ENRICHWISE - Finance/TAX - Channel

552 subscribers

About ENRICHWISE - Finance/TAX - Channel

Admin : Kapil Jain Finance , Tax , Investments, Mutual Funds, Stock Markets, Sensex, Nifty, Insurance, Financial Planning, Retirement Planning, Child Education Planning, Child Marriage Planning, PMS, AIF, SIP - www.enrichwise.com Enrichwise - Founders - Experienced Professionals! - Retirement Specialists! Kapil Jain (Investor/ Gold Medalist - IIM Alumni / 20 yrs+ Fin Services) CA Rishika Jain CA RK Jain (Retired - Ex Banker) We Believe in long term Investing / India Growth Story / Asset Allocation Principles. / Power of Compounding / Wealth Creation. Get your ENRICHWISE EDGE to successfully NAVIGATE your Investment Journey. ACHIEVE your FINANCIAL GOALS.

Similar Channels

Swipe to see more

Posts

Ever wonder why some people get ahead… while others stay stuck? The Rich Buy Time. The Poor Buy Distractions. Distractions don’t need an invitation—they’re already in your pocket. 📱 💰 The wealthy buy back time—they delegate, automate, and build systems. 📚 The ambitious invest in knowledge—turning minutes into momentum. 📉 The lazy trade time for entertainment—and lose their future one scroll at a time. Truth: Every mindless scroll costs you your future. 👉 The rich own time. 👉 The lazy avoid effort—not because they can’t, but because they won’t. Your choice: Keep scrolling… or start building. 🚀 ✅ Key Takeaways: 1. Time is your most valuable asset. 2. Systems build success—stress doesn't. 3. Use time for growth, not escape. 4. Small choices shape big futures. You have a choice: Keep scrolling… or start building. Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for Investments, Insurance & Tax Advisory. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

Wondering how the smartest investors stay calm during market crashes, rallies, or sudden shifts? 🤔 Here are 4 strategies to avoid regret — especially in India: 1. Stay Invested. Keep your SIPs running. It’s a simple, time-tested way to build wealth. 2. Build a Smoother Portfolio. Stressful ups and downs? Opt for funds like Balanced Advantage or Conservative Hybrid Funds that automatically adjust between equity and debt. 3. Be Prepared, Not Predictive. Don’t try to guess the market. Diversify across equity, debt, gold, and international investments to handle all market conditions. 4. Rebalance Smartly. During a market dip, rebalance to maintain your equity-to-debt ratio. Shift to bonds or cash if needed, but do it systematically. At Enrichwise, we follow the PRAG process — Protect and Grow. Don’t fear volatility. Manage it wisely with these strategies. For more insights, follow Enrichwise. Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for Investments, Insurance & Tax Advisory. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

Think mutual funds are only for the rich? Think again. One of the biggest financial myths is that you need to be wealthy to invest in mutual funds. But the truth? You just need to start—small, smart, and soon. 💸 You don’t need lakhs in hand. In fact, many funds let you begin with an amount less than your weekend grocery bill. Because it's not about starting big. It's about starting early, being consistent, and letting time do the heavy lifting. 🕰️ ✅ Key Takeaways: * Myth: Mutual funds are only for the wealthy * Truth: You can start investing with just ₹100–500/month through SIPs 1. Small amounts + consistency = long-term wealth 2. Automated investing builds habit and eliminates decision fatigue 3. The secret isn’t a big wallet, it’s a disciplined mindset 4. Mutual funds are flexible, accessible, and proven 🚀 Ready to begin your journey? Let us help you get started the right way with a free mutual fund portfolio consultation. Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

Is the Market Fall Making You Anxious? Don’t panic — get proactive. At Enrichwise, we empower you with the PrAG process (Protect and Grow) to help you invest smarter, even in volatile times. 👉 Here's what smart investors are doing: ✔️ Rebalancing their portfolio ✔️ Keeping an emergency fund ✔️ Continuing SIPs (volatility = more units!) ✔️ Investing lumpsum in staggered phases 🧠 Plus, understand 5 key reasons behind the current market fall — from geopolitical tension to global trade fears. 🔑 Key Takeaways: PRAG = Protect and Grow Market dips? Don’t panic Smart investor moves Why the market is falling Want expert help? 👉 Connect with Enrichwise to apply PRAG to your portfolio. 💬 Want a customized strategy for your portfolio? Let's talk. 📲 DM us to see the PRAG approach in action! Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice

