Ideological Memoirs

February 18, 2025 at 03:41 PM

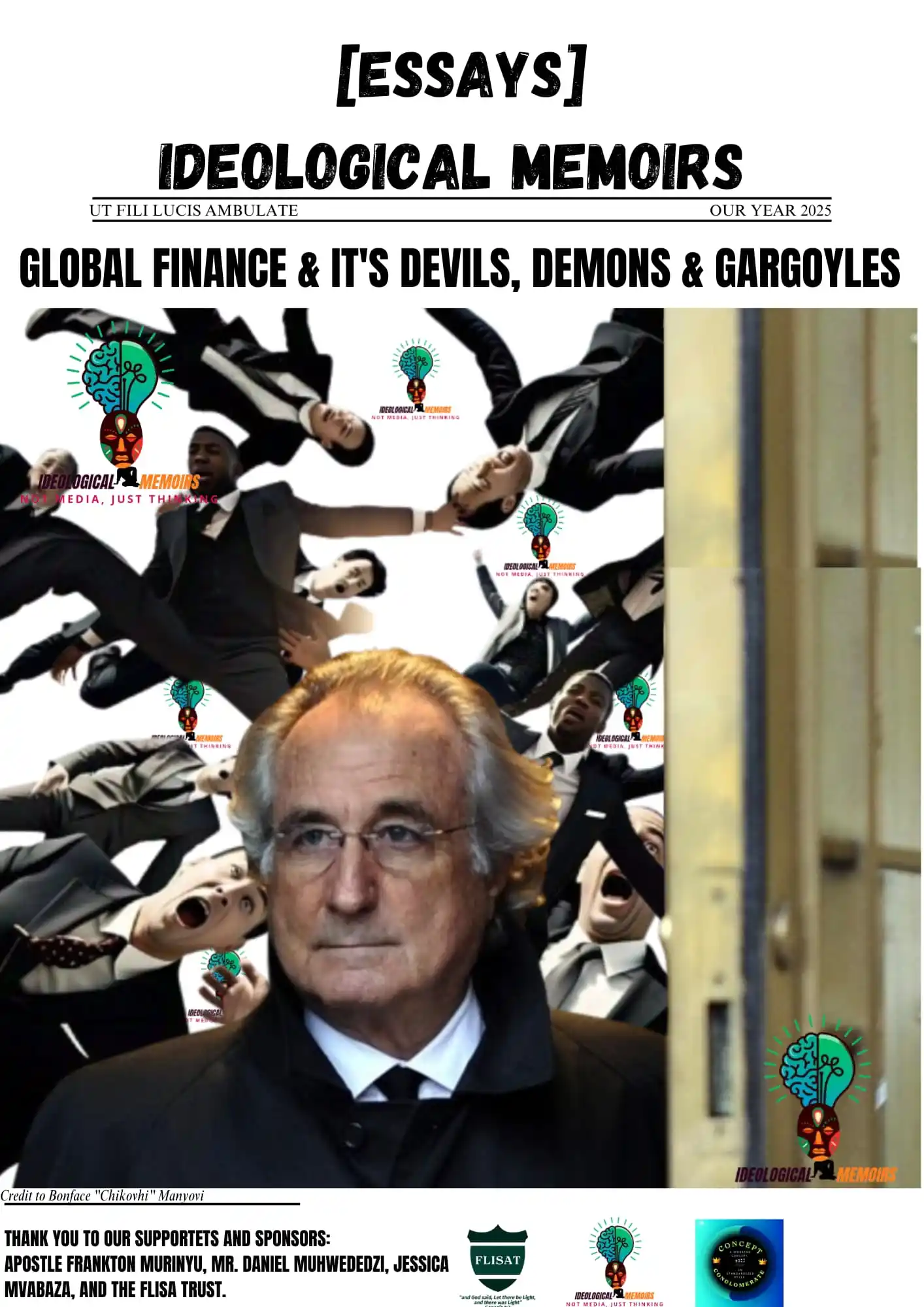

*Bernie Madoff: Died The Most Hated Man In The West*

-The Devil's Devil is a creation manifested from a mixture of his own ways, privileges, and doings-

A 61 year old widowed pensioner, by the name Susan Markowitz, was amongst the thousands of victims claimed by the Bernie Madoff financial fraud scandal. Reportedly it is considered the largest and most notorious financial frauds in human history, counting estimated losses or stollen amounts that reach up to US$65 Billion.

This scandal had a reach of reportedly 127 countries, and you most likely are just founding out about it here. Hence for this essay i present to you *our African paradigm to corruption* . Will explain what that means as opening to this essay's reflection. The assertion behind this essay is; *We are deliberately exposed to a certain kind of information, and also deprived a certain kind of information, all so to shape our perception of ourselves, the people around us, the happenings and the world.*

*Reflection*

_____________

As i promised above, that i will explain my meaning of "Our African Paradigm to corruption". It is actually just the word paradigm, that covers the rest. A paradigm is a basis concept or framework that shapes one's understanding, perception, and approach to an aspect of life, information, subject, or phenomenon. So our African Paradigm to corruption, would be our African basis to how we perceive, understand, and approach the subject and phenomenon of corruption.

Now to get back to Susan Markowitz, the 61 year old widowed pensioner's story of losing her entire life's savings and inheritance from her husband, which together mounted up to US$1 million, that she'd invested with the Bernie L. Madoff Investment Securities LLC. This story is said to be amongst the most touching individual victim stories from the Madoff saga.

Okay... read closely now, this scandal was so big that along with the all mighty Lehman Brothers Saga that broke out only 3 months before it, significantly had a hand in the 2008 global economic crisis. How much do you know about that actually? Yes our own local factors had their part in the 2008 hard times, us Zimbabwe and most of the other African and or developing world economies witnessed.

However, here's how a combination of the Madoff scandal and the mighty Lehman Brothers Saga, had a much more significant hand in the 2008 global economic crisis. Firstly, it started with Lehman Brothers filing on September 15th 2008, what remains the largest bankruptcy filing in Global finance history, and the reported to be trigger of the 2008 global financial crisis, which involved over US$600 Billion in assets.

That much money lost for a company listed on the stock market, with thousands of institutions, companies, investment funds, individuals, groups, schemes, governments, and more, invested in them, sent the stock market globally plummeting to levels of wiping out a reported estimate of US$2 Trillion in one week.

Let me share my two senses on what the stock market has to do with fuel prices, food shortages, shortages of money, and closures of businesses and a country's subsequent economic collapse. You and I are citizens of the so called developing world, or the third world. Our economic situation all around is prone to external influence and effects, in particular for an economy that in 2008 was heavily agro based as our Zimbabwean economy. Our entire industrial and financial wellbeing depended greatly on outside forces that including the climate/weather.

With institutions like your pension funds, your banks, your government institutions, your big and medium businesses and much more, all invested in the stock market, for many reasons, however mainly including fiscal or financial liquidity. This means all the financially important aspects of our modern societies' socio-economic integrity, lies with the stability of the stock markets.

Hence their collapse, would result in job losses, fuel price increases, subsequently food price increases, which then lead to food shortages, all the while emerging market currencies lose value, as investors retreat into safe haven markets/developed world markets and investments, that so culminating in a shortage of forex and further weakening of the local currency.

So what exactly did each the Lehman Brothers Saga and the Madoff Scandal do to set off such a catastrophe? And why the local media outlets and information platforms never bothered you with contextualizing the 2008 economic crisis for you, to that point of highlighting the core. Don't worry, as part of the assertion here being explored, will here also include the areas of failure for public service media and information platforms.

Continue to Part2 [Click View Channel]⬇️

👍

1