GaanBaru - Affluence Stewardship

February 14, 2025 at 06:02 AM

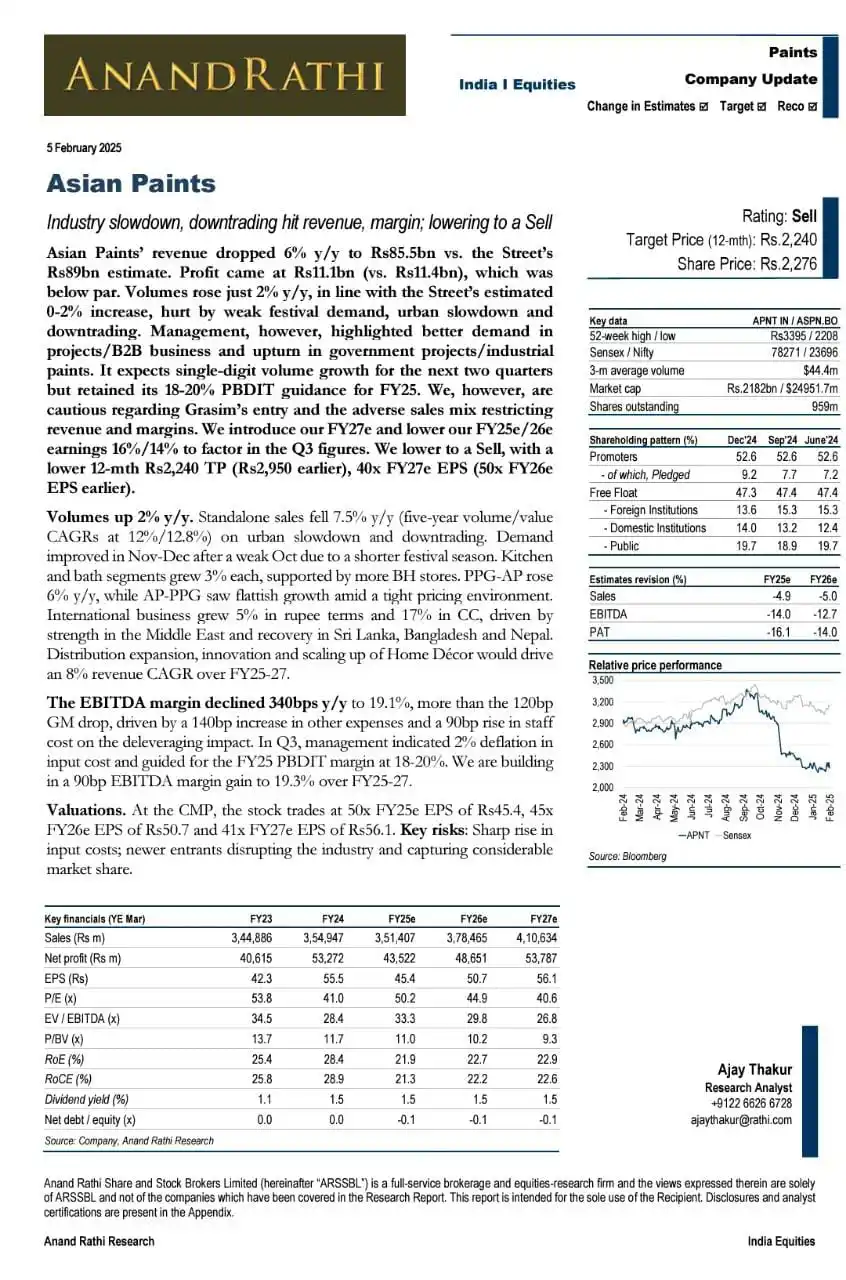

Asian Paints Q3 Earnings: Key Highlights

Demand & Market Trends

Q3 demand weak due to urban slowdown, muted festivals & seasonality.

Decorative Business (India): Volumes +2% YoY, value -8% YoY.

Industrial & Decorative: Q3 volumes +1.7% YoY, value -6.6% YoY.

Rural demand strong; government spending supported B2B growth.

Weakest demand in decades; recovery expected after two quarters.

Expansion & Innovation

Retail touchpoints at ~169,000; focus on mechanization & painting services.

New products (12% of Q3 revenue): Apex Ultima Suprema, Nilaya WALL W.R.A.P, Ultima Protek, NEO latex paint.

Backward integration for white cement & VAM/VAE on track.

Home Decor & International Business

Home decor (4.5% of decorative revenue); White Teak (-22.8%) & Weatherseal (-14.1%) underperformed.

Bath fittings (+2.6%), kitchens (+2.7%) with continued losses.

International revenue +5% INR, +17.1% CC; growth in the Middle East, recovery in South Asia.

Industrial & Margins

Industrial business +3.8% YoY, B2B strong