Jaspreet Singh (Money Matters)

909 subscribers

About Jaspreet Singh (Money Matters)

*Money Matters: The Art of Wealth* Money is life's essential fuel, but making it work for you is a subtle art. Earning is harder than saving, requiring strategy, discipline, and creativity. Don't let money control you - master it! Think of money as a canvas, waiting for your financial vision. Break free from paycheck-to-paycheck living and make money your loyal companion, working tirelessly to achieve your dreams. Take control, and let the art of money-making elevate your financial journey! *For any queries, please ping me here:* ⬇️⬇️ https://wa.me/qr/76P3EFAGYQ4JL1

Similar Channels

Swipe to see more

Posts

*The Hidden Costs of "Buy Now, Pay Later": Are You Paying More Than You Think?* Many consumers fall prey to the "Buy Now, Pay Later" (BNPL) trap. While it may seem like an easy way out, the truth is that BNPL schemes can cost you a lot more than you think. Here are some points to consider: - *Interest Rates*: BNPL schemes often come with interest rates that can range from 20-30% per annum. This can add up quickly, making your purchase much more expensive than you initially thought. - *Late Fees*: Miss a payment, and you'll be slapped with late fees that can be as high as 2-5% of the outstanding amount. - *Hidden Charges*: Some BNPL schemes come with hidden charges, such as processing fees or documentation fees, that can add to your overall cost. - *Debt Trap*: BNPL schemes can lead to a debt trap, where you're forced to take on more debt to pay off previous debts. - *Impact on Credit Score*: Defaulting on BNPL payments can harm your credit score, making it harder to get loans or credit cards in the future. Before you click "buy now," think twice about the true cost of your purchase. Consider your financial situation, and ask yourself: - Can I afford it? - Do I really need it? - Is there a better way to finance it? _By being mindful of the hidden costs of BNPL schemes, you can avoid falling into the debt trap and make more informed financial decisions._