If high returns made you rich, why isn’t everyone wealthy? Because most chase returns, not a solid process. They buy high, panic when markets dip, and exit. That’s not investing — it’s emotional roulette. 📊 ₹50,000 SIP @12% CAGR: 30 years = ₹5.2 Cr 35 years = ₹9.7 Cr ➡️ That’s compounding in action. Miss just 5 best market days? Lose nearly half your wealth. Even Buffett made 99% of his wealth after 50. He didn’t chase returns — he stayed invested. At Enrichwise, we focus on: ✅ Purpose – Beat inflation ✅ Process – SIPs + Asset Allocation ✅ Payoff – Real corpus for real goals 🔖 Key Takeaways: 1. Returns don't make you rich — consistency does. 2. Time in the market > Timing the market. 3. SIP + Discipline + Time = Wealth 4. Don’t panic. Don’t chase. Just stay the course. 🎯 Want long-term wealth & stress-free retirement? Invest the Enrichwise way. 📞 Call us at 98218 60804, 96533 87088 or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for Investments, Insurance & Tax Advisory. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

✨ Client Spotlight: Real Success, Real Stories! ✨ At Enrich Wise, we don’t just offer investment services—we build lasting relationships, simplify complex financial goals, and empower you to achieve your dreams with confidence. One of our valued clients shared: ✨ “Back in 2015–16, I had some surplus funds but didn’t know how to invest them. That’s when I approached Kapil — and his advice gave me the clarity I needed to make smart, fixed investments." Kapil’s guidance has always come at the right time. When I think of financial commitment, his name comes to mind.” ✨ We believe true wealth isn’t just about numbers—it’s about trust, peace of mind, and growth. With Enrichwise by your side, your dreams don’t just stay dreams—they become actionable plans. 💼 Thank you for trusting us with your future. Here’s to a prosperous path ahead! 🌟 📞 Contact us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for expert Investment, Insurance & Tax Advisory services. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

Do you really need term insurance in your 20s? Yes. Here’s why. 🎯 Term insurance is cheapest when you’re young and healthy: At 25: ₹500/month At 40: ₹2,000+/month (if you qualify!) Delaying it means paying more — or worse, not getting approved at all. 💥 No term plan = * No security for your loved ones * No income protection if something happens * No peace of mind One accident, one illness — and your family bears the full financial burden. 🛡 At Enrichwise, we use InsureMax to: ✔️ Review your risks ✔️ Choose the right policy ✔️ Ensure your coverage matches your real life 📌 Key Takeaways: 1. Term insurance is dirt cheap in your 20s 2. It’s not about death — it’s about protecting dreams 3. Start early while you're eligible and healthy 4. Don't wait for a wake-up call 💬 Be smart. Be early. Let Enrichwise (KAVACH) protect what you’re building. 📞 Call us at 98218 60804, 96533 87088 or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for Investments, Insurance & Tax Advisory. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

