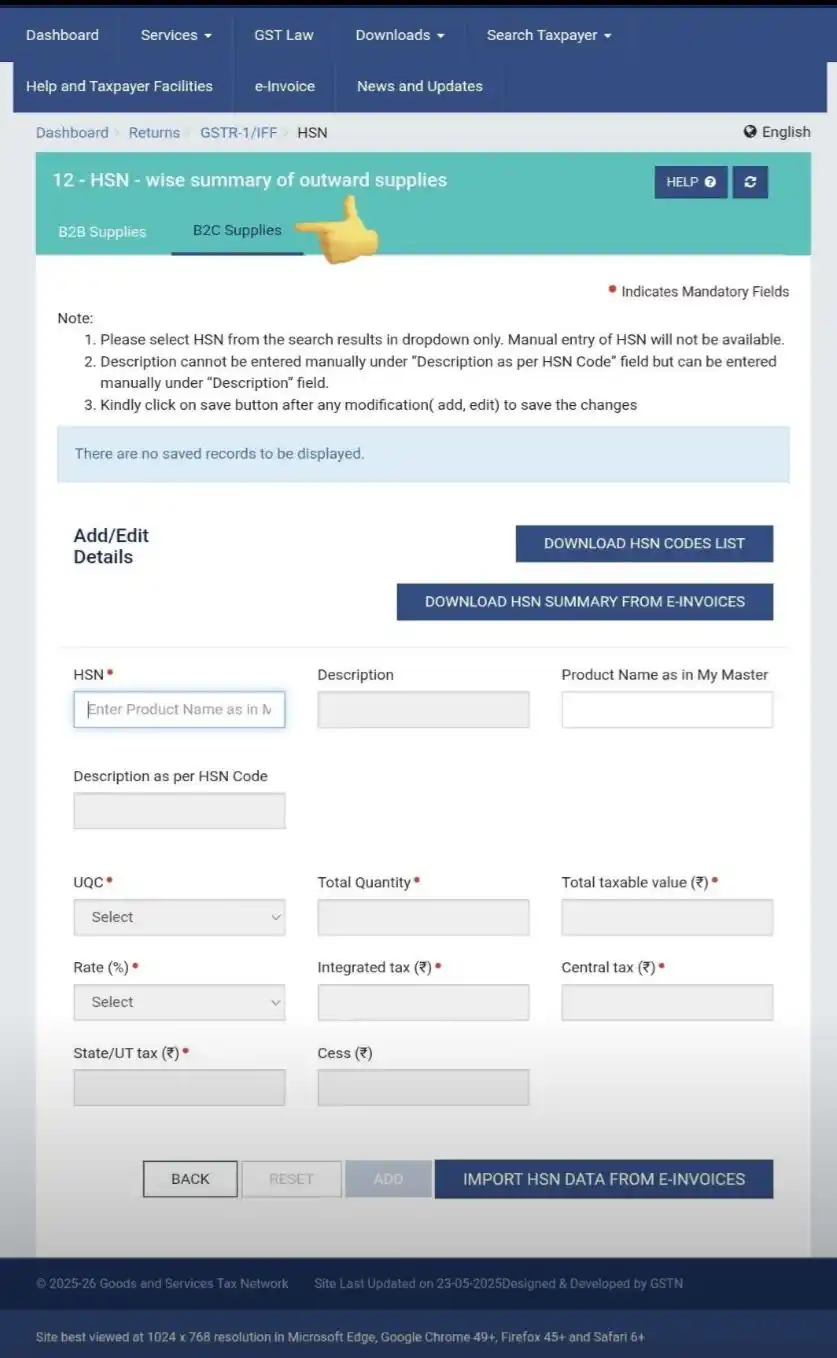

*Reporting of HSN codes in Table 12 and list of documents in table 13 of GSTR-1/1A - May 1st, 2025* Vide Notification No. 78/2020 – Central Tax dated 15th October 2020, it is mandatory for the taxpayers to report minimum 4 digits or 6 digits of HSN Code in table-12 of GSTR-1 on the basis of Aggregate Annual Turnover (AATO) in the preceding Financial Year. To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal wherein Phase 2 was implemented on GST Portal effective from 01st November 2022. In continuation of the phase wise implementation, Phase-3 of reporting of HSN codes in Table 12 of GSTR-1 & 1A shall be implemented from May 2025 return period. Further , table 13 of GSTR-1/1A is also being made mandatory for the taxpayers from the said tax period. For detailed advisory please click here. Thanking You, Team GSTN