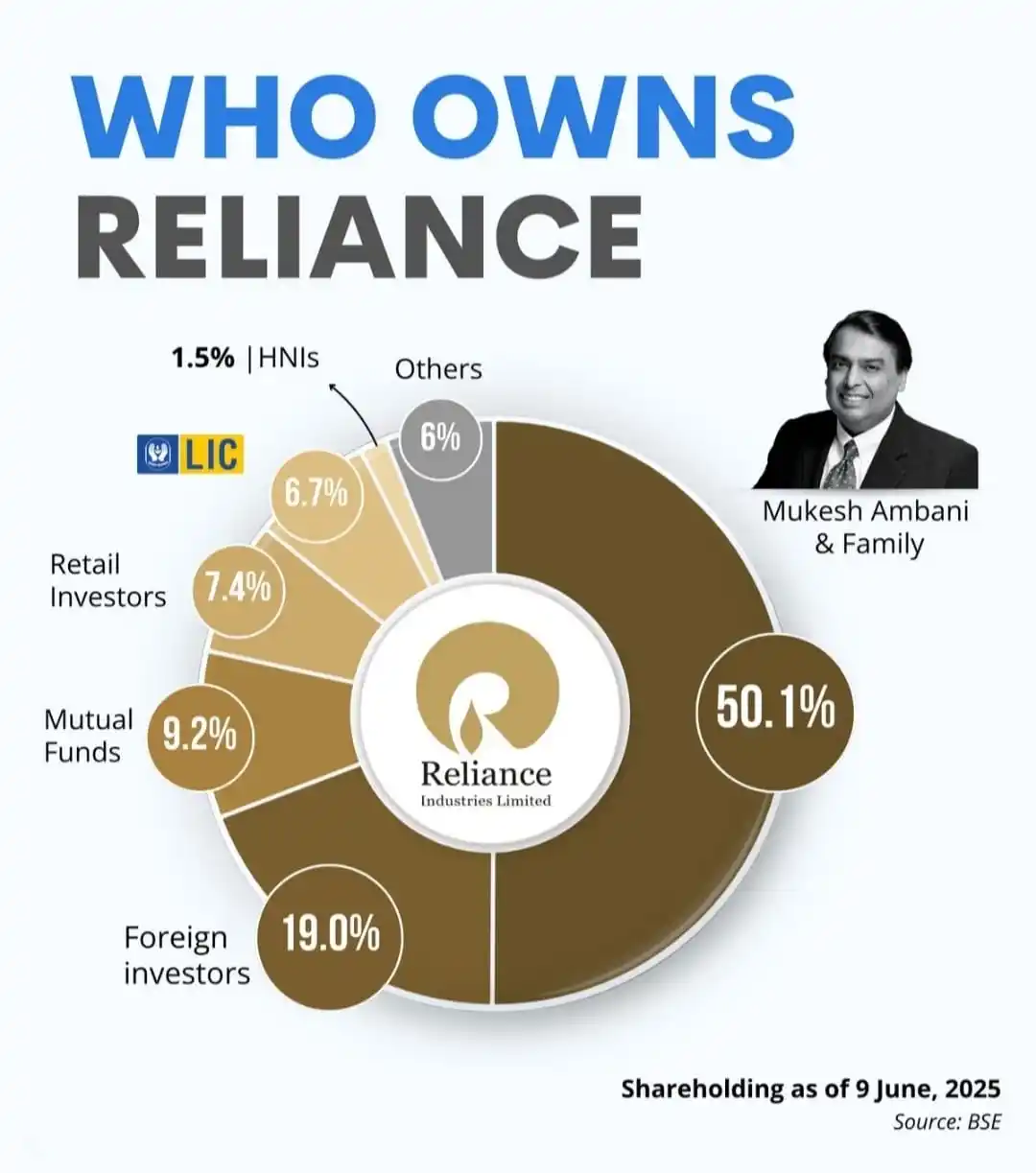

Ever wondered who owns *Reliance Industries*, India's largest company and flagship of the country's richest person?

