B.Pratap

February 3, 2025 at 03:28 PM

*Analysis On Unified Payments Interface (UPI): A Comprehensive Analysis of India's Digital Payment Revolution*

Since its inception in April 2016, the Unified Payments Interface (UPI) has transformed India's financial landscape, steering the nation towards a cashless economy and setting global benchmarks in digital payments. This report delves into UPI's journey, its statistical growth, economic impact, global outreach, and future prospects.

1. *Evolution and Growth of UPI*

Launched by the National Payments Corporation of India (NPCI), UPI was designed to facilitate seamless, real-time payments between banks using mobile platforms. Its user-friendly interface and interoperability have been pivotal in its widespread adoption.

*The growth trajectory of UPI is nothing short of remarkable*:

*2016-17*: In its inaugural year, UPI processed approximately 17.9 million transactions.

*2017-18*: Transactions surged to 915.2 million, indicating growing user trust.

*2018-19*: The platform handled 5.35 billion transactions, reflecting its rapid acceptance.

*2019-20*: Transactions more than doubled to 12.5 billion.

*2020-21*: UPI processed 22.3 billion transactions, showcasing its resilience during the pandemic.

*2021-22*: The platform saw 45.9 billion transactions, underscoring its integral role in daily commerce.

*2022-23*: Transactions reached 83.7 billion, highlighting its dominance in the digital payment space.

*2023-24*: UPI processed 131.1 billion transactions, cementing its position as the preferred payment method.

As of January 2025, UPI achieved a new milestone with 16.99 billion transactions in a single month, amounting to ₹23.48 lakh crore in value.

BUSINESS-STANDARD.COM

2. *Economic Impact*

*UPI's influence on India's economy is profound*:

Financial Inclusion: By offering a free and accessible platform, UPI has brought millions into the formal banking system, promoting financial inclusion.

Cost Savings: Estimates suggest that UPI has saved the Indian economy approximately $67 billion since its launch by reducing transaction costs and enhancing efficiency.

WEFORUM.ORG

GDP Growth: Analyses indicate a strong correlation between UPI transaction volumes and GDP growth, emphasizing its role in economic expansion.

ORFONLINE.ORG

3. Steering India Towards a Cashless Society

The exponential growth of UPI signifies India's shift towards digital transactions:

