Equity Research | Stocks | IPO | DJINVESTOR

254 subscribers

About Equity Research | Stocks | IPO | DJINVESTOR

Follow us for updates on Stocks, IPOs, special opportunities & much more. 🚀 🔥

Similar Channels

Swipe to see more

Posts

BLOCK DEAL ALERT: Hind zinc Promoter Vedanta to sell stake in co via block deals Likely discount of upto 10% to previous close price Vedanta to sell shares worth upto Rs 7500 crores DAM Sec, Citi said to be brokers to the Deal

https://timesofindia.indiatimes.com/city/bengaluru/tcs-sets-225-billing-days-limits-bench-time-to-35-days/articleshow/121892873.cms IT gaint is struggling to maintain/grow profits amid business slowdown. Already not paying quarterly variables to senior grades from a long time ... This will make way for layoffs now.

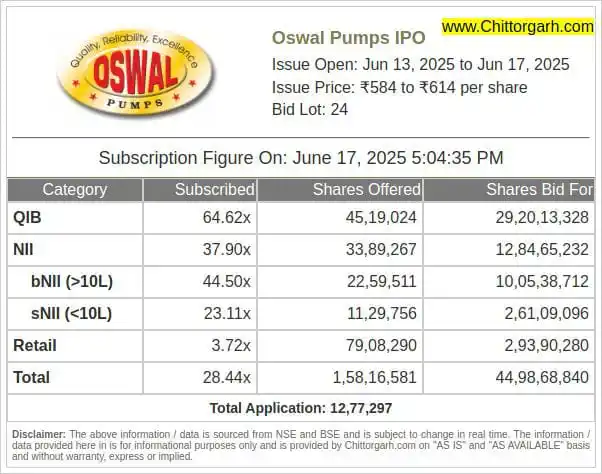

Good subscription .. though valuation not cheap.

Biggies are selling ...sell fast ... Mutual funds are buying..buying fast

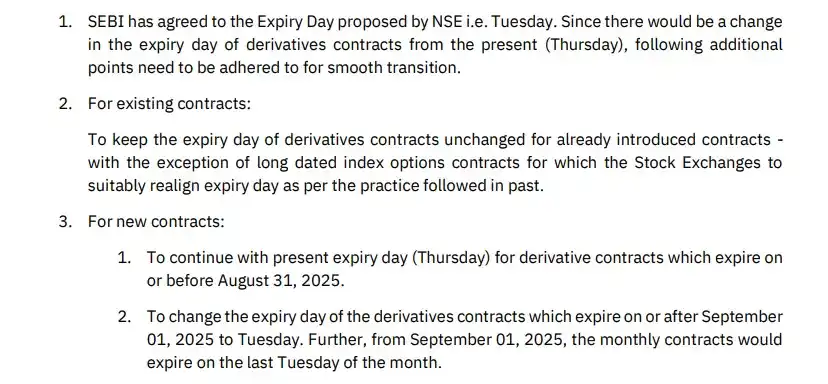

Might impact BSE negatively...do your own research.

https://www.livemint.com/market/stock-market-news/vedanta-divests-1-6-stake-in-subsidiary-company-hindustan-zinc-details-here-11750231722479.html

https://www.livemint.com/companies/company-results/urban-company-swings-to-profit-ahead-of-ipo-trims-issue-size-amid-market-recalibration-11750229918370.html Magic Magic ✨🪄 Profitable just before IPO 😜🤣

Vishal Mega Mart block upsized to 9900 crore, now total 22% stake block likely: Sources

Vishal Mega Mart : Block Deal Kedaara Capital (Samayat Services) has launched a ₹5,000 crore block deal to sell a 10% stake in Vishal Mega Mart. The floor price is set at ₹110 per share, reflecting a 12% discount