*Top AMC's Buy & Sell in May 2025:*

Term Insurance is no more Necessity. *It's Mandatory.*

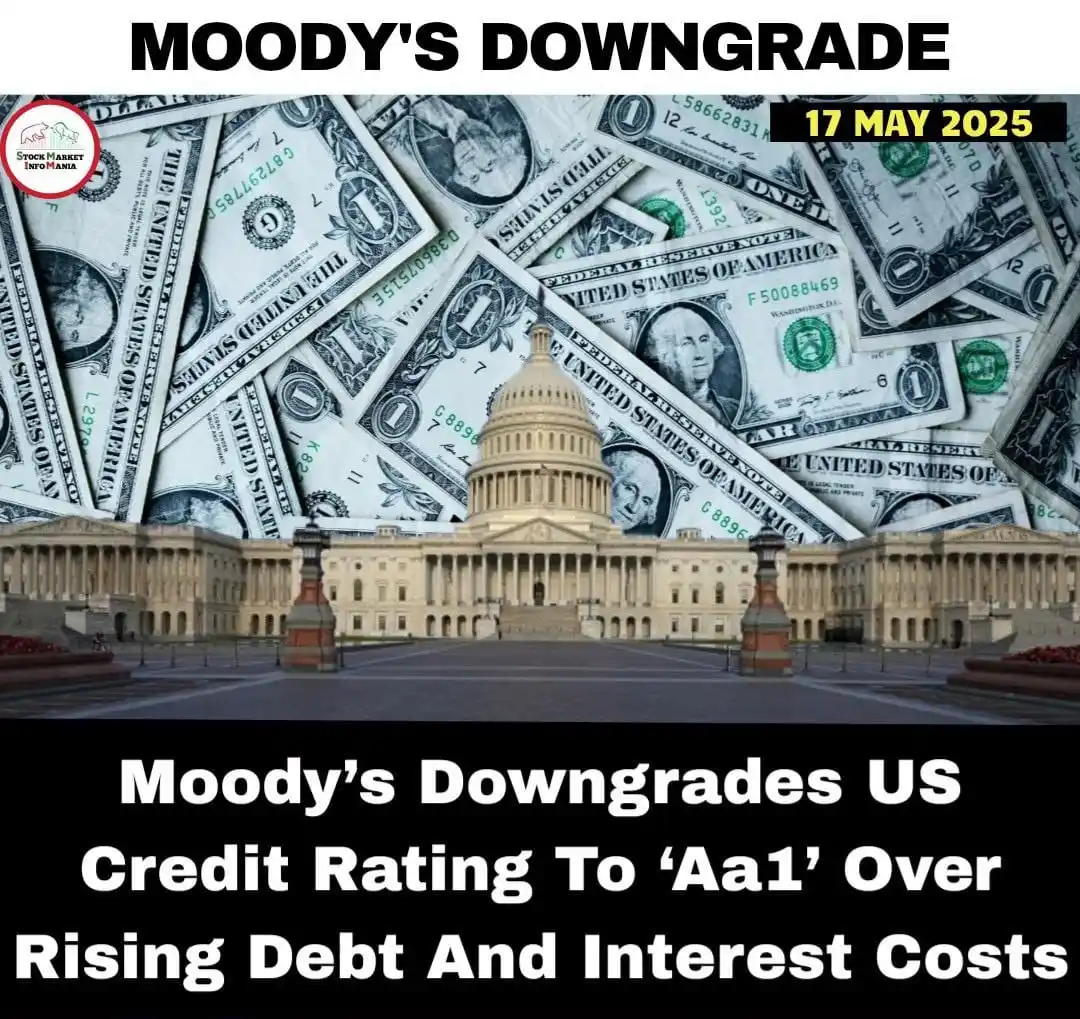

*For the first time ever in history, US's credit rating has been downgraded*

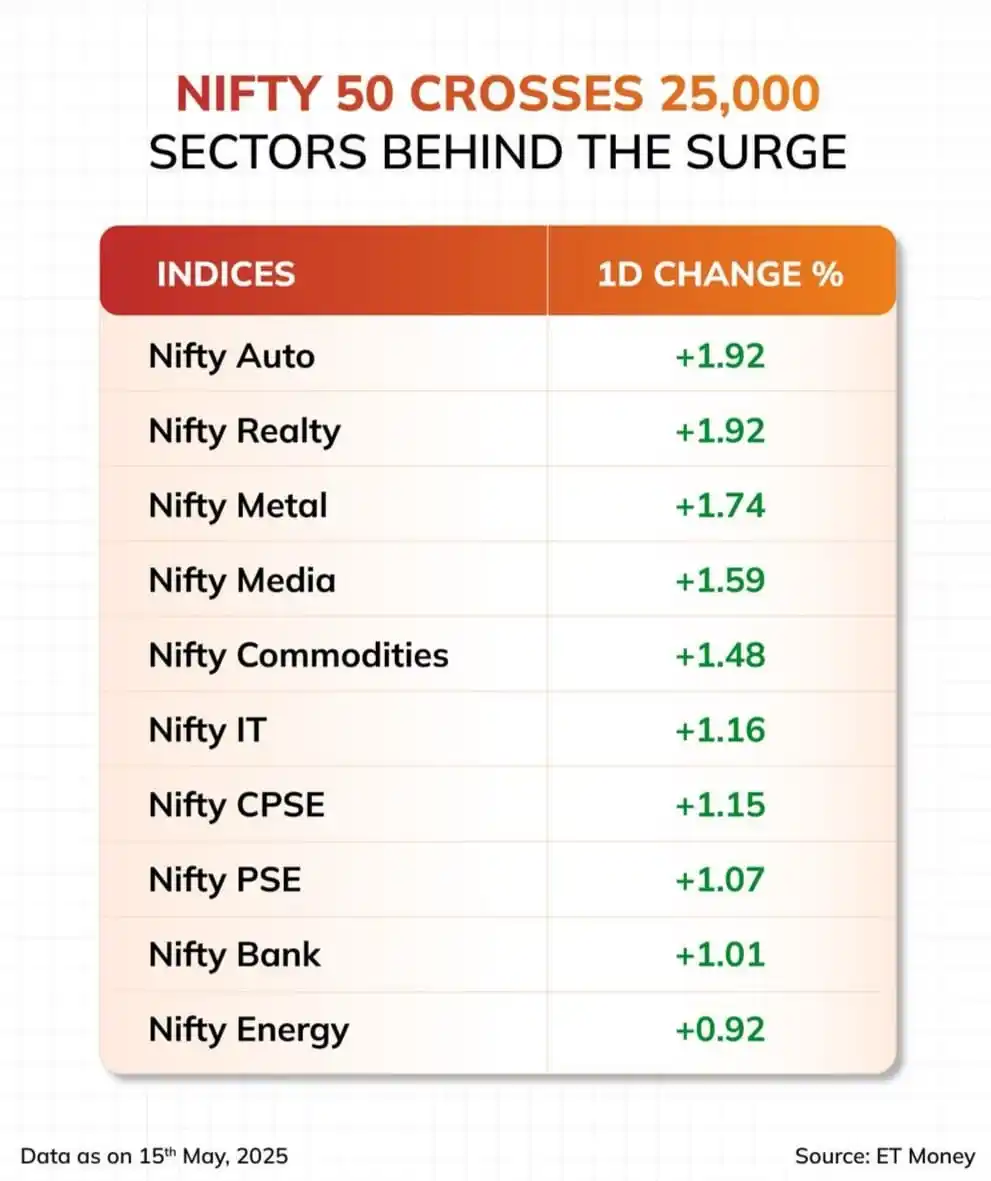

*Nifty 50 crossed the 25,000 mark for the first time since October 17, 2024, with 49 of the 50 Nifty constituents ending in the green.* Hero MotoCorp led the gains on the index, while Tata Motors jumped over 4%. _Check out the top sectoral indices that drove today’s momentum_