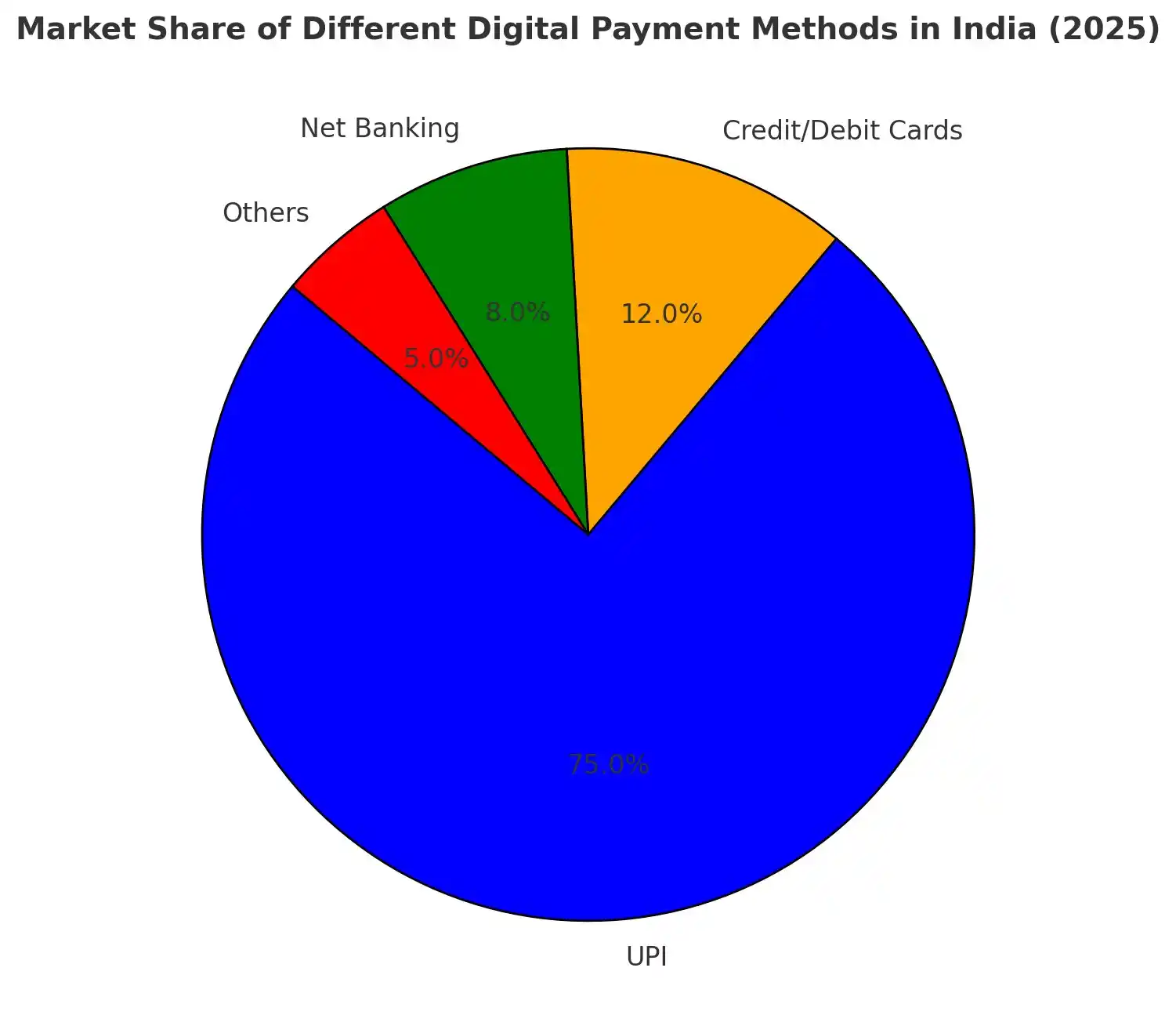

Market Share: UPI now accounts for over 75% of India's retail digital payments, reducing reliance on cash.

KANSASCITYFED.ORG

User Base: With over 350 million active users and 340 million QR codes at merchant locations, UPI's reach is extensive.

KANSASCITYFED.ORG

4. *Global Expansion and Recognition*

*UPI's success has transcended borders*:

International Collaborations: India is engaging with countries in Africa and South America to establish digital payment systems modeled on UPI, with launches expected by early 2027.

REUTERS.COM

Cross-Border Payments: UPI now facilitates live transactions in seven countries, including the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, enabling seamless payments for Indian travelers and expatriates.

PIB.GOV.IN

5. *Future Prospects*

The future of UPI is promising:

Technological Advancements: Continuous innovations, such as UPI 2.0 features, are enhancing user experience and security.

Market Penetration: With plans to expand into more countries and integrate with global payment systems, UPI is poised to become a dominant force in international digital payments.

6. *Visualizing UPI's Growth*

To illustrate UPI's remarkable journey, the following graph charts its transaction volumes from 2016 to January 2025:

Year | Transactions (in billions)

-----------|---------------------------

2016-17 | 0.0179

2017-18 | 0.9152

2018-19 | 5.35

2019-20 | 12.5

2020-21 | 22.3

2021-22 | 45.9

2022-23 | 83.7

2023-24 | 131.1

Jan 2025 | 16.99 (monthly)

Note: The above is a textual representation. please refer to official NPCI reports or financial publications.

*Final Thoughts:*

UPI stands as a testament to India's innovative spirit, transforming the nation's payment ecosystem and setting a global standard. Its journey from a nascent platform to a powerhouse of digital transactions underscores its significance as a visionary achievement for India.

*Sources*:

National Payments Corporation of India (NPCI) Product Statistics:

NPCI.ORG.IN

Decoding India's UPI phenomenon: A digital revolution with global implications:

ORFONLINE.ORG

UPI volume scales new peak of 16.99 billion in January, shows NPCI data:

BUSINESS-STANDARD.COM

India's Unified Payment Interface's impact on the financial landscape:

WEFORUM.ORG

The Role of Nonbanks and FinTech's in Boosting India's UPI Person-to-Merchant Transactions:

KANSASCITYFED.ORG

"Digital Infrastructure in