SAGAR SINHA

June 8, 2025 at 02:58 AM

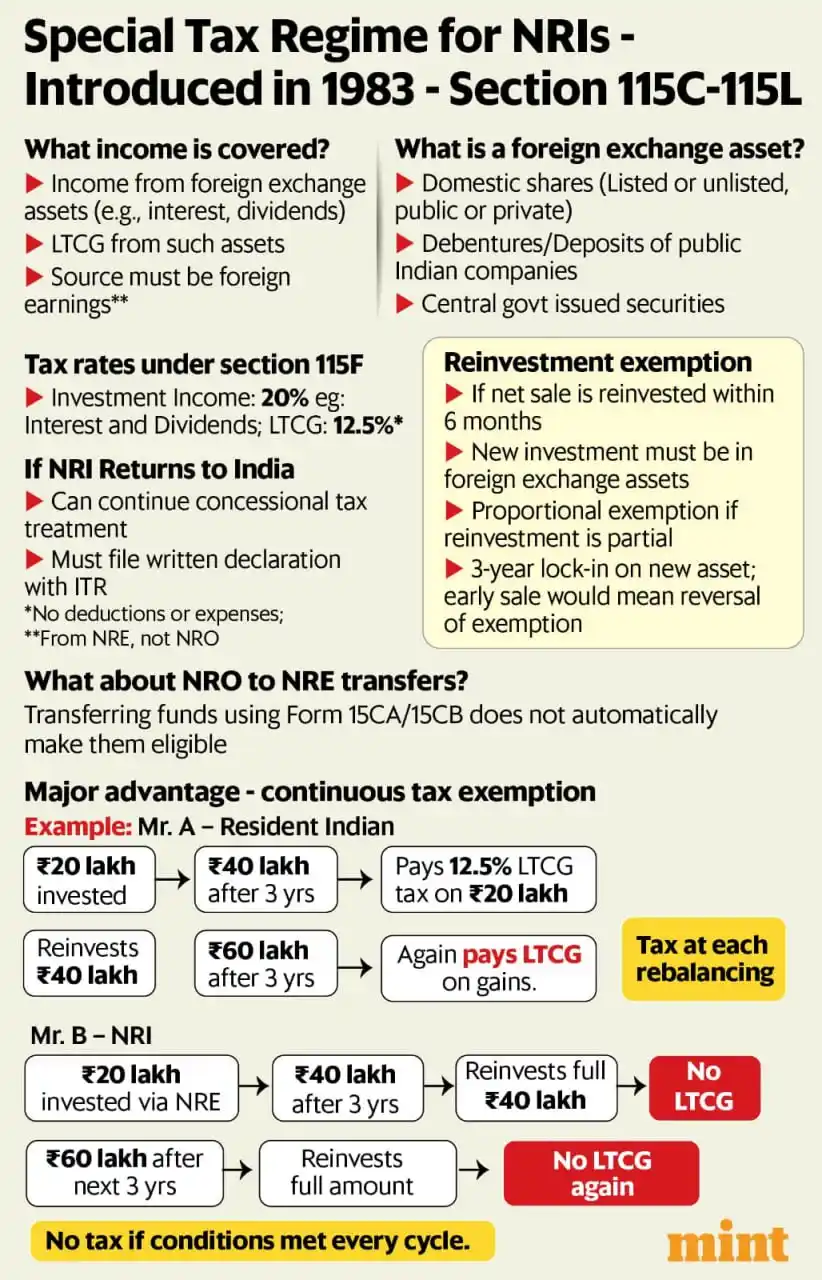

In 1983, India introduced a favourable tax system for NRIs to attract their money. It continues to this day.

The Section 115 regime. Under it, NRIs can invest overseas earnings into Indian stocks. When they book profits & reinvest in other stocks in 6 months, no LTCG to pay!

Of course, residents and NRIs have something similar for reinvestment of capital gains in houses (Section 54F) but not stocks. Every time you churn your stock portfolio, you pay tax.

Of course mutual funds by nature have this advantage if you never churn them. When a mutual fund buys and sells stocks inside the fund, you do not pay tax. So a 'never churn' fund like an index fund or maybe multi-asset, well may be just as good.

👏

1