*Advisory on Case Insensitivity in IRN Generation* Dear Taxpayer, 1. This is to inform you that, effective 1st June 2025, the IRP (Invoice Reporting Portal) would treat invoice/document numbers as case-insensitive for the purpose of IRN generation. 2. To ensure consistency and avoid duplication, invoice numbers reported in any format (e.g., "abc", "ABC", or "Abc") would be automatically converted to uppercase before IRN generation. This change aligns with the treatment of invoice numbers in GSTR-1, which already treats them as case-insensitive. 3. The same is shared for your kind information please. For any further clarification, please reach out to the GST helpdesk. Warm regards, GSTN Team

*Due dates to keep in mind for the week i.e. May 26-May 31* 1. 30th May (Friday) - Due date for Annual return in Form 11 for LLPs 2. 31st May (Saturday) - Due date for File TDS Return for Q4 (Jan - March 2025)

*Invoice-wise Reporting Functionality in Form GSTR-7 on portal-reg* Vide Notification No. 09/2025 – Central Tax dated 11.02.2025, Form GSTR-7 has been amended to capture invoice-wise reporting with effect from 01.04.2025 i.e. the return period for April 2025 onwards. In this regard it is to inform that development and testing of the same is underway, the implementation of invoice-wise reporting in Form GSTR-7 in GST portal will be deployed on portal soon. Thus, the enhanced functionality shall be deployed shortly, and users will be duly informed once the changes are made live on the portal. Regards, GSTN Team

*MCA Portal Update* MCA to launch of final set of 38 Company Forms wef July 14, 2025 which includes 13 Annual Filing Forms and 6 Audit Forms. Key dates: June 8 – Pay Later option in V2 portal will be disabled. June 17 – Upload Pending Details. Ensure no SRNs are pending for payment/resubmission. June 18 - V2 Company Filing Disabled No company e-filing possible in V2 portal after this date. July 9 to July 13 - V3 Portal Downtime No fee waivers or extensions for filings/resubmissions due during this period. List of 38 forms which will be migrated to V3: mca.gov.in/content/dam/mc… Kindly plan accordingly