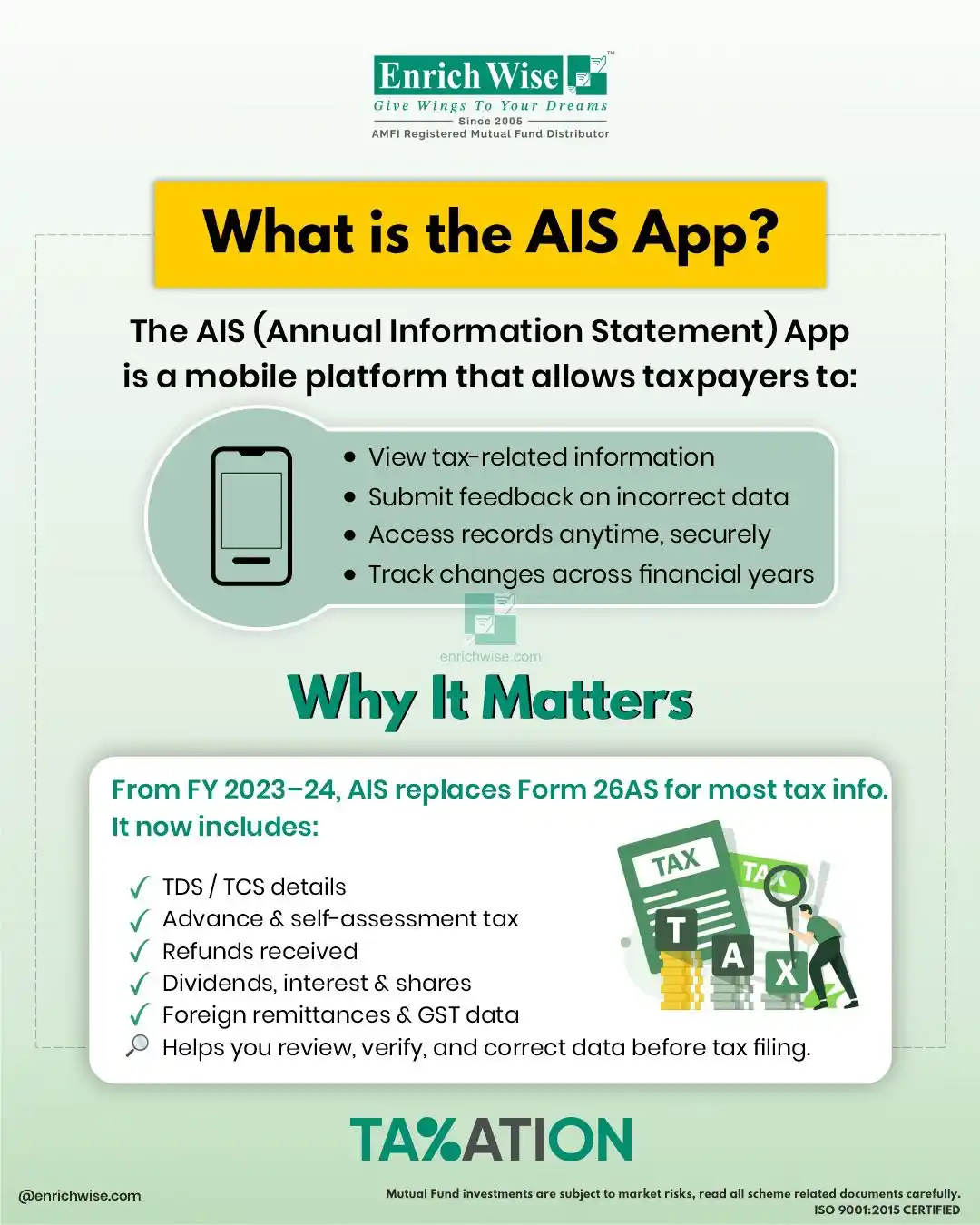

Filed your ITR without checking AIS or Form 26AS? Even honest taxpayers make this common mistake—and it can delay your refund or trigger a tax notice. 😬 🔍 What’s the issue? Form 26AS shows TDS & taxes paid AIS (Annual Info Statement) shows full financial activity: Interest income Mutual fund & stock transactions Rent received High-value spends If there’s a mismatch and you don’t fix it, your return may be flagged. ✅ What to do before filing ITR: 1️⃣ Download AIS & 26AS from the income tax portal 2️⃣ Match with your records 3️⃣ If mismatch: Use AIS Feedback (e.g. "Info not taxable", "Wrong year") Ask deductor to revise 26AS if needed 🛠 Already filed with a mistake? Don’t panic—just file a Revised Return before the deadline. 🧾 Always keep proofs: Form 16, bank statements, demat reports. 🚀 Need help checking your return? Let the experts at Enrichwise review it. Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.

Which company do you think made the highest profit in India in FY 2025? 💼 Here are the Top 10 Most Profitable Companies in India for FY 2025, based on net profit — and the figures are astonishing. Whether you're an investor or just financially curious, this is what real financial leadership looks like. 📊 Top 10 Profitable Companies (Net Profit in ₹ Cr): 1. SBI – ₹77,561 Cr 2. HDFC Bank – ₹70,792 Cr 3. Reliance Industries – ₹69,648 Cr 4. ICICI Bank – ₹51,029 Cr 5. TCS – ₹48,553 Cr 6. LIC – ₹48,320 Cr 7. ONGC – ₹36,226 Cr 8. Coal India – ₹35,358 Cr 9. ITC – ₹34,747 Cr 10. Airtel – ₹33,556 Cr ✅ Quick Takeaways: 1. Banks dominate – 4 of top 5 spots show finance is flying. 2. Reliance & TCS lead industry & tech. 3. Public sector still profitable – SBI, LIC, ONGC, Coal India. 4. Diversification matters – FMCG (ITC), Telecom (Airtel) hold strong. Let Enrichwise help you make smarter financial moves. 📞 Call us at 98218 60804, 96533 87088 or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for Investments, Insurance & Tax Advisory. Disclaimer: Enrichwise is an AMFI registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.