GST & Tax Alerts

May 20, 2025 at 04:09 AM

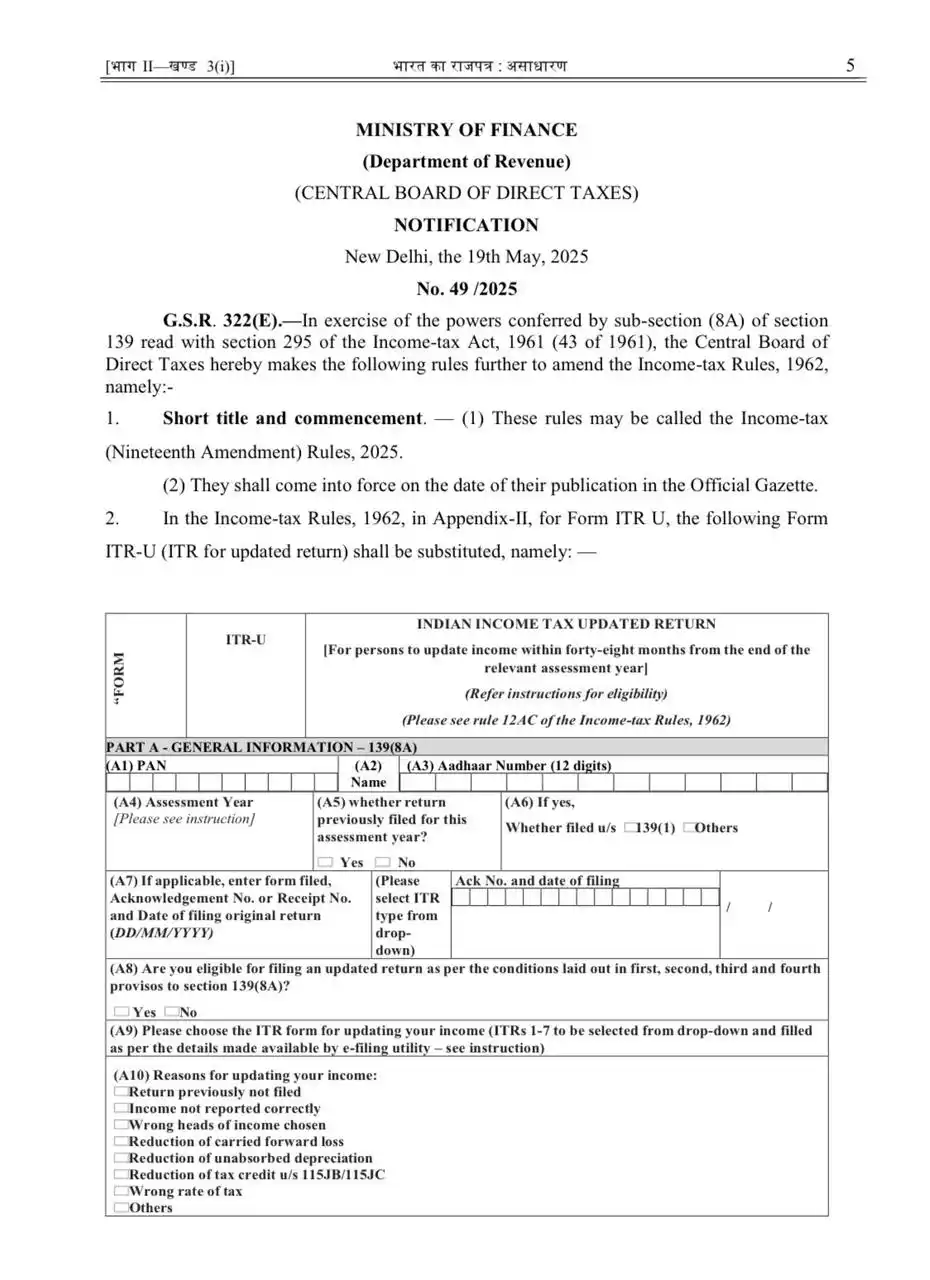

The CBDT has notified the Updated ITR-U vide NN 49/2025.

🔑 Key Highlights:

👉 The time limit for filing ITR-U is now 48 months.

👉 Additional Tax Payable:

Filing in 3rd year: Additional income tax of 60%.

Filing in 4th year: Additional income tax of 70%.

👉ITR-U cannot be filed if a notice under section 148A is issued after 36 months from the end of the relevant A.Y.

However, later if 148A(3) order passed stating that no notice u/s 148 was needed, then ITR U can be filed within 48 months.

👉 Section 140B Amended to prescribe additional income-tax payable for the extended timelines.

❤️

👍

❤

🙏

9