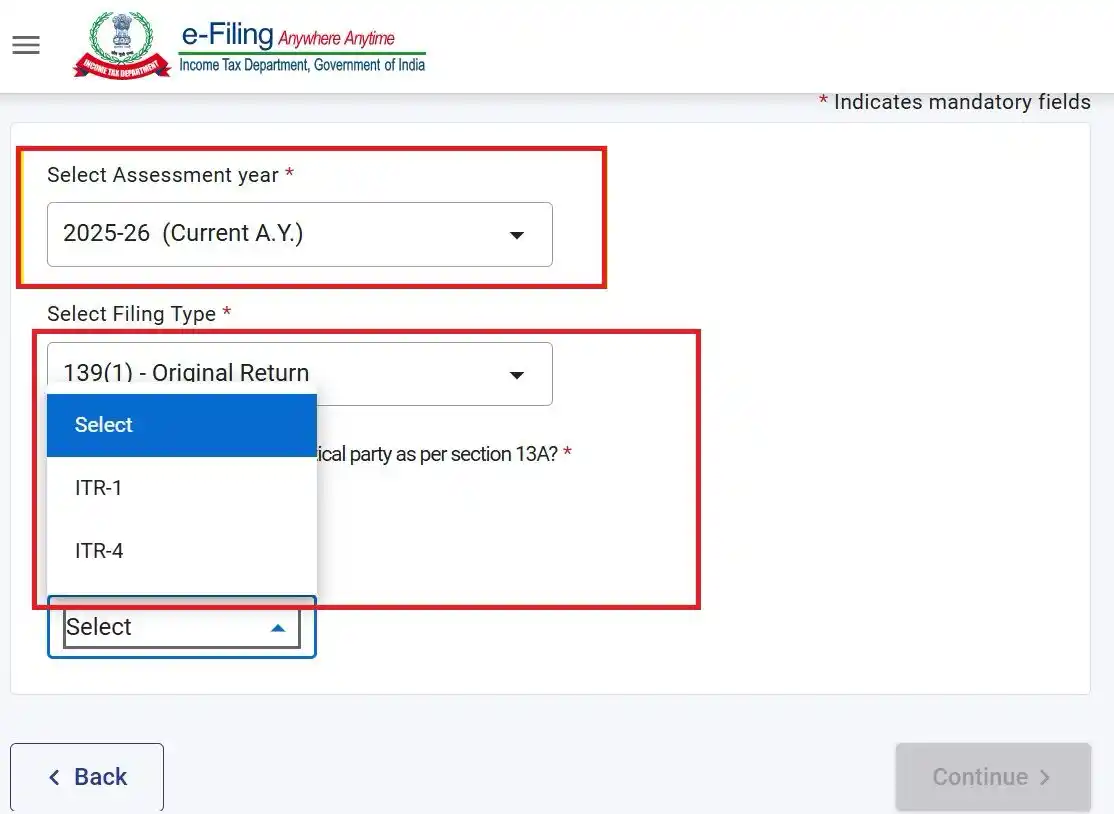

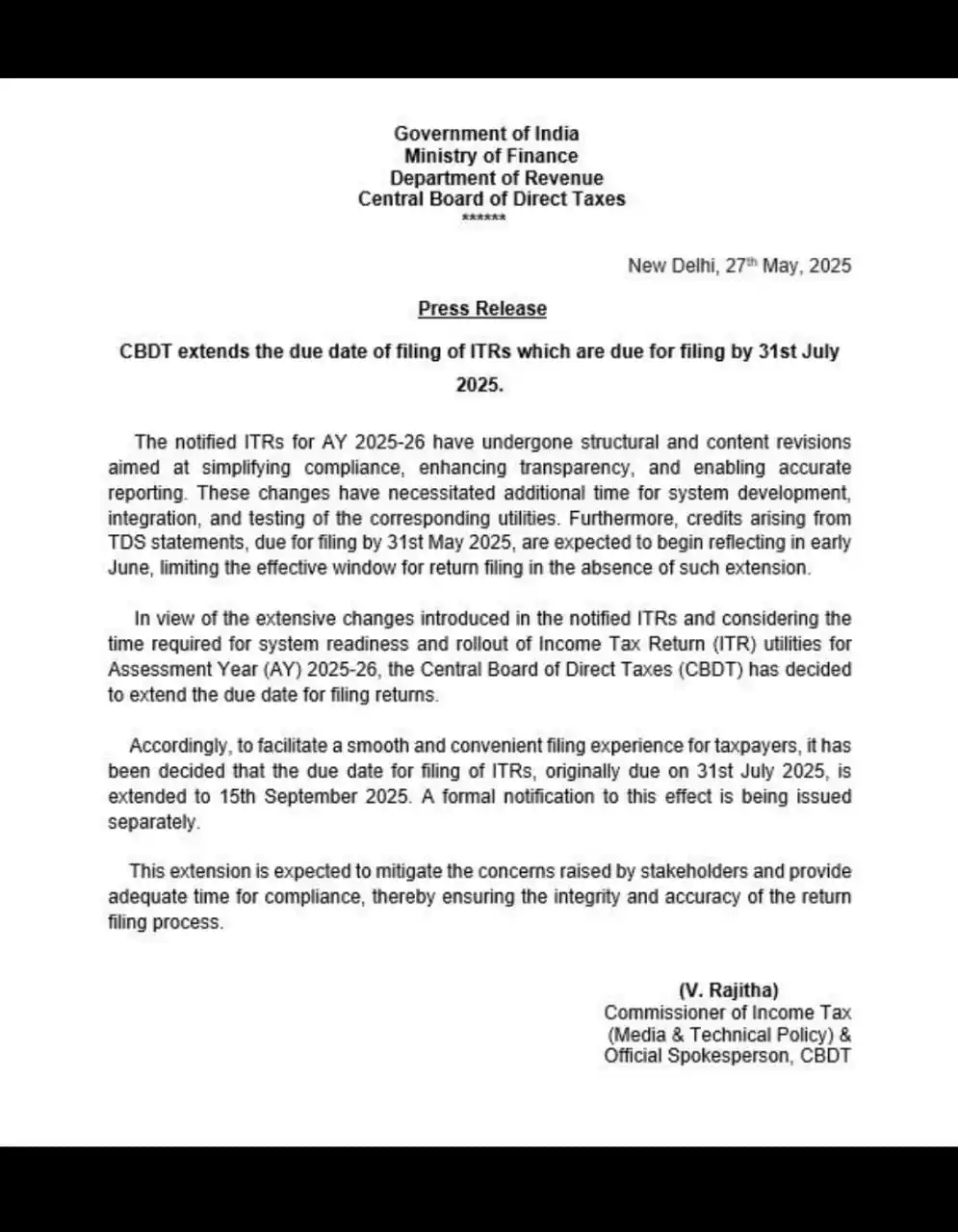

Attention taxpayers! The Excel Utility for ITR-1 and ITR-4 for AY 2025-26 has been enabled and is now available for taxpayers. Utilities of ITR-1 and ITR-4 for AY 2025-26/FY 2024-25 are live now