AZEE Securities

February 15, 2025 at 10:18 AM

*KSE-100 Index Weekly Wrap*

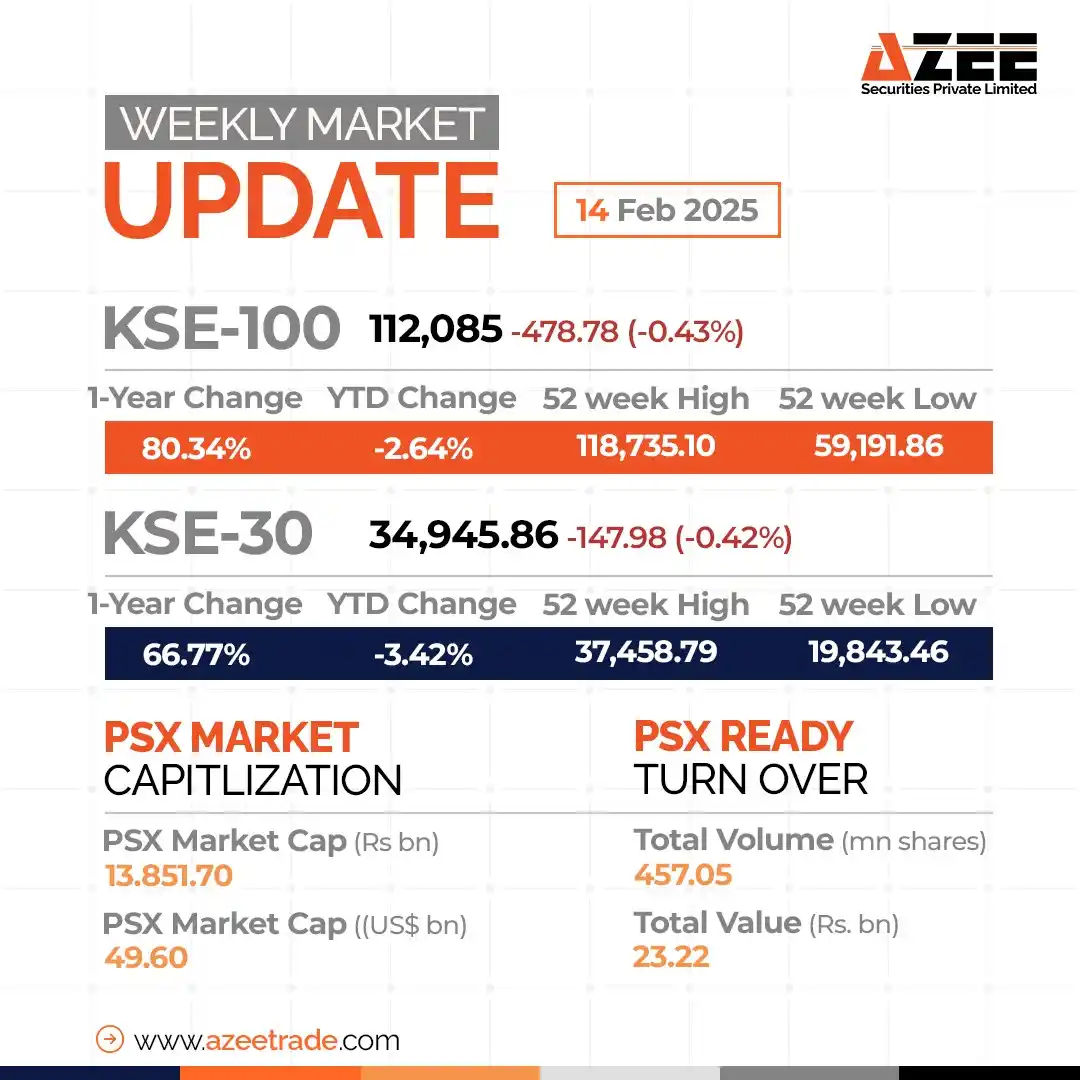

The market made a strong recovery this week, closing at 112,085 points (+1,762 points | +1.6% WoW) following positive news regarding Pakistan’s fiscal performance and strong market activity.

*Economic Highlights*

• Pakistan successfully met three out of five key IMF fiscal conditions for the first review of its USD 7bn program.

• MSCI updated its global indices, with Pakistan's weight in the FM Standard Index at 5.89%.

• SBP raised PKR 454bn in a PIB auction, surpassing the PKR 350bn target.

• Auto sales surged to 17,010 units, marking a 65% MoM increase.

• SBP's foreign exchange reserves declined by USD 252mn, settling at USD 11.2bn.

• The PKR closed at 279.21 against the USD, appreciating by PKR 0.16 (+0.06% WoW).

*Key Developments*

• Turkey’s President visited Pakistan, strengthening bilateral ties and setting a USD 5bn trade target.

• Foreign selling continued, amounting to USD 5.7mn, while local buying was led by Banks / DFIs and Broker Proprietary Trading.

• Barkat Frisian’s IPO set to raise Rs1.23bn.

• HBL MfB and IFC inked an $80mn agreement for risk-sharing.

• BYD electric vehicles arrived in Pakistan, marking the first-ever commercial shipment.

*Outlook and Recommendation* The market is expected to remain positive, driven by the ongoing earnings season and the attractiveness of select stocks. The KSE-100 is currently trading at a PER of 6.1x (2025) vs. its 10-year average of 8.0x, with a dividend yield of 8.3% (vs. 6.5% historically).

*🔹 Preferred Stocks:* PSO, OGDC, PPL, FFC, FCCL, MLCF, LUCK, NBP, AKBL, HUMNL, SYS, AIRLINK, HTL.