AZEE Securities

February 8, 2025 at 10:58 AM

*📈 KSE-100 Index Weekly Wrap*

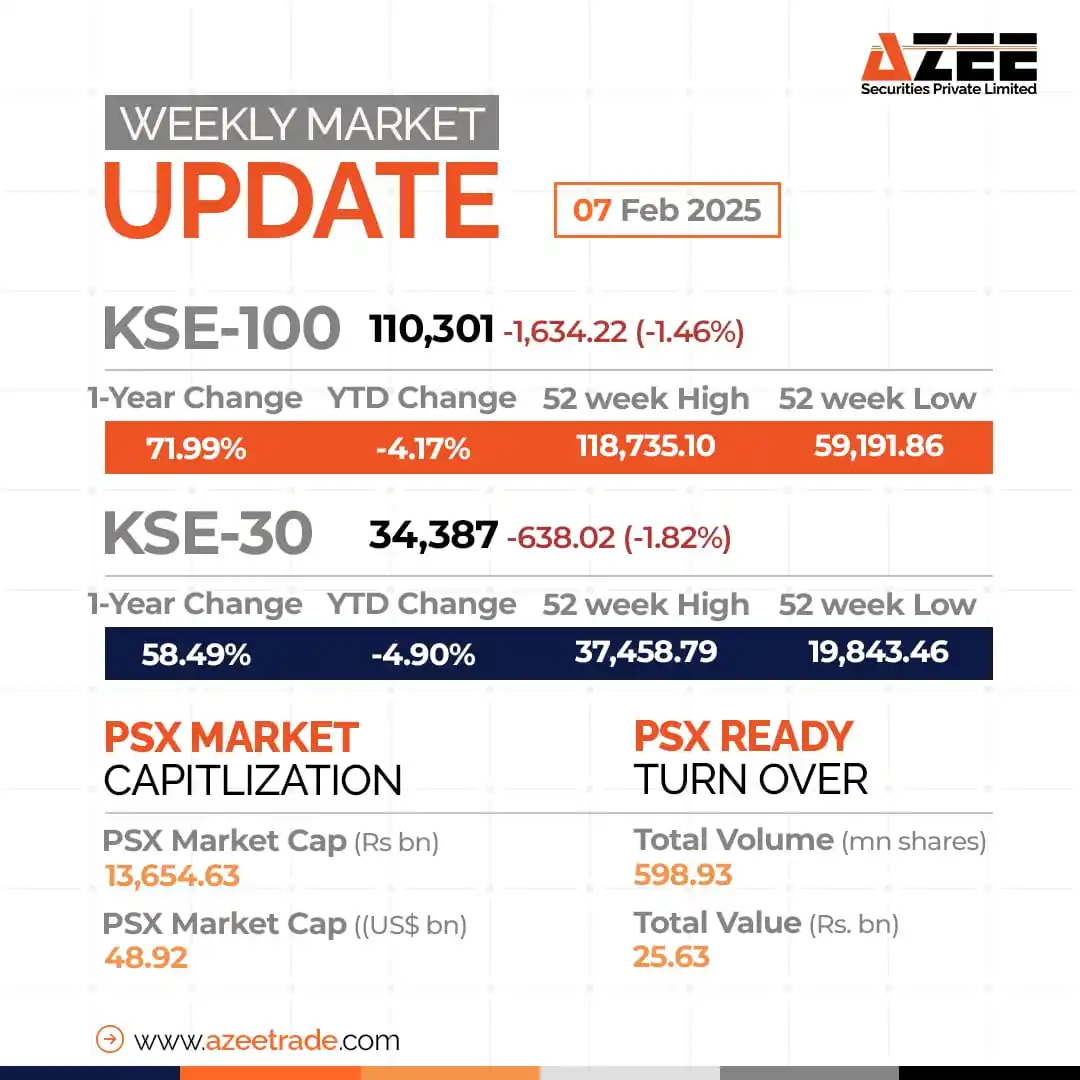

The market remained under pressure this week, closing at 110,323 points (-3,933 points | -3.44% WoW) as profit-taking and concerns over the upcoming IMF review weighed on sentiment.

*Economic Highlights*

Inflation in Jan’25 dropped to a 101-month low of 2.4% YoY.

Trade deficit widened 18% YoY in Jan’25, reaching USD 2.3bn.

SBP raised PKR 452bn in the latest T-bill auction against a target of PKR 450bn.

Petroleum sales remained stable at 1.38mn tons YoY, with 8% MoM growth.

Cement dispatches surged 14% YoY to 3,895K tons in Jan’25.

Fertilizer sales declined: Urea (-27% YoY), DAP (-6% YoY).

SBP reserves increased USD 46mn WoW, reaching USD 11.4bn.

*Key Developments*

Kia Lucky Motors launches EV9-GT Line SUV in Pakistan.

FBR demands Rs18bn from a tractor manufacturer.

PM likely to approve a housing sector package.

Exports rose 10% YoY to $19.55bn (July-Jan’25).

SBP raised Rs651bn through floating rate PIBs.

*Outlook and Recommendation*

The market is expected to turn positive next week, driven by earnings season and selective buying in key scrips.

🔹 KSE-100 is trading at 6.0x (2025E PER) vs. 10-year average of 8.0x, offering an 8.4% dividend yield (vs. 10-year avg: 6.5%).

📌 Preferred Stocks: PSO, OGDC, PPL, FFC, FCCL, MLCF, LUCK, NBP, AKBL, HUMNL, SYS, AIRLINK, HTL.

This version keeps it concise, structured, and impactful. Let me know if you want any tweaks!