GaanBaru - Affluence Stewardship

February 18, 2025 at 04:39 AM

> *Nomura: Iniates Buy | Afcons Infrastructure | (14 February 2025)*

*Investment Thesis*

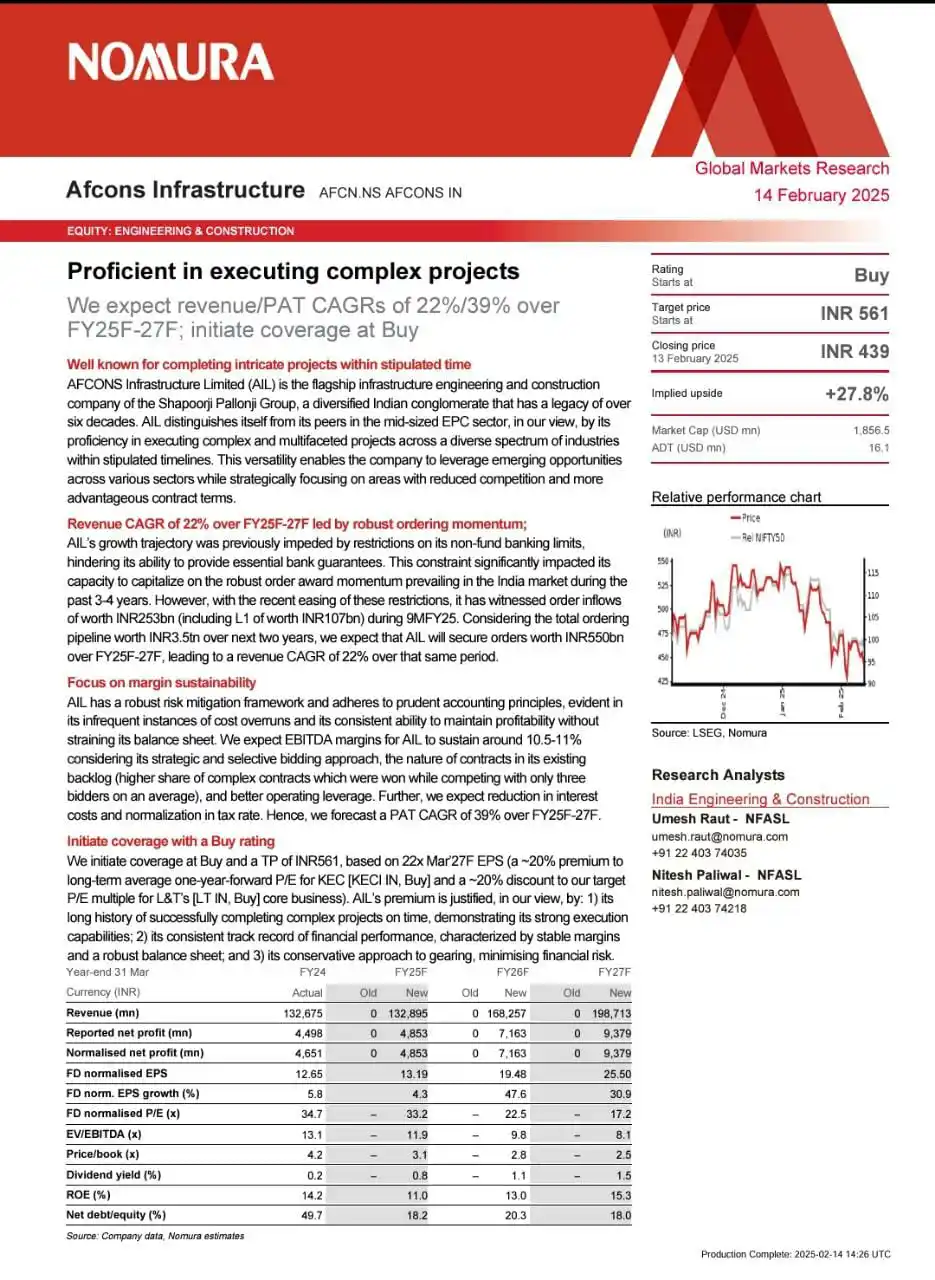

Rating: Initiated coverage with a Buy rating.

Target Price (TP): INR 561, implying a +27.8% upside from the closing price of INR 439.

*Justification for Premium Valuation:*

Strong execution track record for complex projects.

Stable financials with consistent margins and a healthy balance sheet.

Conservative approach to debt and financial risk.

*Growth & Financial Projections*

Revenue CAGR (FY25-FY27): 22%, driven by strong order inflows.

PAT CAGR (FY25-FY27): 39%, supported by sustained margins, reduced interest costs, and normalized tax rates.

EBITDA Margin Outlook: Expected to remain stable at 10.5-11% due to selective bidding on high-margin projects.

Order Inflows: INR 253 billion in 9M FY25, with an additional INR 107 billion in L1 status.

Projected Order Book: INR 550 billion over FY25-FY27.

*Competitive Strengths*

Execution Capabilities: Proven track record of delivering complex projects ahead of schedule.

Selective Bidding Strategy: Focuses on specialized, high-margin projects with fewer competitors.

Operational Excellence: Uses proprietary technology, a strategic equipment base, and efficient risk management.

ESG Initiatives: Recognized for environmental and social efforts, including water recycling and workforce development.

*Risks & Challenges*

Execution Delays: Project slowdowns could impact revenue recognition.

Commodity Price Volatility: Fluctuations in raw material costs could affect margins.

Competitive Intensity: Higher bidding competition may impact profitability.

Working Capital Management: While strong, monitoring of receivables and arbitration cases remains key.

*Valuation Comparison*

Trades at 22.5x FY26F EPS and 17.2x FY27F EPS.

Premium to KEC International (~20%) due to superior execution and financial stability.

Discount to L&T (~20%) due to smaller scale, weaker access to funding, and lower diversification.

*Conclusion*

Afcons Infrastructure is well-positioned to capitalize on India's USD 350 billion+ infrastructure investment pipeline. Its strong execution, disciplined bidding, and improving financials justify a Buy rating with a 27.8% upside potential. However, investors should monitor project execution, order book growth, and macroeconomic risks.